Virgin Islands Buy-Sell Agreement between Two Shareholders of Closely Held Corporation

Description

A buy-sell agreement is an agreement between the owners (shareholders) of a firm, defining their mutual obligations, privileges, protections, and rights.

How to fill out Buy-Sell Agreement Between Two Shareholders Of Closely Held Corporation?

Are you currently in a situation where you require documentation for either business or specific intentions almost every day.

There are numerous legitimate form templates available online, but finding reliable ones can be challenging.

US Legal Forms offers thousands of document templates, such as the Virgin Islands Buy-Sell Agreement between Two Shareholders of a Closely Held Corporation, designed to comply with federal and state requirements.

Once you find the appropriate form, click Acquire now.

Select the payment plan you prefer, complete the required information to create your account, and purchase the order using your PayPal or Visa or Mastercard.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- After that, you can download the Virgin Islands Buy-Sell Agreement between Two Shareholders of a Closely Held Corporation template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Locate the form you need and ensure it corresponds to the correct city/area.

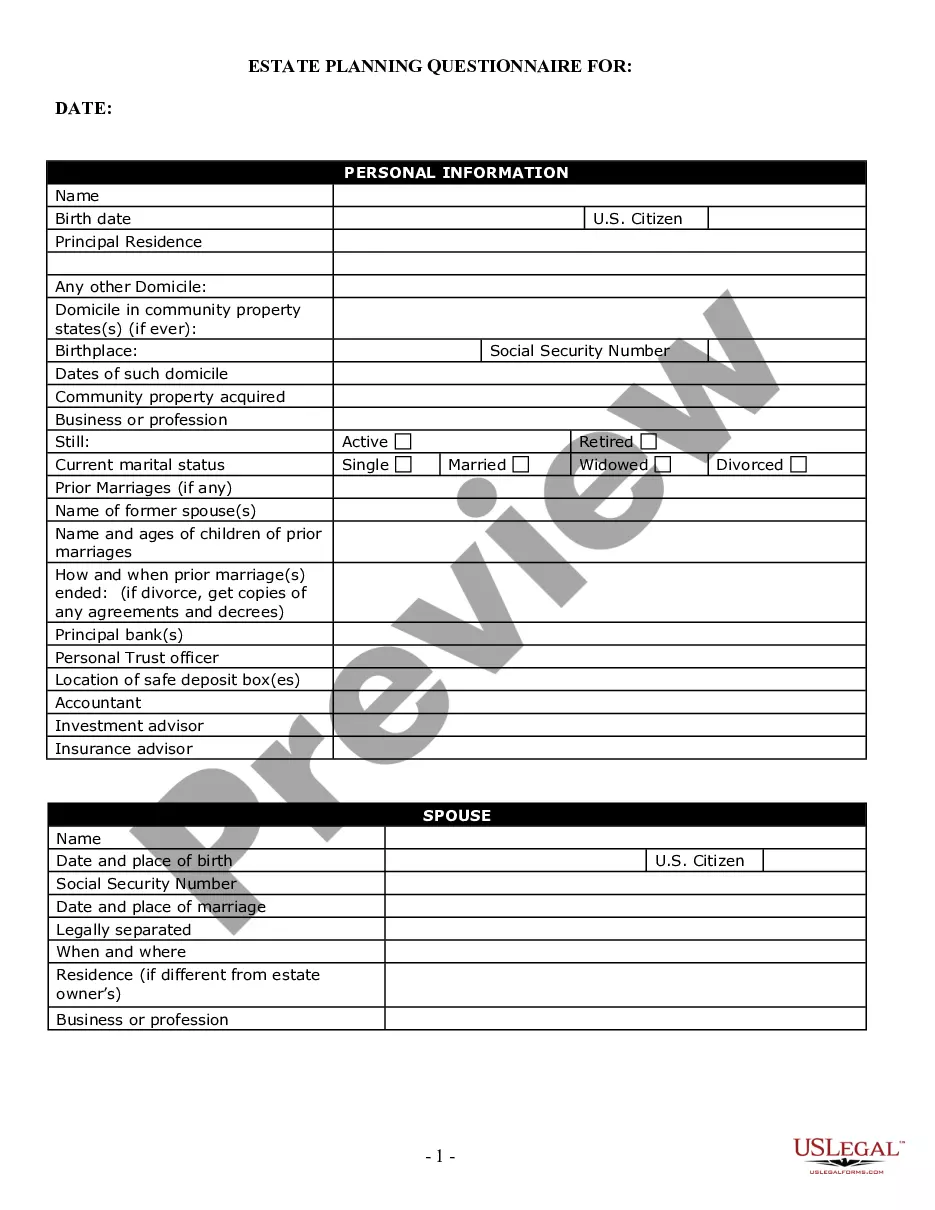

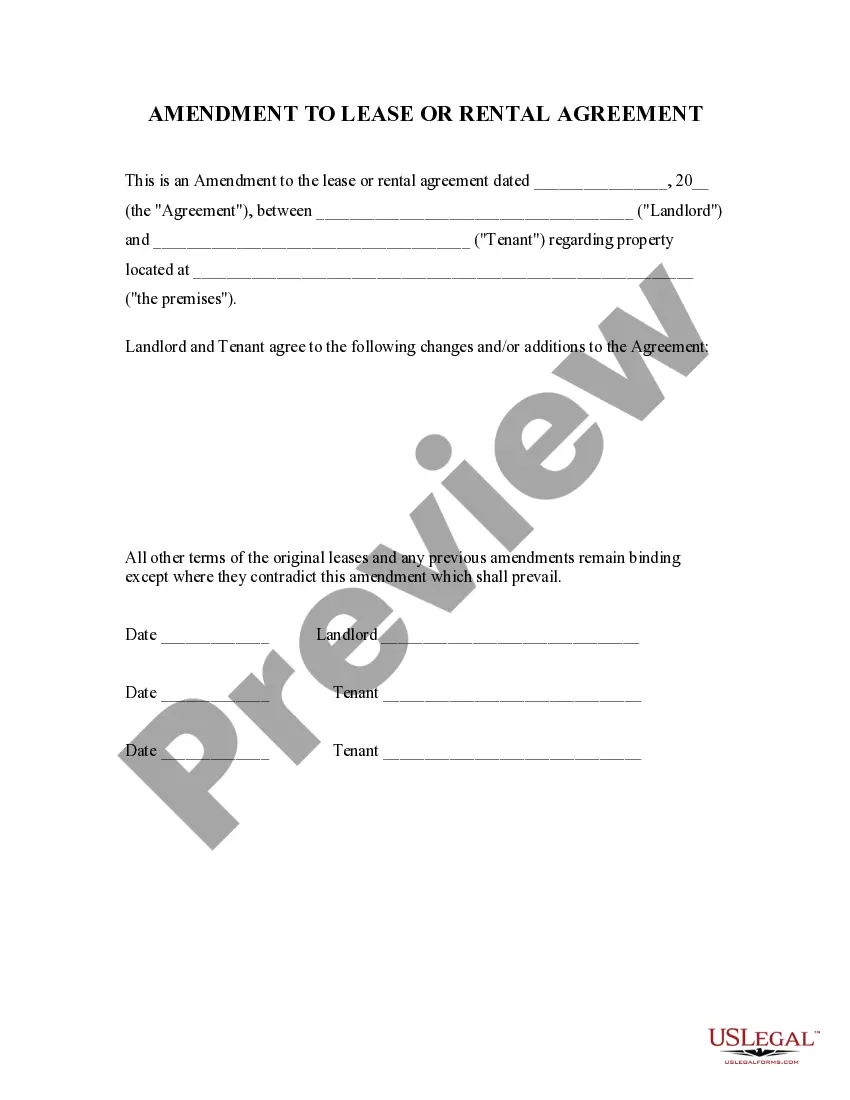

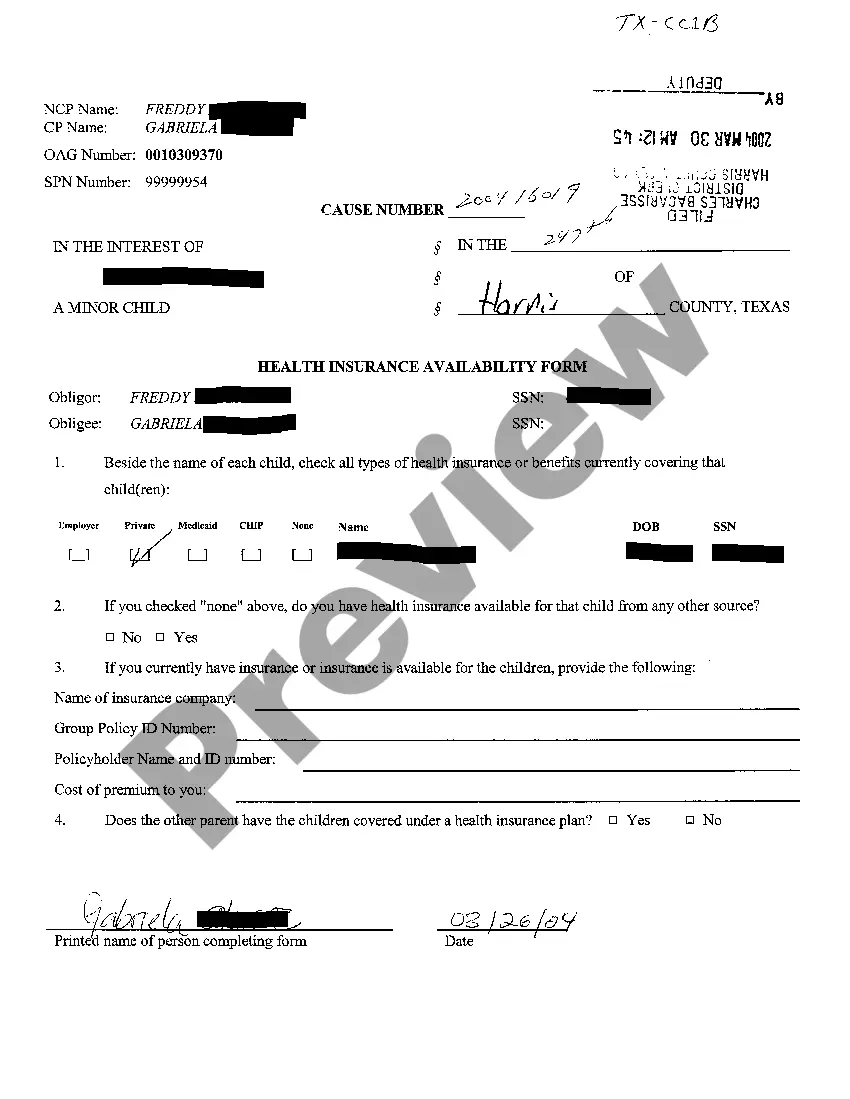

- Use the Review button to verify the form.

- Read the description to ensure you have selected the correct document.

- If the form isn’t what you are looking for, use the Search field to find the form that fits your needs and requirements.

Form popularity

FAQ

Setting up a shareholders agreement involves several steps. First, you need to gather the essential details about each shareholder and the corporation. Then, you can outline the rights, responsibilities, and terms that govern share transactions in a Virgin Islands Buy-Sell Agreement between Two Shareholders of Closely Held Corporation. For simplicity and compliance, using a resource like US Legal Forms can help streamline this process and ensure all legal standards are met.

Generally, selling shares without the consent of other shareholders is not permitted, depending on the terms set in your shareholder or buy-sell agreement. A Virgin Islands Buy-Sell Agreement between Two Shareholders of Closely Held Corporation typically includes clauses that require consent for share transfers. This protects the interests of all shareholders and maintains the corporation's integrity. Referencing these agreements is crucial before initiating any sale.

Generally, backing out of a buy-sell agreement requires mutual consent from all parties involved, as these agreements are legally binding. If you find yourself needing to withdraw, discussing your concerns with the other shareholders is crucial to reach an amicable solution. Consulting legal experts familiar with the Virgin Islands Buy-Sell Agreement between Two Shareholders of Closely Held Corporations can provide guidance on your rights and options.

The main purpose of a buy-sell agreement is to outline the procedures and terms under which shares can be bought or sold among shareholders. This ensures a smooth transition in the event of unforeseen circumstances, like a shareholder's death or departure. For closely held corporations in the Virgin Islands, a Buy-Sell Agreement between Two Shareholders provides security and clear expectations, thus promoting business stability.

You might not need a buy-sell agreement if your corporation has only one shareholder, as there would be no ownership transfer issues. However, even in some closely held corporations, informal agreements or trust among shareholders may eliminate the immediate need for a Virgin Islands Buy-Sell Agreement between Two Shareholders of Closely Held Corporations. Always consider possible future scenarios that could benefit from formal arrangements.

You can obtain a shareholders agreement by working closely with a legal professional who understands your specific needs. Additionally, online resources and platforms like USLegalForms offer templates tailored to the Virgin Islands Buy-Sell Agreement between Two Shareholders of Closely Held Corporations. This ensures you have a solid document that meets all legal requirements and addresses your unique circumstances.

Transferring shares in a BVI company generally requires adherence to the company's articles of association and relevant legal formalities. Documentation, including a stock transfer form, needs to be completed. Utilizing a Virgin Islands Buy-Sell Agreement between Two Shareholders of Closely Held Corporation simplifies this process, ensuring that all parties understand their rights and obligations clearly.

A shareholder agreement and a buy-sell agreement are not the same, although they can complement one another. A buy-sell agreement specifically focuses on the terms of buying and selling shares, while a shareholder agreement generally covers broader governance aspects. To ensure thorough understanding and compliance, consider integrating both agreements, particularly the Virgin Islands Buy-Sell Agreement between Two Shareholders of Closely Held Corporation.

Typically, all shareholders are not required to agree to sell shares unless stipulated by the company's bylaws or an existing agreement. A Virgin Islands Buy-Sell Agreement between Two Shareholders of Closely Held Corporation serves to clarify the process and obligations, aiding in a smooth transaction if the sale of shares is necessary.

Not necessarily. The need for all shareholders to agree depends on the specific terms outlined in the company's governing documents and any existing agreements. A well-drafted Virgin Islands Buy-Sell Agreement between Two Shareholders of Closely Held Corporation can designate the required consents for certain actions, ensuring clarity and preventing disagreements.