Virginia Data Entry Employment Contract - Self-Employed Independent Contractor

Description

How to fill out Data Entry Employment Contract - Self-Employed Independent Contractor?

Are you currently in a situation where you require documentation for both business or specific tasks every day.

There are many legal document templates available online, but finding reliable ones is not easy.

US Legal Forms provides thousands of form templates, such as the Virginia Data Entry Employment Contract - Self-Employed Independent Contractor, that are designed to meet federal and state requirements.

Once you find the correct form, click Acquire now.

Select the pricing plan you want, fill in the necessary details to create your account, and pay for the order using your PayPal or credit card.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- After that, you can download the Virginia Data Entry Employment Contract - Self-Employed Independent Contractor template.

- If you do not have an account and want to start using US Legal Forms, follow these steps.

- Obtain the form you need and ensure it is for your correct area/region.

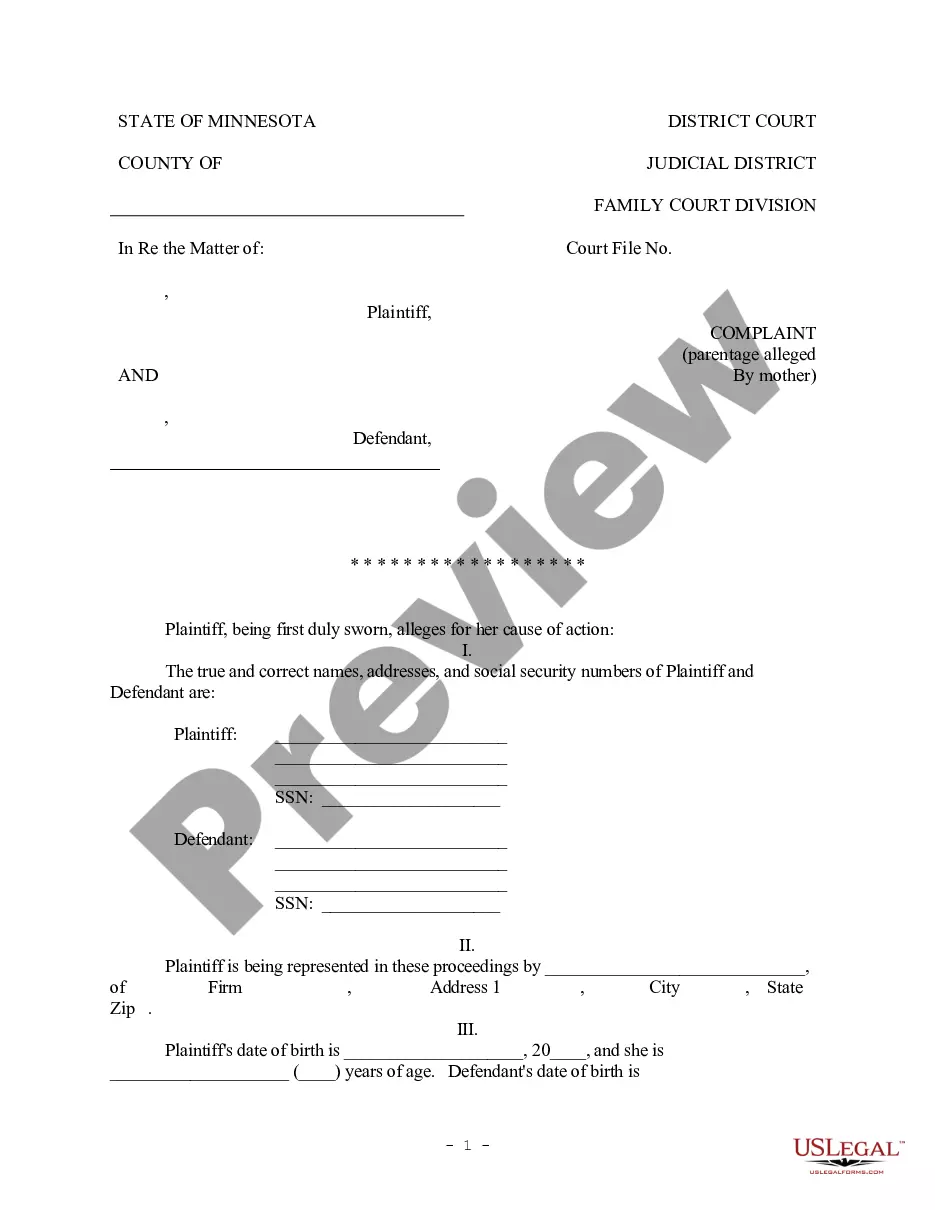

- Utilize the Review button to evaluate the form.

- Read the description to ensure you have selected the right form.

- If the form isn’t what you are looking for, use the Lookup field to find the form that fits your needs and requirements.

Form popularity

FAQ

To fill out an independent contractor agreement, ensure you enter accurate information about the parties involved. Specify the scope of work, deadlines, and payment terms clearly. It is crucial to read through any clauses related to termination and liability. By using the Virginia Data Entry Employment Contract - Self-Employed Independent Contractor from USLegalForms, you can complete this task with confidence and clarity.

Filling out an independent contractor form requires you to provide essential personal information, including your name, address, and social security number. You should also detail the nature of the services you will offer, along with your payment preferences. Additionally, you may need to specify tax deductions and provide a signature to affirm the agreement. Utilizing the Virginia Data Entry Employment Contract - Self-Employed Independent Contractor from USLegalForms can make this process much easier.

Yes, even if you are self-employed, you can and should have a contract in place. A contract helps define the relationship between you and your clients, outlining the services you provide and the payment arrangements. This clarity not only protects your interests, but it also sets professional expectations. Consider using the Virginia Data Entry Employment Contract - Self-Employed Independent Contractor for a structured approach.

To write an independent contractor agreement, start by including the names and contact information of the parties involved. Next, outline the specific services the contractor will provide, as well as the payment terms and schedule. It is important to clarify the duration of the contract and any confidentiality or non-compete clauses. Utilizing a template like the Virginia Data Entry Employment Contract - Self-Employed Independent Contractor from USLegalForms can simplify this process significantly.

Yes, being self-employed and having a contract is common and often necessary for independent contractors. A contract outlines the terms of your work and helps both parties understand their responsibilities. With the Virginia Data Entry Employment Contract - Self-Employed Independent Contractor, you can clarify expectations, protect your interests, and ensure a smooth working relationship with your clients.

In Virginia, whether a 1099 employee needs a business license depends on the nature of their work. Generally, if you are working as a self-employed independent contractor under the Virginia Data Entry Employment Contract - Self-Employed Independent Contractor, you may be required to obtain a business license. It's best to check local regulations and ensure compliance to avoid any legal issues.

The new independent contractor law in Virginia, passed in 2020, impacts how workers are classified. This law aims to protect contractors' rights while imposing some obligations on businesses. Understanding this law is crucial when crafting your Virginia Data Entry Employment Contract - Self-Employed Independent Contractor to ensure compliance and safeguard your work arrangements.

New rules for self-employed individuals may vary by state, including Virginia. These rules often focus on tax obligations, benefits eligibility, and reporting requirements. For those using the Virginia Data Entry Employment Contract - Self-Employed Independent Contractor template, it's essential to stay informed about any changes that could affect your status and business operations.

The terms self-employed and independent contractor are often used interchangeably, but there can be subtle differences. Self-employed may encompass a broader category, while independent contractor specifically refers to contract work for clients. When discussing the Virginia Data Entry Employment Contract - Self-Employed Independent Contractor, clarity in your terminology can help potential clients understand your role better.

Yes, being a contractor typically counts as being self-employed. When you work as a contractor, you operate your own business and manage your own taxes. In the context of the Virginia Data Entry Employment Contract - Self-Employed Independent Contractor, this classification means you have more control over your work schedule and client relationships. This flexibility can enhance your overall work-life balance.