Virgin Islands Job Invoice

Description

How to fill out Job Invoice?

Are you in a position where you need documents for occasional business or personal use almost every day.

There are numerous legal document templates available online, but finding reliable versions is not easy.

US Legal Forms offers a vast selection of form templates, including the Virgin Islands Job Invoice, which can be printed to meet state and federal requirements.

If you find the correct form, click Get now.

Select the payment plan you want, fill in the required information to complete your purchase, and pay for the order using your PayPal or credit card.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- After that, you can download the Virgin Islands Job Invoice template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Find the form you need and ensure it is for the correct city/area.

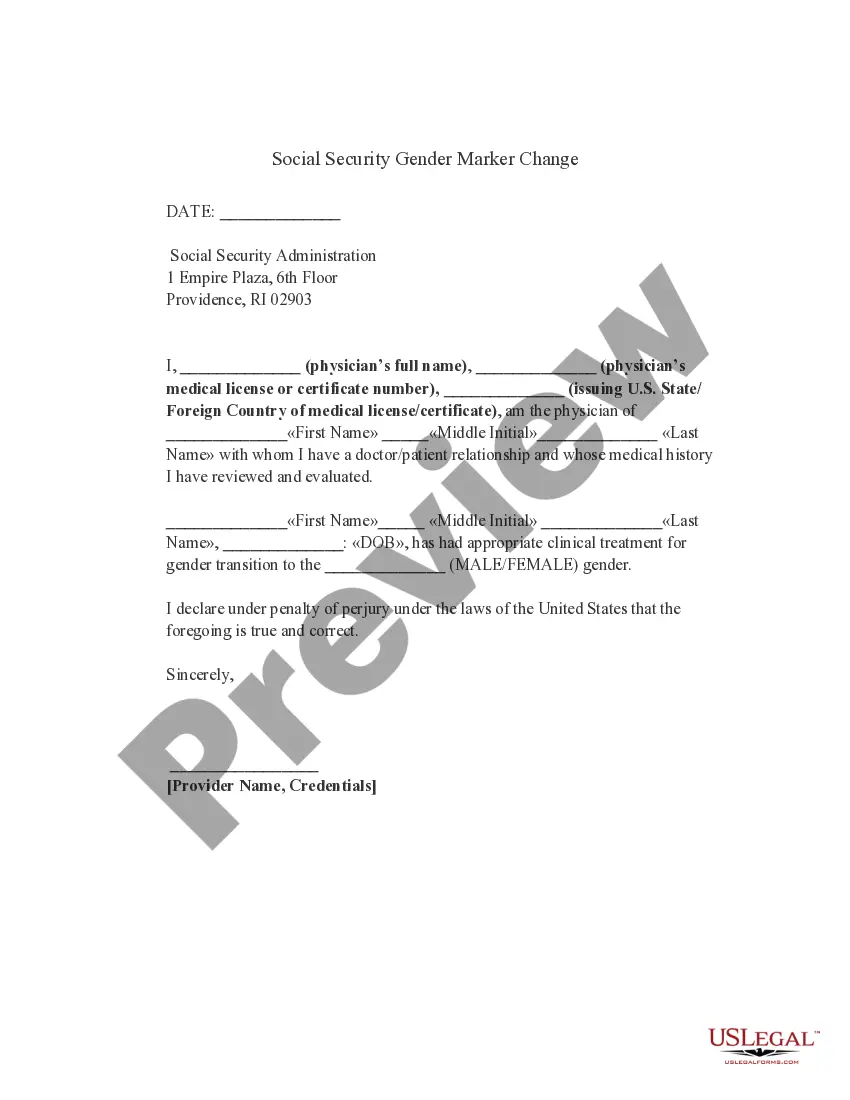

- Use the Preview button to examine the form.

- Check the summary to confirm that you have selected the right form.

- If the form is not what you are looking for, use the Search field to locate the form that fits your needs.

Form popularity

FAQ

Yes, the U.S. Virgin Islands are considered a part of the United States for certain tax purposes. However, the tax rules differ from those in the mainland U.S. Understanding these differences is essential, especially when filing for a Virgin Islands Job Invoice, as specific local credits and exemptions may apply.

Filing your US Islands tax return involves gathering your income documents and completing the appropriate forms. You can file electronically or via mail, depending on your preference. Using platforms like USLegalForms simplifies the process, ensuring you accurately report your Virgin Islands Job Invoice and comply with local requirements.

Yes, you can file your USVI taxes online. This method is convenient and helps streamline tax compliance in the Virgin Islands. By leveraging online resources, including USLegalForms, you can handle your Virgin Islands Job Invoice and related tax documents with ease and efficiency.

You can file your taxes by yourself online in the Virgin Islands. The process is user-friendly and simplifies tax preparation. Utilizing services like USLegalForms helps you manage your Virgin Islands Job Invoice and ensures that all necessary details are included in your tax submission.

Yes, you can submit your taxes electronically in the Virgin Islands. Electronic filing enhances the accuracy of your tax returns and speeds up the processing time. You can use various platforms, including USLegalForms, to file your Virgin Islands Job Invoice and other tax-related documents easily and securely.

Form 1120-F is the U.S. Income Tax Return of a Foreign Corporation, which is essential for foreign entities operating in the Virgin Islands. If your business does work in the Islands and you plan to submit a Virgin Islands Job Invoice, understanding this form’s requirements is crucial. It ensures compliance with local tax laws while allowing businesses to claim certain tax benefits effectively.

Filling out a DHL commercial invoice requires careful attention to detail. Start by listing the seller and buyer information accurately. Include a detailed description of the goods being shipped, and ensure to mention the value of items. For a smooth shipping process, it is wise to cross-reference with a Virgin Islands Job Invoice that maintains clarity and compliance with shipping standards.

To fill out a work invoice, begin with your details at the top, followed by your client's information. Then, list the services or tasks completed, specifying dates and hours worked if necessary. Don’t forget to include payment terms, and consider using a Virgin Islands Job Invoice template for a professional presentation that enhances your business’s reputation.

Yes, a commercial invoice is typically necessary when shipping internationally. This document serves as a record of the sale, detailing the items being shipped, their value, and other important information. Utilizing a Virgin Islands Job Invoice can simplify this process, especially when dealing with customs.

To obtain a Virgin Islands Job Invoice, you can utilize the services provided by U.S. Legal Forms. Their platform offers tools to easily create and customize invoices that meet legal requirements. By following the steps provided, you can generate the necessary documents efficiently.