Virgin Islands General Form of Factoring Agreement - Assignment of Accounts Receivable

Description

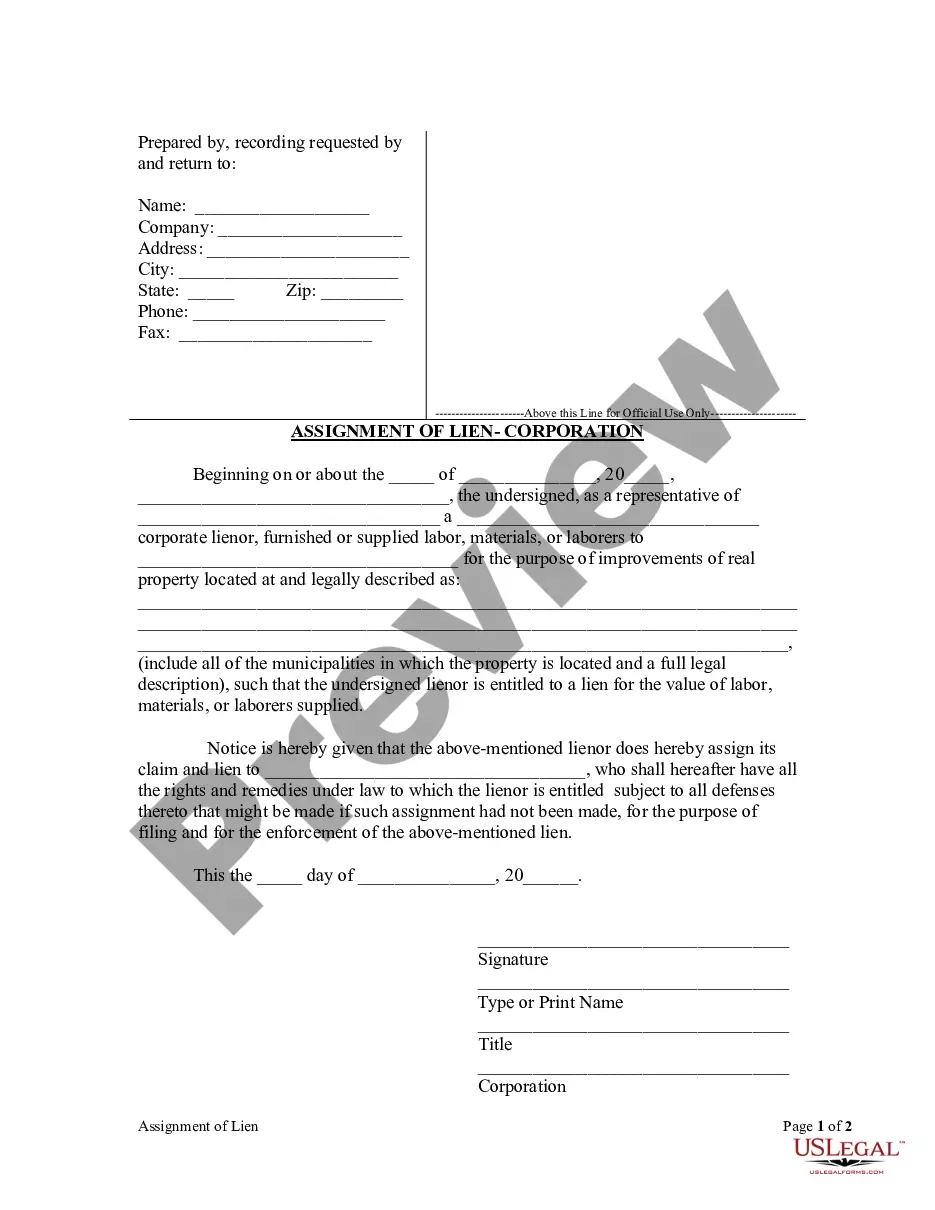

How to fill out General Form Of Factoring Agreement - Assignment Of Accounts Receivable?

Selecting the optimal legal document template can be challenging.

Certainly, numerous designs are available online, but how do you locate the legal document you need.

Utilize the US Legal Forms website.

If you are already registered, Log In to your account and click the Acquire button to obtain the Virgin Islands General Form of Factoring Agreement - Assignment of Accounts Receivable. Use your account to browse the legal forms you have purchased previously. Visit the My documents tab of your account to download another copy of the document you need. For new users of US Legal Forms, here are simple steps you can follow: First, ensure you have selected the correct document for your area/county. You may review the form using the Review button and read the form details to confirm it is the right one for you. If the form does not meet your requirements, use the Search field to find the appropriate form. Once you are confident the form is suitable, click on the Purchase now button to acquire the form. Choose the pricing plan you want and enter the required information. Create your account and process the payment using your PayPal account or credit card. Select the file format and download the legal document template to your device. Complete, edit, print, and sign the obtained Virgin Islands General Form of Factoring Agreement - Assignment of Accounts Receivable. US Legal Forms is the largest repository of legal documents where you can find a variety of document templates. Utilize the service to download professionally crafted files that meet state regulations.

- The service provides thousands of templates, such as the Virgin Islands General Form of Factoring Agreement - Assignment of Accounts Receivable, which you can use for business and personal purposes.

- All documents are reviewed by experts and comply with federal and state regulations.

Form popularity

FAQ

The accounts receivable step process involves several key stages, starting with the creation of an invoice once a product or service is delivered. Next, the invoice is sent to the customer, who then has a designated period to make payment. If the business uses a factoring agreement, it can sell the invoice to a factor for immediate funds instead of waiting for payment. The Virgin Islands General Form of Factoring Agreement - Assignment of Accounts Receivable clarifies this procedure and enhances transparency.

In factoring, a Notice of Assignment (Noa) is a critical document that informs customers that their invoice has been sold to a factor. The Noa serves as official notification, ensuring that customers know where to send payments. This aspect is essential for maintaining clear communication and compliance with the Virgin Islands General Form of Factoring Agreement - Assignment of Accounts Receivable. It helps safeguard the interests of all parties involved in the transaction.

The key difference between pledge and assignment of receivables lies in ownership rights. A pledge allows a lender to take possession of the receivables as collateral while the borrower retains ownership. Conversely, assignment transfers ownership rights to the lender fully. Understanding these differences is crucial when choosing a Virgin Islands General Form of Factoring Agreement - Assignment of Accounts Receivable.

Consent to assignment of receivables refers to the agreement by a debtor to allow a business to transfer its rights to collect debts owed to it. This consent ensures that the new creditor has the legal authority to collect those funds. Including consent clauses in your Virgin Islands General Form of Factoring Agreement - Assignment of Accounts Receivable can protect both the business and the new lender.

Factoring allows companies to immediately build up their cash balance and pay any outstanding obligations. Therefore, factoring helps companies free up capital. that is tied up in accounts receivable and also transfers the default risk associated with the receivables to the factor.

In algebra, 'factoring' (UK: factorising) is the process of finding a number's factors. For example, in the equation 2 x 3 = 6, the numbers two and three are factors.

Factoring is a financial transaction and a type of debtor finance in which a business sells its accounts receivable (i.e., invoices) to a third party (called a factor) at a discount. A business will sometimes factor its receivable assets to meet its present and immediate cash needs.

The notice of assignment (NOA) informs your customer that a third party (bank, financing company, or factoring company) will manage and collect your accounts receivable (AR) going forward.

How to Factor InvoicesYour business invoices a customer and sends a copy to the factoring company.The factor then funds your business with an advance typically between 70% to 90% of the invoice amount.Your business gets the remaining invoice amount, minus a small fee, once the customer pays the invoice.

Complete Document ListingComprehensive Factoring Application.Corporate or personal tax returns.Corporate or personal Financial statements.Articles of incorporation, (if corporation)Partnership agreement, (if partnership)Current aging of accounts receivables.Current aging of accounts payable.More items...