Are you in the placement in which you need paperwork for sometimes company or personal functions virtually every time? There are tons of legal papers web templates accessible on the Internet, but getting types you can depend on is not easy. US Legal Forms gives a large number of develop web templates, just like the Virgin Islands Complaint for Wrongful Repossession of Automobile and Impairment of Credit, that are published to satisfy state and federal requirements.

Should you be presently informed about US Legal Forms website and get a free account, just log in. Following that, it is possible to acquire the Virgin Islands Complaint for Wrongful Repossession of Automobile and Impairment of Credit format.

Should you not provide an bank account and would like to begin to use US Legal Forms, follow these steps:

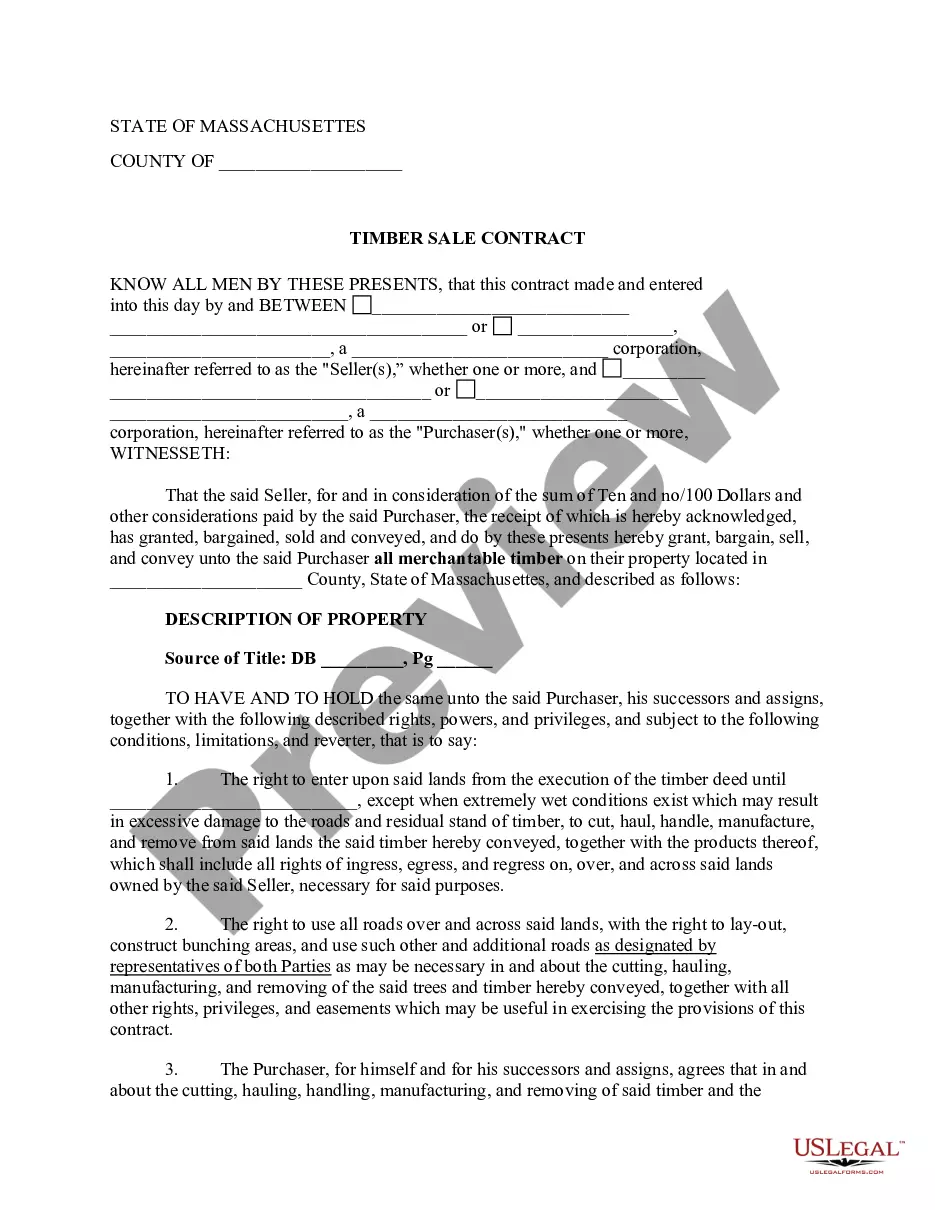

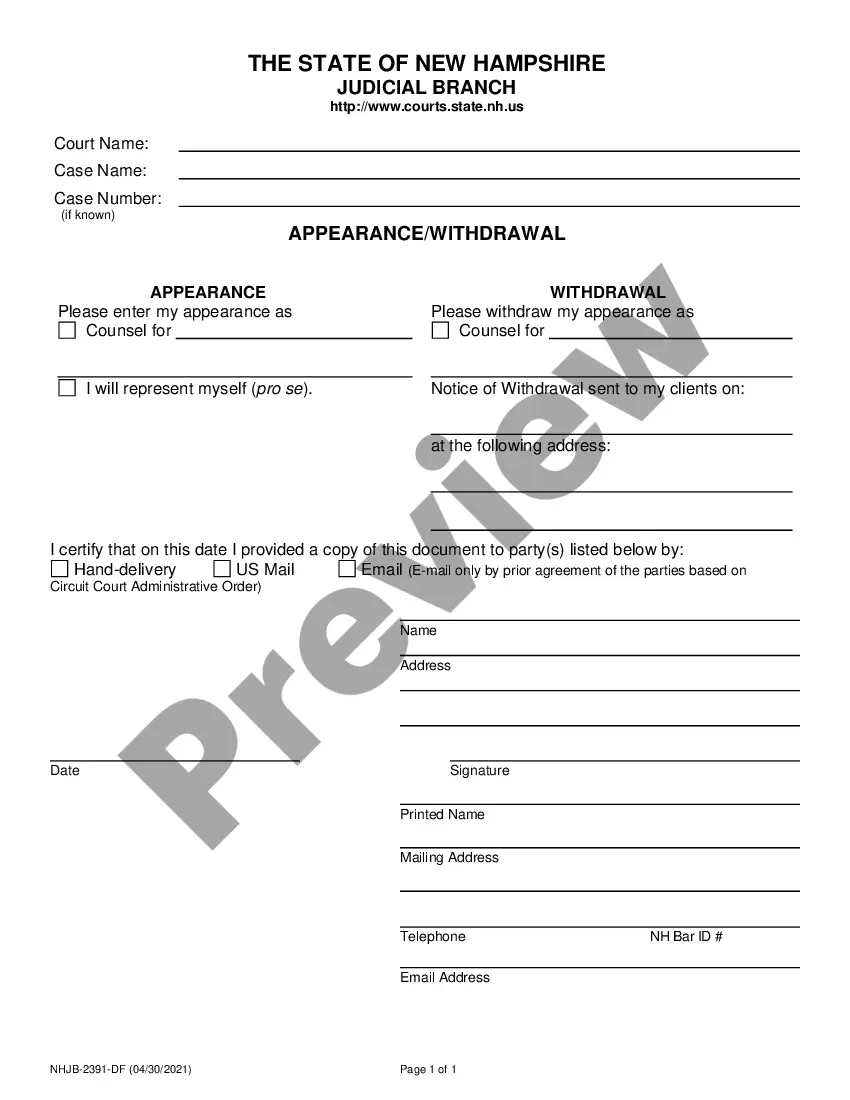

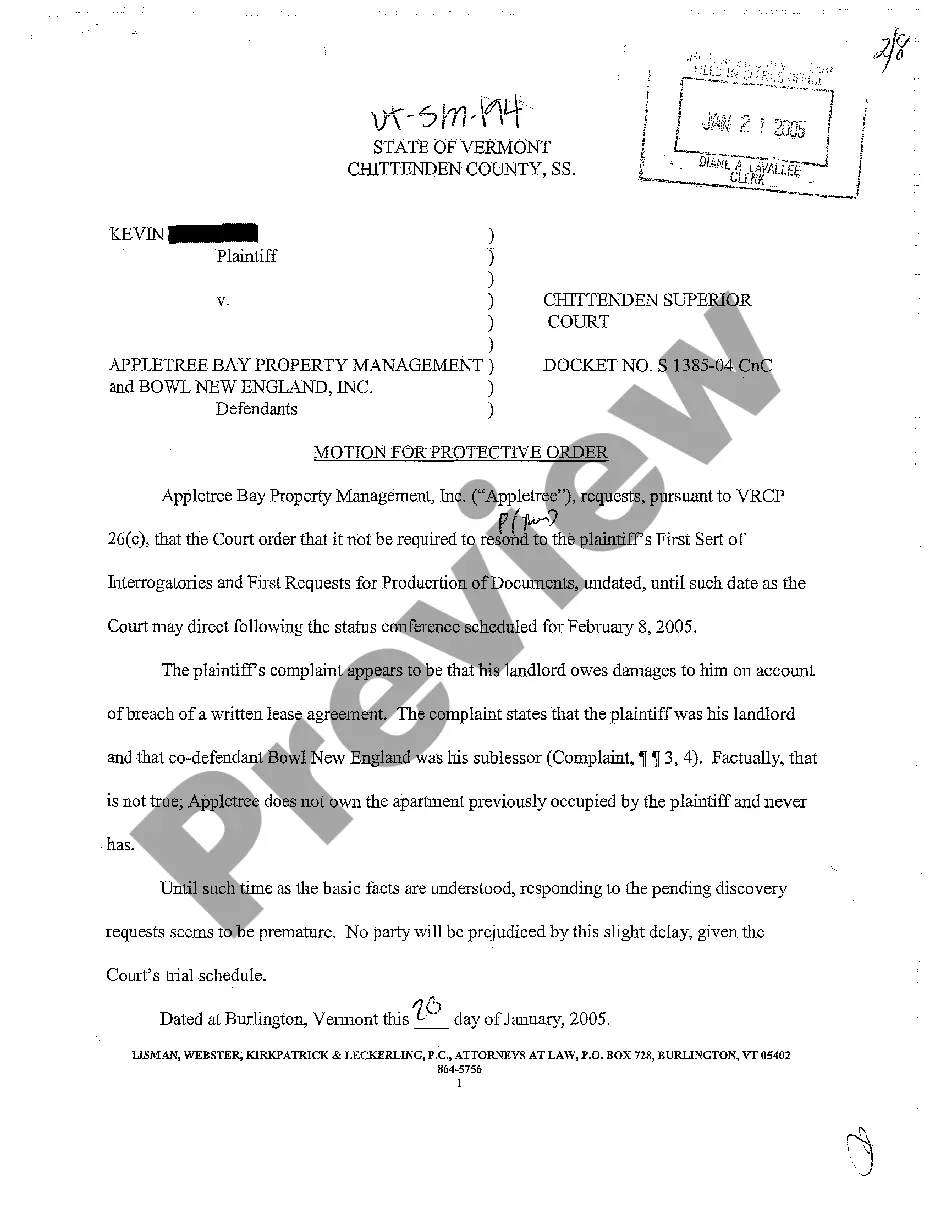

- Obtain the develop you will need and ensure it is for that correct metropolis/area.

- Utilize the Preview option to review the shape.

- Look at the information to ensure that you have chosen the right develop.

- If the develop is not what you are searching for, take advantage of the Research area to get the develop that suits you and requirements.

- When you find the correct develop, click Purchase now.

- Opt for the costs prepare you desire, fill in the desired info to produce your bank account, and pay for an order with your PayPal or charge card.

- Select a convenient file structure and acquire your duplicate.

Find all of the papers web templates you might have bought in the My Forms food selection. You may get a further duplicate of Virgin Islands Complaint for Wrongful Repossession of Automobile and Impairment of Credit any time, if required. Just select the needed develop to acquire or print the papers format.

Use US Legal Forms, probably the most considerable selection of legal types, to conserve efforts and prevent mistakes. The support gives expertly made legal papers web templates that can be used for a selection of functions. Create a free account on US Legal Forms and start making your life a little easier.