Virginia Accounts Receivable - Guaranty

Description

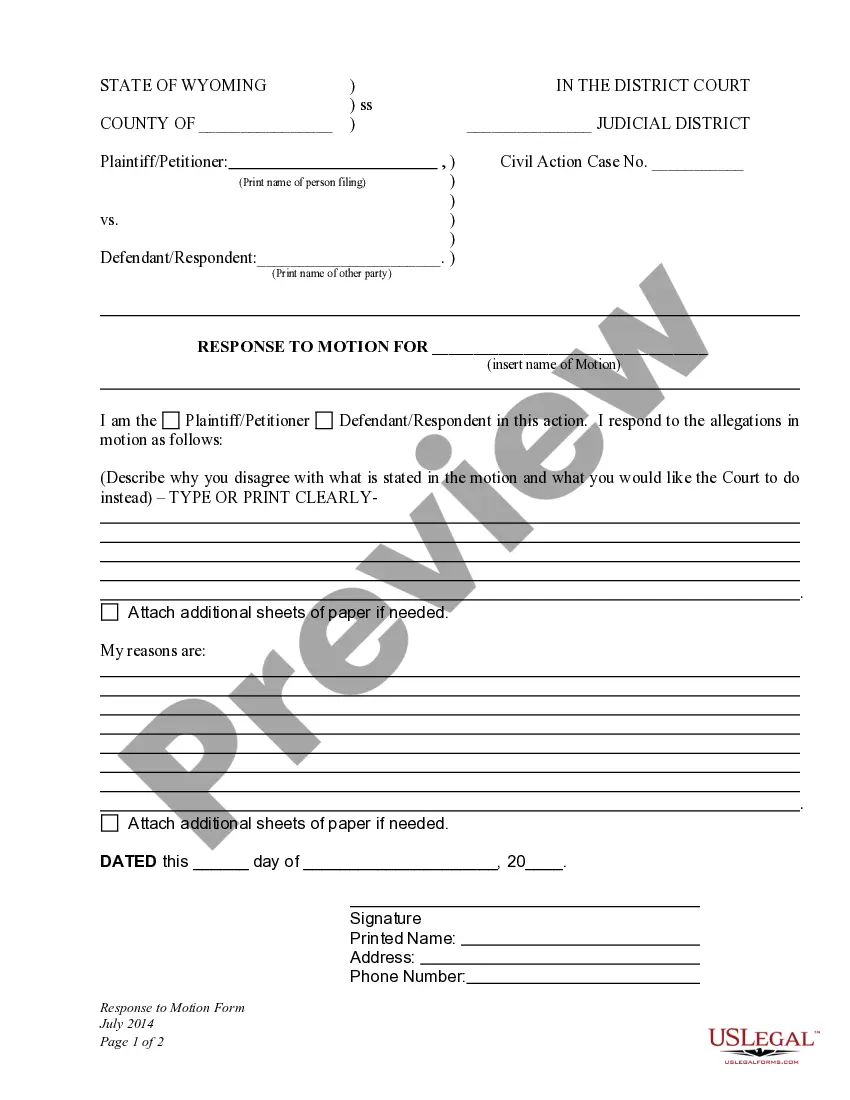

How to fill out Accounts Receivable - Guaranty?

Locating the appropriate valid document template can be a challenge. Of course, there are countless templates accessible online, but how can you find the correct type you need? Visit the US Legal Forms website. The service provides thousands of templates, including the Virginia Accounts Receivable - Guaranty, which you can utilize for business and personal purposes. All of the forms are reviewed by experts and comply with state and federal regulations.

If you are already registered, Log In to your account and click the Download button to obtain the Virginia Accounts Receivable - Guaranty. Use your account to browse through the legal forms you have previously purchased. Navigate to the My documents section of your account to get another copy of the document you need.

If you are a new user of US Legal Forms, here are basic steps you should follow: First, ensure you have selected the correct form for your location/region. You can review the form using the Review option and read the form description to confirm it is suitable for you. If the form does not meet your requirements, utilize the Search field to find the right form. When you are certain that the form is appropriate, click the Purchase now button to download the form. Select the pricing plan you prefer and input the necessary details. Create your account and pay for the order using your PayPal account or credit card. Choose the document format and download the legal document template to your device. Complete, modify, print, and sign the obtained Virginia Accounts Receivable - Guaranty.

- US Legal Forms is the largest repository of legal forms where you can discover a variety of document templates.

- Utilize the service to download properly crafted paperwork that comply with state regulations.

Form popularity

FAQ

A. Each state agency and institution shall take all appropriate and cost-effective actions to aggressively collect its accounts receivable.

A. Each state agency and institution may charge interest on all past due accounts receivable in ance with guidelines adopted by the Department of Accounts.

In Virginia, there is a statute of limitations, also known as the length of time debt collectors have to recover the unpaid debt. In a written contract, debt collectors generally have a five-year period to try and collect or take legal action. However, a three-year period applies for oral contracts.

Summary: Generally, debt collection agencies won't sue over debts less than $500, but it isn't unheard of.

§ 2.2-4800. Policy of the Commonwealth; collection of accounts receivable. This chapter establishes the policy of the Commonwealth as it relates to the accounting for, management and collection of all accounts receivable due to the Commonwealth.