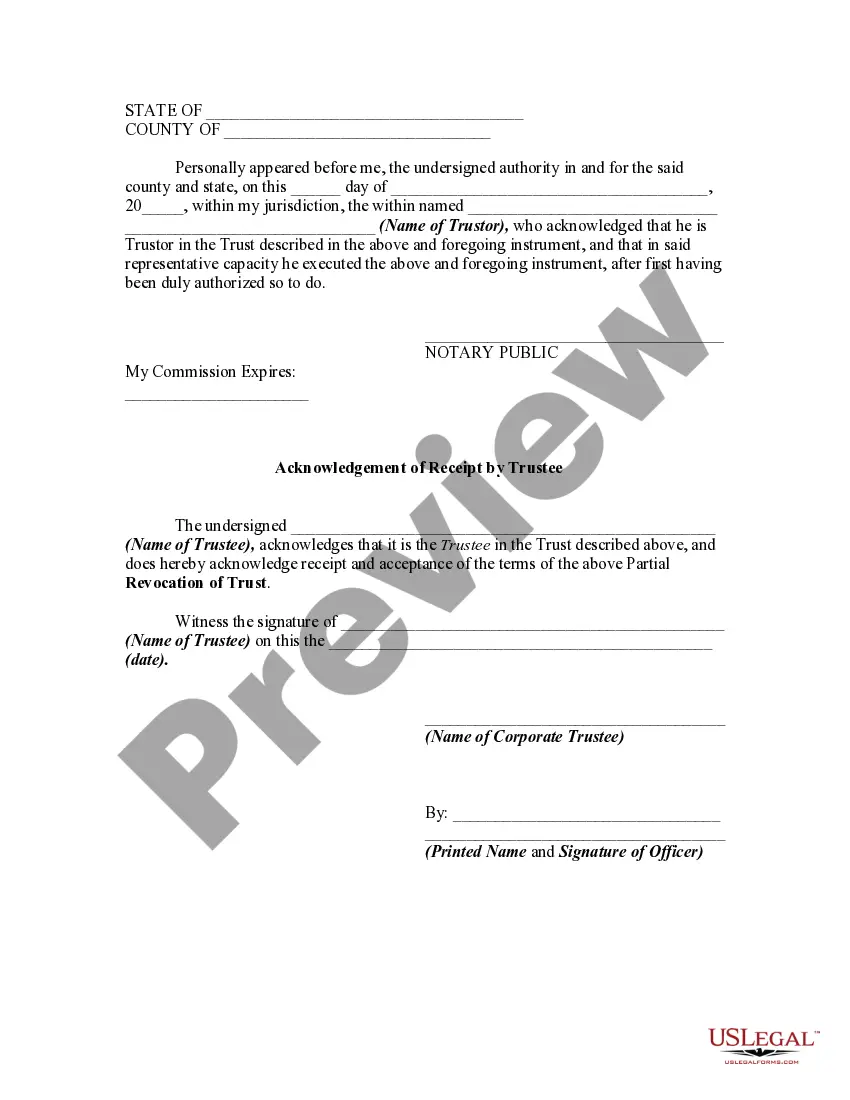

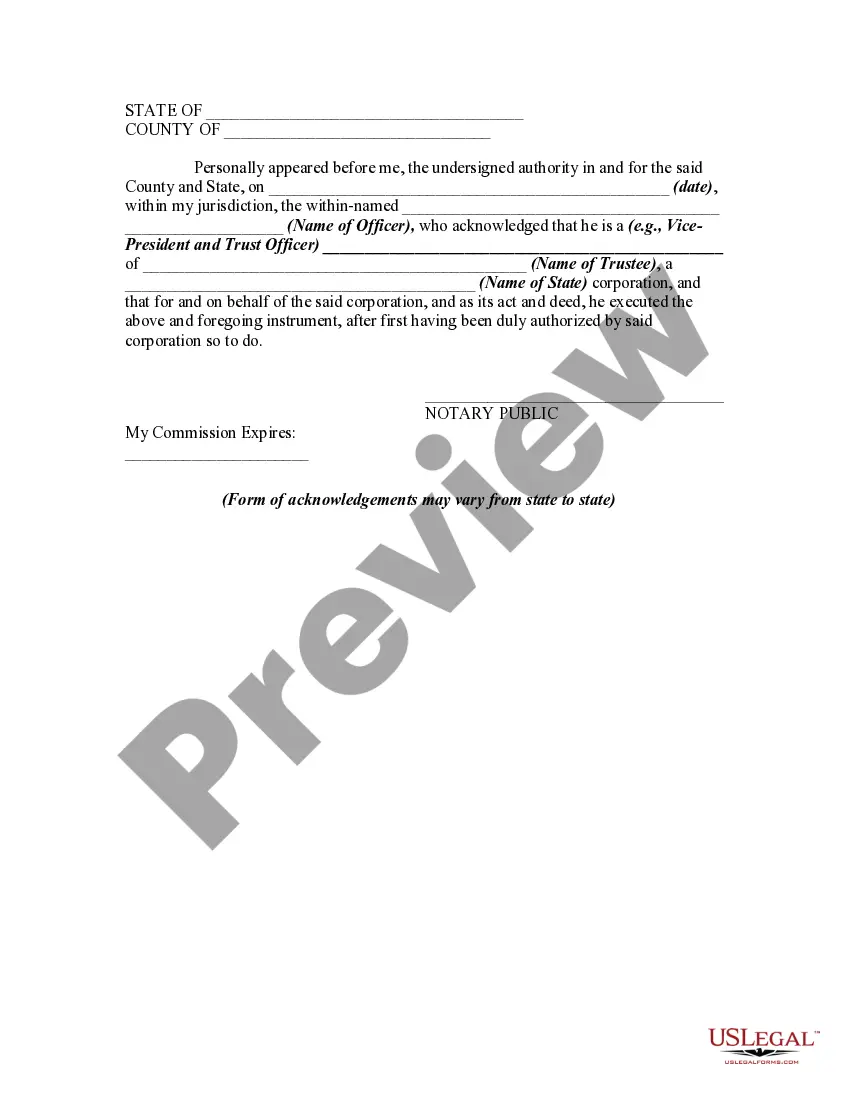

Whether a trust is to be revocable or irrevocable is very important, and the trust instrument should so specify in plain and clear terms. This form is a partial revocation of a trust (as to specific property) by the trustor pursuant to authority given to him/her in the trust instrument. This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Virgin Islands Partial Revocation of Trust and Acknowledgment of Receipt of Notice of Partial Revocation by Trustee

Description

How to fill out Partial Revocation Of Trust And Acknowledgment Of Receipt Of Notice Of Partial Revocation By Trustee?

You are competent to dedicate numerous hours online searching for the legal document format that satisfies the state and federal requirements you need.

US Legal Forms provides a vast array of legal templates that have been reviewed by experts.

You can effortlessly download or print the Virgin Islands Partial Revocation of Trust and Acknowledgment of Receipt of Notice of Partial Revocation by Trustee from my assistance.

If available, make use of the Review button to browse through the document template as well.

- If you possess a US Legal Forms account, you can Log In and click the Download button.

- Then, you can complete, modify, print, or sign the Virgin Islands Partial Revocation of Trust and Acknowledgment of Receipt of Notice of Partial Revocation by Trustee.

- Each legal document template you obtain is yours permanently.

- To obtain another copy of a purchased form, navigate to the My documents tab and click the corresponding button.

- If you are visiting the US Legal Forms website for the first time, follow the simple instructions below.

- First, ensure that you have selected the correct document format for your county/area of your choice.

- Check the form description to confirm you have chosen the appropriate form.

Form popularity

FAQ

A revocation of trust is a process through which a trust is terminated, letting the trustor revoke or cancel the trust's terms. This may occur due to life changes, such as divorce or financial decisions that require a reassessment of asset management. It's important to follow specific legal procedures to ensure a proper revocation, which might include filing certain documents. Understanding the implications of Virgin Islands Partial Revocation of Trust and Acknowledgment of Receipt of Notice of Partial Revocation by Trustee can aid in ensuring a smooth transition during this process.

In Oregon, a trustee has several essential duties, including managing trust assets prudently and in accordance with the trust terms. The trustee must act in the best interests of the beneficiaries, keep accurate records, and provide regular reports to them. Trustees also need to make decisions regarding the investment and allocation of trust assets while ensuring that all actions align with the legal requirements. Being aware of Virgin Islands Partial Revocation of Trust and Acknowledgment of Receipt of Notice of Partial Revocation by Trustee can further clarify a trustee's responsibilities.

One of the biggest mistakes parents make when setting up a trust fund is not clearly defining the terms and conditions in the trust document. Vague language can lead to confusion and conflict among beneficiaries, undermining the trust's intended purposes. It's crucial to outline specific goals and distributions, considering various life situations. Also, understanding Virgin Islands Partial Revocation of Trust and Acknowledgment of Receipt of Notice of Partial Revocation by Trustee can help prevent future complications.

Yes, a trust can help avoid the probate process in South Carolina. Since the assets are transferred to the trust, they do not need to go through probate after the trust creator passes away. This can save time and expenses for the beneficiaries, allowing for more prompt access to the assets. It's essential to understand how Virgin Islands Partial Revocation of Trust and Acknowledgment of Receipt of Notice of Partial Revocation by Trustee can further impact the distribution and management of your assets.

In South Carolina, a trust works by allowing the trustee to manage the assets according to the terms specified in the trust document. The trustee has a legal duty to act in the best interest of the beneficiaries while adhering to the wishes of the person who created the trust. Trusts can provide control over when and how assets are distributed, helping to achieve specific goals like education or retirement. Additionally, the Virgin Islands Partial Revocation of Trust and Acknowledgment of Receipt of Notice of Partial Revocation by Trustee can influence how assets are managed or reallocated.

A trust in South Carolina is a legal arrangement where one party, known as the trustee, holds and manages assets for the benefit of another party, the beneficiary. It can be used to provide financial support, manage investments, or distribute assets after death. Establishing a trust can help with estate planning and may simplify the process of handling your assets. For those dealing with Virgin Islands Partial Revocation of Trust and Acknowledgment of Receipt of Notice of Partial Revocation by Trustee, understanding local trust laws is crucial.

The Uniform Trustee Powers Act in Oregon provides guidelines for the powers that trustees have when managing trusts. It defines the scope of authority, allowing trustees to make necessary decisions regarding trust assets. While this act is specific to Oregon, knowing about the Virgin Islands Partial Revocation of Trust and Acknowledgment of Receipt of Notice of Partial Revocation by Trustee can help you understand how trust management works across different jurisdictions.

Revocation of trust refers to the legal process of terminating a trust and reclaiming control over the trust assets. This action allows the grantor to adjust their financial plans based on current needs. In the Virgin Islands, understanding the implications of the Partial Revocation of Trust and Acknowledgment of Receipt of Notice of Partial Revocation by Trustee is vital for ensuring your assets are managed according to your wishes.

In many cases, a nursing home cannot directly access the funds in your revocable trust. However, if you need to qualify for Medicaid, they may consider the trust assets during the eligibility assessment. This situation underscores the need for clear understanding of the Virgin Islands Partial Revocation of Trust and Acknowledgment of Receipt of Notice of Partial Revocation by Trustee, as it can help you structure your trust to protect your assets from nursing home costs.

An example of a revocation of a trust might be when a trustee decides to terminate a family trust because the intended beneficiaries no longer require financial support. For instance, a parent may revoke a trust set up for their minor children once they reach adulthood and can manage their finances independently. This scenario highlights the importance of the Virgin Islands Partial Revocation of Trust and Acknowledgment of Receipt of Notice of Partial Revocation by Trustee in ensuring the proper execution of asset management.