Virgin Islands Credit Card Application for Unsecured Open End Credit

Description

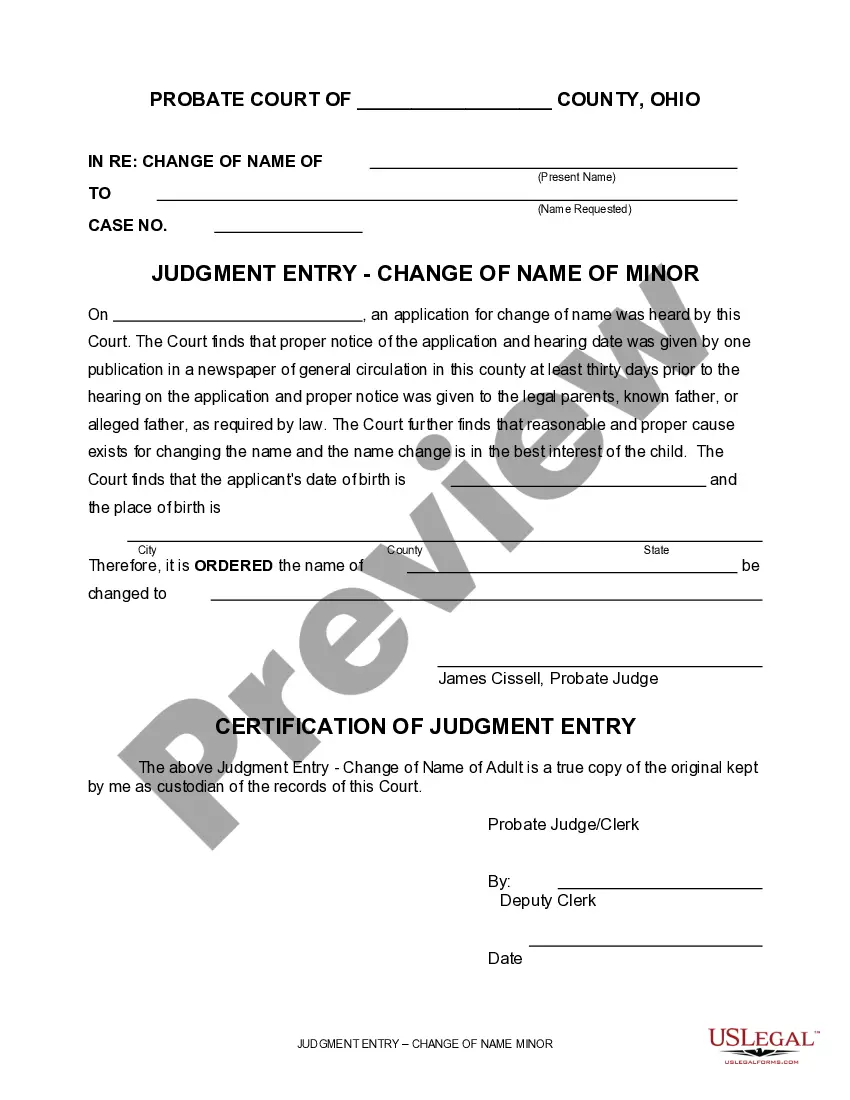

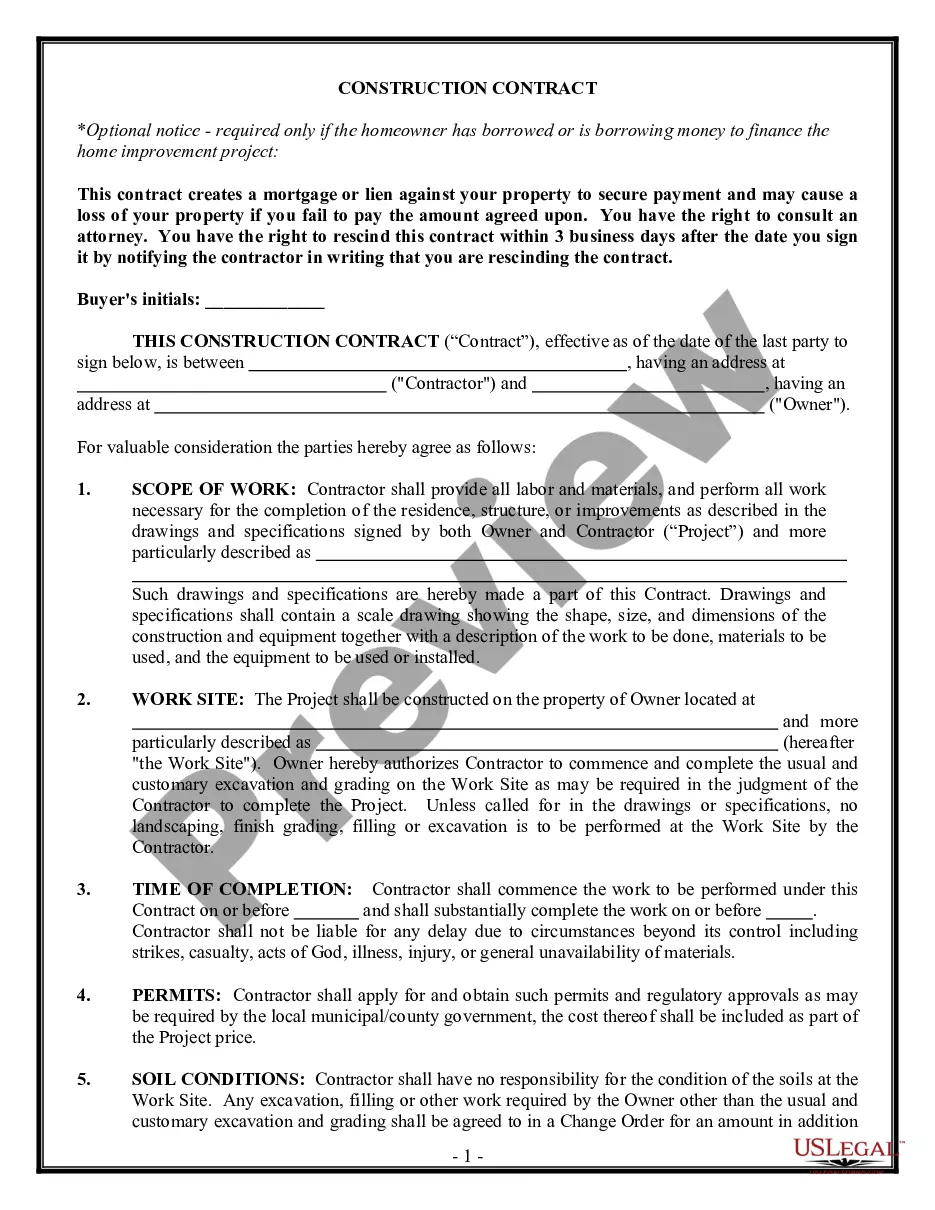

How to fill out Credit Card Application For Unsecured Open End Credit?

If you have to total, down load, or printing authorized papers layouts, use US Legal Forms, the greatest selection of authorized kinds, that can be found on the web. Make use of the site`s simple and convenient lookup to discover the papers you will need. Different layouts for organization and individual purposes are sorted by classes and suggests, or key phrases. Use US Legal Forms to discover the Virgin Islands Credit Card Application for Unsecured Open End Credit in a handful of mouse clicks.

When you are previously a US Legal Forms client, log in to the account and click the Download switch to obtain the Virgin Islands Credit Card Application for Unsecured Open End Credit. You can also accessibility kinds you in the past acquired in the My Forms tab of your own account.

Should you use US Legal Forms the first time, follow the instructions below:

- Step 1. Be sure you have chosen the form for that right city/nation.

- Step 2. Take advantage of the Preview choice to check out the form`s content material. Never overlook to read through the outline.

- Step 3. When you are not satisfied with the kind, take advantage of the Research industry towards the top of the display to locate other models of the authorized kind format.

- Step 4. When you have identified the form you will need, click on the Purchase now switch. Opt for the pricing prepare you choose and add your references to register to have an account.

- Step 5. Method the purchase. You can use your bank card or PayPal account to perform the purchase.

- Step 6. Pick the format of the authorized kind and down load it on your device.

- Step 7. Comprehensive, edit and printing or sign the Virgin Islands Credit Card Application for Unsecured Open End Credit.

Every authorized papers format you purchase is your own forever. You might have acces to every kind you acquired in your acccount. Select the My Forms portion and choose a kind to printing or down load once more.

Be competitive and down load, and printing the Virgin Islands Credit Card Application for Unsecured Open End Credit with US Legal Forms. There are millions of skilled and state-specific kinds you can use for the organization or individual requirements.

Form popularity

FAQ

Defaulting on your credit card means you've failed to make at least the minimum payment for 180 days. Should that happen, your credit score will plummet, and your account might be closed and handed to debt collectors. Your wages may also be garnished if a lawsuit is filed.

Editorial and user-generated content is not provided, reviewed or endorsed by any company. Yes, a $2,000 credit limit is ok, if you take into consideration that the median credit line is $5,394, ing to TransUnion data from 2021.

To make this assessment, they generally review your credit report and history as well as the income information you provided on your application. If you're issued a credit card with a low credit limit, it could be for a number of reasons, including: Poor credit history. High balances with other credit cards.

You should use less than 30% of a $2,000 credit card limit each month in order to avoid damage to your credit score. Having a balance of $600 or less when your monthly statement closes will show that you are responsible about keeping your credit utilization low.

All Credit One cards start off with a credit limit of $300 to $500. You can be considered for a credit limit increase with a history of consistent on-time payments.

The maximum credit line for a Credit One credit card is $2,000, ing to online reports, The issuer does not publicly disclose a maximum official amount. If approved for a Credit One card, applicants can expect a minimum credit line of $300 to $500 initially, depending on the card and their credit standing.

How to get an unsecured line of credit online Understand Your Credit and Income Qualifications. ... Review Unsecured Line of Credit Providers. ... Submit Your Online Line of Credit Application. ... Know Your Line of Credit Terms. ... Use What You Need. ... Repay on Time.

The Revvi Card is a pretty good unsecured credit card for people with bad credit who want to earn rewards but need to borrow for emergencies. Cardholders earn 1% cash back on all purchases, after paying the card's bill, and the card has a $300 minimum credit limit with no deposit needed.