Virginia Cosmetologist Agreement - Self-Employed Independent Contractor

Description

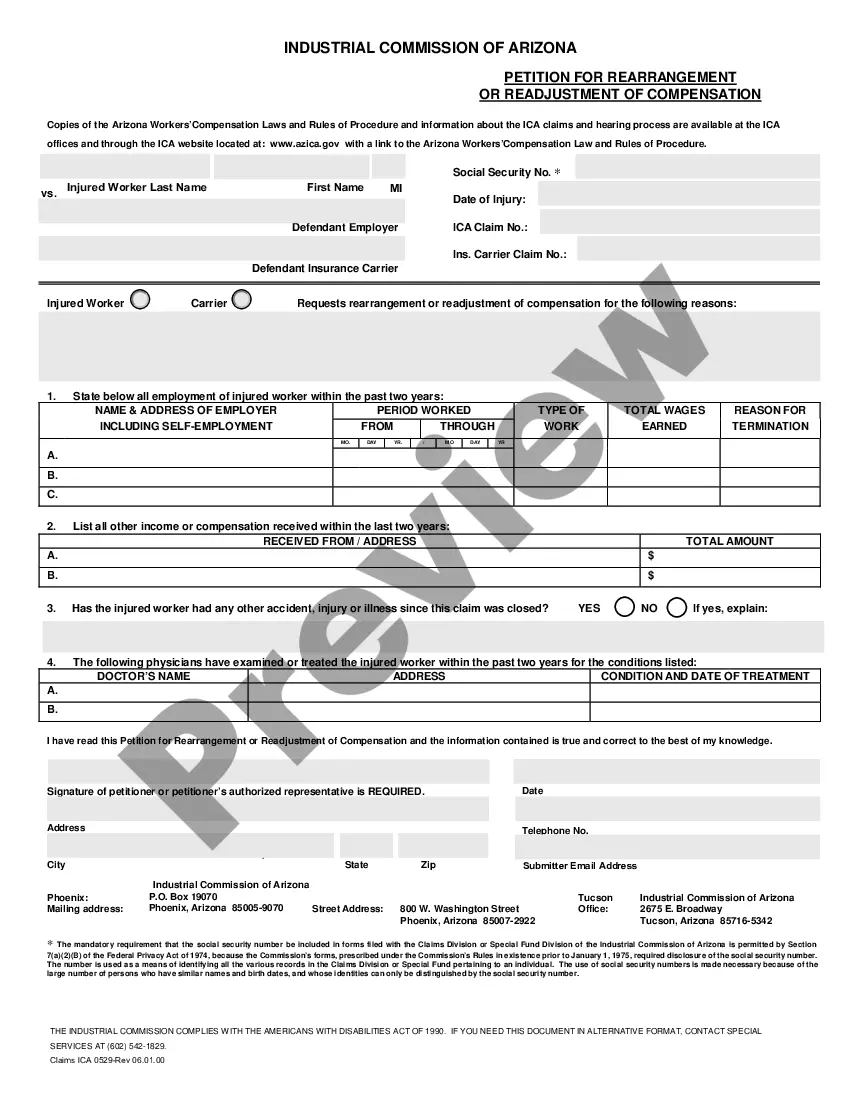

How to fill out Cosmetologist Agreement - Self-Employed Independent Contractor?

If you desire to be thorough, download, or print sanctioned document templates, utilize US Legal Forms, the largest selection of legal forms available online. Employ the site's straightforward and efficient search to locate the documents you require. An assortment of templates for commercial and personal purposes are categorized by types and states, or keywords.

Use US Legal Forms to obtain the Virginia Cosmetologist Agreement - Self-Employed Independent Contractor in just a few clicks. If you are already a US Legal Forms user, Log In to your account and select the Download option to acquire the Virginia Cosmetologist Agreement - Self-Employed Independent Contractor. You can also retrieve forms you previously obtained within the My documents section of your account.

If you are using US Legal Forms for the first time, follow the steps outlined below: Step 1. Ensure you have selected the form for the correct city/state. Step 2. Use the Preview option to review the form's content. Always remember to read the details. Step 3. If you are not satisfied with the type, utilize the Search area at the top of the screen to find other variations of the legal form template. Step 4. Once you have identified the form you need, click on the Purchase now option. Choose the pricing plan you prefer and input your information to register for the account. Step 5. Complete the purchase. You can use your credit card or PayPal account to finalize the transaction. Step 6. Select the format of the legal form and download it to your device. Step 7. Fill out, revise, and print or sign the Virginia Cosmetologist Agreement - Self-Employed Independent Contractor.

Avoid altering or deleting any HTML tags. Only synonymize plain text outside of the HTML tags.

- Every legal document template you acquire is yours permanently.

- You will have access to every type you purchased with your account.

- Click the My documents section and choose a type to print or download again.

- Compete and download, and print the Virginia Cosmetologist Agreement - Self-Employed Independent Contractor with US Legal Forms.

- There are countless professional and state-specific forms available for your business or personal needs.

Form popularity

FAQ

The new independent contractor law in Virginia provides clear guidelines for self-employed workers, including cosmetologists. Under this law, the Virginia Cosmetologist Agreement - Self-Employed Independent Contractor is essential for defining the relationship between a cosmetologist and a salon. This agreement outlines the rights and responsibilities of both parties, ensuring compliance with state regulations. By utilizing this agreement, you can ensure a smoother working arrangement while protecting your legal rights as a self-employed independent contractor.

Creating a Virginia Cosmetologist Agreement - Self-Employed Independent Contractor begins with outlining the key terms of the working relationship. Start by defining the scope of work, payment details, and any specific obligations you both agree upon. You can use uslegalforms to access customizable templates that ensure compliance with Virginia laws. This way, you can establish a solid agreement that protects both parties and clarifies expectations.

To fill out an independent contractor form, begin by providing personal details like your name and address, followed by information about the services you offer. Make sure to include payment details and any other relevant terms agreed upon with the client. Utilizing a Virginia Cosmetologist Agreement - Self-Employed Independent Contractor form can streamline this process and ensure all necessary information is captured.

An independent contractor in cosmetology refers to a licensed cosmetologist who operates their own business rather than working as an employee in a salon. They are responsible for their own taxes, scheduling, and client base. Understanding your role under a Virginia Cosmetologist Agreement - Self-Employed Independent Contractor helps clarify these responsibilities.

In Virginia, independent contractors typically need a business license depending on the services they offer. Cosmetologists, as independent contractors, may require special licensing to operate legally. Always check your local regulations to ensure compliance when using a Virginia Cosmetologist Agreement - Self-Employed Independent Contractor.

To write an independent contractor agreement, start by defining the working relationship clearly. Specify the services to be provided, the duration of the agreement, and payment details. It’s beneficial to follow a Virginia Cosmetologist Agreement - Self-Employed Independent Contractor template to ensure that your agreement is legally sound and comprehensive.

Yes, independent contractors file taxes as self-employed individuals. This means they report their earnings and expenses on Schedule C of their tax returns. It is essential to keep accurate records of income and expenses related to your Virginia Cosmetologist Agreement - Self-Employed Independent Contractor work to ensure compliance during tax season.

Filling out an independent contractor agreement involves several key steps. First, include basic information such as the names and addresses of both parties. Next, outline the scope of work, payment terms, and any specific conditions. Utilizing a Virginia Cosmetologist Agreement - Self-Employed Independent Contractor template can simplify this process and ensure that you include all necessary details.