Virginia Self-Employed Commercial Fisherman Services Contract

Description

How to fill out Self-Employed Commercial Fisherman Services Contract?

If you need to total, acquire, or printing lawful papers web templates, use US Legal Forms, the greatest collection of lawful forms, that can be found on the web. Utilize the site`s easy and handy lookup to find the files you require. Different web templates for organization and personal functions are categorized by categories and states, or search phrases. Use US Legal Forms to find the Virginia Self-Employed Commercial Fisherman Services Contract in a few click throughs.

If you are presently a US Legal Forms client, log in in your bank account and then click the Acquire switch to obtain the Virginia Self-Employed Commercial Fisherman Services Contract. Also you can entry forms you earlier downloaded from the My Forms tab of your respective bank account.

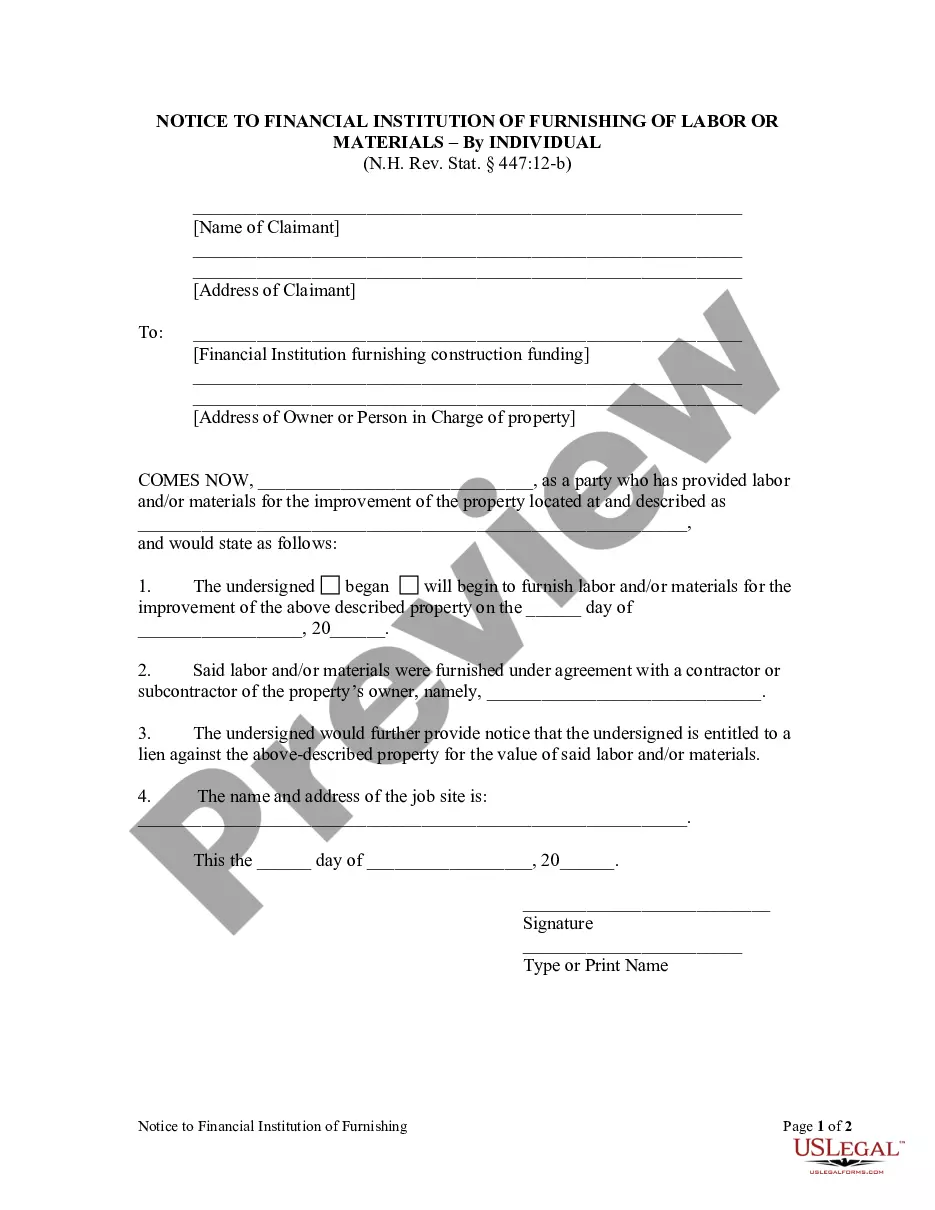

If you are using US Legal Forms initially, refer to the instructions listed below:

- Step 1. Ensure you have chosen the form for that proper city/nation.

- Step 2. Utilize the Review choice to check out the form`s information. Do not forget to read the description.

- Step 3. If you are not happy together with the form, use the Look for industry at the top of the monitor to discover other variations in the lawful form web template.

- Step 4. Upon having found the form you require, click the Buy now switch. Pick the rates prepare you like and include your accreditations to register for an bank account.

- Step 5. Approach the purchase. You can utilize your Мisa or Ьastercard or PayPal bank account to finish the purchase.

- Step 6. Find the file format in the lawful form and acquire it on your own gadget.

- Step 7. Comprehensive, revise and printing or signal the Virginia Self-Employed Commercial Fisherman Services Contract.

Every lawful papers web template you purchase is yours forever. You possess acces to each form you downloaded within your acccount. Select the My Forms segment and decide on a form to printing or acquire once again.

Remain competitive and acquire, and printing the Virginia Self-Employed Commercial Fisherman Services Contract with US Legal Forms. There are millions of specialist and status-particular forms you can utilize to your organization or personal requires.

Form popularity

FAQ

A worker does not have to meet all 20 criteria to qualify as an employee or independent contractor, and no single factor is decisive in determining a worker's status. The individual circumstances of each case determine the weight IRS assigns different factors.

A 'self-employed contractor' is a person who is genuinely in business for themselves (ie s/he takes responsibility for the success or failure of the business) and is neither an employee nor a worker.

Although 'self-employment' is not defined in legislation, if a person is a business owner or contractor that provides services to other businesses, either directly or through a personal services company (PSC),1 they will generally be considered to be self-employed.

You have to file an income tax return if your net earnings from self-employment were $400 or more. If your net earnings from self-employment were less than $400, you still have to file an income tax return if you meet any other filing requirement listed in the Form 1040 and 1040-SR instructionsPDF.

If you have generated an income amounting to $600 or more and/or paid $600 or more to an entity or an independent contractor in exchange for their services, then you're required to file 1099 forms for the tax year.

How Do You Become Self-Employed?Think of a Name for Your Self-Employed Business. Consider what services you will offer, and then pick a name that describes what you do.Choose a Self-Employed Business Structure and Get a Proper License.Open a Business Bank Account.Advertise Your Independent Contractor Services.

If you are a business owner or contractor who provides services to other businesses, then you are generally considered self-employed. For more information on your tax obligations if you are self-employed (an independent contractor), see our Self-Employed Individuals Tax Center.

The general rule is that an individual is an independent contractor if the payer has the right to control or direct only the result of the work and not what will be done and how it will be done. If you are an independent contractor, then you are self-employed.

The general rule is that an individual is an independent contractor if the payer has the right to control or direct only the result of the work and not what will be done and how it will be done. If you are an independent contractor, then you are self-employed.

What is the $600 threshold? You are required to complete a 1099-MISC reporting form for an independent worker or unincorporated business if you paid that independent worker or business $600 or more.