Virgin Islands Revocable Trust for Married Couple

Description

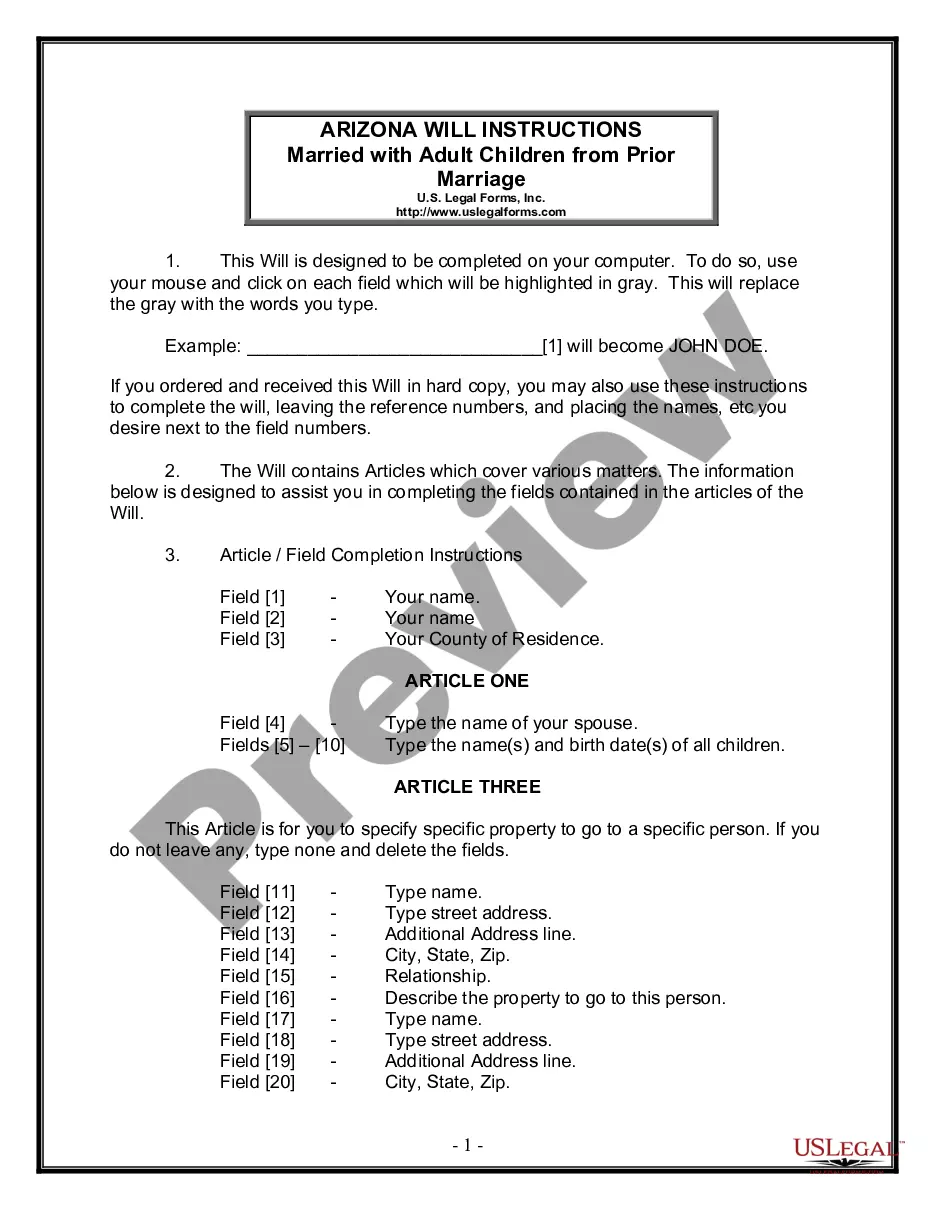

How to fill out Revocable Trust For Married Couple?

Finding the appropriate legal document template can be a challenge. Clearly, there are numerous templates accessible online, but how do you find the legal form you need.

Utilize the US Legal Forms website. This platform provides a vast array of templates, including the Virgin Islands Revocable Trust for Married Couples, which you may use for business and personal purposes.

All documents are reviewed by professionals and meet federal and state standards.

When you are confident that the form is suitable, click the Get now button to acquire the document. Choose the pricing plan you prefer and enter the required information. Create your account and place an order using your PayPal account or credit card. Select the file format and download the legal document template to your device. Complete, modify, print, and sign the obtained Virgin Islands Revocable Trust for Married Couples. US Legal Forms is the largest repository of legal templates where you can find a variety of document forms. Utilize this service to obtain professionally prepared documents that comply with state laws.

- If you are already registered, Log In to your account and click the Obtain button to retrieve the Virgin Islands Revocable Trust for Married Couples.

- Use your account to browse the legal documents you have acquired in the past.

- Visit the My documents section of your account to download another copy of the form you need.

- If you are a new user of US Legal Forms, here are simple steps you can follow.

- First, ensure you have selected the correct form for your city/region. You can preview the form using the Preview button and read the form outline to confirm it is the right one for you.

- If the form does not meet your requirements, use the Search field to find the appropriate document.

Form popularity

FAQ

When one spouse dies, a joint Virgin Islands Revocable Trust for Married Couple typically splits into two separate trusts. The remaining spouse usually retains full control over their half of the assets, while the other half will be governed by the trust terms laid out for that deceased spouse. This arrangement allows for seamless management and distribution of assets, ensuring that both spouses' intentions are respected.

Yes, a Virgin Islands Revocable Trust for Married Couple transitions to an irrevocable trust upon the death of one or both spouses. This change means that the terms set forth in the trust cannot be altered anymore. Consequently, the assets held within the trust are distributed according to the established plan, ensuring that the deceased spouse's wishes are honored.

A Virgin Islands Revocable Trust for Married Couple is not designed to protect assets from creditors, as it allows for flexibility and control over assets. While it helps in bypassing probate and offers privacy regarding asset distribution, its revocable nature means that assets can still be reached by creditors. For those concerned about creditor protection, exploring additional types of trusts may be beneficial.

Trusts, including a Virgin Islands Revocable Trust for Married Couple, are generally low-risk when established correctly. They provide a clear set of instructions for managing and distributing assets, reducing the potential for family disputes. However, risks can arise from poorly drafted trusts or not properly funding the trust; therefore, working with a professional is advisable.

A Virgin Islands Revocable Trust for Married Couple offers a reasonable level of security, as it remains flexible during the lifetime of both spouses. While assets can be changed or revoked as needed, this trust still provides a structured approach to managing assets. It's important to remember that this type of trust doesn't shield assets from creditors; however, it does facilitate smoother transitions upon death.

For asset protection, a Virgin Islands Revocable Trust for Married Couple can be a strong option. This trust allows both spouses to retain control over their assets during their lifetime, while also providing a plan for distribution after death. It efficiently addresses estate planning needs, helping secure family wealth against future claims or uncertainties.

The first step when a spouse dies is to check if they had a Virgin Islands Revocable Trust for Married Couple in place. If so, it’s important to review the trust documents promptly and notify the trustee. Communicating with legal and financial advisors is crucial to understand the next steps and ensure that the wishes of the deceased spouse are honored.

The most popular form of marital trust is the QTIP trust (Qualified Terminable Interest Property), which allows a surviving spouse to receive income from the trust during their lifetime. A Virgin Islands Revocable Trust for Married Couple can incorporate QTIP provisions, ensuring that the surviving spouse is adequately supported while providing for eventual beneficiaries. This combination protects families and eases the management of assets.

The best living trust for a married couple is often a Virgin Islands Revocable Trust for Married Couple. This trust allows both spouses to retain control over their assets during their lifetime while ensuring a smooth transition of property upon death. The trust is flexible, meaning couples can make changes as needed, making it a sound choice for managing joint resources.

Yes, typically, a joint trust becomes irrevocable when one person dies. This means that the surviving spouse can no longer make changes to the trust without the other spouse's consent, unless they have specific provisions in place. Therefore, establishing a Virgin Islands Revocable Trust for Married Couple can help navigate these situations, offering clarity and ongoing management.