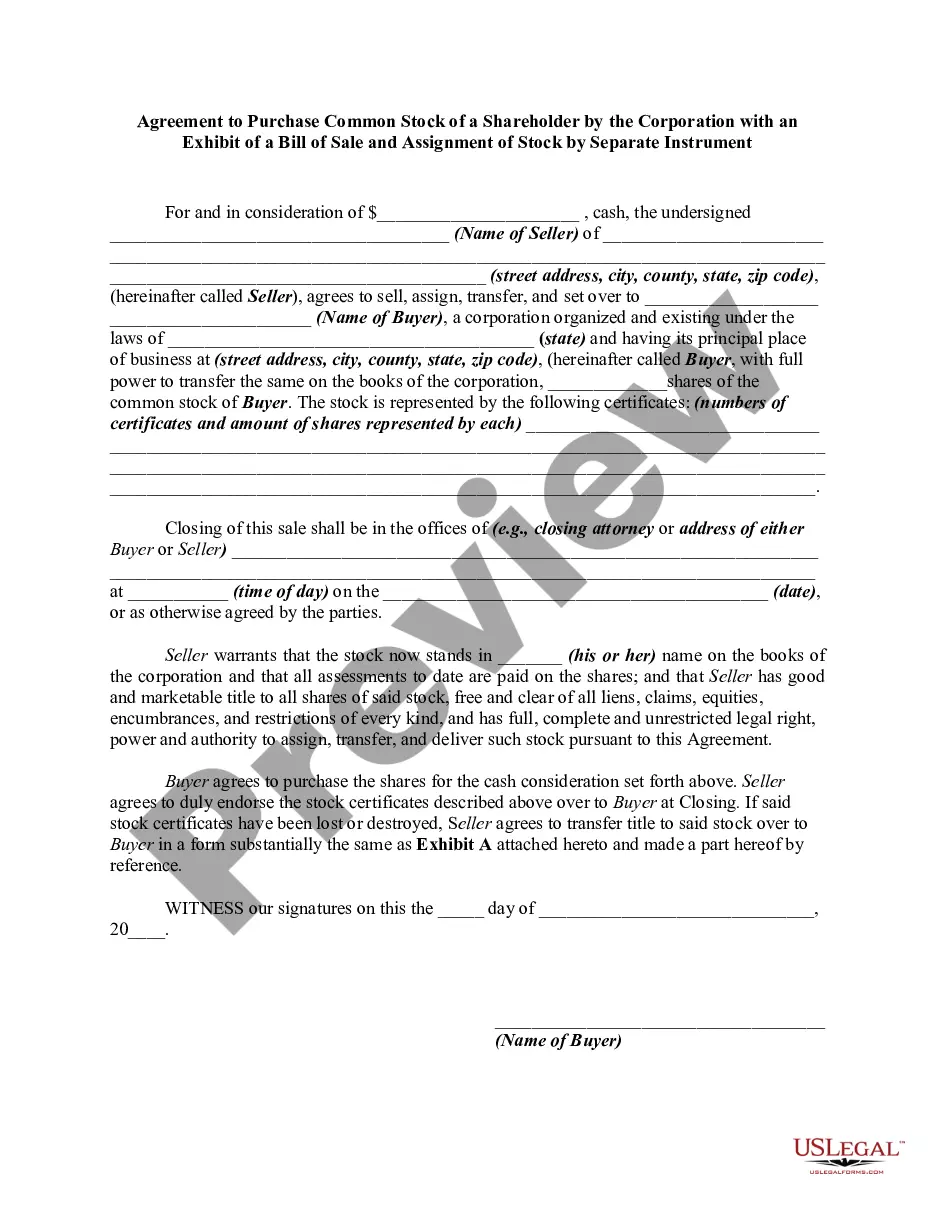

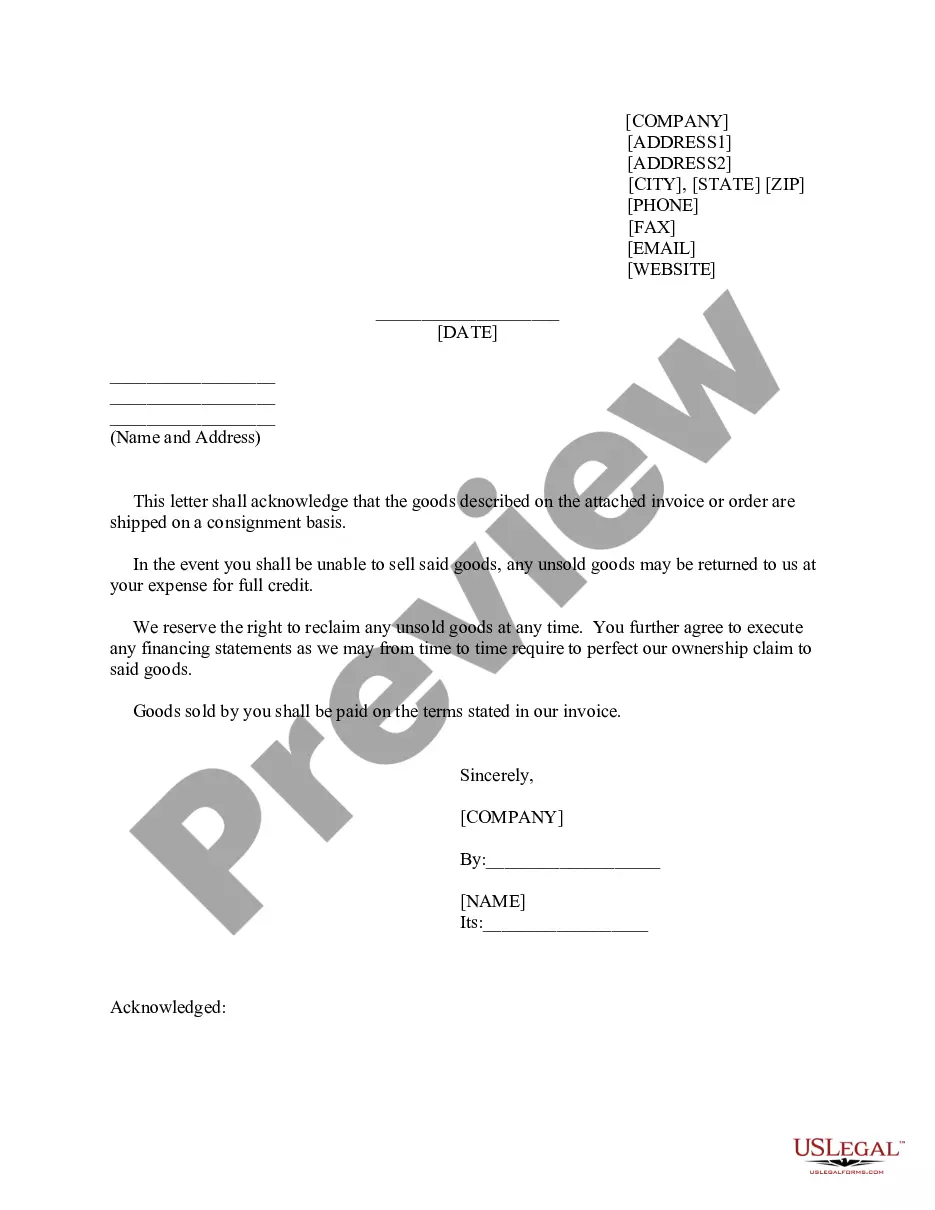

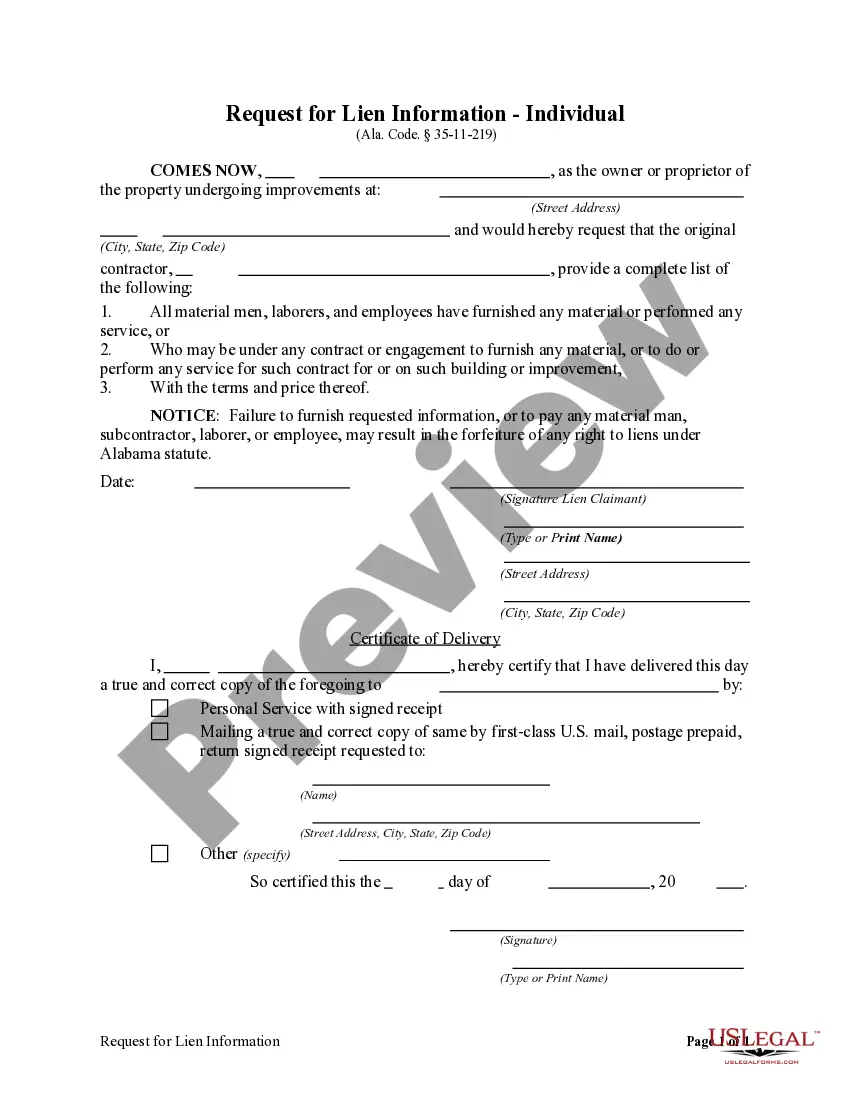

A corporation is owned by its shareholders. An ownership interest in a corporation is represented by a share or stock certificate. A certificate of stock or share certificate evidences the shareholder's ownership of stock. The ownership of shares may be transferred by delivery of the certificate of stock endorsed by its owner in blank or to a specified person. Ownership may also be transferred by the delivery of the certificate along with a separate assignment. This form is a sample of the transfer of ownership of stock by a separate instrument.

Virgin Islands Bill of Sale and Assignment of Stock by Separate Instrument

Description

How to fill out Bill Of Sale And Assignment Of Stock By Separate Instrument?

Finding the correct legal document format can be challenging.

Clearly, there are numerous templates available online, but how can you obtain the legal form you need.

Utilize the US Legal Forms website. The service offers a vast array of templates, including the Virgin Islands Bill of Sale and Assignment of Stock by Separate Instrument, suitable for both business and personal purposes.

First, ensure you have selected the appropriate document for your city/state. You can browse the form using the Review option and read the form description to confirm it is suitable for you.

- All forms are reviewed by experts and comply with state and federal standards.

- If you are already registered, Log In to your account and click the Download button to obtain the Virgin Islands Bill of Sale and Assignment of Stock by Separate Instrument.

- Use your account to view the legal forms you have previously purchased.

- Access the My documents tab in your account to download another copy of the document you require.

- If you are a new user of US Legal Forms, here are simple steps for you to follow.

Form popularity

FAQ

Generally, the transfer of shares in a BVI company does not attract stamp duties in Hong Kong, making it an attractive option for investors. However, it’s crucial to consult with legal experts to ensure compliance with local laws. Understanding the nuances of the Virgin Islands Bill of Sale and Assignment of Stock by Separate Instrument can further empower investors throughout the transfer process.

The BVI company shareholder agreement outlines the rights and responsibilities of shareholders within a company. This document is essential for governing the relationship between shareholders and ensuring smooth operations. Incorporating elements from the Virgin Islands Bill of Sale and Assignment of Stock by Separate Instrument can reinforce ownership dynamics, promoting clarity and compliance.

Transferring shares in a BVI company typically involves a simple process, requiring a signed transfer document and the application of the Virgin Islands Bill of Sale and Assignment of Stock by Separate Instrument. This instrument serves as a formal agreement that ensures legal recognition of the transfer. Utilizing a platform like uslegalforms can streamline the process, providing the necessary documentation to facilitate share transfers smoothly.

Yes, BVI companies do have share capital, which defines the ownership structure and financial foundation of the business. The amount of share capital can be tailored to suit the specific needs of the company, providing flexibility for shareholders. Familiarizing yourself with the Virgin Islands Bill of Sale and Assignment of Stock by Separate Instrument can enhance your grasp on managing share capital efficiently.

Despite numerous benefits, BVI companies do come with a few disadvantages, such as potential scrutiny from other jurisdictions. Additionally, while the Virgin Islands offer low tax rates, they may lack some benefits available in other financial centers. Understanding the implications of the Virgin Islands Bill of Sale and Assignment of Stock by Separate Instrument helps mitigate risks associated with ownership structure.

Yes, BVI companies can issue bearer shares, although this practice has faced regulatory changes. Bearer shares offer increased confidentiality, but it’s crucial to comply with the legal framework in place. Utilizing the Virgin Islands Bill of Sale and Assignment of Stock by Separate Instrument can further facilitate the management of such shares.

The minimum share capital for a BVI company is generally $1, which allows for affordability and accessibility for new businesses. This flexible requirement is advantageous, as it enables entrepreneurs to focus on growth rather than heavy initial investments. Moreover, understanding the Virgin Islands Bill of Sale and Assignment of Stock by Separate Instrument can guide you in structuring share capital effectively.

BVI companies offer several advantages, including tax efficiency, privacy, and flexible corporate structures. The Virgin Islands Bill of Sale and Assignment of Stock by Separate Instrument simplifies ownership transfer, making it easier for business owners. Additionally, BVI companies benefit from strong legal protection and a stable political environment, enhancing their appeal for entrepreneurs.