US Legal Forms - one of several most significant libraries of legal types in the United States - provides an array of legal file layouts it is possible to download or printing. Utilizing the internet site, you may get a large number of types for enterprise and person purposes, categorized by categories, claims, or search phrases.You will find the newest types of types such as the Virgin Islands Receipt of Beneficiary for Early Distribution from Estate and Indemnity Agreement in seconds.

If you have a registration, log in and download Virgin Islands Receipt of Beneficiary for Early Distribution from Estate and Indemnity Agreement from your US Legal Forms collection. The Obtain key will appear on each develop you look at. You have accessibility to all in the past saved types in the My Forms tab of your profile.

If you want to use US Legal Forms the very first time, listed below are basic instructions to obtain started out:

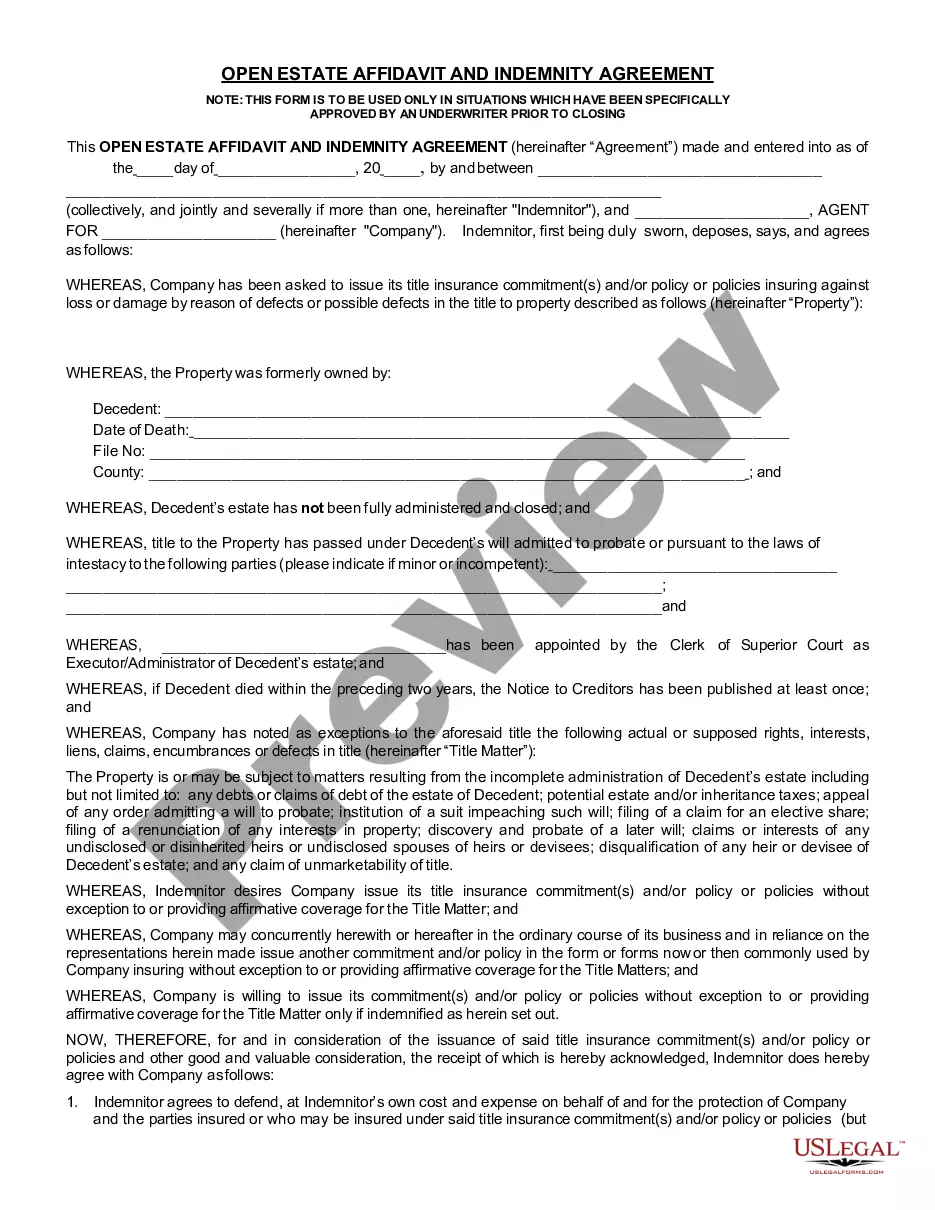

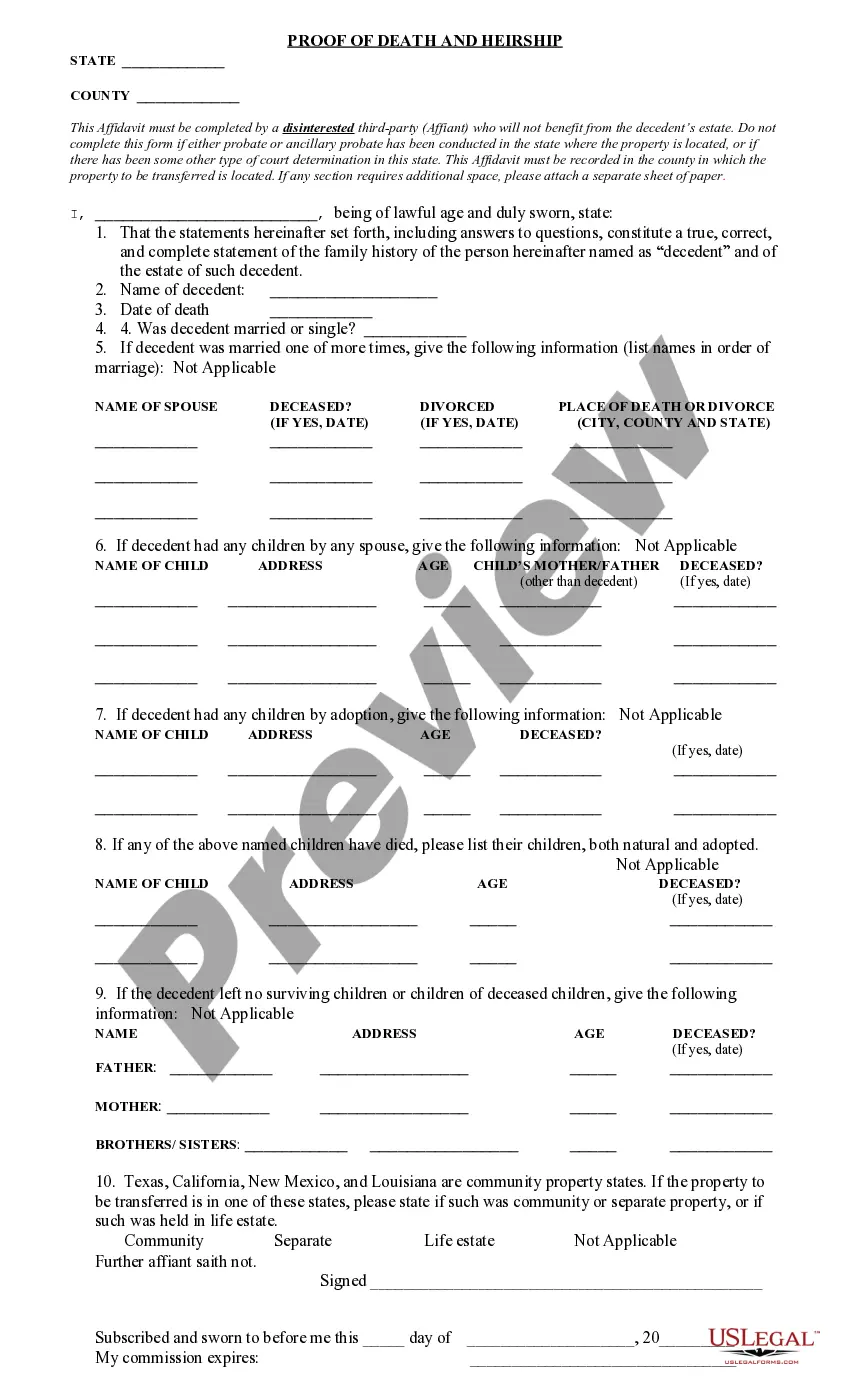

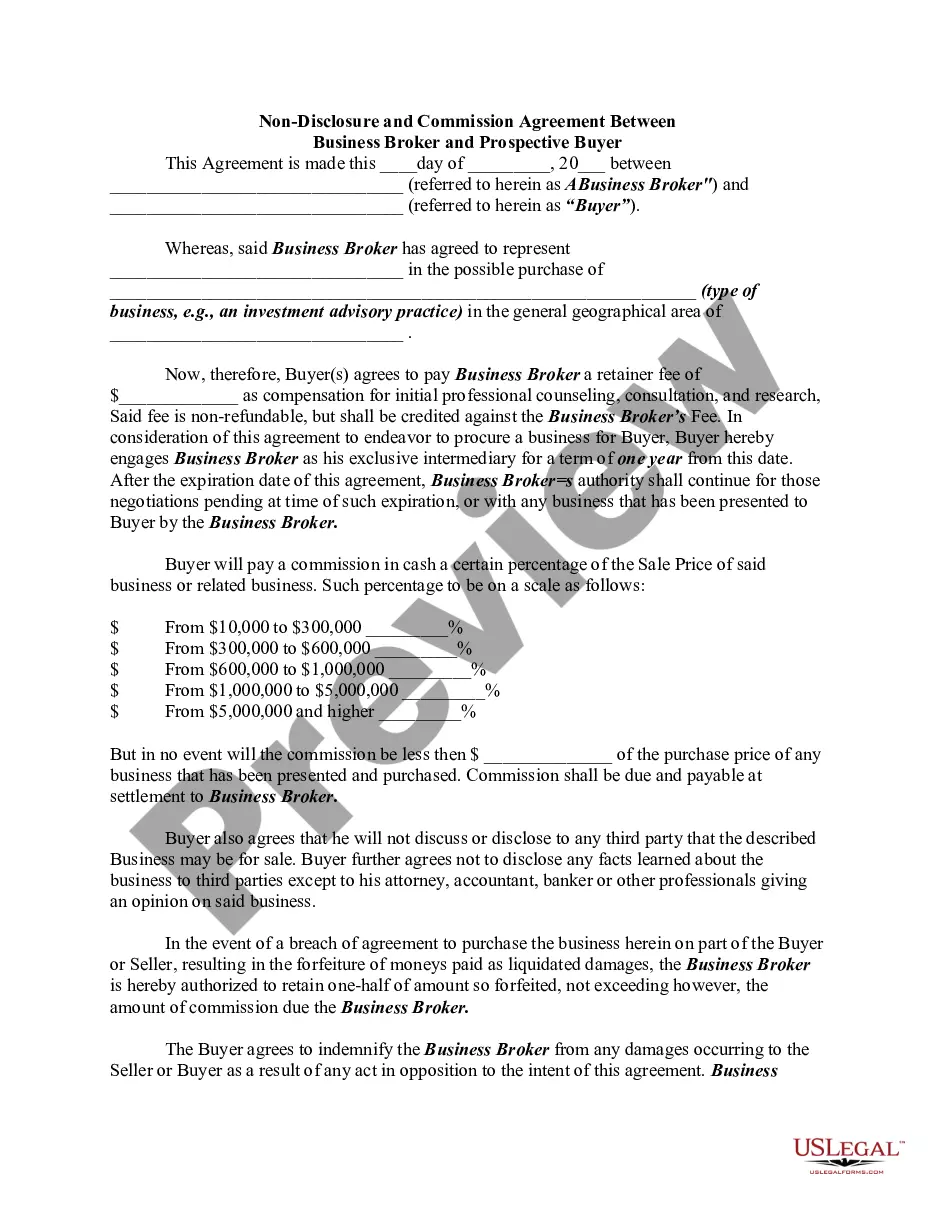

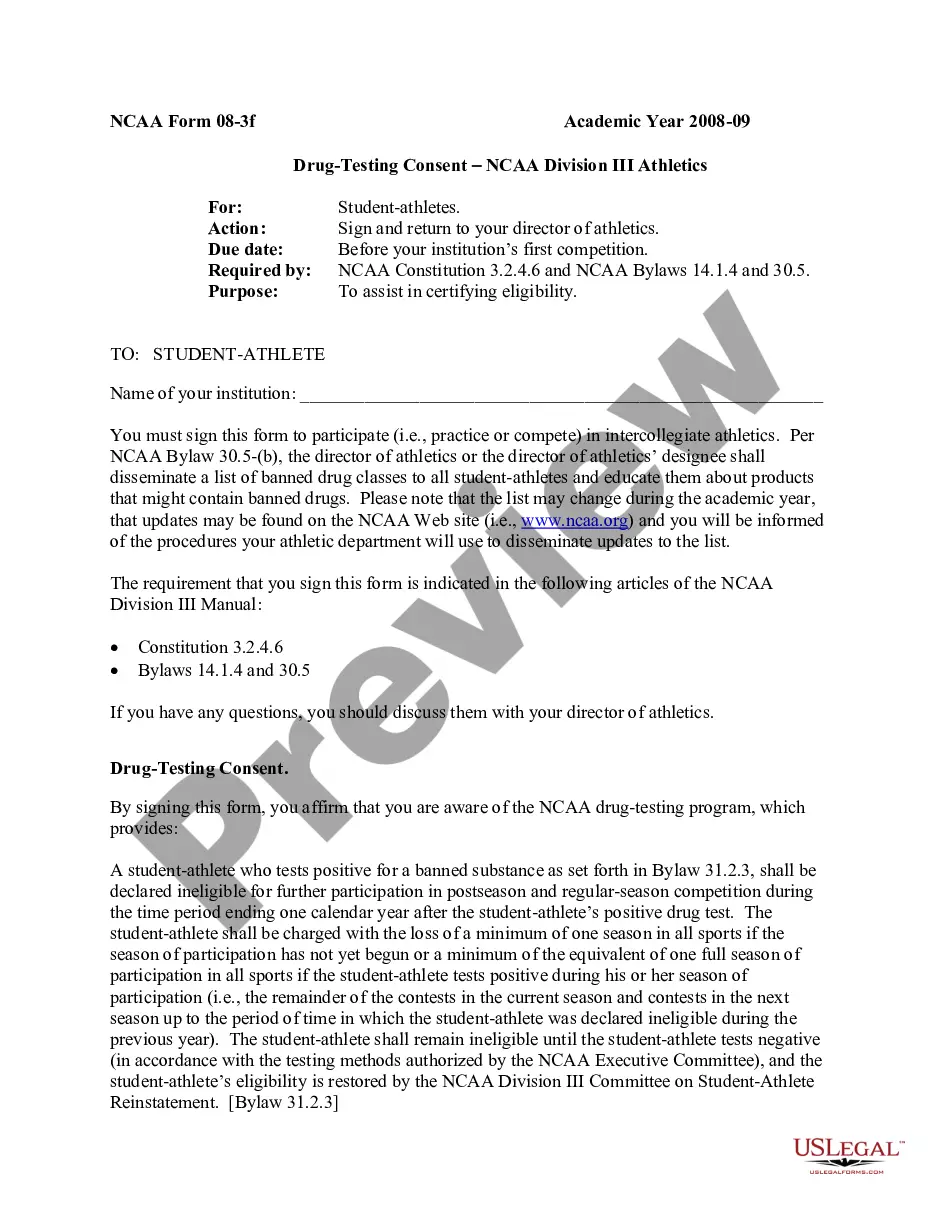

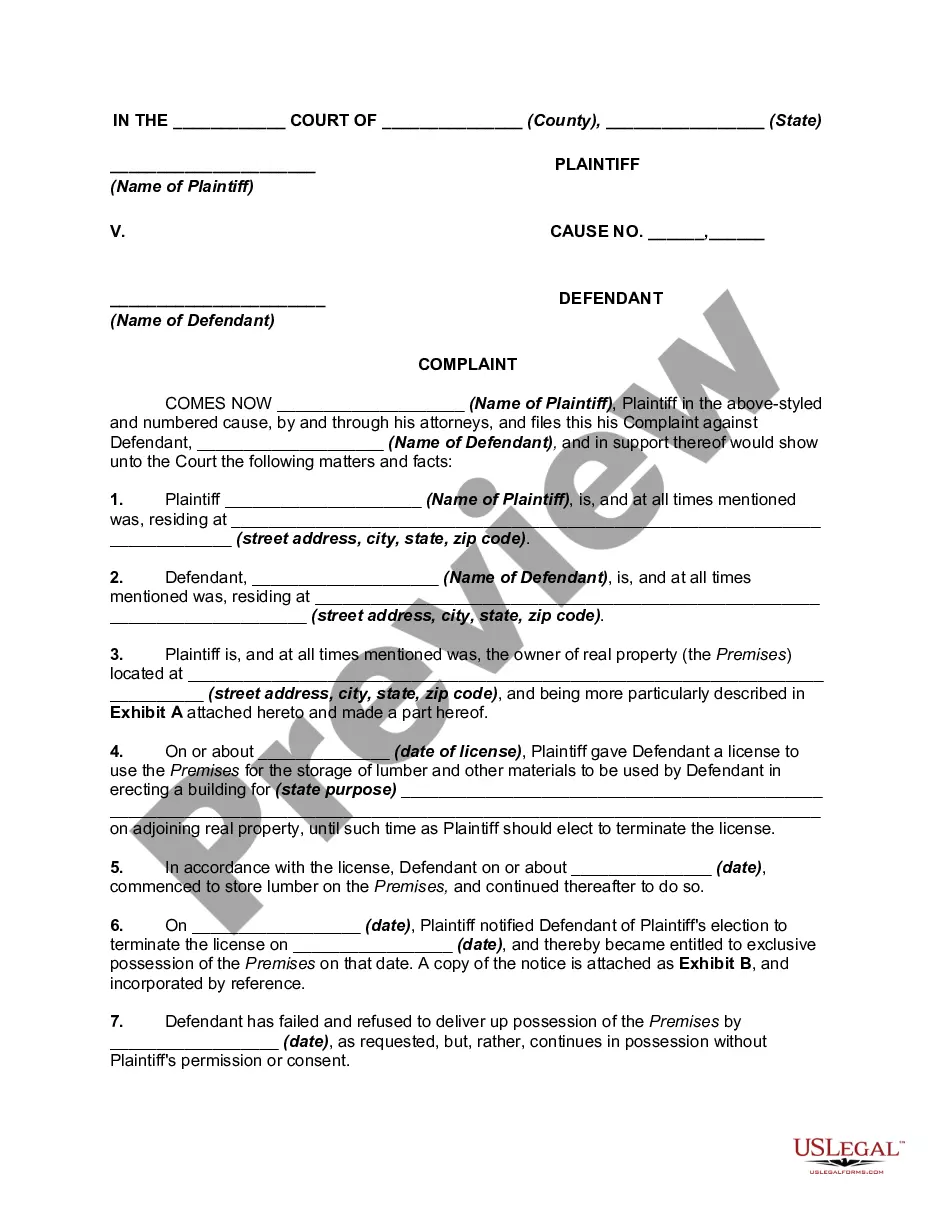

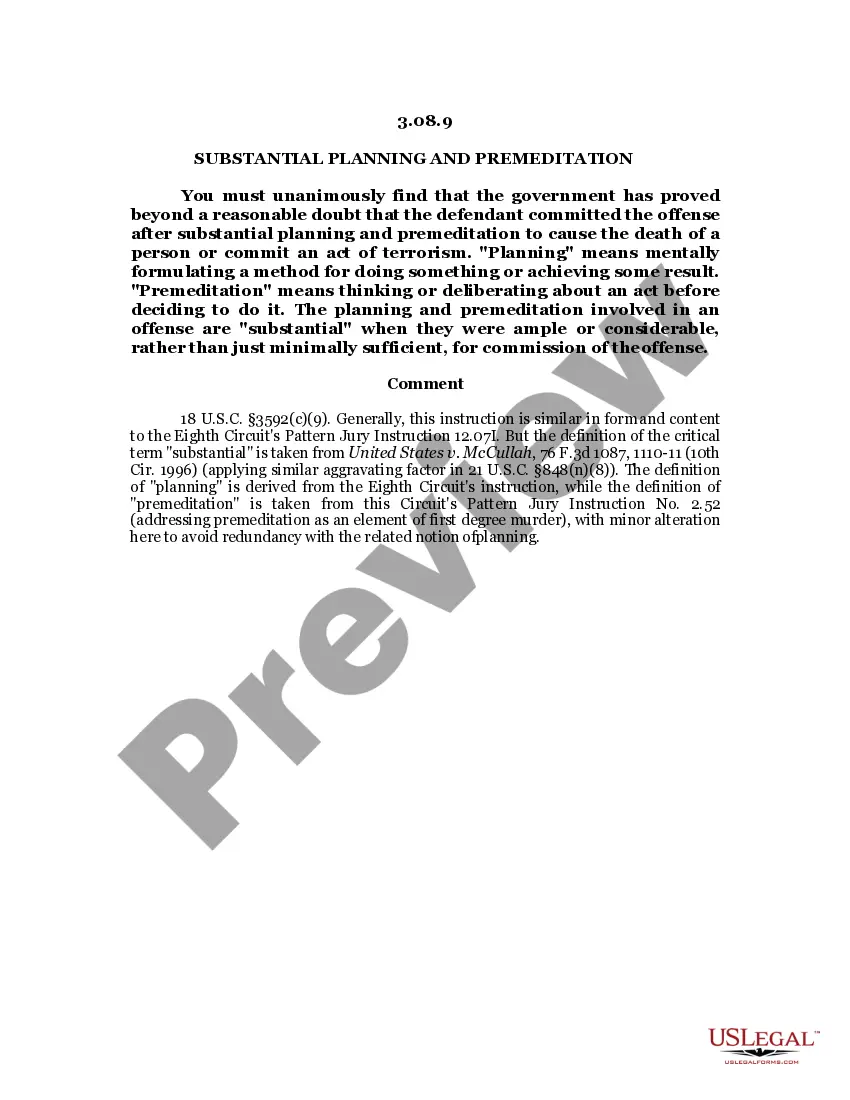

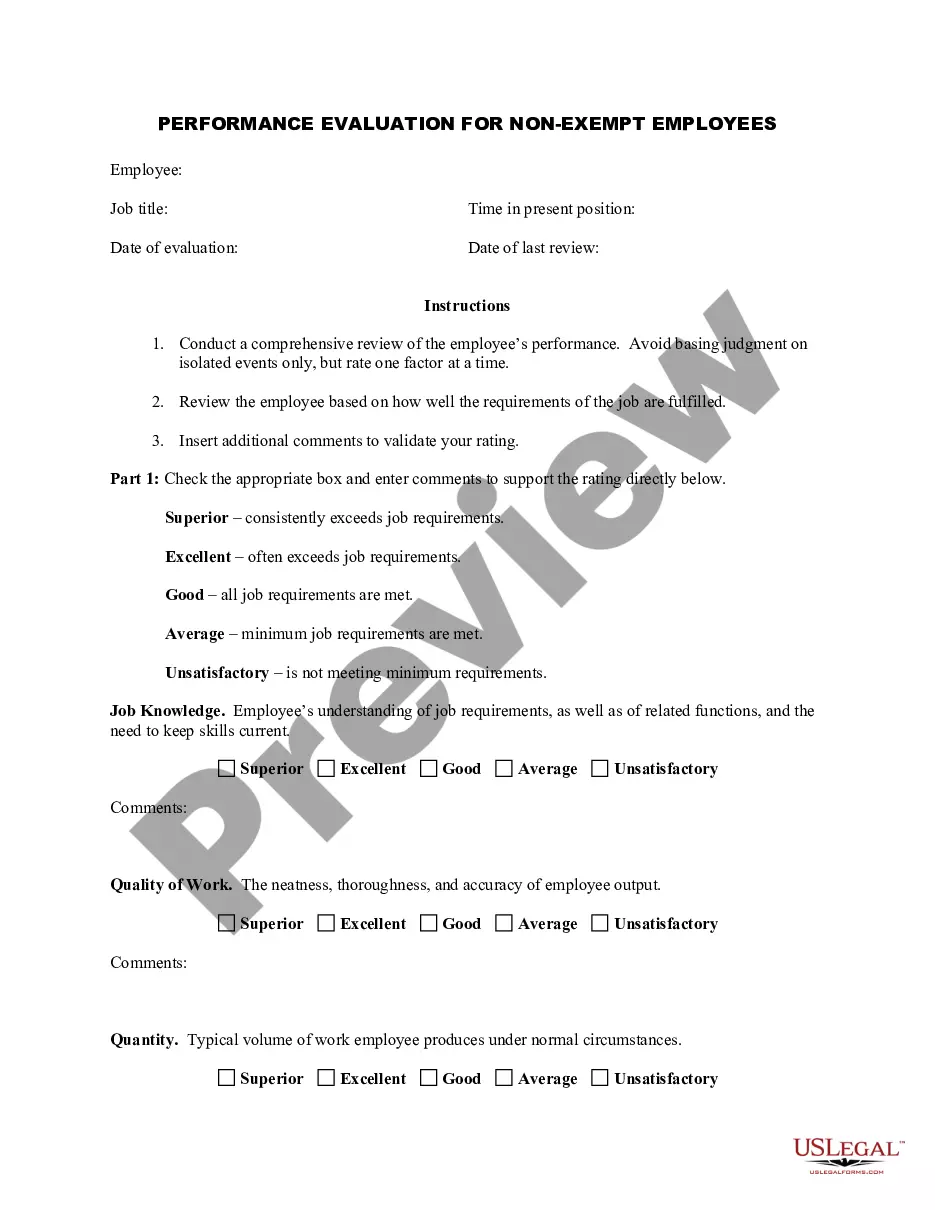

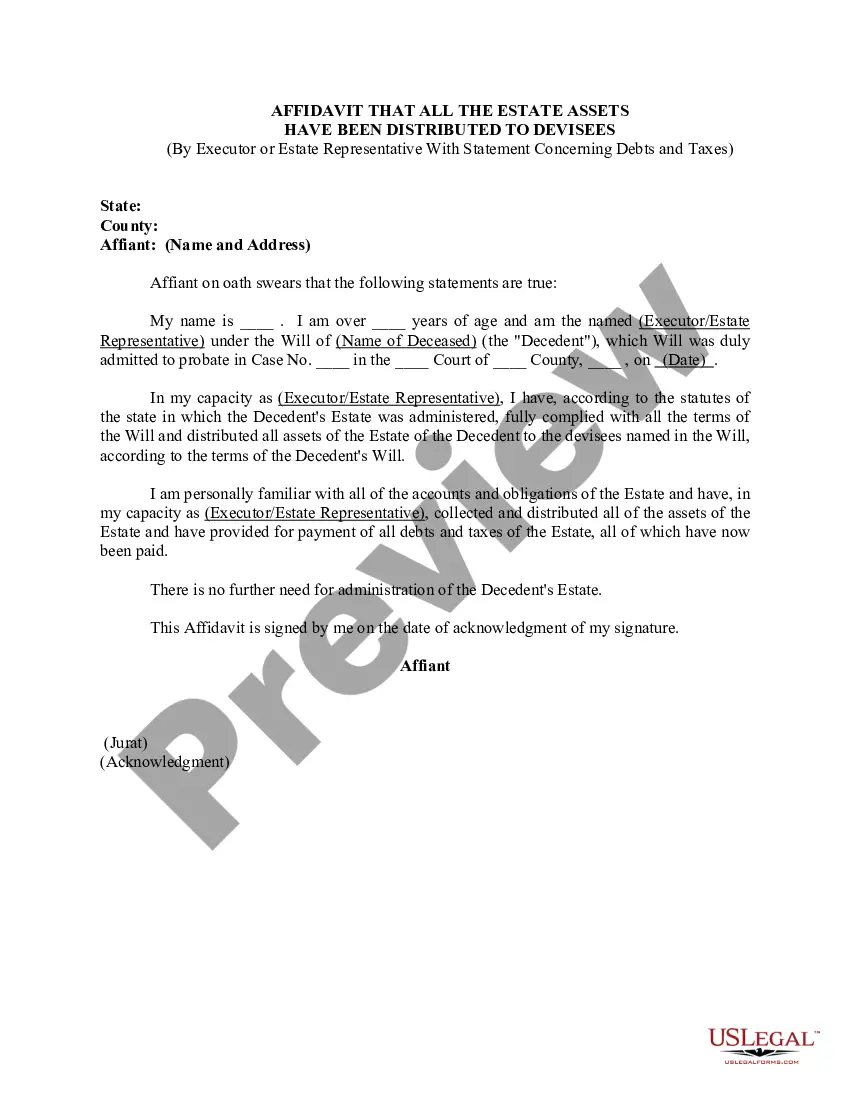

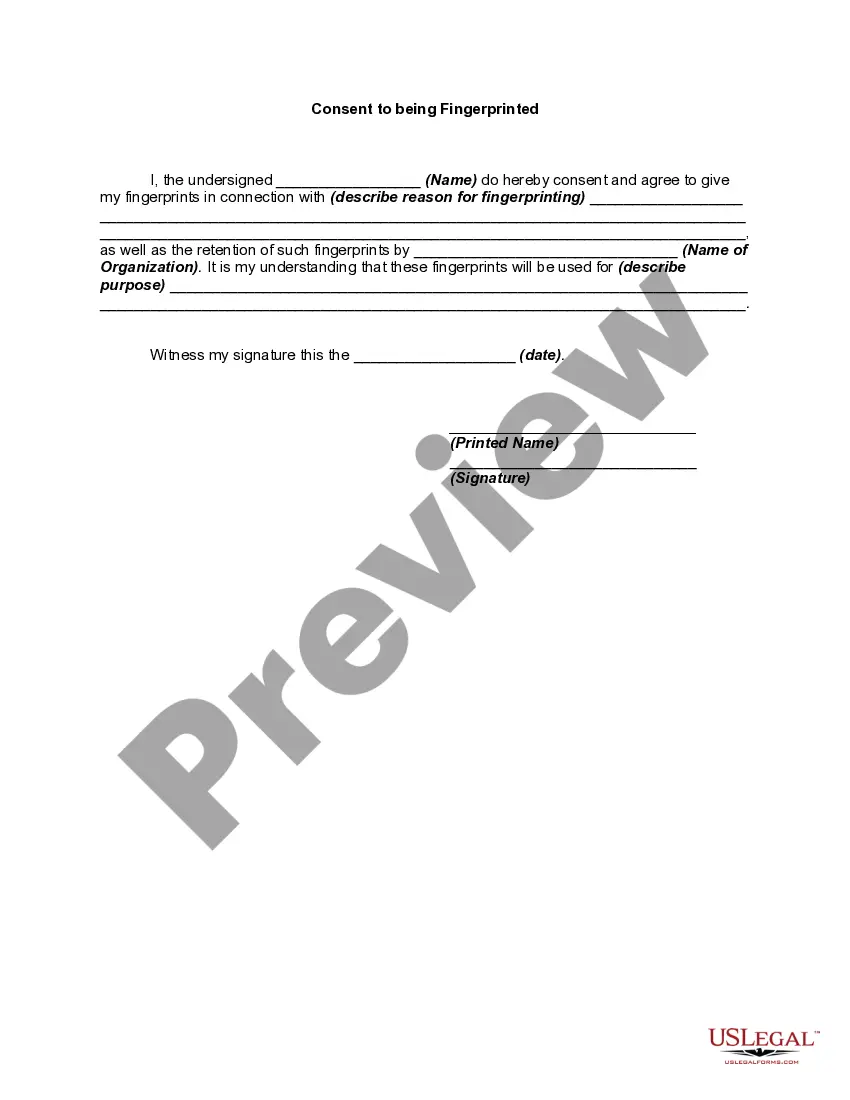

- Be sure you have chosen the correct develop to your town/area. Click on the Preview key to review the form`s information. See the develop outline to actually have chosen the proper develop.

- When the develop doesn`t satisfy your specifications, utilize the Research discipline towards the top of the screen to find the one who does.

- Should you be content with the shape, affirm your option by clicking on the Get now key. Then, choose the pricing strategy you prefer and supply your credentials to register for the profile.

- Procedure the transaction. Utilize your credit card or PayPal profile to complete the transaction.

- Pick the file format and download the shape in your device.

- Make changes. Fill up, revise and printing and indicator the saved Virgin Islands Receipt of Beneficiary for Early Distribution from Estate and Indemnity Agreement.

Every design you included with your bank account lacks an expiry time and is your own property eternally. So, if you want to download or printing an additional backup, just check out the My Forms section and click on about the develop you require.

Get access to the Virgin Islands Receipt of Beneficiary for Early Distribution from Estate and Indemnity Agreement with US Legal Forms, one of the most comprehensive collection of legal file layouts. Use a large number of professional and express-particular layouts that meet your organization or person needs and specifications.