Virgin Islands Shareholder and Corporation agreement to issue additional stock to a third party to raise capital

Description

How to fill out Shareholder And Corporation Agreement To Issue Additional Stock To A Third Party To Raise Capital?

If you require extensive, download, or print sanctioned document templates, utilize US Legal Forms, the largest assortment of official forms, which can be accessed online.

Leverage the site’s straightforward and user-friendly search function to obtain the documents you desire.

Various templates for business and personal purposes are organized by categories and regions, or keywords.

Step 4. After finding the form you need, click the Get now button. Select your pricing option and provide your information to register for an account.

Step 5. Complete the transaction. You may utilize your credit card or PayPal account to finalize the purchase.

- Utilize US Legal Forms to acquire the Virgin Islands Shareholder and Corporation agreement to issue extra stock to a third party for capital augmentation in just a few clicks.

- If you are already a US Legal Forms client, sign in to your account and click the Download button to obtain the Virgin Islands Shareholder and Corporation agreement to issue additional stock to a third party to raise funds.

- You can also access forms you previously obtained from the My documents section of your account.

- If this is your first time using US Legal Forms, follow the instructions below.

- Step 1. Ensure you have selected the form for the correct city/state.

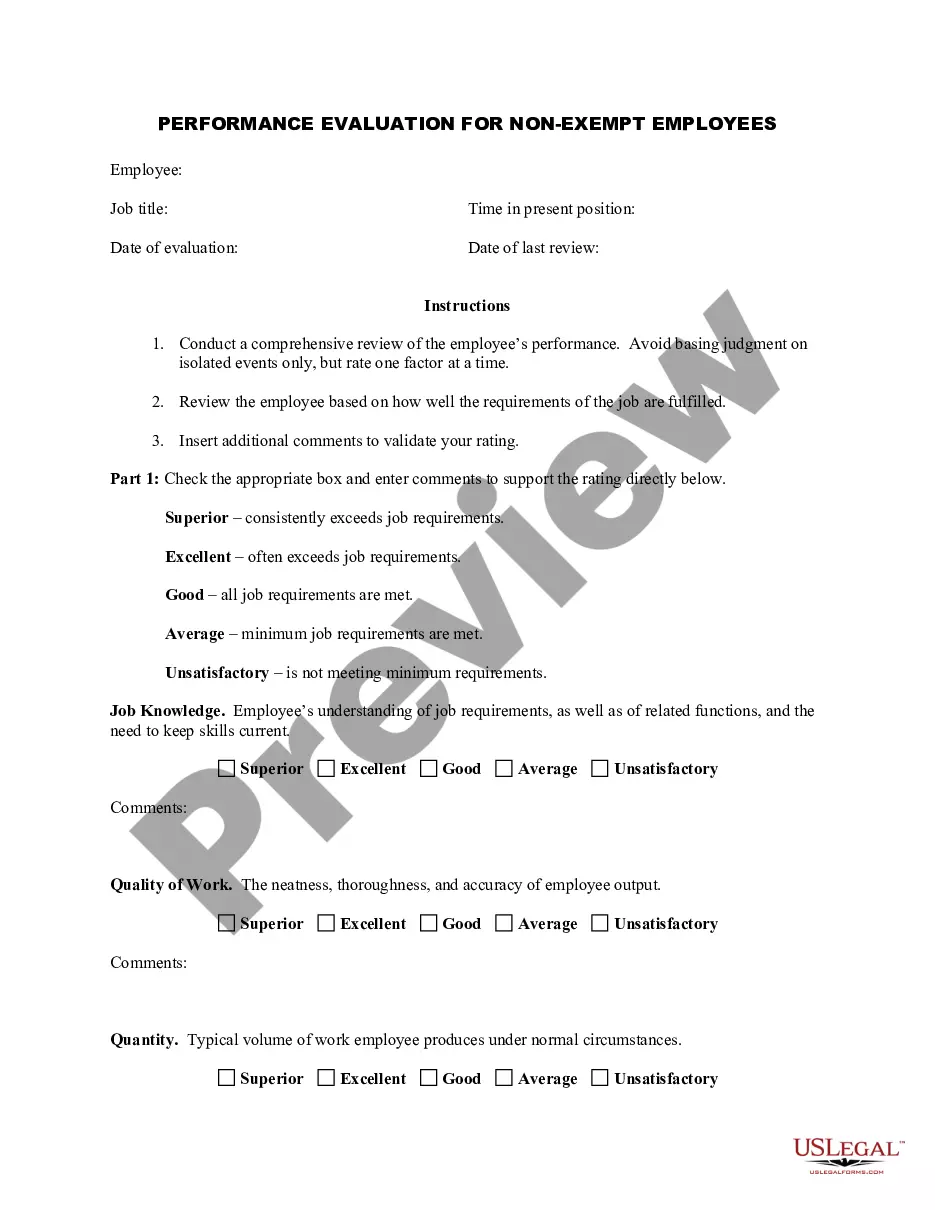

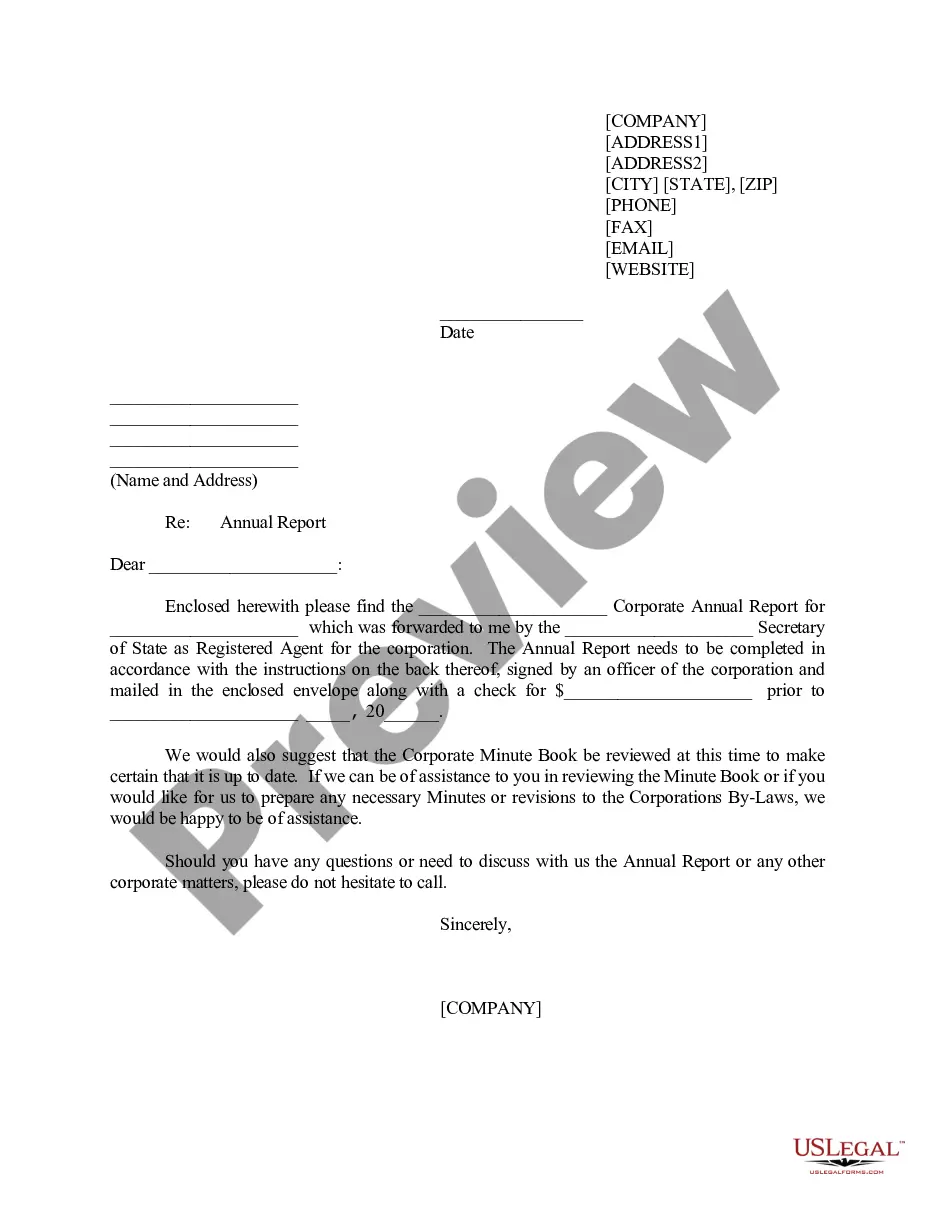

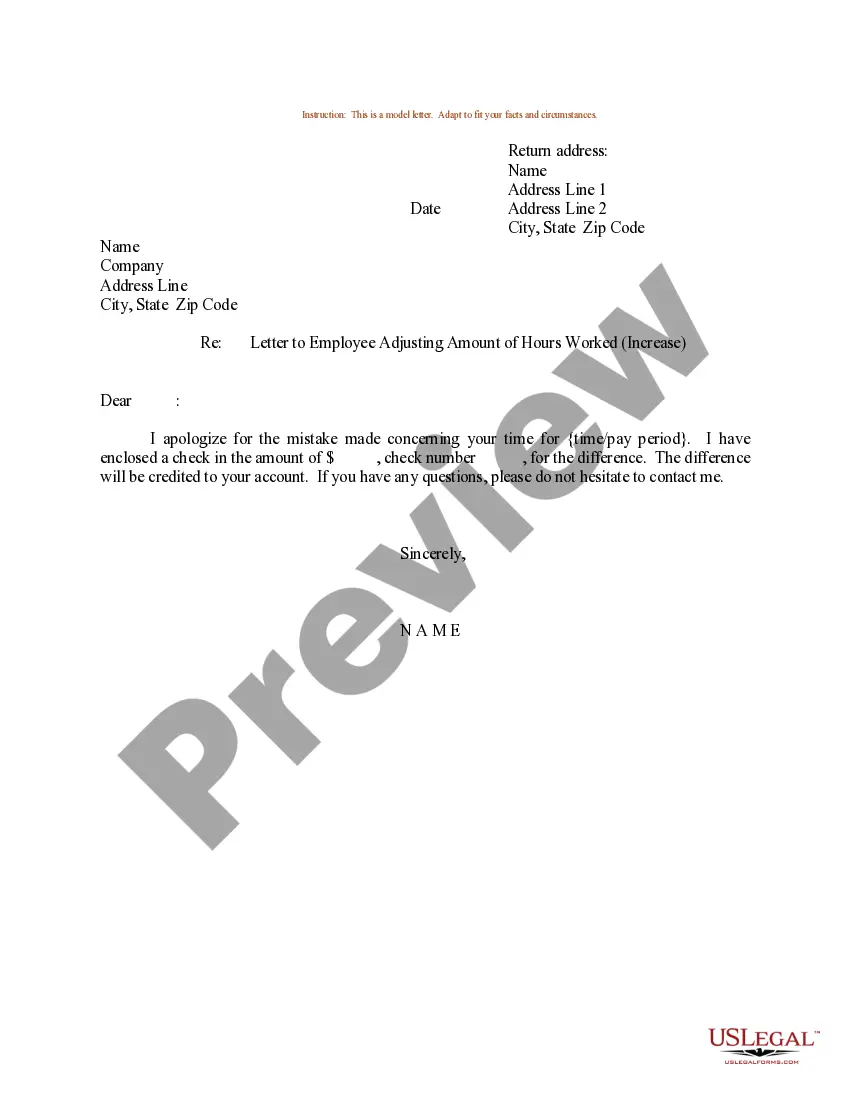

- Step 2. Use the Preview option to review the form’s details. Don’t forget to read the information.

- Step 3. If you are not satisfied with the form, use the Search field at the top of the screen to find alternative forms in the legal form directory.

Form popularity

FAQ

However, a company commonly has the right to increase the amount of stock it's authorized to issue through approval by its board of directors. Also, along with the right to issue more shares for sale, a company has the right to buy back existing shares from stockholders.

Secondary offerings to raise additional capital: A firm looking for new capital to fund growth opportunities or to service existing debt may issue additional shares to raise the funds.

Depending on the issuing price of the new shares as compared to the current value of the stock, adding more shares may increase, maintain constant or decrease the value of a company's stock. As a result, such a value change can have opposite effects on the share value for existing and new shareholders.

A new issue refers to a stock or bond offering that is made for the first time. Most new issues come from privately held companies that become public, presenting investors with new opportunities.

Private limited companies are prohibited from making any invitation to the public to subscribe to shares of the company. Shares of a private limited company can also not be issued to more than 200 shareholders, as per the Companies Act, 2013.

Issuing of extra shares will require a resolution to be passed by a general meeting of the company shareholders. The only way of avoiding diluting the company further by issuing shares to new investors is by existing shareholders taking up the extra shares on top of their own.

When companies issue additional shares, it increases the number of common stock being traded in the stock market. For existing investors, too many shares being issued can lead to share dilution. Share dilution occurs because the additional shares reduce the value of the existing shares for investors.

Share dilution is when a company issues additional stock, reducing the ownership proportion of a current shareholder. Shares can be diluted through a conversion by holders of optionable securities, secondary offerings to raise additional capital, or offering new shares in exchange for acquisitions or services.

Shareholder approval will only be required for issuances to a related party, and will not be required for issuances to 1) a subsidiary, affiliate, or other closely related person of a related party, or 2) any company or entity in which a related party has a substantial direct or indirect interest.

Additional Shares means shares or other securities issued in respect of the Shares by reason of or in connection with any stock dividend, stock distribution, stock split or similar issuance.