Virgin Islands Sale or Return is a business concept where a seller allows a buyer to purchase goods or products with the option to return any unsold items to the seller for a refund or credit. It provides a flexible solution for retailers or individuals who want to minimize their financial risk when investing in inventory. In the Virgin Islands, Sale or Return is an arrangement commonly used in various industries including fashion, electronics, books, and more. It enables retailers to stock their shelves with a wide range of products without committing to paying for them upfront. The key benefit of this approach is that it allows the retailer to test market demand and avoid potential losses by returning any unsold items. There are different types of Virgin Islands Sale or Return agreements available depending on the terms negotiated between the seller and the buyer. These types include: 1. Standard Sale or Return: In this type, the retailer purchases the goods from the seller and has a specified timeframe within which they can return any unsold items. The refund or credit is typically provided minus any restocking fees or transportation costs. 2. Consignment Sale or Return: This type of arrangement is common in the Virgin Islands. The seller retains ownership of the goods until they are sold by the retailer. Any unsold items are returned to the seller without any payment obligation on behalf of the retailer. This approach is often used in high-value or luxury items where the retailer may have limited capital to invest. 3. Wholesale Sale or Return: In this type, the retailer purchases goods from the seller at a wholesale price with the option to return unsold items within a specified period. This arrangement allows the retailer to benefit from bulk pricing while maintaining flexibility in managing inventory levels. 4. Commission Sale or Return: This type of sale or return agreement involves the retailer promoting and selling the seller's products in exchange for a commission or percentage of the sale. If any items are not sold, they can be returned to the seller, and the retailer does not need to pay for them. The Virgin Islands Sale or Return concept provides an advantageous solution for both sellers and retailers. Sellers can expand their market reach by accessing new retail outlets, while retailers can diversify their inventory without bearing the full financial risk. It fosters a win-win situation where both parties can maximize their profits and minimize losses.

Virgin Islands Sale or Return

Description

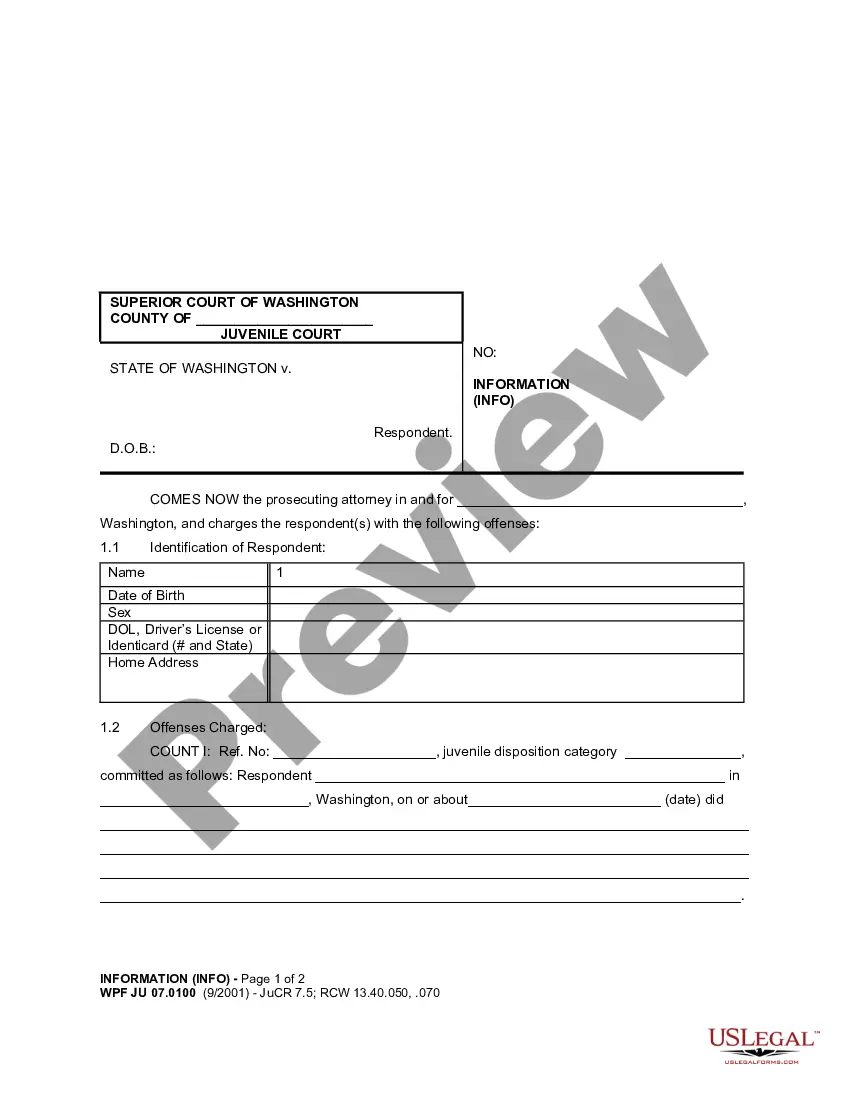

How to fill out Virgin Islands Sale Or Return?

You can spend hours online looking for the legal document template that meets the state and federal requirements you need.

US Legal Forms provides a vast array of legal forms that have been reviewed by experts.

It is easy to obtain or print the Virgin Islands Sale or Return from your service.

If available, use the Review button to browse through the document template as well. To find another version of the form, use the Search field to locate the template that fits your needs and requirements.

- If you have an account with US Legal Forms, you may Log In and then click the Acquire button.

- Next, you can complete, modify, print, or sign the Virgin Islands Sale or Return.

- Every legal document template you obtain is yours permanently.

- To get another copy of a purchased form, visit the My documents tab and click the appropriate button.

- If you're using the US Legal Forms website for the first time, follow the simple instructions below.

- First, ensure you have selected the correct document template for your county/town of choice.

- Check the form description to confirm you have selected the right form.

Form popularity

FAQ

Yes, the U.S. Virgin Islands has a capital gains tax system in place. Depending on your specific circumstances, your applicable rate may vary. If you are planning a Virgin Islands Sale or Return, being informed about potential capital gains tax is crucial, as it could affect your profits and overall investment strategy.

In the U.S. Virgin Islands, capital gains tax may apply, but the rates can differ based on the context of the sale. If you are involved in a Virgin Islands Sale or Return, understanding your potential tax liabilities is vital. It's advisable to seek expert advice to navigate these financial obligations effectively.

While not states, several U.S. territories, including the U.S. Virgin Islands, have favorable tax structures, with no capital gains tax imposed under specific conditions. This can be particularly beneficial if you are considering a Virgin Islands Sale or Return. However, the specifics may vary, so it's wise to consult a tax professional for personalized guidance.

The U.S. Virgin Islands offers attractive tax incentives, such as exemptions on certain income types and low corporate tax rates. For individuals and businesses alike, these advantages can significantly improve your financial situation. If you are exploring a Virgin Islands Sale or Return, these tax benefits can enhance your investment strategy.

Yes, the U.S. Virgin Islands does impose a property tax, which varies depending on the property type and location. Homeowners should keep in mind that rates can change, so it’s essential to consult local regulations. If you are considering a Virgin Islands Sale or Return, understanding property tax implications is crucial for your financial planning.

Filing a U.S. Islands tax return involves understanding the local tax laws and requirements. You can start by gathering your financial information and referring to the official tax documents for the Virgin Islands. If this seems overwhelming, consider using platforms like uslegalforms, which provide resources and guidance tailored to help you through the tax return process. This support can simplify your experience as you navigate your Virgin Islands Sale or Return.

Denmark's decision to sell the Virgin Islands was largely driven by financial difficulties and military concerns. The islands required significant resources for defense and development, which Denmark struggled to provide. Furthermore, the sale to the US offered a lucrative payment and relieved Denmark of its colonial responsibilities. This transition was a pivotal moment in the legacy of the Virgin Islands Sale or Return.

The Virgin Islands were originally inhabited by the Taino people before European exploration. In the 17th century, the islands came under the control of various European powers, including Spain, the Dutch, and the French. Denmark officially claimed the islands in the mid-17th century, establishing a lasting colonial presence. This rich history laid the foundation for the eventual Virgin Islands Sale or Return.

Absolutely, a US citizen can buy property in the Virgin Islands. There are specific regulations and processes involved in these property transactions that you should be aware of, especially if you're considering a Virgin Islands Sale or Return. Exploring these legal requirements will help ensure a smooth buying experience. The uslegalforms platform offers valuable insights and resources to assist you throughout the property acquisition process.

The U.S. Virgin Islands certainly has a sales tax system in place. This tax is applicable to various goods sold in the territory, making it essential for anyone involved in a Virgin Islands Sale or Return to understand its implications. Familiarizing yourself with these tax obligations can simplify your purchasing experience. For more information, you can utilize the resources provided on the uslegalforms platform.

Interesting Questions

More info

Anne Villas Wind ham Village Condos Wind ham Village WINTERS IDE Villas Mahogany VILLA MONTROSE RESIDENCE Village North Island VILLA LABYRINTH RENOWNED Villas North Island THE VILLA LABYRINTH ERS VILLA NORTH Island St. Anne Village St.