Virgin Islands Line of Credit Promissory Note

Description

Form popularity

FAQ

A promissory note could become invalid if: It isn't signed by both parties. The note violates laws. One party tries to change the terms of the agreement without notifying the other party.

A form of promissory note to be used to evidence advances under an uncommitted line of credit when the lender uses a line of credit confirmation letter instead of a separate line of credit agreement and the parties are not contemplating a negotiable instrument.

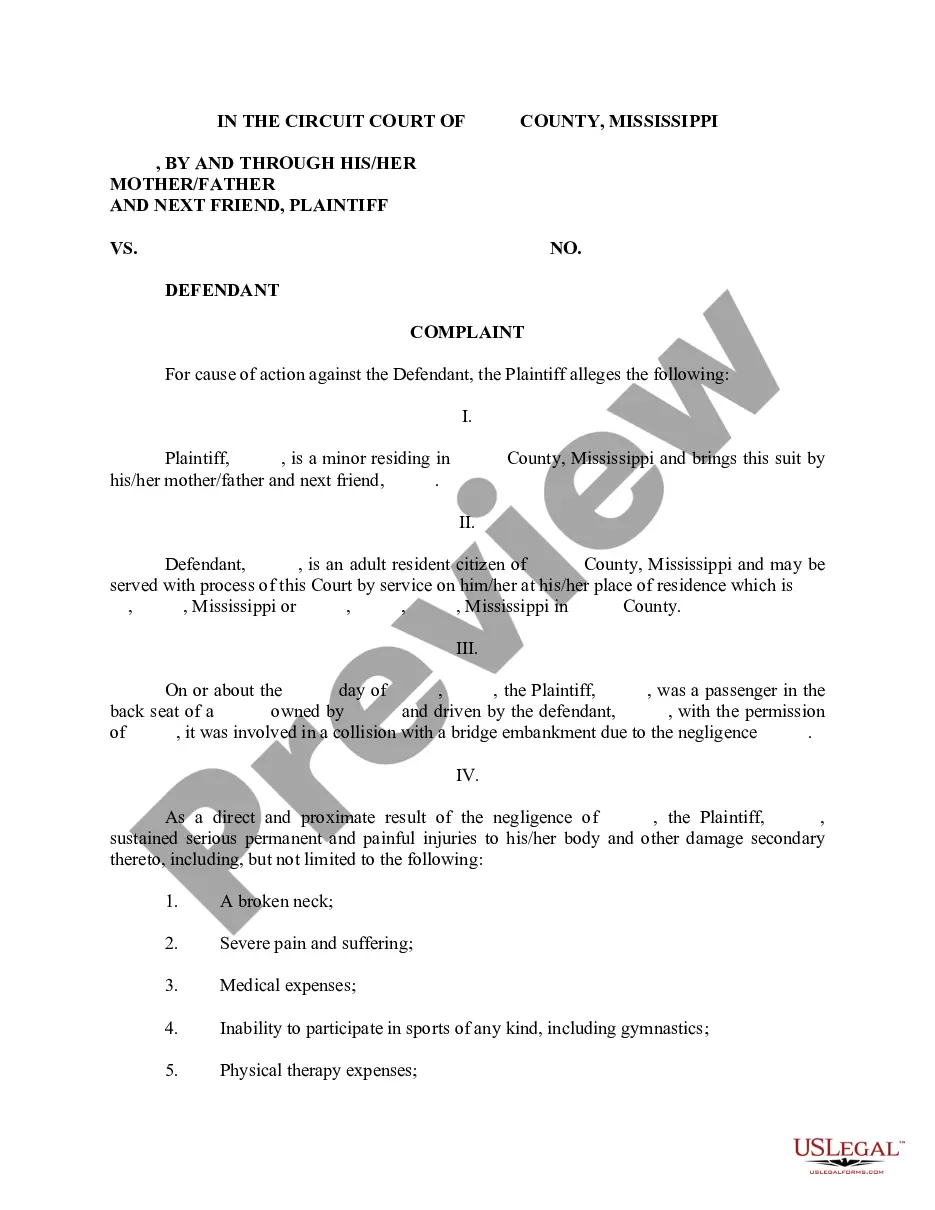

If timely payment is not made by the borrower, the note holder can file an action to recover payment. Depending upon the amount owed and/or specified in the note, a summons and complaint may be filed with the court or a motion in lieu of complaint may be filed for an expedited judgment.

Promissory Notes Are Legal Contracts A promissory note or promissory letter is a legal instrument similar in nature to any common law contract. In order for a contract to be enforceable, it must contain certain legal conditions such as an offer and an acceptance of that offer.

Promissory notes are a valuable legal tool that any individual can use to legally bind another individual to an agreement for purchasing goods or borrowing money. A well-executed promissory note has the full effect of law behind it and is legally binding on both parties.

Before a promissory note can be canceled, the lender must agree to the terms of canceling it. A well-drafted and detailed promissory note can help the parties involved avoid future disputes, misunderstandings, and confusion. When canceling the promissory note, the process is referred to as a release of the note.

Promissory notes are legally binding whether the note is secured by collateral or based only on the promise of repayment. If you lend money to someone who defaults on a promissory note and does not repay, you can legally possess any property that individual promised as collateral.

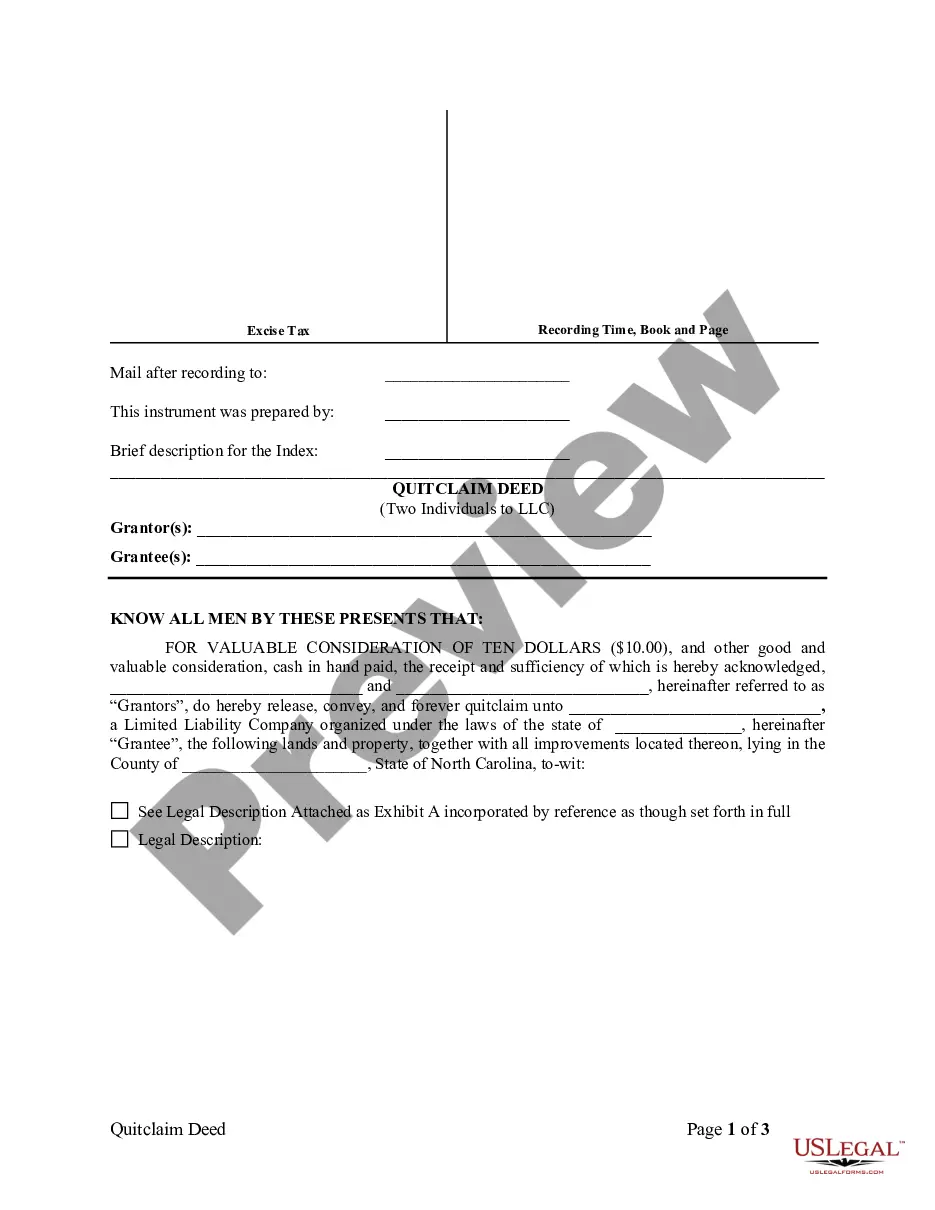

Although it's a legal document, writing a promissory note doesn't have to be difficult. There are even websites online that offer fill-in-the-blank templates, like eForms or .