Virginia Exhibit Schedule of Oil and Gas Leases Form 3

Description

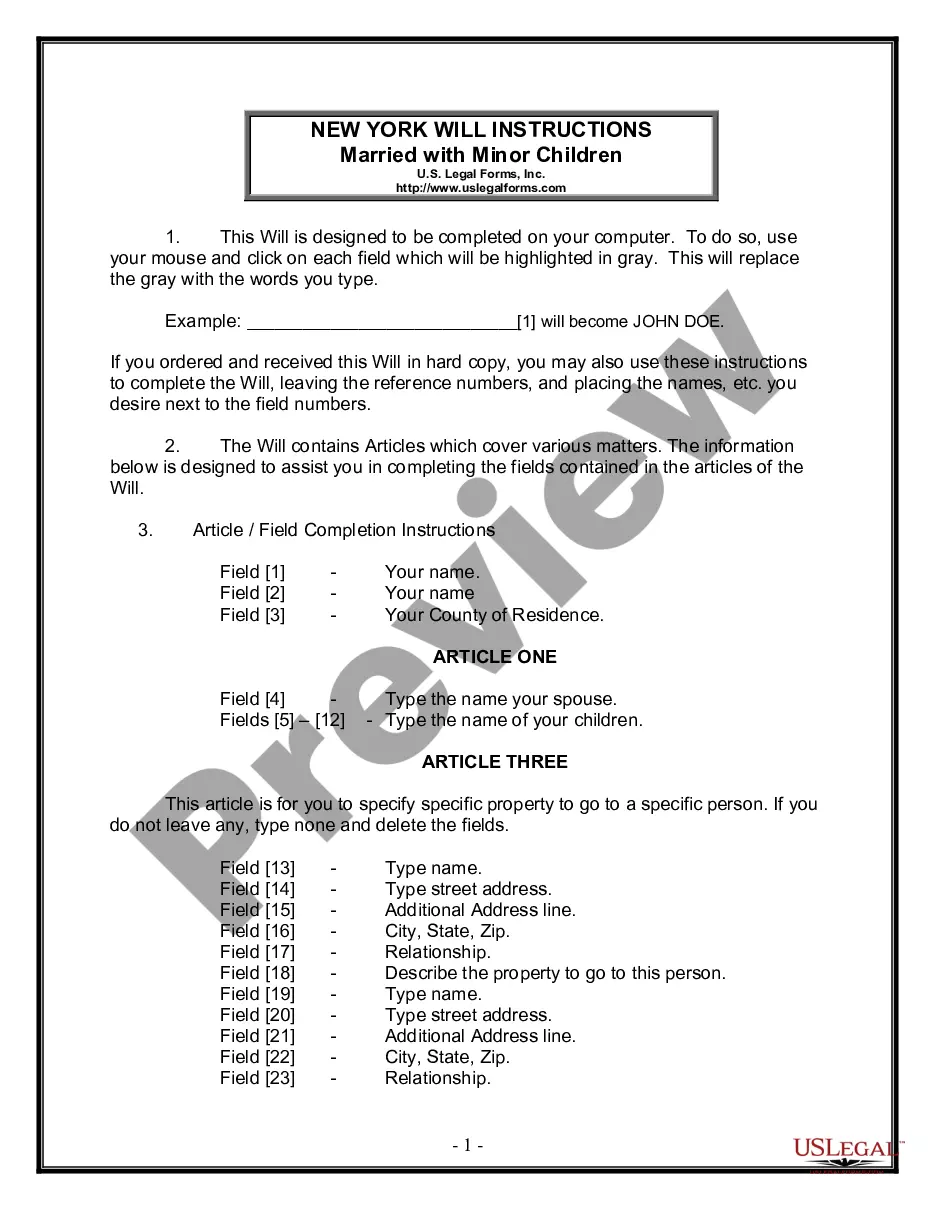

How to fill out Exhibit Schedule Of Oil And Gas Leases Form 3?

You can invest hrs online looking for the legal file design that fits the state and federal demands you need. US Legal Forms supplies a huge number of legal forms which can be evaluated by specialists. You can actually acquire or printing the Virginia Exhibit Schedule of Oil and Gas Leases Form 3 from our assistance.

If you already have a US Legal Forms bank account, you are able to log in and click the Acquire switch. After that, you are able to comprehensive, modify, printing, or signal the Virginia Exhibit Schedule of Oil and Gas Leases Form 3. Each and every legal file design you buy is yours for a long time. To have an additional copy associated with a acquired type, go to the My Forms tab and click the corresponding switch.

If you are using the US Legal Forms web site for the first time, keep to the easy directions beneath:

- Very first, make sure that you have selected the right file design for your state/area of your liking. See the type information to make sure you have chosen the appropriate type. If accessible, use the Preview switch to search through the file design as well.

- In order to discover an additional version in the type, use the Look for field to get the design that meets your needs and demands.

- After you have located the design you need, click on Acquire now to carry on.

- Find the rates strategy you need, type your qualifications, and sign up for your account on US Legal Forms.

- Full the financial transaction. You may use your credit card or PayPal bank account to pay for the legal type.

- Find the formatting in the file and acquire it to the device.

- Make adjustments to the file if required. You can comprehensive, modify and signal and printing Virginia Exhibit Schedule of Oil and Gas Leases Form 3.

Acquire and printing a huge number of file layouts using the US Legal Forms Internet site, which offers the greatest collection of legal forms. Use professional and express-particular layouts to take on your business or specific requires.

Form popularity

FAQ

The primary term is usually for a set amount of years, 1, 3, 5, 7 or 10 years. The secondary term normally takes effect once the primary term has expired and the condition(s) set forth in the term clause, or habendum clause, of your oil and gas lease for the secondary term to take effect is satisfied.

Search online database of new and updated oil and gas leases. Use Enverus analytics to focus search on specific geographies, lease dates and contract terms, production record and leasing costs.

A mineral lease is a contractual agreement between the owner of a mineral estate (known as the lessor), and another party such as an oil and gas company (the lessee). The lease gives an oil or gas company the right to explore for and develop the oil and gas deposits in the area described in the lease.

The royalty percentage is usually 12.5% to 15% but can change based on regional regulations or negotiations. Types of Leases: There are different types of oil and gas leases, and they affect royalty calculations differently.

The memorandum of lease is a short form version of the oil and gas lease. The memorandum of lease is recorded. The full lease will not be recorded. You may also receive an addendum.

Again, negotiating oil leases takes time. Don't Respond That You're Not Interested. ... Don't Rush to Hire a Lawyer. ... Don't Start Spending Money You Don't Yet Have. ... Don't Warrant the Mineral Title. ... Don't Lease Multiple Non-contiguous Tracts on One Lease Form. ... Don't Spout Off during Negotiating.

Oil and gas lessees retain royalties on all production from their lease. The mineral rights owners receive a royalty interest since drilling and production costs are not deducted from it. Most oil and gas royalty interests are expressed as fractions or percentages.

The type used most often by oil and gas companies today is known as the ?Paid-Up? lease. In this type of lease form, no bonus payments are due from the company after the lease is signed... you get 100% of your lease bonus money combined with the annual rental payments up front.