Virginia Partial Release of Mortgage / Deed of Trust on A Mineral / Royalty Interest Sold by Grantor

Description

How to fill out Partial Release Of Mortgage / Deed Of Trust On A Mineral / Royalty Interest Sold By Grantor?

Are you in the position where you require documents for possibly enterprise or specific reasons almost every working day? There are tons of lawful document web templates available on the net, but finding ones you can trust is not simple. US Legal Forms gives 1000s of develop web templates, just like the Virginia Partial Release of Mortgage / Deed of Trust on A Mineral / Royalty Interest Sold by Grantor, which are written to fulfill state and federal demands.

If you are currently knowledgeable about US Legal Forms site and also have a merchant account, basically log in. Following that, you may obtain the Virginia Partial Release of Mortgage / Deed of Trust on A Mineral / Royalty Interest Sold by Grantor template.

If you do not offer an accounts and wish to begin using US Legal Forms, abide by these steps:

- Obtain the develop you will need and ensure it is for your correct city/area.

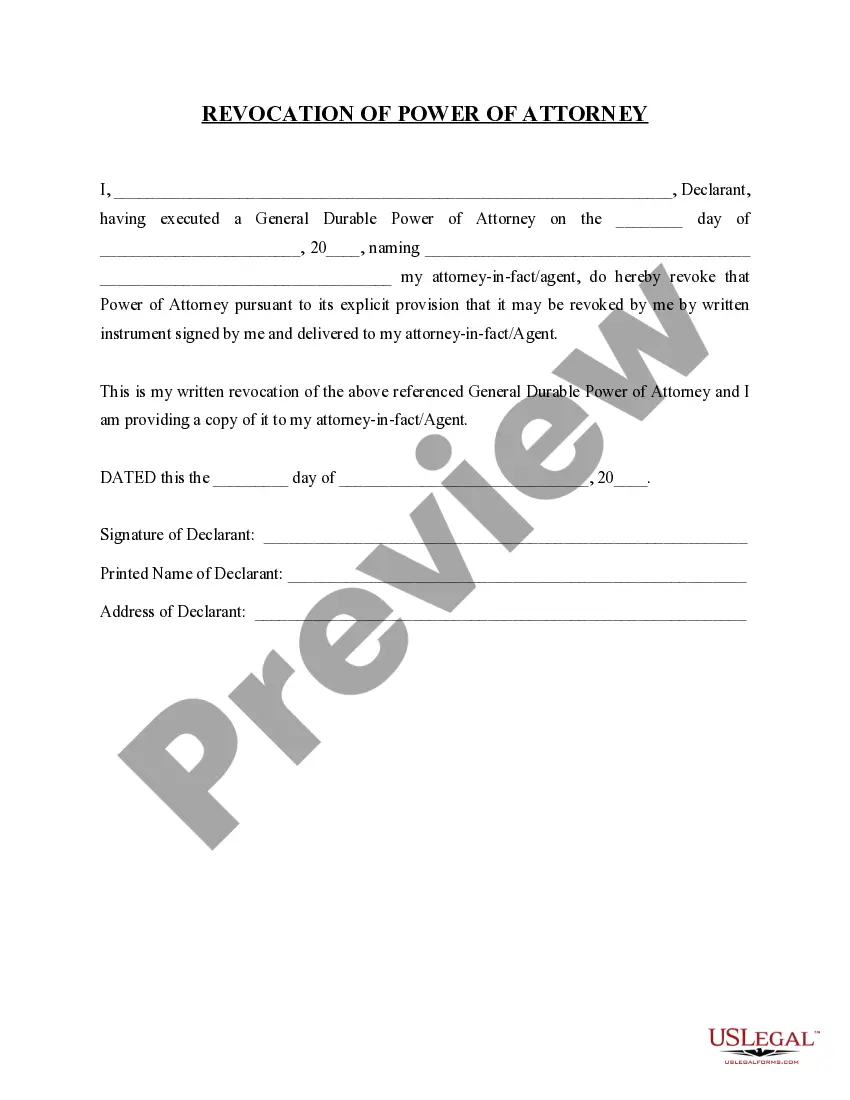

- Utilize the Preview switch to analyze the form.

- Look at the description to ensure that you have selected the appropriate develop.

- In case the develop is not what you are trying to find, make use of the Look for discipline to get the develop that meets your requirements and demands.

- When you obtain the correct develop, click on Purchase now.

- Opt for the rates strategy you want, fill out the required details to make your money, and pay for your order making use of your PayPal or charge card.

- Decide on a handy data file format and obtain your backup.

Locate all of the document web templates you might have purchased in the My Forms food selection. You can get a further backup of Virginia Partial Release of Mortgage / Deed of Trust on A Mineral / Royalty Interest Sold by Grantor at any time, if necessary. Just select the necessary develop to obtain or produce the document template.

Use US Legal Forms, by far the most extensive selection of lawful types, to save lots of some time and avoid faults. The services gives skillfully produced lawful document web templates that can be used for a variety of reasons. Make a merchant account on US Legal Forms and initiate creating your lifestyle easier.

Form popularity

FAQ

Information on Virginia Land Records Such deeds show the names of the grantor and grantee, the residence of both parties, a description of what is being sold, the consideration (or price), the location of the tract of land, the tract's boundaries, and any limitations on the property being sold.

Several easy-to-follow steps are required to create a Virginia deed: Locate the most recent deed to the property. ... Create the new deed. ... Sign and notarize the new deed. ... Record the deed in the land records of the clerk's office of the circuit court in the jurisdiction where the property is located.

Every deed and corrected or amended deed may be made in the following form, or to the same effect: "This deed, made the ______ day of ______, in the year ____, between (here insert names of parties as grantors or grantees), witnesseth: that in consideration of (here state the consideration, nominal or actual), the said ...

All documents put to record must be acknowledged and contain a notary seal. All acknowledgements by a Virginia notary must include their commission number, expiration date and a darkened seal.

Who pays the transfer and recordation tax in Virginia? The home seller typically pays the state transfer tax, called the grantor's tax. The cost is one percent, or $1.00/$1,000 of the transaction amount.

After or accompanying payment in full of the obligation secured by a deed of trust or judgment lien, a settlement agent or title insurance company intending to release a deed of trust or judgment lien pursuant to this subsection shall deliver to the lien creditor by certified mail or commercial overnight delivery ...

Can I prepare my own deed? The Clerk's Office Land Records Department will accept a deed prepared by a property owner or an attorney, who is a member of the Virginia Bar. The document must meet all recording standards.

A trust deed ?also known as a deed of trust?is a document sometimes used in real estate transactions in the U.S. It is a document that comes into play when one party has taken out a loan from another party to purchase a property.