Virginia Form of Anti-Money Laundering Policy

Description

How to fill out Form Of Anti-Money Laundering Policy?

Are you in the place where you will need documents for possibly organization or specific reasons almost every day? There are tons of authorized papers themes accessible on the Internet, but locating kinds you can rely is not simple. US Legal Forms provides thousands of type themes, much like the Virginia Form of Anti-Money Laundering Policy, that happen to be created to fulfill federal and state demands.

Should you be already familiar with US Legal Forms site and get a free account, simply log in. After that, you are able to obtain the Virginia Form of Anti-Money Laundering Policy format.

If you do not offer an profile and wish to begin using US Legal Forms, adopt these measures:

- Find the type you require and ensure it is to the appropriate metropolis/state.

- Take advantage of the Preview switch to check the shape.

- Look at the explanation to ensure that you have chosen the proper type.

- If the type is not what you are searching for, take advantage of the Research discipline to obtain the type that meets your requirements and demands.

- If you discover the appropriate type, just click Acquire now.

- Pick the rates prepare you desire, fill out the desired details to make your account, and pay for the transaction with your PayPal or bank card.

- Choose a handy file structure and obtain your version.

Get each of the papers themes you possess bought in the My Forms menu. You may get a further version of Virginia Form of Anti-Money Laundering Policy any time, if needed. Just go through the required type to obtain or print the papers format.

Use US Legal Forms, by far the most extensive assortment of authorized kinds, in order to save time and prevent faults. The assistance provides expertly produced authorized papers themes which you can use for a variety of reasons. Generate a free account on US Legal Forms and commence creating your lifestyle easier.

Form popularity

FAQ

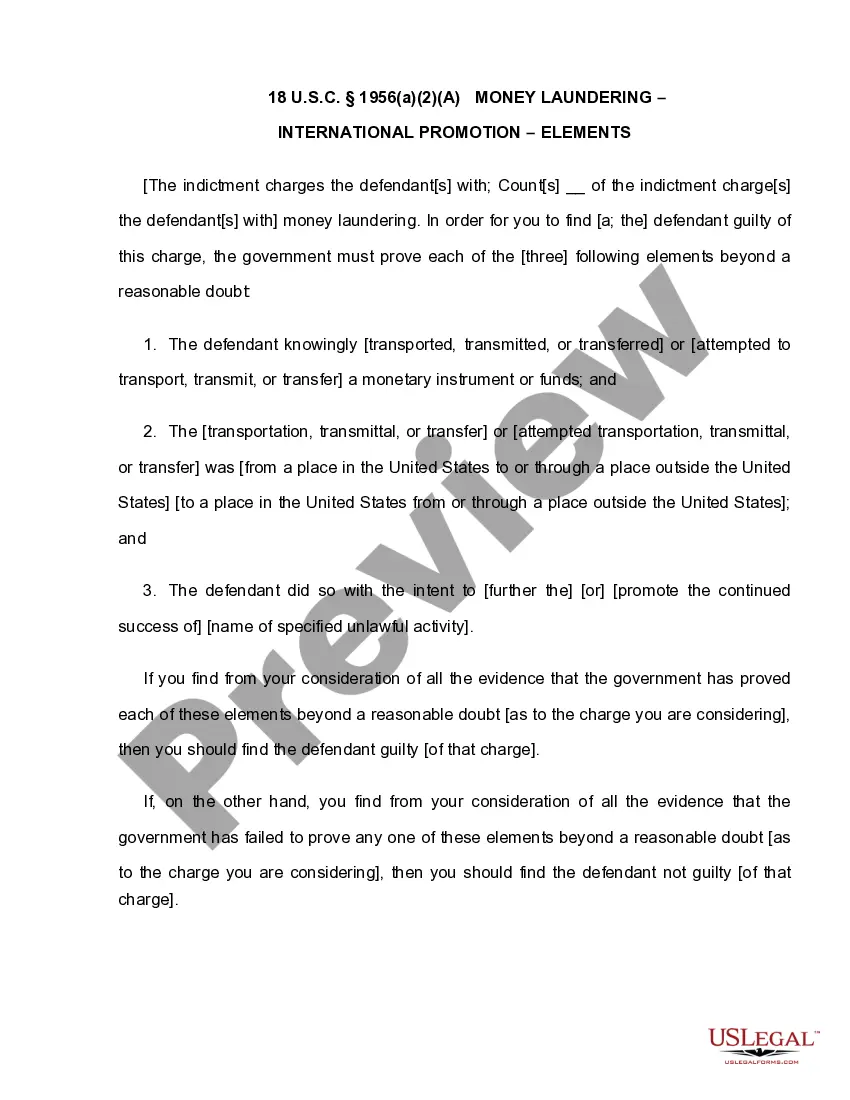

The BSA gives the Secretary of the Treasury the authority to implement reporting, recordkeeping, and AML Program requirements by regulation for financial institutions and other businesses listed in the statute. 31 U.S.C. § 5312(a)(2). The BSA is administered and enforced by a Department of the Treasury bureau, FinCEN.

Money laundering involves disguising financial assets so they can be used without detection of the illegal activity that produced them. Through money laundering, the criminal transforms the monetary proceeds derived from criminal activity into funds with an apparently legal source.

Section 18.2-152.(A), of the Code of Virginia makes it a Class 1 misdemeanor to use a computer or computer network with the intent to falsify or forge electronic mail transmission information in connection with the transmission of unsolicited commercial electronic mail (SPAM) through or into the computer network of ...

Conducts or attempts to conduct a financial transaction involving property represented to be the proceeds of specified unlawful activity, or property used to conduct or facilitate specified unlawful activity, shall be fined under this title or imprisoned for not more than 20 years, or both.

The AMLA law defines money laundering as any act involving the conversion, transfer, concealment, or disguising of illegally obtained funds. This act lays out what's considered money laundering in the country, and it gives clear guidelines on how businesses, especially financial institutions, should act to prevent it.

§ 18.2-246.3. A violation of this section is punishable by imprisonment of not more than forty years or a fine of not more than $500,000 or by both imprisonment and a fine.

To be sure, 18 U.S.C. §1956 criminalizes financial transactions that satisfy the conventional understanding of money laundering-namely, transactions intended ?to conceal or disguise the nature, the location, the source, the ownership, or the control of the proceeds of specified unlawful activity.? 18 U.S.C.

The AMLA contains provisions prohibiting politically exposed persons (PEPs) from falsifying the source of funds, ownership or control of assets, or concealing or misrepresenting such information to a financial institution. Any violations of the above prohibitions are subject to fines, imprisonment, or forfeiture.