The process of substituting all or most of your old windows with new replacement windows can be expensive, depending in part on the number of windows you replace.

Virgin Islands Replacement Window Estimate

Description

How to fill out Replacement Window Estimate?

Are you presently in a situation where you require documents for either organizational or personal purposes almost every day.

There are numerous legal document templates accessible online, but finding reliable ones is not simple.

US Legal Forms offers a vast collection of document templates, including the Virgin Islands Replacement Window Estimate, designed to meet state and federal requirements.

Once you find the correct form, click on Purchase now.

Choose your desired pricing plan, enter the necessary information to create your account, and complete your order using your PayPal or credit card.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- After that, you can download the Virgin Islands Replacement Window Estimate template.

- If you do not have an account and want to start using US Legal Forms, follow these steps.

- Locate the form you need and confirm it is for the correct region/state.

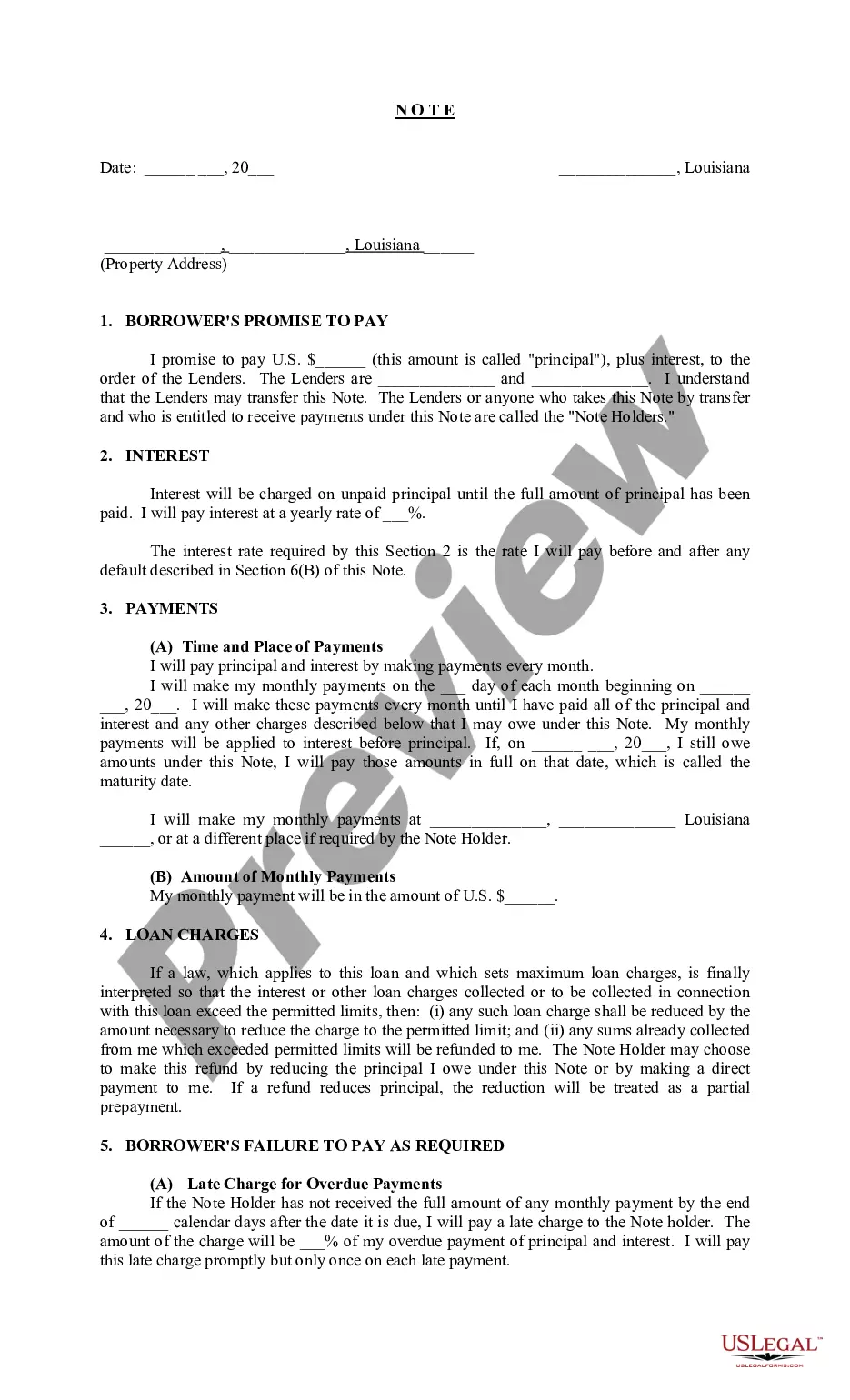

- Use the Review button to check the document.

- Read the description to ensure you have selected the right form.

- If the form is not what you're looking for, use the Search field to find the form that meets your requirements.

Form popularity

FAQ

While some may attempt window replacement as a DIY project, it often comes with risks, particularly if you lack experience. Proper installation is crucial for energy efficiency and structural integrity. If you're considering a window replacement, obtaining a Virgin Islands Replacement Window Estimate will help you assess whether this project is best suited for professionals.

To file your Island tax return, start by gathering all necessary information about your income and financial activities. Complete the applicable tax forms, correctly reporting your earnings in accordance with Virgin Islands tax laws. Using platforms like uslegalforms can streamline this process and help you achieve a clear and accurate Virgin Islands Replacement Window Estimate.

In the U.S. Virgin Islands, Form 1120-F is used by foreign corporations to report income derived from sources within the islands. This form helps corporations outline their financial situation, ensuring they comply with local tax laws. By accurately completing this form, businesses can avoid potential penalties while discovering avenues to optimize their Virgin Islands Replacement Window Estimate.

Yes, the U.S. Virgin Islands is considered a part of the United States for certain tax purposes, but it has its own tax system. Residents and businesses must comply with local tax laws, which can differ from the federal tax regulations. Understanding these differences is vital when estimating costs, such as a Virgin Islands Replacement Window Estimate, as it affects your overall tax liability.

Any foreign corporation that engages in business in the United States must file Form 1120-F. This includes corporations that receive income from U.S. sources or have a permanent establishment in the U.S. By becoming familiar with this requirement, you can better navigate your financial responsibilities, which can even impact your Virgin Islands Replacement Window Estimate.

Form 1120-F is primarily used by foreign corporations to report their income, gains, losses, deductions, and to determine their U.S. tax liability. This form helps ensure that corporations comply with tax laws while getting a clear picture of their financial standing. If you're evaluating potential investments in the U.S. Virgin Islands, understanding this form can aid you in calculating a Virgin Islands Replacement Window Estimate effectively.

Filing taxes in the U.S. Islands requires you to complete the appropriate forms based on your residency and income types. The process can vary depending on your specific situation, so it is essential to consult with a tax professional familiar with Virgin Islands regulations. Utilizing the uslegalforms platform can simplify this process and help you receive your Virgin Islands Replacement Window Estimate more efficiently.

Schedule F is used with Form 1120 to report farm income and expenses for corporations. It helps separate your farming activities from other business operations, ensuring clarity in your tax reporting. By understanding this form, you can better assess the implications for your Virgin Islands Replacement Window Estimate. Properly filing Schedule F ensures compliance and maximizes your potential deductions.

Filing Form 8689 involves providing detailed information about your income and tax liability in the U.S. Virgin Islands. Start by completing the form accurately, ensuring that you include all necessary documentation. When you complete this process, you will set yourself up for a seamless Virgin Islands Replacement Window Estimate. Finally, submit the form to the appropriate tax authority to meet your filing requirements.

Hurricane windows are designed to withstand extreme weather conditions, and generally, they offer a life expectancy of 20 to 30 years. With proper maintenance and care, these windows can effectively serve your home for decades, enhancing safety and energy efficiency. When you consider a Virgin Islands Replacement Window Estimate, it’s important to note that selecting high-quality products contributes to longevity and durability. Regular inspections and minor repairs can further extend the lifespan of your hurricane windows, ensuring they protect your home effectively.