This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Virgin Islands Agreement Dissolving Business Interest in Connection with Certain Real Property

Description

How to fill out Agreement Dissolving Business Interest In Connection With Certain Real Property?

Are you in a situation where you often need documentation for either business or personal reasons almost every day? There are numerous legal document templates available online, but finding reliable ones can be challenging.

US Legal Forms offers a vast array of form templates, including the Virgin Islands Agreement Dissolving Business Interest in Connection with Certain Real Property, that are drafted to meet federal and state standards.

If you are already acquainted with the US Legal Forms website and possess an account, simply Log In. After that, you can download the Virgin Islands Agreement Dissolving Business Interest in Connection with Certain Real Property template.

Choose a convenient document format and download your copy.

Access all the document templates you may have purchased in the My documents section. You can download another copy of the Virgin Islands Agreement Dissolving Business Interest in Connection with Certain Real Property at any time if needed. Simply click on the required form to download or print the document template. Utilize US Legal Forms, the most extensive collection of legal forms, to save time and avoid errors. The service offers professionally crafted legal document templates that you can use for various purposes. Create an account on US Legal Forms and start making your life easier.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Obtain the form you need and ensure it is for the correct area/state.

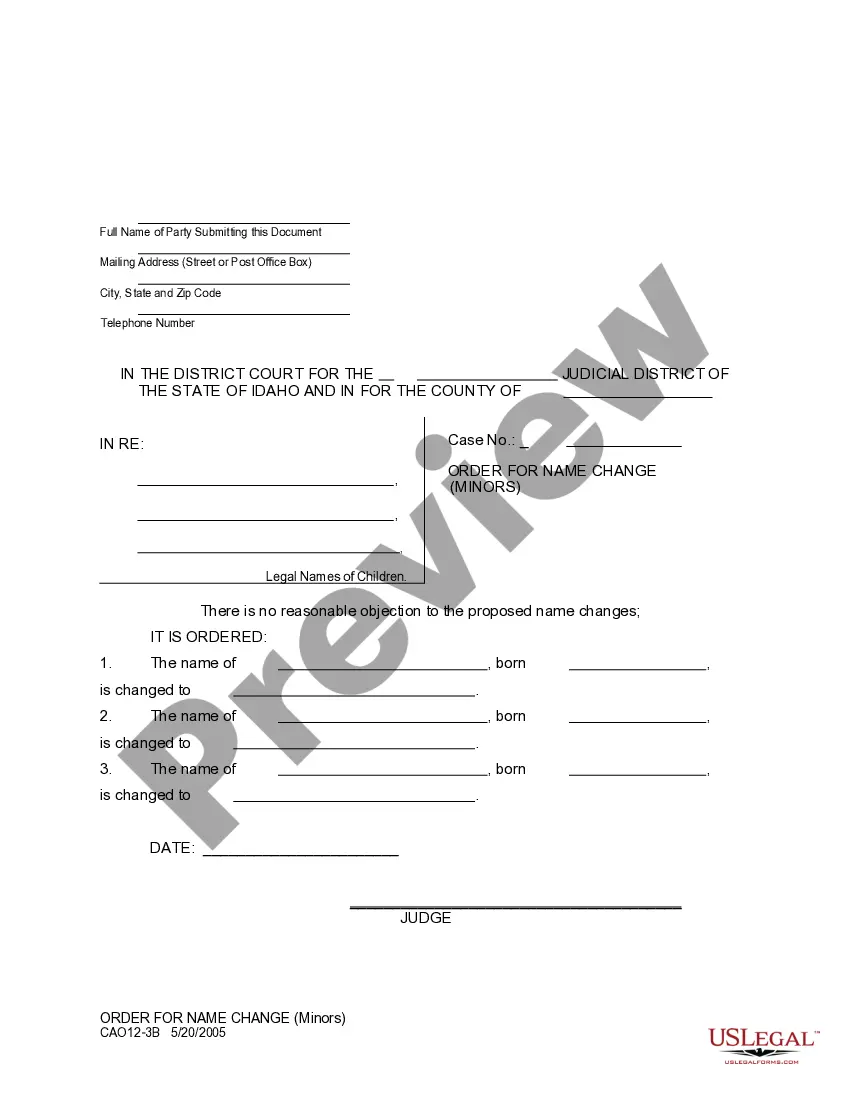

- Use the Preview option to review the form.

- Check the information to make sure you have selected the right form.

- If the form is not what you are looking for, use the Lookup field to find the form that meets your requirements and needs.

- Once you have the appropriate form, click Get now.

- Select the pricing plan you want, fill in the necessary information to create your account, and pay for your order using PayPal or credit card.

Form popularity

FAQ

To avoid FIRPTA withholding, you can apply for a withholding certificate from the IRS prior to the sale. This certificate may allow you to reduce or eliminate the withholding tax based on estimated gains. Engaging with platforms like uslegalforms can assist you in understanding how a Virgin Islands Agreement Dissolving Business Interest in Connection with Certain Real Property impacts your tax obligations.

A U.S. real property interest refers to any interest in real estate located in the United States. This includes ownership, leasehold interests, and rights associated with the property. If your dealings include a Virgin Islands Agreement Dissolving Business Interest in Connection with Certain Real Property, clarifying your property interests is crucial for complying with tax regulations.

Yes, you need to report foreign property to the IRS if you meet certain thresholds. The IRS requires U.S. taxpayers with foreign assets exceeding specific values to report these holdings via Form 8938. When it involves a Virgin Islands Agreement Dissolving Business Interest in Connection with Certain Real Property, ensure that you comply with reporting to avoid penalties.

The 15% tax required for foreigners when selling a home in the U.S. arises from the Foreign Investment in Real Property Tax Act (FIRPTA). This tax aims to ensure that foreign sellers contribute to U.S. tax obligations related to real property sales. Therefore, if your situation involves a Virgin Islands Agreement Dissolving Business Interest in Connection with Certain Real Property, it is essential to consult a tax professional for guidance on compliance.

The Virgin Islands are considered a favorable location for tax purposes, but they are not classified as a tax haven in the traditional sense. The islands offer tax incentives designed to attract business investment. However, the Virgin Islands Agreement Dissolving Business Interest in Connection with Certain Real Property establishes specific terms that can influence your tax position and ensure compliance.

To register a business in the Virgin Islands, you must first choose a unique name for your business. Next, file the necessary documents with the Office of the Lieutenant Governor. After that, you will need to obtain all required licenses and permits for your specific business type. Finally, ensure compliance with the Virgin Islands Agreement Dissolving Business Interest in Connection with Certain Real Property to protect your investments.

Yes, the U.S. owns the Virgin Islands. These islands are a U.S. territory, which gives them a unique status. Local residents can enjoy certain benefits, while laws related to real property and business agreements, such as the Virgin Islands Agreement Dissolving Business Interest in Connection with Certain Real Property, continue to be governed by U.S. federal and local laws. For specific legal needs regarding property interests in the Virgin Islands, consider exploring the resources available on the US Legal Forms platform.

The U.S. Constitution applies to the Virgin Islands but with some exceptions. Certain rights and provisions may be modified or interpreted differently in this territory. This is an essential factor to consider, especially when addressing agreements such as the Virgin Islands Agreement Dissolving Business Interest in Connection with Certain Real Property. By using uslegalforms, you can obtain the necessary legal information to navigate these constitutional nuances effectively.

Yes, if you plan to conduct business in the Virgin Islands, you typically need a business license. Specific requirements may vary based on your business activities and the type of entity you operate. Before finalizing agreements like the Virgin Islands Agreement Dissolving Business Interest in Connection with Certain Real Property, check the licensing regulations to ensure you're fully compliant. uslegalforms can guide you through the licensing process.

Yes, US territories, including the Virgin Islands, must follow many US laws, but with some local adaptations. This creates a unique legal landscape that can impact various business agreements. When exploring the Virgin Islands Agreement Dissolving Business Interest in Connection with Certain Real Property, ensuring compliance with both sets of laws is crucial. uslegalforms offers a wide range of resources to help navigate these complexities.