Virgin Islands Option to Purchase a Business

Description

How to fill out Option To Purchase A Business?

Selecting the appropriate legal document template can be challenging.

It's clear there are numerous templates accessible online, but how can you acquire the legal form you require.

Utilize the US Legal Forms platform. The service provides thousands of templates, such as the Virgin Islands Option to Purchase a Business, that you can employ for both business and personal purposes.

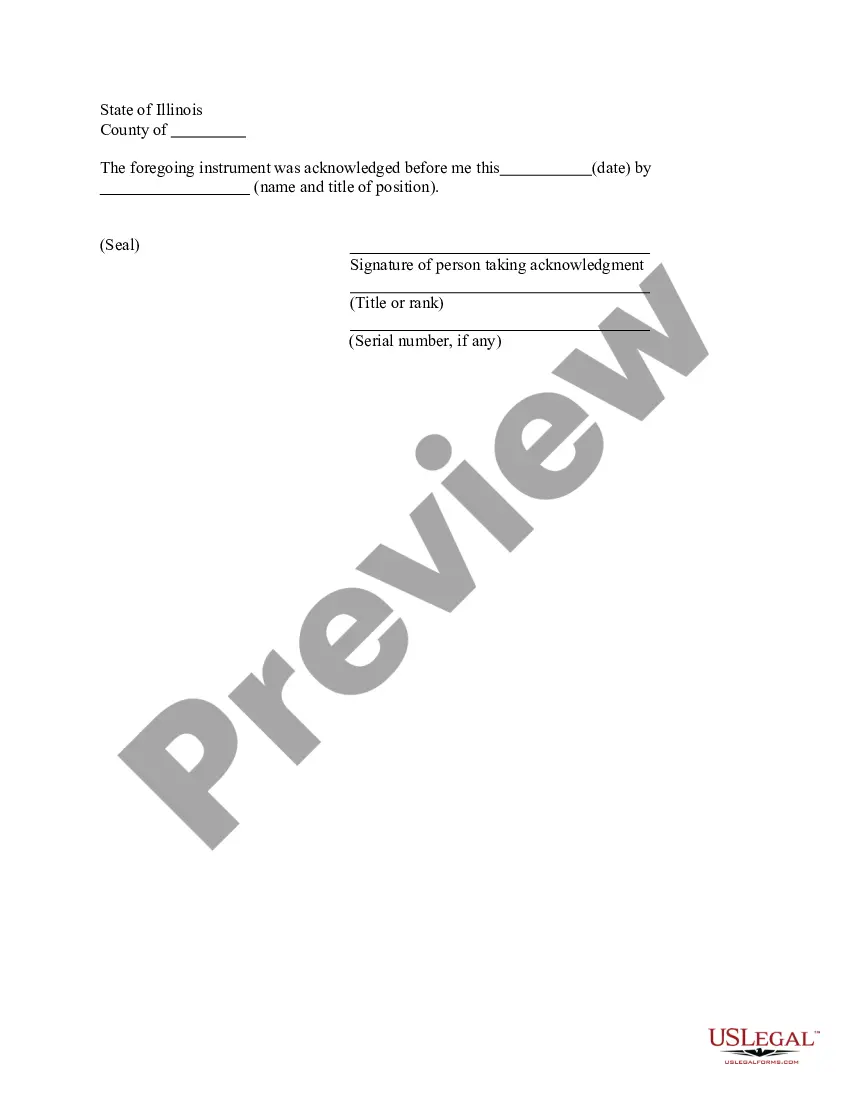

You can review the form using the Review button and examine the form outline to verify it is suitable for your needs.

- All templates are verified by experts and comply with state and federal regulations.

- If you are already registered, Log In to your account and click the Acquire button to get the Virgin Islands Option to Purchase a Business.

- Utilize your account to browse the legal forms you have previously purchased.

- Visit the My documents section of your account to obtain another copy of the document you require.

- For new users of US Legal Forms, follow these simple steps.

- First, ensure you have chosen the correct form for your city/state.

Form popularity

FAQ

In the U.S. Virgin Islands, unique tax benefits translate to a better bottom line. The USVI's tax program is not only one of the most competitive tax benefits packages within the Caribbean, but across the globe. The USVI offers a tax program that is fully sanctioned by the U.S. government and Internal Revenue Service.

The three main islands and 60 small cays that comprise the US Virgin Islands aren't entirely American; they are the only US territory where traffic drives on the left. The USVI does not impose any restrictions on foreign ownership of USVI property and property is owned fee simple.

Prices can range from approximately US $500,000 for a 0.5 to 1 acre undeveloped private island up to US $10 to $12 million for larger 60 to 70 acre islands, often with some infrastructure and development in place such as existing homes, docks, roads and airstrips.

Those looking to form LLCs in the US Virgin Islands must have both a local registered agent and a local office address. This address will be used for process service requests. Your agent who forms the company for you (such as this one) should automatically include this for you in the initial filing.

The Deal Took 50 Years. During World War I, Denmark finally sold Saint Thomas, Saint John and Saint Croix to the U.S. for $25 million in gold coin. During World War I, Denmark finally sold Saint Thomas, Saint John and Saint Croix to the U.S. for $25 million in gold coin.

The Deal Took 50 Years. During World War I, Denmark finally sold Saint Thomas, Saint John and Saint Croix to the U.S. for $25 million in gold coin.

To get started:Create a business plan.Register your trade name and/or corporation with the Office of the Lieutenant Governor.Select a good location and obtain a copy of an unsigned lease or letter of intent from the owner.Obtain a business license from the V.I. Department of Licensing and Consumer Affairs (DLCA)

Buying Process, Fees & TaxesYes, foreigners can buy property in the US Virgin Islands and the Government of the US Virgin Islands welcomes investment from overseas buyers. There are no restrictions on foreign buyers acquiring real estate in the US Virgin Islands.

John, St. Croix and Water Islandis the same as purchasing property in the United States. If you do decide to buy property in paradise, the title is handled the same and have the same guarantees and the Constitutional protections that one enjoys on the continent.

To start a business in the U.S. Virgin Islands you will need to obtain a business license from the Department of Licensing and Consumer Affairs (DLCA). DLCA will complete the "One Step" review process with the following government agencies: Police Department. VI Bureau of Internal Revenue (tax clearance)