Virginia Personal Shopper Services Contract - Self-Employed Independent Contractor

Description

How to fill out Personal Shopper Services Contract - Self-Employed Independent Contractor?

You can devote multiple hours online searching for the sanctioned document template that complies with the state and federal requirements you will require.

US Legal Forms offers a vast array of legal templates that are assessed by experts.

You can obtain or print the Virginia Personal Shopper Services Contract - Self-Employed Independent Contractor from your account.

If available, utilize the Preview button to review the document template as well. If you wish to find another version of your form, use the Search field to locate the template that fulfills your needs and specifications. Once you have found the template you desire, click on Buy now to proceed. Select the pricing plan you want, enter your credentials, and register for an account on US Legal Forms. Complete the transaction. You may use your credit card or PayPal account to pay for the legal template. Choose the format of your document and download it to your device. Make modifications to your document if necessary. You can complete, edit, sign, and print the Virginia Personal Shopper Services Contract - Self-Employed Independent Contractor. Download and print thousands of document templates using the US Legal Forms website, which offers the largest selection of legal templates. Utilize professional and state-specific templates to address your business or personal needs.

- If you currently possess a US Legal Forms account, you may sign in and click on the Download button.

- Subsequently, you may complete, edit, print, or sign the Virginia Personal Shopper Services Contract - Self-Employed Independent Contractor.

- Every legal document template you acquire is yours indefinitely.

- To obtain another copy of any purchased form, visit the My documents section and click on the appropriate button.

- If you are using the US Legal Forms website for the first time, follow the simple instructions below.

- First, ensure that you have selected the correct document template for the region/city of your choice.

- Review the form description to verify that you have picked the correct template.

Form popularity

FAQ

Yes, an independent contractor is considered self-employed. When you operate under a Virginia Personal Shopper Services Contract - Self-Employed Independent Contractor, you work for yourself rather than an employer. This status gives you the freedom to set your own schedule and choose your clients. To formalize this arrangement, using platforms like uslegalforms can simplify the process of creating a contract that outlines your responsibilities and rights.

Whether independent contractors need a business license in Virginia depends on the specific services they provide and local ordinances. If you’re working under a Virginia Personal Shopper Services Contract - Self-Employed Independent Contractor, you must check with your local government. Ensuring you have the right licenses will help legitimize your services and build trust with your clients.

The new independent contractor law in Virginia focuses on clarifying the classification of independent contractors and the protections afforded to them. This law affects those working under contracts like the Virginia Personal Shopper Services Contract - Self-Employed Independent Contractor. Understanding this law can help you gain better insight into your rights and responsibilities as an independent contractor in the state.

In most cases, you do not need to formally register your business if you are an independent contractor. However, you might consider registering your name, especially if you are using a trade name related to your Virginia Personal Shopper Services Contract - Self-Employed Independent Contractor. Always verify local regulations to ensure compliance with any necessary registrations or permits.

Yes, a self-employed person can and should have a contract. A contract protects you and your clients by outlining the terms of service under a Virginia Personal Shopper Services Contract - Self-Employed Independent Contractor. It clarifies expectations, responsibilities, and payment terms, which helps avoid misunderstandings in your business relationships.

In Virginia, independent contractors may need a business license depending on the nature of their work and the local regulations. If you are operating under a Virginia Personal Shopper Services Contract - Self-Employed Independent Contractor, it is crucial to check with your local government to determine any specific licensing requirements. This ensures your business operates legally and avoids potential fines.

Yes, independent contractors file their taxes as self-employed individuals. This means they report income from their services, such as those offered under a Virginia Personal Shopper Services Contract - Self-Employed Independent Contractor. By filing as self-employed, you can also claim relevant business expenses that may help reduce your taxable income.

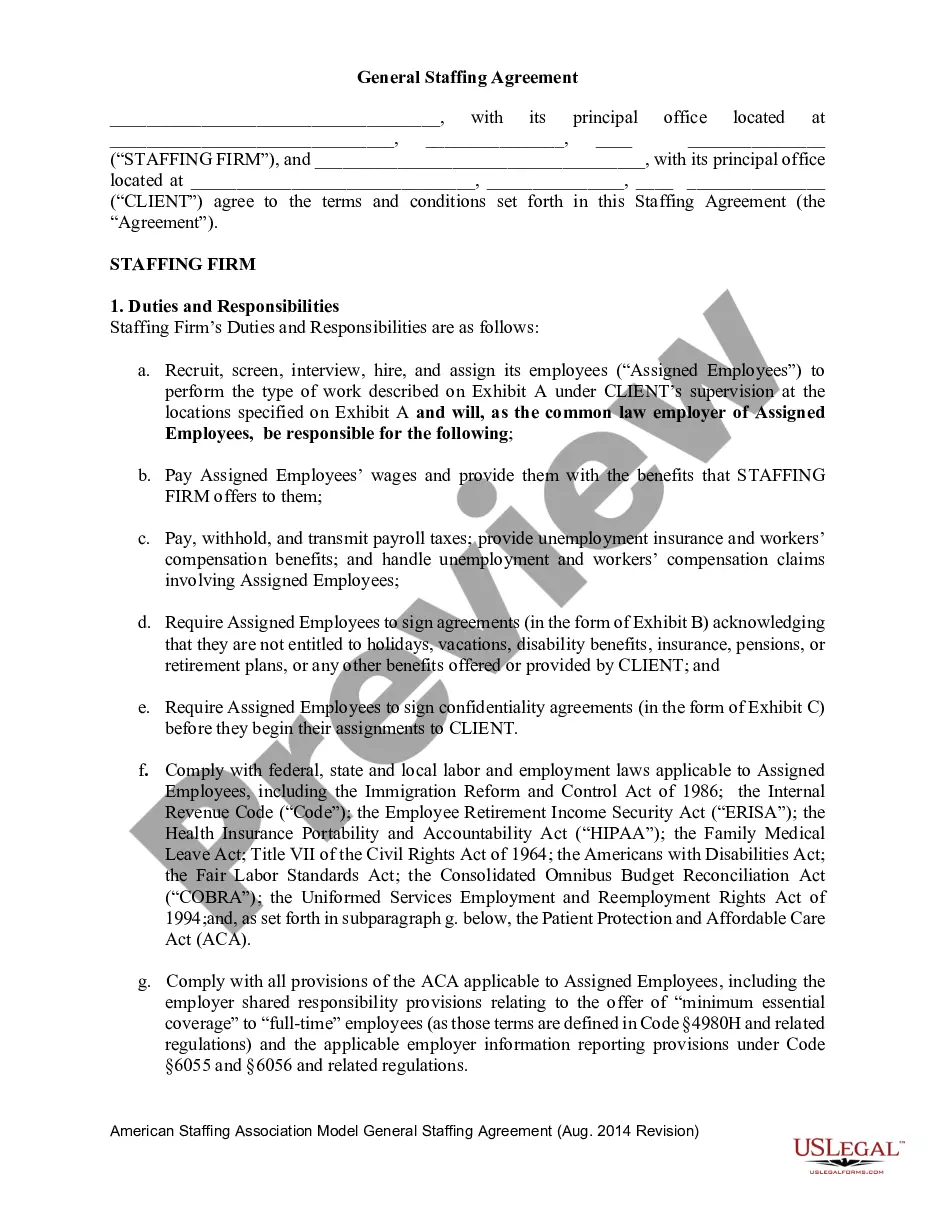

To fill out an independent contractor agreement, start by entering the names and addresses of both parties involved. Clearly articulate the services you will provide, including a timeline and payment structure. Ensure you include clauses that cover confidentiality and any required licenses or permits. Utilizing uslegalforms for your Virginia Personal Shopper Services Contract can streamline the process and ensure your agreement complies with local laws.

Filling out an independent contractor form requires careful attention to detail. Begin by entering your personal information, such as your name, address, and taxpayer ID. Next, provide specific details about your services, payment rates, and any other relevant terms. Implementing a Virginia Personal Shopper Services Contract is beneficial, as it helps clarify expectations and protects your interests. Uslegalforms can assist you in obtaining the correct templates and guidance.

Writing an independent contractor agreement starts with clearly outlining the project details, including services, timeline, and compensation. Be sure to include legal language that specifies the relationship between you and the client, protecting both parties. Incorporating terms related to confidentiality and termination can enhance your Virginia Personal Shopper Services Contract. For added guidance, consider using resources from uslegalforms to help streamline the writing process.