Virgin Islands Office Sharing Agreement

Description

How to fill out Office Sharing Agreement?

In the event that you need to accumulate, retrieve, or print legal documents templates, utilize US Legal Forms, the largest collection of legal forms that are accessible online.

Make the most of the website's straightforward and convenient search to find the documents you seek.

Various templates for business and personal purposes are organized by categories, states, or keywords.

Step 5. Complete the payment. You can use your Visa or Mastercard or PayPal account to finalize the transaction.

Step 6. Choose the format of the legal form and download it to your device. Step 7. Complete, edit, and print or sign the Virgin Islands Office Sharing Agreement. Every legal document template you purchase is yours permanently. You have access to each form you acquired in your account. Visit the My documents section and select a form to print or download again. Be proactive and download, and print the Virgin Islands Office Sharing Agreement using US Legal Forms. There are various professional and state-specific forms available for your business or personal needs.

- Utilize US Legal Forms to locate the Virgin Islands Office Sharing Agreement in just a few clicks.

- If you are an existing US Legal Forms user, sign in to your account and then click the Download button to retrieve the Virgin Islands Office Sharing Agreement.

- You can also access forms you have previously downloaded within the My documents section of your account.

- If you are using US Legal Forms for the first time, adhere to the instructions outlined below.

- Step 1. Ensure you have chosen the form for the correct city/state.

- Step 2. Use the Preview feature to review the form's details. Don’t forget to read the description.

- Step 3. If you are dissatisfied with the form, take advantage of the Search area at the top of the page to find other types within the legal form category.

- Step 4. Once you have located the form you need, click the Buy Now button. Select your preferred payment plan and provide your credentials to register for an account.

Form popularity

FAQ

Yes, U.S. citizens can own property in the U.S. Virgin Islands without any special restrictions. This makes the territory an appealing option for both personal and commercial investments. If you're looking to establish a Virgin Islands Office Sharing Agreement, knowing that property ownership is straightforward can streamline your planning and execution.

Home insurance in the U.S. Virgin Islands can be somewhat higher than the mainland due to the risks posed by hurricanes and tropical storms. It's important to shop around and compare rates from different providers to find an affordable plan that fits your needs. This consideration is especially relevant for businesses entering a Virgin Islands Office Sharing Agreement, as insurance will be part of your operating costs.

The property tax rate in the U.S. Virgin Islands is typically around 1% of a property's assessed value, but this can change based on specific local regulations. Since property tax rates can fluctuate, it's beneficial to conduct thorough research. Knowing the tax obligations is essential for anyone considering a Virgin Islands Office Sharing Agreement as it affects overall expenses.

Property taxes in the U.S. Virgin Islands tend to be relatively manageable compared to many U.S. states. Rates can vary based on property type and location but generally range between 0.5% to 1.5%. When entering into a Virgin Islands Office Sharing Agreement, understanding potential property taxes can help you budget more effectively.

The U.S. Virgin Islands does not tax retirement income for residents. This can significantly increase your disposable income, making it an attractive place to retire or establish a business. Therefore, if you are planning to engage in a Virgin Islands Office Sharing Agreement, the favorable tax treatment of retirement income can be a crucial aspect to consider.

Living in the U.S. Virgin Islands offers notable tax advantages. The territory does not impose some federal taxes, allowing residents to retain more of their income. Additionally, individuals who meet residency requirements may enjoy reduced tax rates. If you are considering a Virgin Islands Office Sharing Agreement, understanding these benefits can enhance your operations.

An office service agreement outlines the services provided within a shared office environment. It may cover administrative support, internet access, and maintenance services. With a Virgin Islands Office Sharing Agreement, you can streamline operations and focus on your core business while ensuring all essential services are covered.

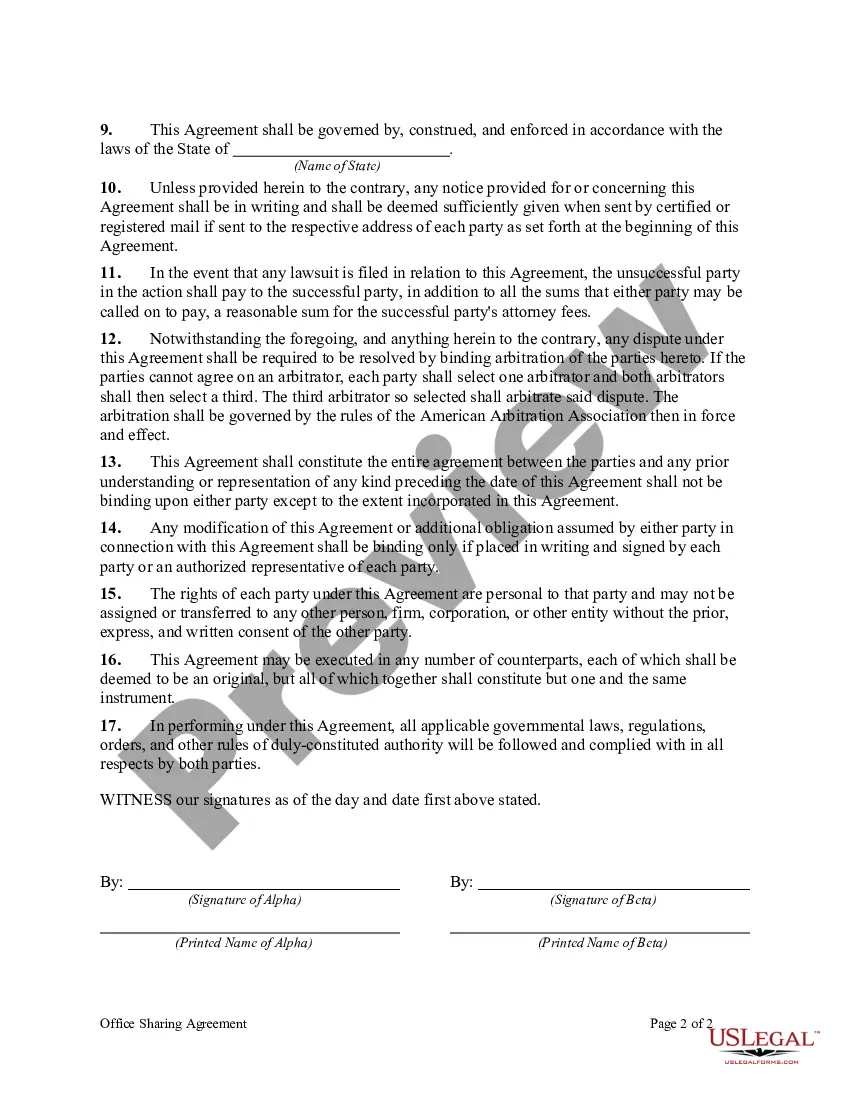

An office sharing agreement is a contract that specifies the terms under which office space is shared between parties. It typically addresses rental fees, office amenities, and responsibility for maintenance. A Virgin Islands Office Sharing Agreement provides a framework for a seamless and productive co-working experience.

Office sharing involves multiple businesses or individuals utilizing a common office space to optimize costs and resources. This model fosters collaboration and creates a vibrant community. A Virgin Islands Office Sharing Agreement formalizes this relationship, ensuring a structured environment for all participants.

The purpose of a shared agreement is to establish clear guidelines for parties sharing resources. It defines responsibilities, usage rights, and financial arrangements. Using a Virgin Islands Office Sharing Agreement, businesses can enhance accountability and safeguard each party's interests.