Virgin Islands Balance Sheet Deposits

Description

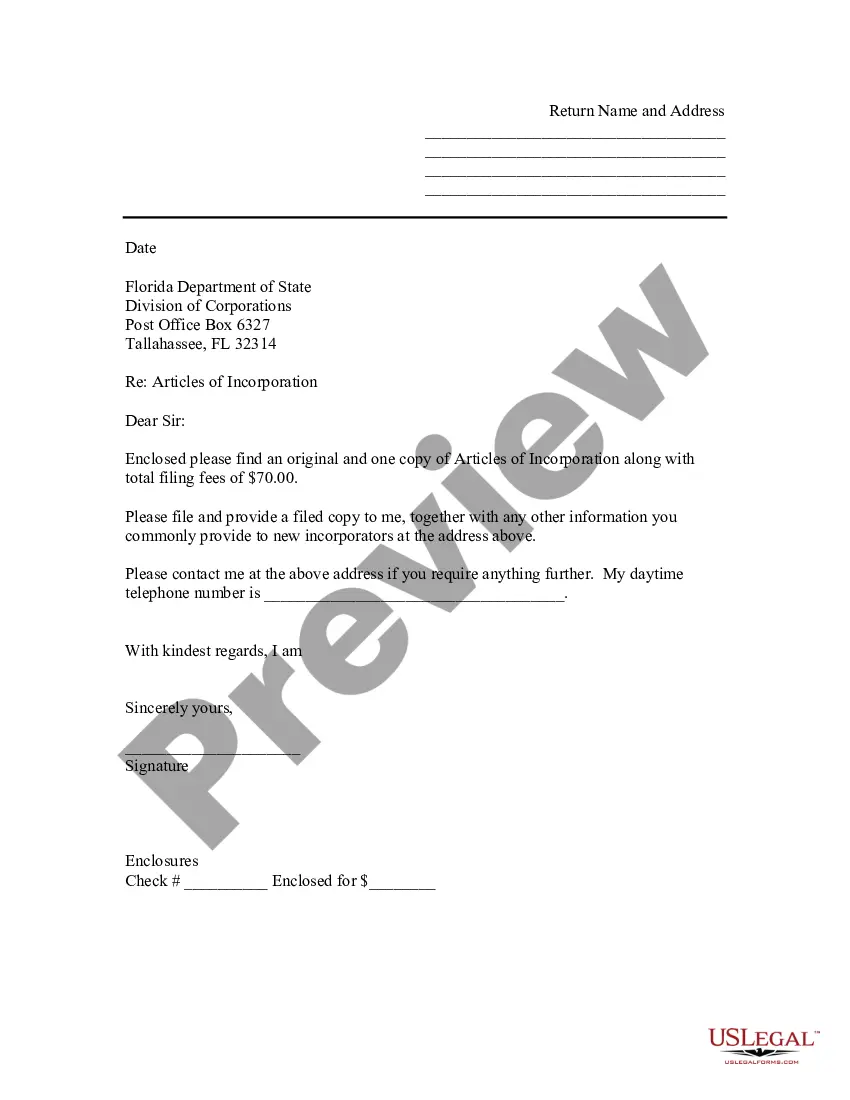

How to fill out Balance Sheet Deposits?

If you require to total, acquire, or print sanctioned document templates, utilize US Legal Forms, the largest collection of legal forms available online.

Take advantage of the site’s convenient and efficient search to find the documents you need.

Various templates for business and personal purposes are organized by categories and claims, or keywords.

Step 4. Once you have found the form you want, click the Get now button. Choose your preferred payment plan and enter your details to create an account.

Step 5. Process the transaction. You can use your Visa, MasterCard, or PayPal account to complete the payment.

- Utilize US Legal Forms to obtain the Virgin Islands Balance Sheet Deposits with just a few clicks.

- If you are already a US Legal Forms client, Log In to your profile and then click the Download button to acquire the Virgin Islands Balance Sheet Deposits.

- You can also access forms you previously downloaded in the My documents tab of your profile.

- If you are using US Legal Forms for the first time, follow the instructions below.

- Step 1. Ensure you have selected the form for the correct city/country.

- Step 2. Use the Review option to examine the form’s content. Be sure to read the description.

- Step 3. If you are not satisfied with the form, utilize the Search field at the top of the screen to find other variations of the legal form template.

Form popularity

FAQ

Generally, you must file Form 941, Employer's QUARTERLY Federal Tax Return or Form 944, Employer's ANNUAL Federal Tax Return to report wages you've paid and tips your employees have reported to you, as well as employment taxes (federal income tax withheld, social security and Medicare taxes withheld, and your share of

To take the credit, you must complete Form 8689 and attach it to your Form 1040 or 1040-SR. Add line 41 and line 46 of Form 8689 and include the amount in the total on Form 1040 or 1040-SR, Total payments line. On the dotted line next to it, enter Form 8689 and the amount paid.

Who must file Form 941. Generally, any person or business that pays wages to an employee must file a Form 941 each quarter, and must continue to do so even if there are no employees during some of the quarters.

Nearly all of the machines are operated by three banks: Scotiabank ( ), FirstBank ( ), and Banco Popular ( ).

The U.S. Virgin Islands uses a mirror system of taxation, also known as the Mirror Code, meaning that USVI taxpayers pay taxes to the Virgin Islands Bureau of Internal Revenue ("BIR") generally to the same extent as U.S. taxpayers would under the Code to the U.S. Internal Revenue Service.

Form 8689 is a tax form distributed by the Internal Revenue Service (IRS) for use by U.S. citizens and resident aliens who earned income from sources in the U.S. Virgin Islands (USVI) but are not bona fide residents. The U.S. Virgin Islands are considered an unincorporated territory of the United States.

In general, employers who withhold federal income tax, social security or Medicare taxes must file Form 941, Employer's Quarterly Federal Tax Return, each quarter.

Where to file. You must file identical tax returns with the United States and the USVI. If you are not enclosing a check or money order, file your original tax return (including Form 8689) with the Department of the Treasury, Internal Revenue Service Center, Austin, TX 73301-0215 USA.

Who Must File Form 941-SS? Generally, you must file a return for the first quarter in which you pay wages subject to social security and Medicare taxes, and for each quarter thereafter until you file a final return.

Subtitle C, Employment Taxes, of the Internal Revenue Code imposes employment taxes on wages and provides for income tax withholding. Form 941-SS is used to determine the amount of the taxes that you owe. Section 6011 requires you to provide the requested information if the tax is applicable to you.