Virginia Gas Sales Contract

Description

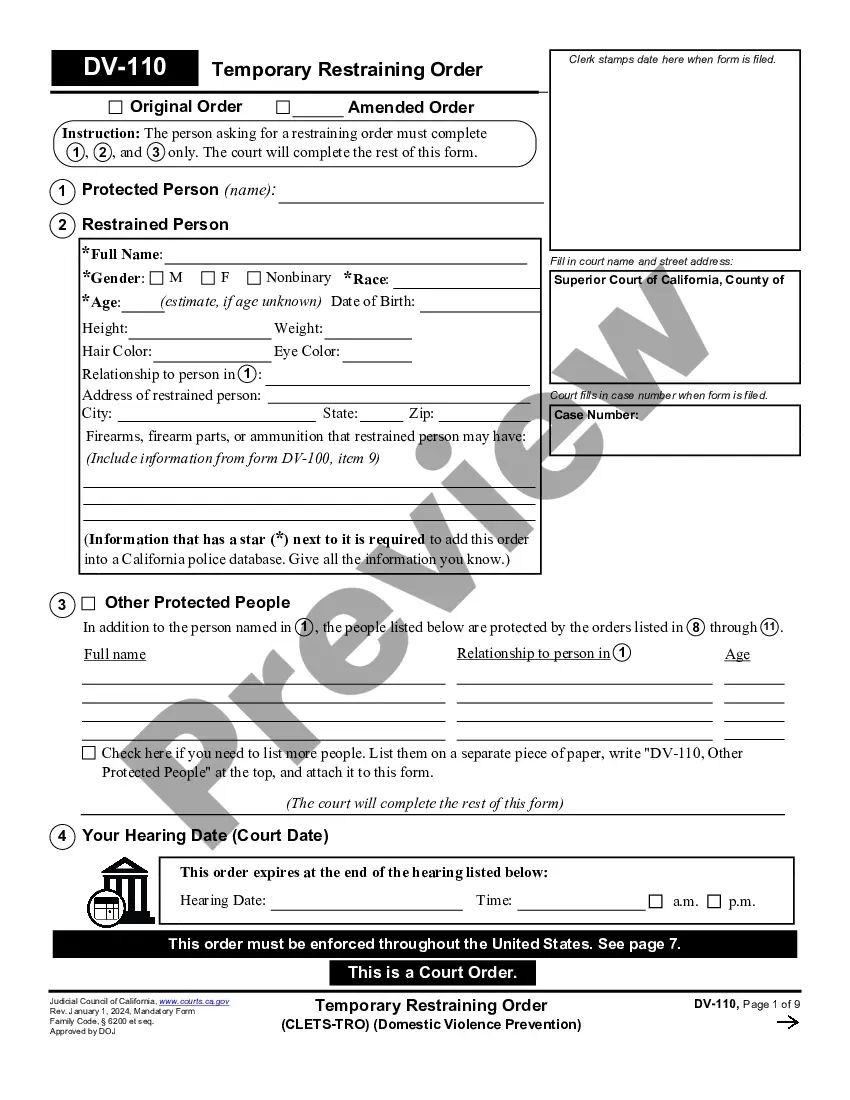

How to fill out Gas Sales Contract?

If you need to comprehensive, obtain, or printing lawful file templates, use US Legal Forms, the most important assortment of lawful types, that can be found on-line. Utilize the site`s simple and easy handy search to find the paperwork you will need. Numerous templates for enterprise and person purposes are sorted by categories and says, or keywords. Use US Legal Forms to find the Virginia Gas Sales Contract with a handful of clicks.

If you are presently a US Legal Forms consumer, log in for your accounts and click on the Download option to obtain the Virginia Gas Sales Contract. Also you can entry types you formerly acquired within the My Forms tab of your own accounts.

If you use US Legal Forms the very first time, follow the instructions below:

- Step 1. Make sure you have selected the form for your appropriate metropolis/nation.

- Step 2. Utilize the Preview method to examine the form`s information. Do not overlook to read the information.

- Step 3. If you are unhappy with the kind, utilize the Search industry on top of the screen to locate other versions in the lawful kind web template.

- Step 4. After you have identified the form you will need, go through the Purchase now option. Choose the rates strategy you like and put your accreditations to register for an accounts.

- Step 5. Procedure the deal. You may use your credit card or PayPal accounts to perform the deal.

- Step 6. Choose the structure in the lawful kind and obtain it on your product.

- Step 7. Full, edit and printing or indicator the Virginia Gas Sales Contract.

Every lawful file web template you acquire is your own property for a long time. You possess acces to each kind you acquired inside your acccount. Go through the My Forms segment and pick a kind to printing or obtain again.

Contend and obtain, and printing the Virginia Gas Sales Contract with US Legal Forms. There are millions of professional and status-specific types you may use to your enterprise or person requirements.

Form popularity

FAQ

Owner/Applicant must be at least 65 or permanently disabled as of December 31 of the previous year. Sworn affidavits from two medical doctors licensed in Virginia or two military officers who practice medicine in the United States Armed Forces - use the Tax Relief Affidavit of Disability (PDF) for their completion.

Whether or not you will owe taxes for selling personal items, goods, or services online will depend on several factors, including whether you made a profit. Usually, you need to pay federal income taxes and self-employment taxes if you make more than $400 during the tax year. How Much Can You Sell Online Without Paying Taxes? Rocket Lawyer ? legal-guide ? how-m... Rocket Lawyer ? legal-guide ? how-m...

How to Avoid Capital Gains Tax on Sale of Business Negotiate wisely. As mentioned, you and the buyer will have competing interests with regard to the allocation of the purchase price. ... Consider an installment sale. ... Watch the timing. ... Sell to employees. ... Explore Opportunity Zone reinvestment. How to Avoid Capital Gains Tax on Business Sale | SmartAsset smartasset.com ? taxes ? how-to-avoid-capital-gai... smartasset.com ? taxes ? how-to-avoid-capital-gai...

One-off sales where you sell an item for less than what you paid are considered nondeductible losses by the IRS. You can't deduct the loss, but you won't have to pay taxes on it either. Do I Need to Report Online Marketplace Sales on My Taxes? Experian ? blogs ? ask-experian ? do... Experian ? blogs ? ask-experian ? do...

One-off sales where you sell an item for less than what you paid are considered nondeductible losses by the IRS. You can't deduct the loss, but you won't have to pay taxes on it either.

Here are seven tried-and-true passive income strategies that are tax-free. Buy Tax-Free Municipal Bonds. ... Open a Roth IRA and Invest. ... Sell Your Home. ... Earn Long-Term Capital Gains. ... Collect Social Security Benefits. ... Get Disability Insurance. ... Invest In an HSA. ... Bottom Line. 7 Ways To Grow Passive Income Without Paying Taxes - Nasdaq nasdaq.com ? articles ? 7-ways-to-grow-pass... nasdaq.com ? articles ? 7-ways-to-grow-pass...

Things sold to federal or state governments, or their political subdivisions, are not subject to sales tax. The exemption doesn't apply to property purchased by the Commonwealth of Virginia, then transferred to a private business.

Form ST-9 is used to report and pay the tax to the Department of Taxation and must be filed for each reporting period even if no tax is due. Unless paying by Electronic Funds Transfer, make a check or money order pay- able to the Virginia Department of Taxation.