Alabama Audio Systems Contractor Agreement - Self-Employed

Description

How to fill out Audio Systems Contractor Agreement - Self-Employed?

Are you presently within a position that you need documentation for either company or particular tasks every single time.

There are numerous legal document templates available online, but finding forms you can trust is not simple.

US Legal Forms offers thousands of form templates, such as the Alabama Audio Systems Contractor Agreement - Self-Employed, that are crafted to comply with federal and state regulations.

Once you find the correct form, click Acquire now.

Select the pricing plan you want, fill in the required details to create your account, and complete the purchase with your PayPal or credit card.

- If you are currently acquainted with the US Legal Forms website and have an account, simply Log In.

- Then, you can download the Alabama Audio Systems Contractor Agreement - Self-Employed template.

- If you do not possess an account and wish to start utilizing US Legal Forms, follow these steps.

- Find the form you need and ensure it is for the correct city/state.

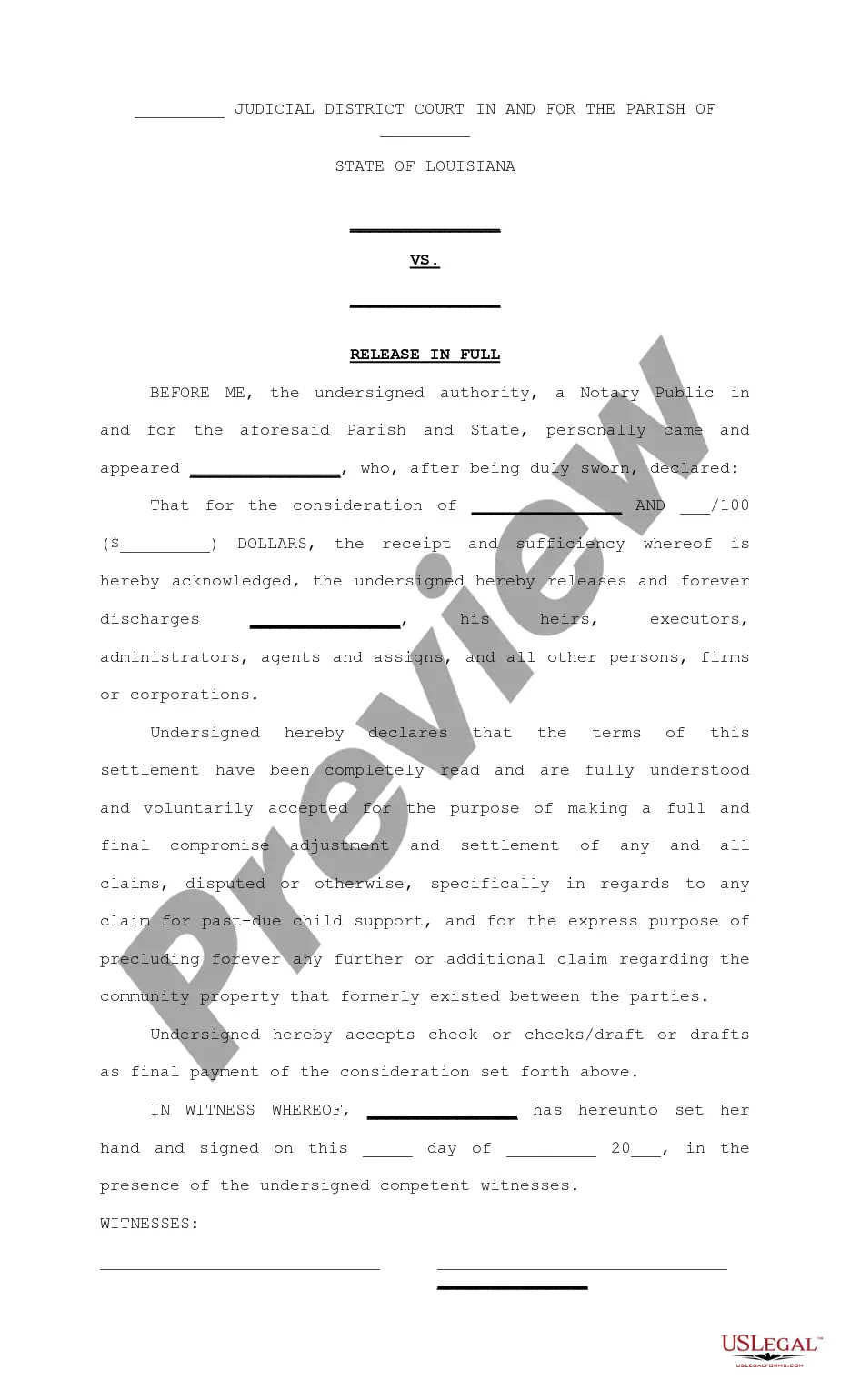

- Use the Review button to examine the form.

- Check the details to confirm that you have selected the correct form.

- If the form is not what you are looking for, use the Search area to find the form that suits your needs and requirements.

Form popularity

FAQ

To prove your status as an independent contractor, you can provide contracts, invoices, and documentation that illustrate your work arrangement. Keeping records of projects, communications, and payments will also strengthen your case. The Alabama Audio Systems Contractor Agreement - Self-Employed can serve as critical proof of your contractor status, as it outlines the scope of your work and any agreements made. Staying organized is key to presenting your independent contractor status effectively.

In Alabama, an operating agreement is not legally required for sole proprietors or independent contractors. However, having one can help clarify your business structure and operational procedures. When utilizing the Alabama Audio Systems Contractor Agreement - Self-Employed, you establish clear expectations between you and your clients, which can serve as a de facto operating agreement. This clarity can enhance trust and professionalism.

You qualify as self-employed if you own a business, are an independent contractor, or earn income through freelance work. This status gives you more control over your work but also comes with tax responsibilities. The Alabama Audio Systems Contractor Agreement - Self-Employed details your rights and obligations in this arrangement, aiding your understanding. To maintain this status, you should consistently report your income and manage your business activities.

Both terms are often used interchangeably, but 'self-employed' broadly refers to anyone who works for themselves. In contrast, 'independent contractor' specifies a particular type of self-employed individual, often working under a contract. When you use the Alabama Audio Systems Contractor Agreement - Self-Employed, it reinforces your status as an independent contractor, which can be beneficial for business relationships.

Yes, an independent contractor is considered self-employed. They work for themselves, providing services or products on a contract basis. The Alabama Audio Systems Contractor Agreement - Self-Employed outlines the terms for such arrangements, ensuring you understand your rights and responsibilities. This classification offers flexibility in managing your work schedule.

Yes, independent contractors file taxes as self-employed individuals. They report their income on Schedule C of their tax return. Using the Alabama Audio Systems Contractor Agreement - Self-Employed can help you understand your obligations and ensure compliance. It's essential to keep accurate records of your earnings and expenses to make tax filing easier.

Creating an independent contractor agreement is straightforward. First, clearly define the scope of work and the expectations for both parties. Then, incorporate essential elements such as payment terms, duration of the agreement, and confidentiality clauses. Using a reliable platform like USLegalForms can simplify this process, offering a tailored Alabama Audio Systems Contractor Agreement - Self-Employed that meets your specific needs.