Virginia Acoustical Contractor Agreement - Self-Employed

Description

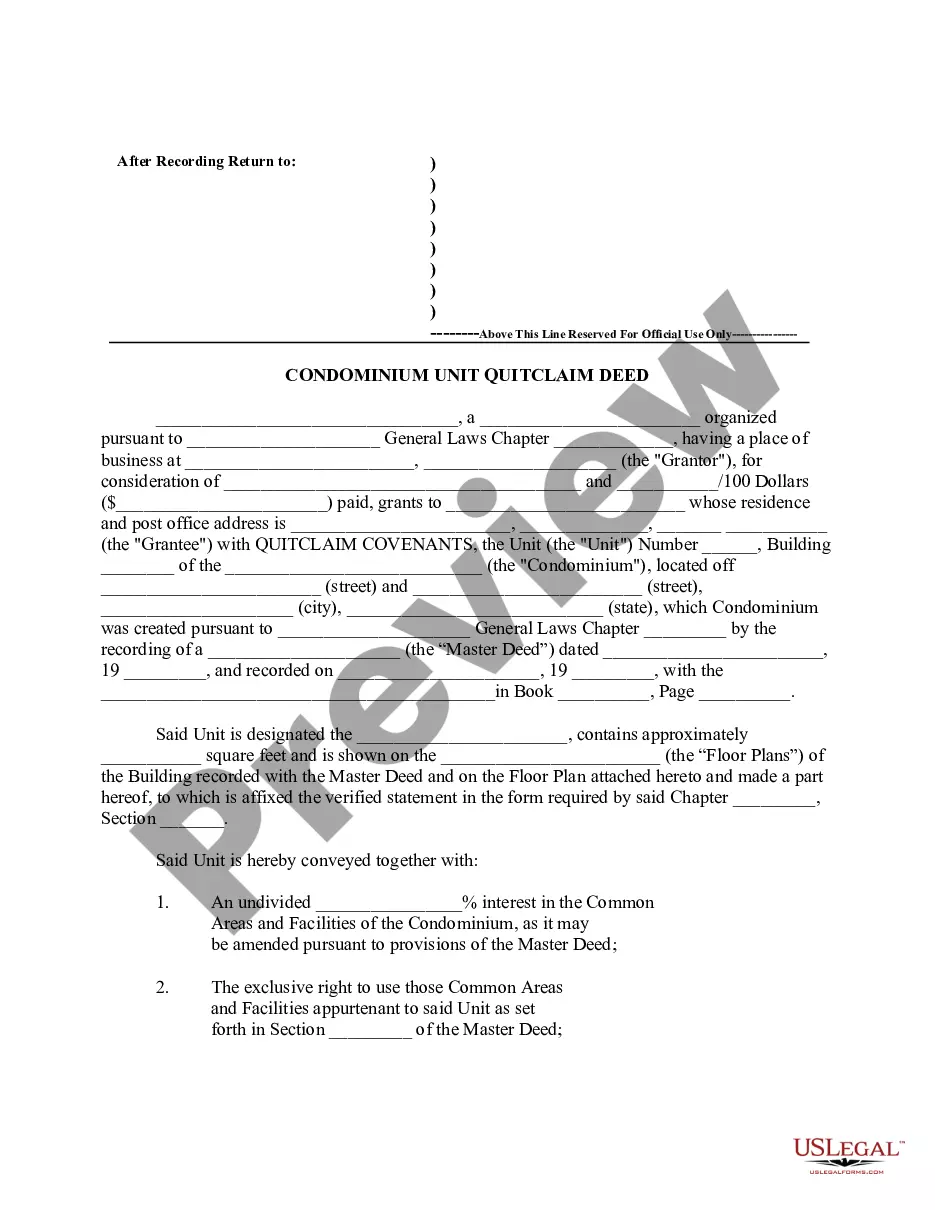

How to fill out Acoustical Contractor Agreement - Self-Employed?

You can spend hours online trying to locate the legal document template that fulfills the state and federal requirements you need. US Legal Forms provides thousands of legal forms that have been reviewed by professionals.

It is easy to obtain or create the Virginia Acoustical Contractor Agreement - Self-Employed from my service. If you already have a US Legal Forms account, you may sign in and click the Download button. Afterwards, you can complete, modify, print, or sign the Virginia Acoustical Contractor Agreement - Self-Employed. Each legal document template you purchase is yours forever.

To get an additional copy of any purchased form, navigate to the My documents section and click the respective option. If you are using the US Legal Forms website for the first time, follow the simple instructions below: First, ensure that you have selected the correct document template for the county/city of your choice. Review the form description to confirm you have selected the appropriate form. If available, use the Preview option to view the document template as well.

Utilize professional and state-specific templates to address your business or personal needs.

- To find another version of the form, use the Search field to locate the template that suits your needs.

- Once you have found the template you want, click Purchase now to proceed.

- Select the pricing plan you desire, enter your details, and create your account on US Legal Forms.

- Complete the transaction. You can use your credit card or PayPal account to pay for the legal form.

- Choose the format of the document and download it to your device.

- Make changes to your document if necessary. You can fill out, modify, sign, and print the Virginia Acoustical Contractor Agreement - Self-Employed.

- Download and print thousands of document templates using the US Legal Forms website, which offers the largest collection of legal forms.

Form popularity

FAQ

A Virginia Acoustical Contractor Agreement - Self-Employed should include essential details such as the scope of work, payment terms, and project timelines. Clearly defining the responsibilities of each party reduces misunderstandings and sets clear expectations. Additionally, consider including clauses about confidentiality and dispute resolution. Utilizing USLegalForms can help you create a comprehensive contract that covers all necessary elements.

In Virginia, independent contractors can perform limited projects without a contractor license, typically under a certain dollar value for minor repairs or related work. However, the specifics can vary by locality. If you’re working under a Virginia Acoustical Contractor Agreement - Self-Employed, it's vital to be aware of these thresholds to avoid potential fines and maintain the integrity of your business.

In Virginia, whether an independent contractor needs a business license often depends on the nature of the work and local regulations. Many contractors must register their businesses and obtain necessary permits. If you are preparing a Virginia Acoustical Contractor Agreement - Self-Employed, consider incorporating language about licensing requirements to ensure compliance and professionalism.

Yes, an independent contractor is generally considered self-employed. This classification means that they operate their own business, manage their own taxes, and set their schedules. When you work under a Virginia Acoustical Contractor Agreement - Self-Employed, knowing this distinction helps you navigate your responsibilities and rights more effectively.

The new independent contractor law in Virginia introduces stricter criteria for classifying workers as independent contractors. This law highlights the necessity of maintaining control over business operations while ensuring flexibility. If you are drafting a Virginia Acoustical Contractor Agreement - Self-Employed, understanding these specifications will help you better structure your agreements and avoid legal pitfalls.

Starting July 1st, 2025, Virginia will implement new laws that affect independent contractors and self-employment. These laws aim to provide clearer definitions and standards for contract work, ensuring better protections for workers. If you operate under a Virginia Acoustical Contractor Agreement - Self-Employed, it's crucial to familiarize yourself with these changes to ensure compliance and safeguard your rights.

The new federal rule on independent contractors clarifies the classification between employees and contract workers. It emphasizes the importance of control and independence in work relationships. For those engaged under a Virginia Acoustical Contractor Agreement - Self-Employed, understanding these rules can aid in compliance and prevent misclassification. It's essential to stay updated as these regulations can impact your business.

To create an independent contractor agreement, start by clearly outlining the scope of work. You should include important details such as payment terms, deadlines, and the rights and responsibilities of both parties. A well-structured Virginia Acoustical Contractor Agreement - Self-Employed can protect your interests and prevent misunderstandings. Consider using a reliable platform like US Legal Forms, which offers templates to simplify the process and ensure you cover all necessary legal aspects.

To fill out an independent contractor agreement effectively, start by inserting the names of both parties and their contact details. Then, detail the services being provided according to the specifications in your Virginia Acoustical Contractor Agreement - Self-Employed, including deadlines and deliverables. Be sure to explain payment arrangements, as well as any conditions or obligations. The uslegalforms platform can help make this process easier by providing templates and resources tailored to your specific agreement needs.

Filling out an independent contractor form involves providing clear and accurate information about the services you offer. Be sure to include your name, address, and the specific terms of the Virginia Acoustical Contractor Agreement - Self-Employed. This will help both you and your client understand obligations and expectations. Using the uslegalforms platform can simplify this process, offering user-friendly forms that guide you through each step.