This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Virgin Islands Mortgage Securing Guaranty of Performance of Lease

Description

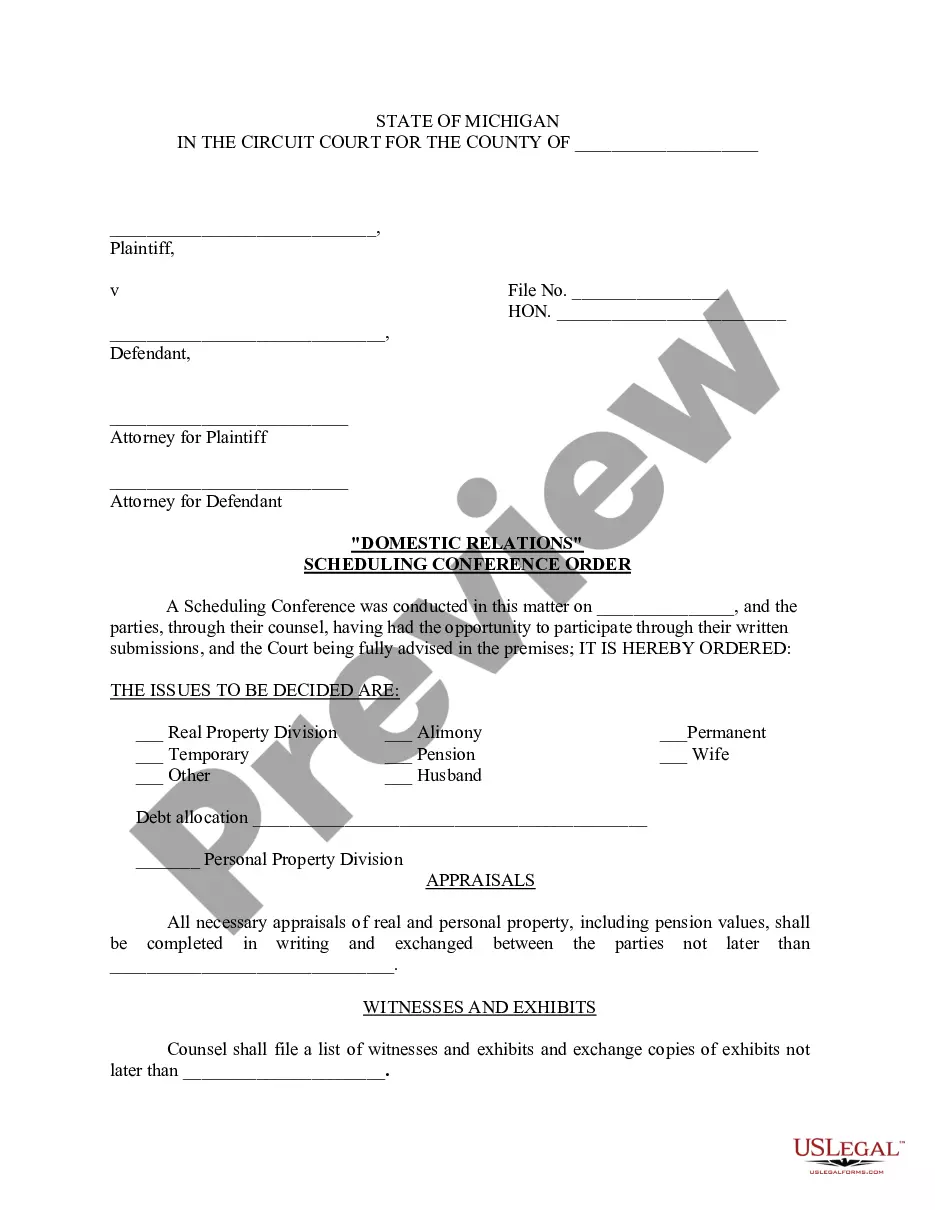

How to fill out Mortgage Securing Guaranty Of Performance Of Lease?

You can commit hours on the web attempting to find the lawful document web template that fits the state and federal requirements you will need. US Legal Forms gives thousands of lawful varieties which can be examined by experts. You can actually download or print the Virgin Islands Mortgage Securing Guaranty of Performance of Lease from your service.

If you currently have a US Legal Forms account, you can log in and then click the Obtain switch. After that, you can complete, change, print, or indicator the Virgin Islands Mortgage Securing Guaranty of Performance of Lease. Each lawful document web template you acquire is your own property permanently. To get an additional backup for any bought develop, go to the My Forms tab and then click the corresponding switch.

Should you use the US Legal Forms web site for the first time, follow the easy guidelines under:

- Very first, ensure that you have chosen the correct document web template for your area/area that you pick. Look at the develop outline to make sure you have picked the appropriate develop. If readily available, utilize the Review switch to search from the document web template at the same time.

- If you would like locate an additional edition of your develop, utilize the Research area to obtain the web template that suits you and requirements.

- Upon having found the web template you need, click on Acquire now to carry on.

- Select the rates plan you need, key in your references, and sign up for your account on US Legal Forms.

- Comprehensive the transaction. You should use your Visa or Mastercard or PayPal account to pay for the lawful develop.

- Select the formatting of your document and download it to the system.

- Make changes to the document if necessary. You can complete, change and indicator and print Virgin Islands Mortgage Securing Guaranty of Performance of Lease.

Obtain and print thousands of document themes using the US Legal Forms site, that provides the biggest collection of lawful varieties. Use expert and express-specific themes to take on your organization or specific needs.

Form popularity

FAQ

A personal guarantee is not mandatory. The Lease Coach frequently negotiates to minimize these for the protection of the tenant or eliminate them entirely.

A personal guarantee clause is a common provision in commercial lease agreements that requires the tenant or a third party to be liable for the rent and other obligations of the lease in case of default or breach by the tenant.

A lease guaranty is a contract between an individual or entity (guarantor) that is typically related to the tenant. The guarantor promises to pay the landlord any and all payments due under the lease in the event the tenant defaults under its lease obligations and otherwise cure the tenant's defaults.

A personal guarantee clause is a common provision in commercial lease agreements that requires the tenant or a third party to be liable for the rent and other obligations of the lease in case of default or breach by the tenant.

If this happens and additional funds are advanced or re-advanced, the guarantee secures the additional funds up to the fixed amount. When a mortgage secures a guarantee, it secures the guarantor's obligation to repay the funds advanced related to the other party's debt, up to the guarantee amount.

The elements of offer, acceptance, intention to be bound by law and consideration must be satisfied. This also slightly varies depending on the form of the agreement. Personal guarantees are often written in the form of a deed because deeds do not require consideration.

Corporate credit cards that are issued to an individual are another example of a personal guarantee. The individual or employee is responsible for the debt that the organization takes on and the overall spending on the credit card. Here, the cardholder takes the role of a guarantor.

A loan guarantee is a legally binding commitment to pay a debt in the event the borrower defaults. This most often occurs between family members, where the borrower can't obtain a loan because of a lack of income or down payment, or due to a poor credit rating.