Virgin Islands Controlling Persons Questionnaire

Description

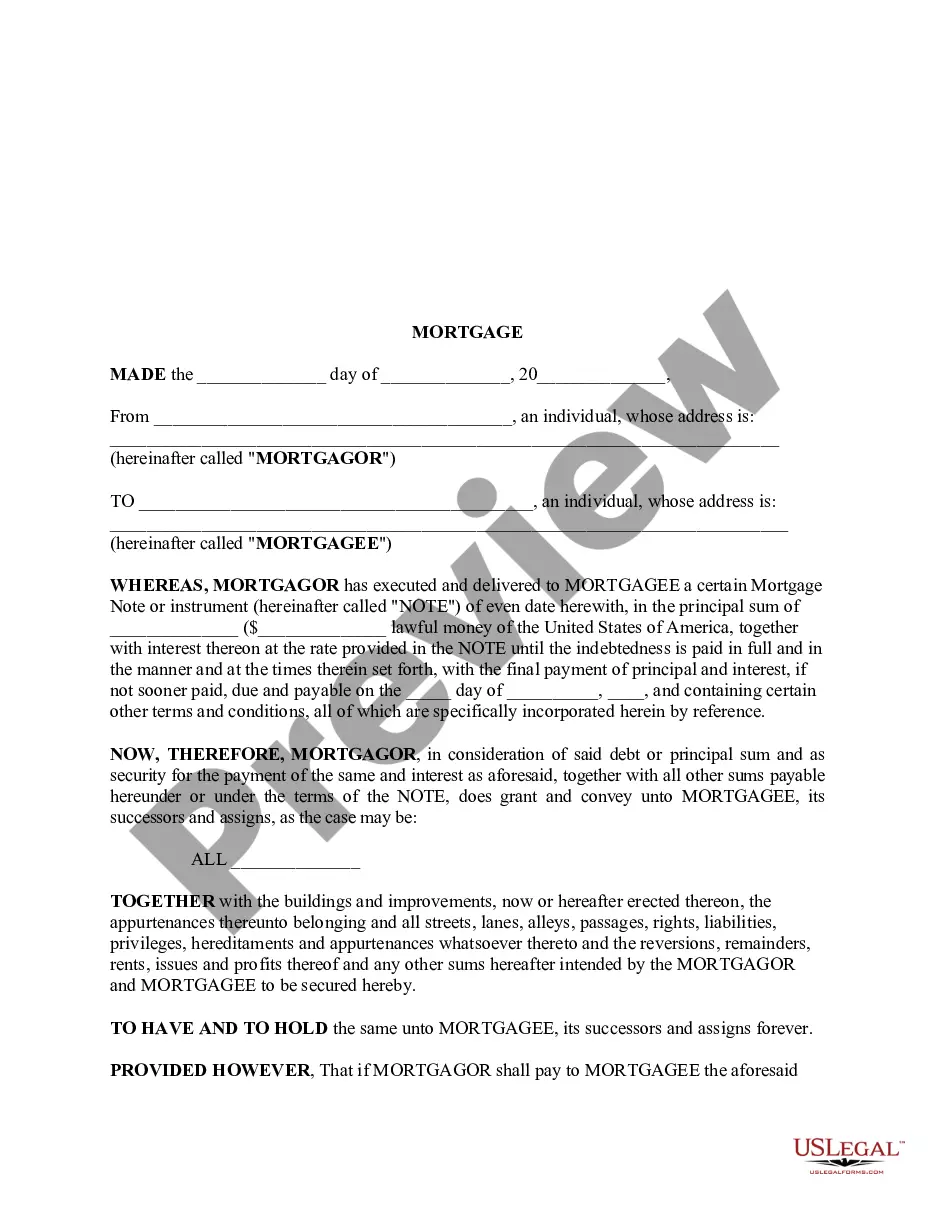

How to fill out Controlling Persons Questionnaire?

If you need to full, obtain, or produce legitimate record templates, use US Legal Forms, the largest assortment of legitimate varieties, which can be found on the Internet. Utilize the site`s simple and hassle-free research to discover the paperwork you want. A variety of templates for organization and specific reasons are sorted by categories and suggests, or key phrases. Use US Legal Forms to discover the Virgin Islands Controlling Persons Questionnaire within a couple of clicks.

When you are currently a US Legal Forms customer, log in in your bank account and click on the Download button to have the Virgin Islands Controlling Persons Questionnaire. Also you can accessibility varieties you in the past acquired inside the My Forms tab of your bank account.

If you work with US Legal Forms for the first time, refer to the instructions below:

- Step 1. Be sure you have selected the form for your correct area/land.

- Step 2. Make use of the Review option to look over the form`s information. Never overlook to learn the information.

- Step 3. When you are not happy with the form, utilize the Research discipline near the top of the display screen to get other types in the legitimate form design.

- Step 4. Once you have identified the form you want, go through the Buy now button. Select the pricing program you prefer and include your accreditations to sign up on an bank account.

- Step 5. Process the financial transaction. You can utilize your Мisa or Ьastercard or PayPal bank account to complete the financial transaction.

- Step 6. Pick the structure in the legitimate form and obtain it on your own device.

- Step 7. Comprehensive, edit and produce or signal the Virgin Islands Controlling Persons Questionnaire.

Every legitimate record design you purchase is the one you have forever. You might have acces to each and every form you acquired in your acccount. Select the My Forms section and choose a form to produce or obtain yet again.

Contend and obtain, and produce the Virgin Islands Controlling Persons Questionnaire with US Legal Forms. There are many skilled and condition-certain varieties you can utilize for your organization or specific demands.

Form popularity

FAQ

The term 'Controlling Person' refers to a natural person who exercises control over an Entity. In the case of a Trust, this term refers to the Settlor, the Trustees and the Beneficiaries. For Companies, this would be any shareholder with a stake of 25% or more in the company.

Who is reportable? The CRS seeks to establish the tax residency of customers. Under the CRS, financial institutions are required to identify customers who appear to be tax resident outside of the country/jurisdiction where they hold their accounts and products, and report certain information to our local tax authority.

Controlling Persons of a trust, means the settlor(s), the trustee(s), the protector(s) (if any), the beneficiary(ies) or class(es) of beneficiaries, and any other natural person(s) exercising ultimate effective control over the trust (including through a chain of control or ownership).

Like FATCA, the Standard requires all financial institutions operating in a country to apply specified due diligence procedures to customers to determine the customers' country or countries of tax residence. Financial institutions typically include all banks and asset managers, as well as certain insurance companies.

The BVI will now use a 10% threshold for a controlling ownership interest of a legal person not 25%. The BVI reminded Financial Institutions (FIs) that documentary evidence must be accurate and the FIs have a duty to confirm the reasonableness of self-certifications.

?Controlling Person? This is a natural person who exercises control over an entity. Where that entity is treated as a Passive Non-Financial Entity (?NFE?) then a Financial Institution must determine whether such Controlling Persons are Reportable Persons.

Cytokine storm may affect those who are receiving immunotherapy for cancer. These treatments include checkpoint inhibitors and CAR T-cell therapy. CRS can also develop as a result of infection. When your body comes into contact with a virus or other type of infection, it triggers your immune system.

Controlling Person. The controlling persons are in general the same individuals that have been identified as Ultimate Beneficial Owners ("UBO"). The UBOs are generally being determined based on the 25% ownership/voting threshold (see more details below).