Virgin Islands General Guaranty and Indemnification Agreement

Description

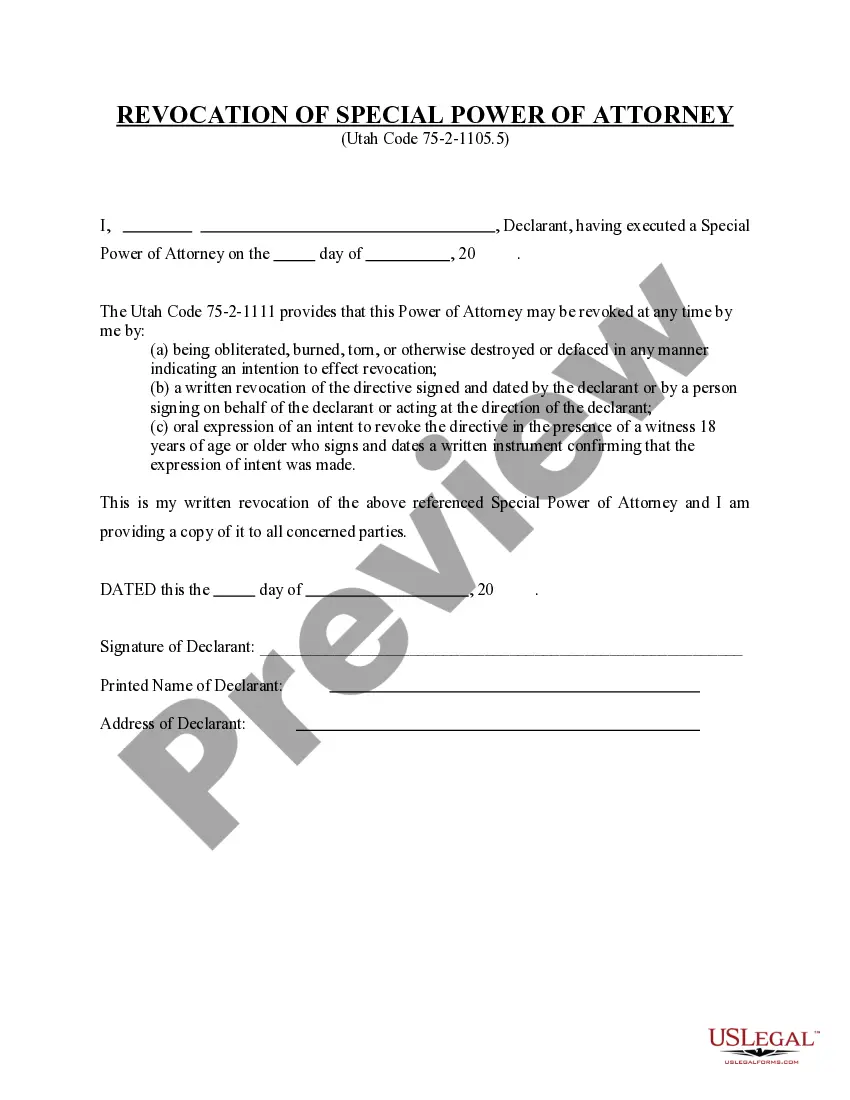

How to fill out General Guaranty And Indemnification Agreement?

If you need to tally, obtain, or create legal documentation formats, utilize US Legal Forms, the largest collection of legal forms available online.

Take advantage of the site's user-friendly search to locate the documents you need.

A variety of templates for business and personal purposes are categorized by groups and regions, or keywords.

Step 4. Once you have located the form you need, click the Purchase now button. Select the pricing plan you prefer and provide your information to register for an account.

Step 5. Complete the transaction. You may use your credit card or PayPal account to finalize the purchase.

- Utilize US Legal Forms to locate the Virgin Islands General Guaranty and Indemnification Agreement within a few clicks.

- If you are currently a US Legal Forms user, sign in to your account and click the Download button to access the Virgin Islands General Guaranty and Indemnification Agreement.

- You can also access forms you previously saved within the My documents section of your account.

- If you are utilizing US Legal Forms for the first time, follow the instructions below.

- Step 1. Ensure you have selected the form for the correct city/state.

- Step 2. Utilize the Preview option to review the form's information. Be sure to read the details.

- Step 3. If you are not satisfied with the form, use the Search area at the top of the screen to find alternative versions of the legal form template.

Form popularity

FAQ

An indemnification agreement provides additional protection for businesses by ensuring that they are not held liable for damages or losses that occur outside of their control. This agreement allows the company to continue its operations while protecting against lawsuits.

An indemnity agreement is a contract that protect one party of a transaction from the risks or liabilities created by the other party of the transaction. Hold harmless agreement, no-fault agreement, release of liability, or waiver of liability are other terms for an indemnity agreement.200c

Company/Business/Individual Name shall fully indemnify, hold harmless and defend and its directors, officers, employees, agents, stockholders and Affiliates from and against all claims, demands, actions, suits, damages, liabilities, losses, settlements, judgments, costs and expenses (including but not

Letters of indemnity should include the names and addresses of both parties involved, plus the name and affiliation of the third party. Detailed descriptions of the items and intentions are also required, as are the signatures of the parties and the date of the contract's execution.

California courts have held that indemnify and hold harmless confer distinct rights: (1) Indemnify is an offensive right, allowing the indemnified party to seek indemnification from the indemnifying party; (2) Hold harmless is a defensive right, protecting the indemnified party from being bothered by the other

$20/Month. The cost of professional indemnity insurance varies considerably. While these policies are extremely common, and typically inexpensive for most industries, the cost can increase significantly for specialized services with much higher risks.

For example, in the case of home insurance, the homeowner pays insurance premiums to the insurance company in exchange for the assurance that the homeowner will be indemnified if the house sustains damage from fire, natural disasters, or other perils specified in the insurance agreement.

Purpose of GuarantyThe guarantor agrees to pay the obligations of the borrower under the loan agreement in the event that the borrower does not pay. In addition to being an alternate source of repayment, guaranties provide evidence that the guarantor intends to stand behind the borrower.

Guaranty Agreement a two-party contract in which the first party agrees to perform in the event that a second party fails to perform. Unlike a surety, a guarantor is only required to perform after the obligee has made every reasonable and legal effort to force the principal's performance.

An indemnity agreement is a contract that protect one party of a transaction from the risks or liabilities created by the other party of the transaction. Hold harmless agreement, no-fault agreement, release of liability, or waiver of liability are other terms for an indemnity agreement.200c