Virgin Islands Assumption Agreement of Loan Payments

Description

How to fill out Assumption Agreement Of Loan Payments?

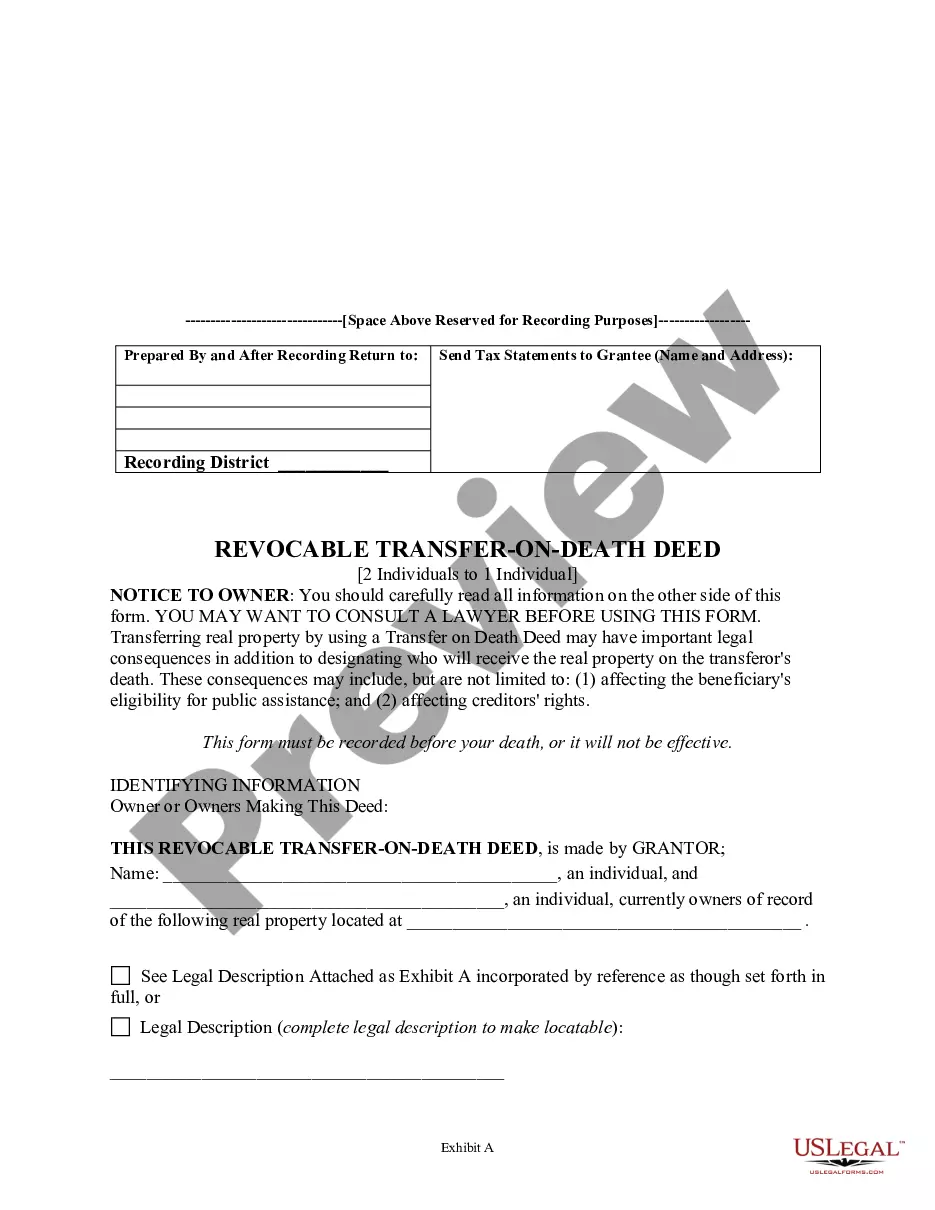

US Legal Forms - one of the largest collections of legal forms in the United States - offers a variety of legal document templates that you can download or print. By using the site, you can find thousands of forms for business and personal use, organized by categories, states, or keywords. You can access the most recent versions of forms such as the Virgin Islands Assumption Agreement of Loan Payments within moments.

If you already have a subscription, Log In and download the Virgin Islands Assumption Agreement of Loan Payments from the US Legal Forms repository. The Download button will appear on every form you view. You can access all previously saved forms in the My documents section of your account.

If you are using US Legal Forms for the first time, here are simple instructions to help you get started: Ensure you have selected the correct form for your city/county. Click on the Preview button to review the form's details. Read the form information to confirm that you have chosen the correct form. If the form does not suit your needs, utilize the Search field at the top of the screen to find a suitable one. If you are satisfied with the form, confirm your selection by clicking the Get now button. Then, select the pricing plan you prefer and provide your details to register for an account. Process the purchase. Use your credit card or PayPal account to complete the transaction. Choose the format and download the form to your device. Make adjustments. Fill out, modify, print, and sign the downloaded Virgin Islands Assumption Agreement of Loan Payments. Each template you added to your account has no expiration date and is yours forever. Therefore, if you wish to download or print an additional copy, simply go to the My documents section and click on the form you desire.

- Access the Virgin Islands Assumption Agreement of Loan Payments with US Legal Forms, the most extensive library of legal document templates.

- Utilize thousands of professional and state-specific templates that meet your business or personal needs and requirements.

- Download or print forms easily and efficiently.

- Enjoy lifetime access to all forms saved in your account.

- Search and find the right legal forms effortlessly.

Form popularity

FAQ

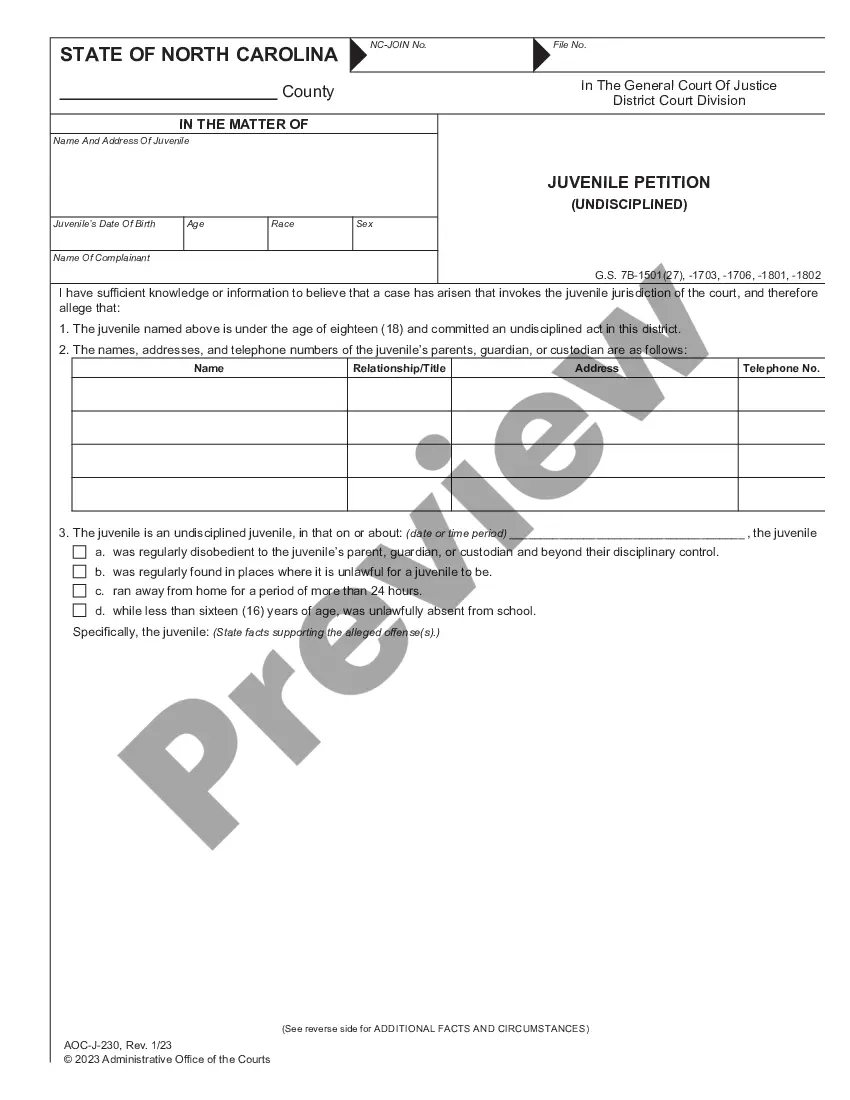

Yes, assumptions are legally binding when properly documented and executed. The Virgin Islands Assumption Agreement of Loan Payments must be signed by all relevant parties to ensure enforceability. Once recorded, this agreement holds the new borrower accountable for the loan's terms. Always consult legal advice to make sure your agreement meets all necessary legal requirements.

Yes, assumption agreements can and should be recorded to protect all parties involved. When you record a Virgin Islands Assumption Agreement of Loan Payments, it provides legal evidence of the new borrower's responsibilities. This recording helps prevent future disputes regarding the loan and ensures transparency. Always confirm with your local jurisdiction about the specific recording requirements.

A loan assumption is documented through a formal agreement, often called a Virgin Islands Assumption Agreement of Loan Payments. This document outlines the terms and conditions under which the new borrower takes over the existing loan. You should include details such as payment amounts, due dates, and any obligations of the original borrower. Using a platform like uslegalforms can help you create a clear and legally binding document.

Yes, an assumption of a mortgage is typically recorded in the public records. This recording serves as legal notice that the existing mortgage has been assumed by a new borrower. By documenting the Virgin Islands Assumption Agreement of Loan Payments, all parties can ensure clarity regarding loan responsibilities. This process protects both the lender and the new borrower by formalizing the agreement.

Documenting a loan assumption involves several important steps. First, you must complete a loan assumption agreement that outlines the terms between the parties involved. Next, both the new borrower and the lender will sign this agreement, formally transferring the loan obligations. Proper documentation is essential for a successful Virgin Islands Assumption Agreement of Loan Payments, and platforms like uslegalforms can provide the necessary templates and guidance.

When pursuing a loan assumption, you will need several key documents. Typically, these include a formal request to assume the loan, financial statements, and proof of income. You may also need to provide credit reports to demonstrate your creditworthiness. Using the correct documents will facilitate the Virgin Islands Assumption Agreement of Loan Payments, ensuring a seamless process.

To assume a VA loan in the Virgin Islands, the new borrower must meet specific eligibility criteria set by the VA. This includes being a qualified veteran or an active-duty service member. Additionally, the lender must approve the assumption, ensuring the new borrower can handle the loan payments. Understanding these rules is crucial for a smooth Virgin Islands Assumption Agreement of Loan Payments.