Virginia Guaranty of Payment of Open Account

Description

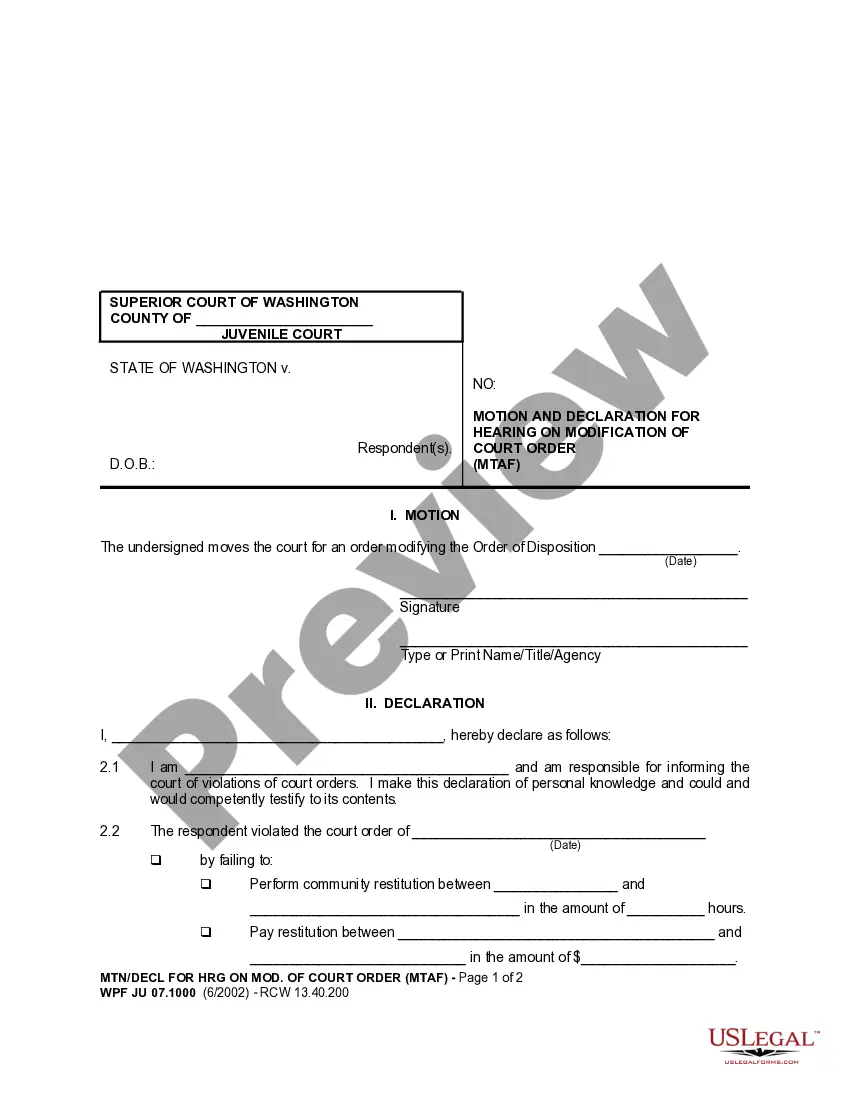

How to fill out Guaranty Of Payment Of Open Account?

US Legal Forms - one of the largest collections of legal documents in the United States - provides a broad selection of legal form templates that you can download or print.

By utilizing the website, you can locate thousands of forms for business and personal use, organized by categories, claims, or keywords. You can find the most recent versions of forms such as the Virginia Guaranty of Payment of Open Account in moments.

If you already have a subscription, Log In and retrieve the Virginia Guaranty of Payment of Open Account from your US Legal Forms archive. The Obtain button will appear on every form you review. You can access all previously downloaded forms in the My documents section of your account.

Process the transaction. Use a credit card or PayPal account to complete the payment.

Select the format and download the document to your device. Make edits. Complete, modify, and print the downloaded Virginia Guaranty of Payment of Open Account.

Every template you add to your account has no expiration date and is yours forever. So, if you wish to download or print another copy, simply visit the My documents section and click on the form you need.

- Make sure you have selected the appropriate form for your city/area.

- Click the Examine button to review the form’s contents.

- Check the form details to confirm you have chosen the correct document.

- If the form does not suit your needs, use the Search bar at the top of the screen to find the one that does.

- Once you are satisfied with the form, confirm your choice by clicking on the Get now button.

- Then, choose the payment plan you prefer and provide your details to register for the account.

Form popularity

FAQ

The VA Code 6.2 303 A refers to a crucial regulation under Virginia law that supports the Virginia Guaranty of Payment of Open Account. This code establishes a legal framework for payment obligations in business transactions, specifically ensuring that debts incurred on open accounts are honored. By understanding this code, businesses can navigate their accounts payable more effectively and avoid potential disputes. This framework enhances security for creditors, facilitating smoother financial interactions.

The statute of limitations for open accounts in Virginia is typically five years. This means that creditors can legally pursue owed amounts only within this time frame, making it vital to initiate claims under a Virginia Guaranty of Payment of Open Account before the deadline. If you're facing challenges in collecting an open account, consider leveraging resources from uslegalforms to ensure compliance and proper documentation. This understanding can empower you to act effectively on outstanding debts.

In Virginia, a debt becomes uncollectible after a specified period, generally three to six years, depending on the type of debt. This applies to debts related to a Virginia Guaranty of Payment of Open Account as well. Once this period passes, the law limits your ability to pursue recovery through legal channels. Keeping track of outstanding accounts can help you address debts before they reach this point.

In Virginia, the maximum interest rate allowed is typically 6% per annum, unless parties agree to a higher rate in writing. This is particularly relevant when entering into agreements related to a Virginia Guaranty of Payment of Open Account. It's crucial to document any agreed interest rates within the contract to avoid disputes. Understanding these limits ensures you stay compliant while protecting your financial interests.

To successfully fill out a guaranty form, particularly for a Virginia Guaranty of Payment of Open Account, you'll want to be thorough. Begin with your name, address, and relationship to the debtor, followed by specific details about the account and the guaranty amount. Always review your entries before submitting the form to avoid any errors or unclear statements.

Filling out a guarantee form for a Virginia Guaranty of Payment of Open Account involves several key steps. First, gather essential information like the creditor’s name and the debtor’s details. After that, clearly state your guaranty amount, ensuring it aligns with what you are prepared to back financially.

To fill a guarantee form for a Virginia Guaranty of Payment of Open Account, start by providing your personal information, such as your name and address. Next, include details about the account you are guaranteeing, along with the amount that you intend to cover. Be sure to read the terms carefully, as this ensures you understand your responsibilities.