Virgin Islands LLC Operating Agreement - Taxed as a Partnership

Description

How to fill out LLC Operating Agreement - Taxed As A Partnership?

You can spend hours on the web searching for the legal document format that meets the state and federal requirements you will need.

US Legal Forms offers a wide array of legal forms that are reviewed by professionals.

You can download or print the Virgin Islands LLC Operating Agreement for S Corp from my service.

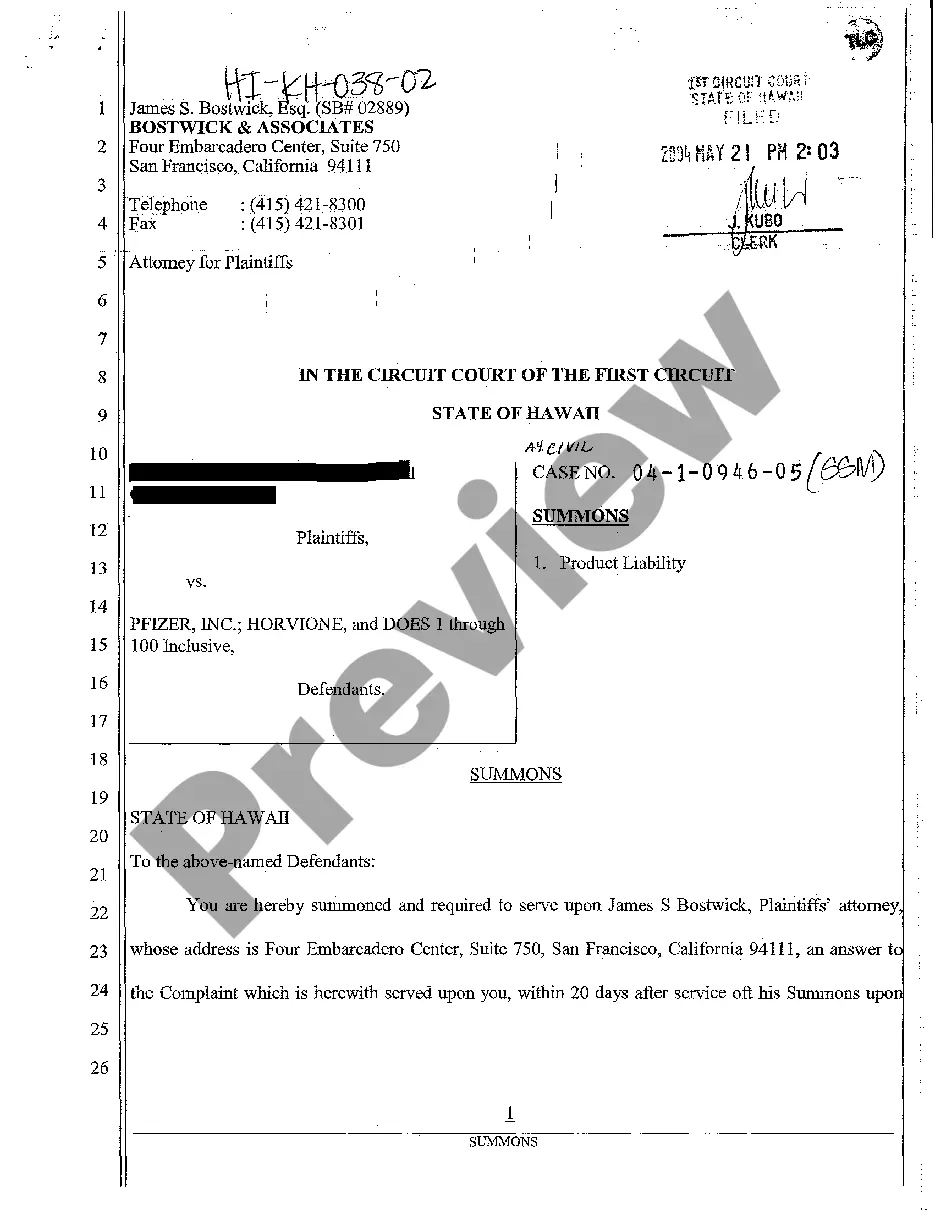

If available, utilize the Review option to browse through the document format as well.

- If you already have a US Legal Forms account, you may Log In and click the Obtain button.

- After that, you can fill out, edit, print, or sign the Virgin Islands LLC Operating Agreement for S Corp.

- Every legal document format you acquire is yours permanently.

- To obtain another copy of any purchased form, navigate to the My documents section and click the corresponding option.

- If you are using the US Legal Forms site for the first time, follow the simple instructions below.

- First, ensure you have selected the correct document format for your chosen county/city.

- Review the document summary to confirm you have selected the appropriate form.

Form popularity

FAQ

Those looking to form LLCs in the US Virgin Islands must have both a local registered agent and a local office address. This address will be used for process service requests. Your agent who forms the company for you (such as this one) should automatically include this for you in the initial filing.

The main difference between an LLC and a corporation is that an llc is owned by one or more individuals, and a corporation is owned by its shareholders. No matter which entity you choose, both entities offer big benefits to your business. Incorporating a business allows you to establish credibility and professionalism.

Unlike most U.S. states, the USVI requires corporations to have a minimum of three directors, three officers, a president, treasurer and secretary. Corporate directors are not allowed. Stock must also be registered and there is a minimum capital requirement of $1,000.

Both types of entities have the significant legal advantage of helping to protect assets from creditors and providing an extra layer of protection against legal liability. In general, the creation and management of an LLC are much easier and more flexible than that of a corporation.

The U.S. Virgin Islands is unique among offshore tax planning jurisdictions: it is the only jurisdiction which can offer a tax-free entity under the U.S. flag.

To get started:Create a business plan.Register your trade name and/or corporation with the Office of the Lieutenant Governor.Select a good location and obtain a copy of an unsigned lease or letter of intent from the owner.Obtain a business license from the V.I. Department of Licensing and Consumer Affairs (DLCA)

In order to create an LLC in Canada, an investor must prepare the Articles of Association, but also an Initial Registered Office address and first Board of Directors. These are questionnaires that need to be filled out and in which information about the registered address and directors of the company are provided.

U.S. Virgin Islands (USVI)The USVI has its own income tax system based on the same laws and tax rates that apply in the United States. An important factor in USVI taxation is whether, during the entire tax year, you are a bona fide resident of the USVI.

How to Set Up an LLCDecide on a Business Name.Designate a Registered Agent.Get a Copy of Your State's LLC Article of Organization Form.Prepare the LLC Article of Organization Form.File the Articles of Organization.Create an Operating Agreement.Keep Your LLC Active.

How to Set Up an LLCDecide on a Business Name.Designate a Registered Agent.Get a Copy of Your State's LLC Article of Organization Form.Prepare the LLC Article of Organization Form.File the Articles of Organization.Create an Operating Agreement.Keep Your LLC Active.