A mobile home may be defined as a movable or portable dwelling built on a chassis, connected to utilities, designed without a permanent foundation, and intended for year-round living. There has been a tremendous rise in the number of mobile homes purchased, and correspondingly, more land being used for mobile home park purposes.

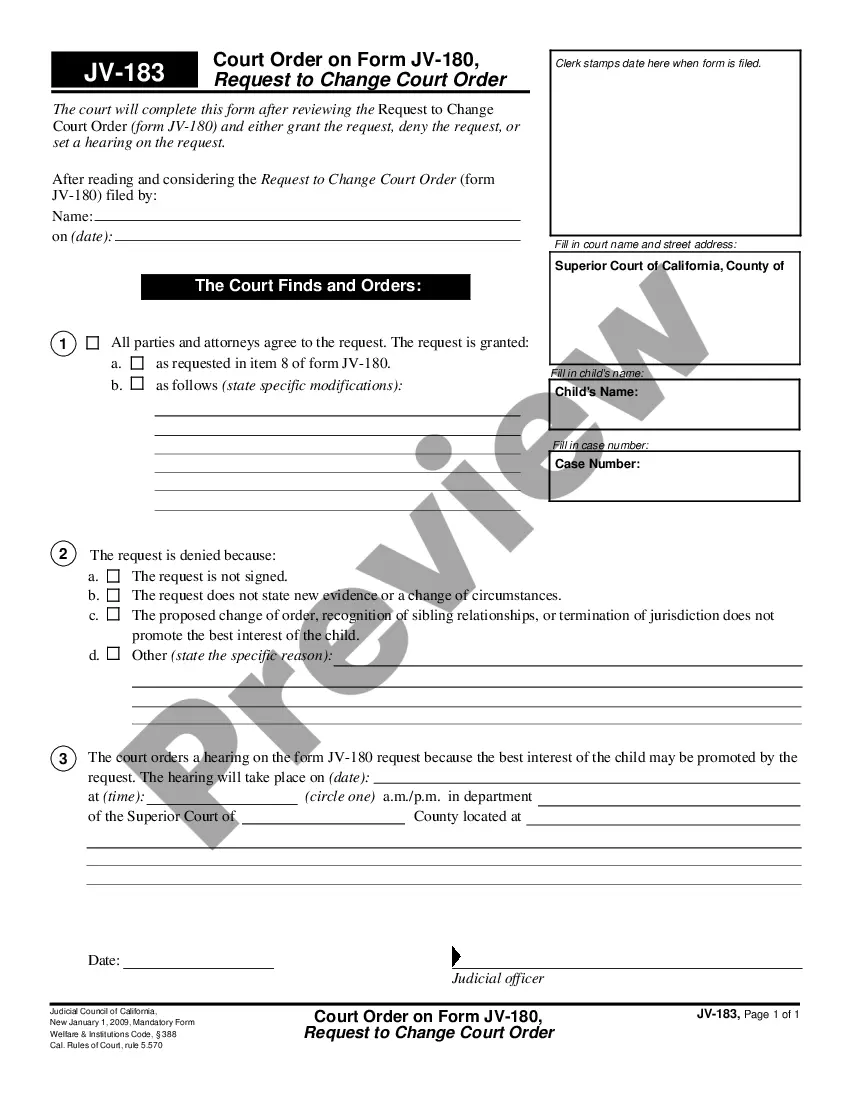

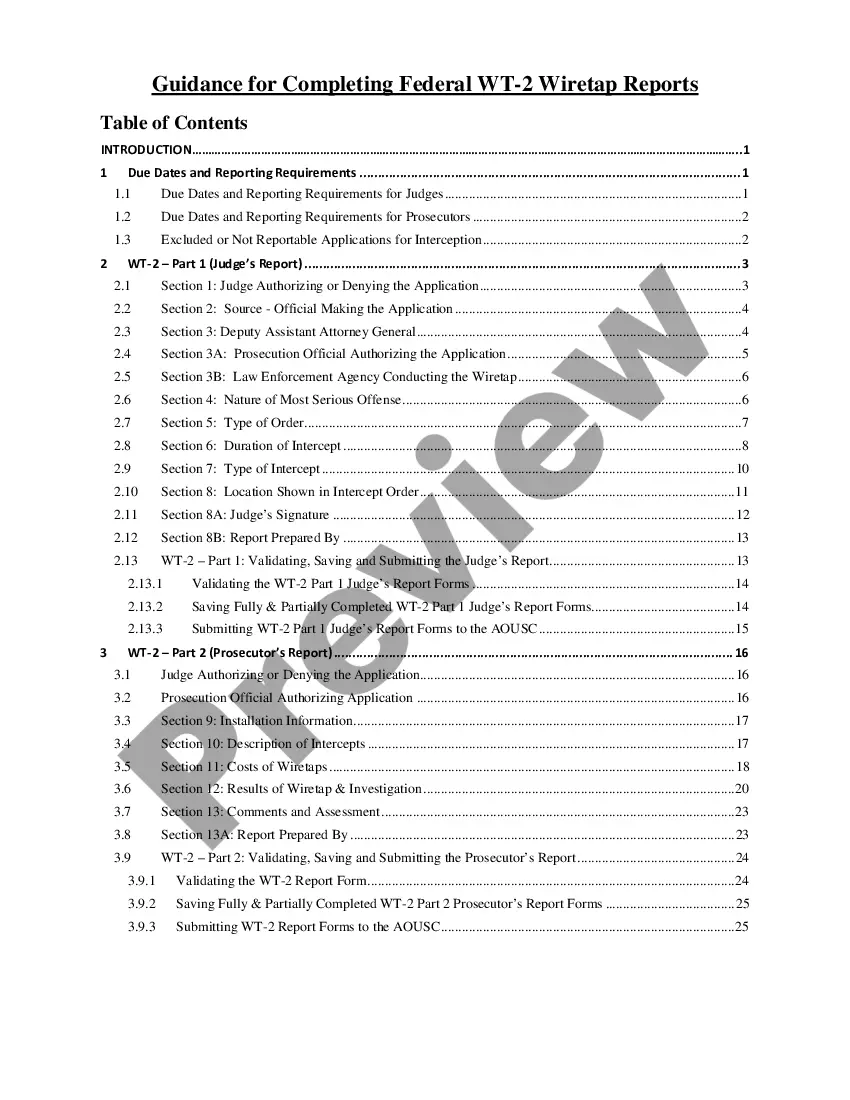

This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.