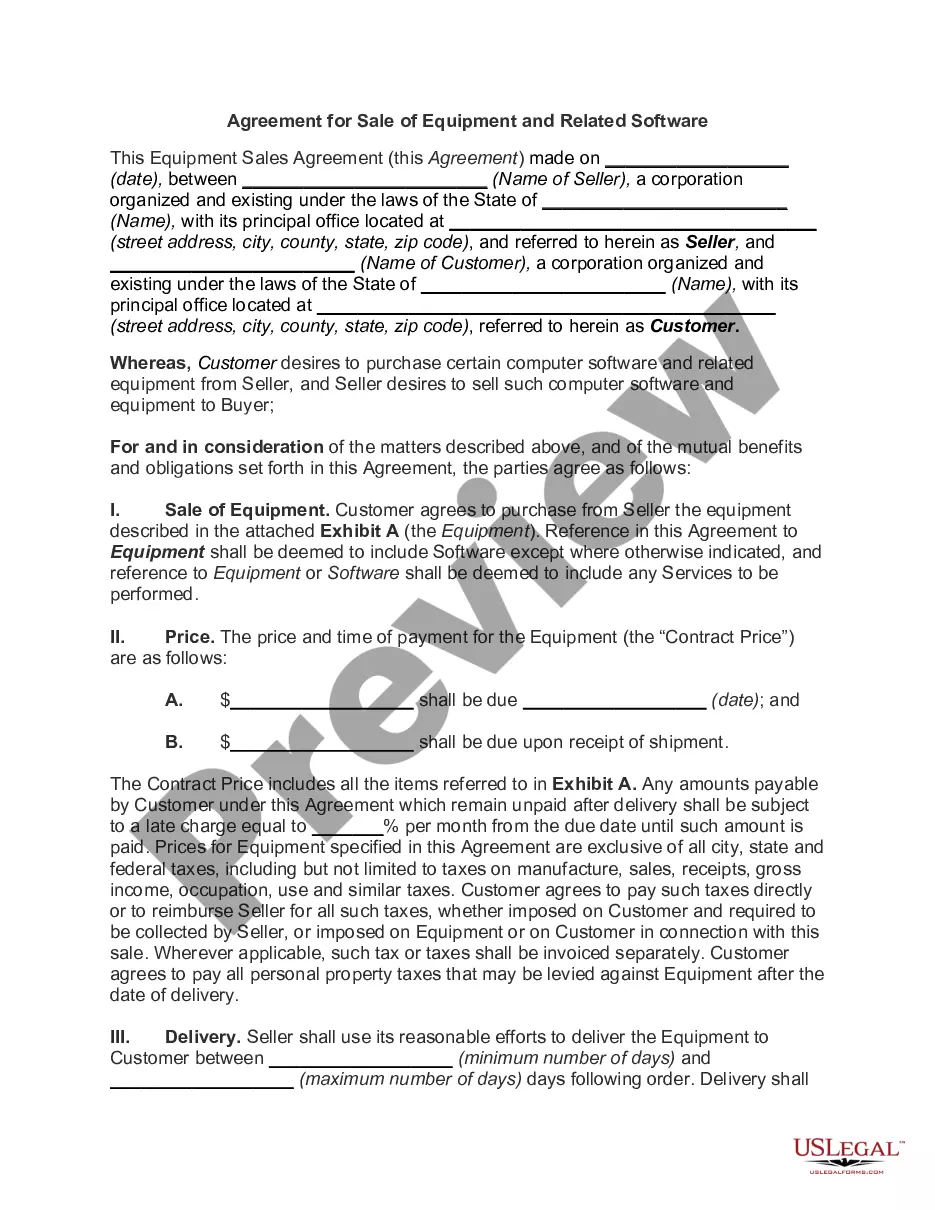

Virginia Agreement for Sales of Data Processing Equipment

Description

How to fill out Agreement For Sales Of Data Processing Equipment?

You can spend hours online searching for the legal document template that satisfies the state and federal standards you require.

US Legal Forms offers thousands of legal forms that have been evaluated by experts.

You can easily download or print the Virginia Agreement for Sales of Data Processing Equipment from the platform.

Review the form description to confirm that you have chosen the correct form. If available, use the Review button to examine the document template as well. If you wish to obtain another version of the form, utilize the Search field to find the template that meets your needs and requirements. Once you have found the template you want, click Buy now to proceed. Select the pricing plan you prefer, enter your details, and register for an account on US Legal Forms. Complete the purchase. You can use your Visa or Mastercard or PayPal account to pay for the legal form. Choose the format of the document and download it to your device. Make modifications to your document if necessary. You can fill out, edit, sign, and print the Virginia Agreement for Sales of Data Processing Equipment. Acquire and print thousands of document templates using the US Legal Forms Website, which offers the largest selection of legal forms. Utilize professional and state-specific templates to address your business or personal needs.

- If you already have a US Legal Forms account, you may Log In and click the Acquire button.

- Then, you can complete, modify, print, or sign the Virginia Agreement for Sales of Data Processing Equipment.

- Every legal document template you obtain is yours forever.

- To get another copy of any purchased form, navigate to the My documents tab and click the corresponding button.

- If you are using the US Legal Forms site for the first time, follow the simple instructions below.

- First, ensure that you have selected the correct document template for your county/city of choice.

Form popularity

FAQ

Yes, uslegalforms offers resources and templates that can assist businesses in understanding and implementing the Virginia Agreement for Sales of Data Processing Equipment effectively. With user-friendly legal forms, you can streamline the documentation process and mitigate the risk of compliance issues concerning sales tax.

Virginia attracts data centers due to its favorable tax regulations, reliable infrastructure, and a robust technology ecosystem. The Virginia Agreement for Sales of Data Processing Equipment offers businesses the opportunity to capitalize on these benefits, making it an ideal location for large-scale operations. This shift towards data centers boosts local economies and job opportunities.

Yes, in some cases, data centers in Virginia can be exempt from sales and use tax, particularly for equipment crucial to their operations. To fully leverage these exemptions, businesses should refer to the Virginia Agreement for Sales of Data Processing Equipment and consult legal experts who can guide them through the process.

While data centers may have access to certain tax exemptions, they are generally not entirely tax-exempt. However, with the right agreements and understanding of Virginia regulations, like the Virginia Agreement for Sales of Data Processing Equipment, they can significantly reduce their tax liabilities on qualifying equipment.

Data centers in Virginia may benefit from specific sales tax exemptions, mainly if they utilize qualified equipment in their operations. The Virginia Agreement for Sales of Data Processing Equipment can play a vital role in assessing what is eligible for such exemptions. Engaging with legal expertise can streamline this process and ensure compliance.

Sales nexus in Virginia refers to the connection between a business and the state that requires the business to collect sales tax. Generally, having a physical presence, such as offices or data centers in Virginia, creates this nexus. Understanding how the Virginia Agreement for Sales of Data Processing Equipment affects your sales nexus is crucial for compliance and tax planning.

In Virginia, certain items are exempt from sales tax, including food for human consumption, prescription medications, and some items used in manufacturing. If you are considering the Virginia Agreement for Sales of Data Processing Equipment, it's essential to know that specific equipment may qualify for exemptions if they are used directly in production or processing.

To obtain a resale certificate in Virginia, you need to apply through the Virginia Department of Taxation. Start by filling out the appropriate form for the resale certificate and provide the necessary business information. This certificate allows you to buy goods, including data processing equipment, without paying sales tax, which is essential when working under the Virginia Agreement for Sales of Data Processing Equipment. If you have questions during the process, platforms like uslegalforms can help guide you through the requirements and forms needed.

A checklist for a data processing agreement includes several important items: identify the data controller and processor, outline the purpose of data processing, define the type of data being processed, specify security measures, and establish the processes for handling data breaches. This checklist is crucial when drafting a Virginia Agreement for Sales of Data Processing Equipment to ensure legal compliance and proper handling of sensitive information.

Writing a data processing agreement involves several key elements, such as defining the roles of data controllers and processors, detailing the type of data being processed, and specifying the security measures in place. It's important to ensure that the agreement is clear and compliant with regulations. If you need guidance, consider using resources from uslegalforms to create a robust Virginia Agreement for Sales of Data Processing Equipment that meets your specific needs.