Virginia Employer Training Memo - Payroll Deductions

Description

How to fill out Employer Training Memo - Payroll Deductions?

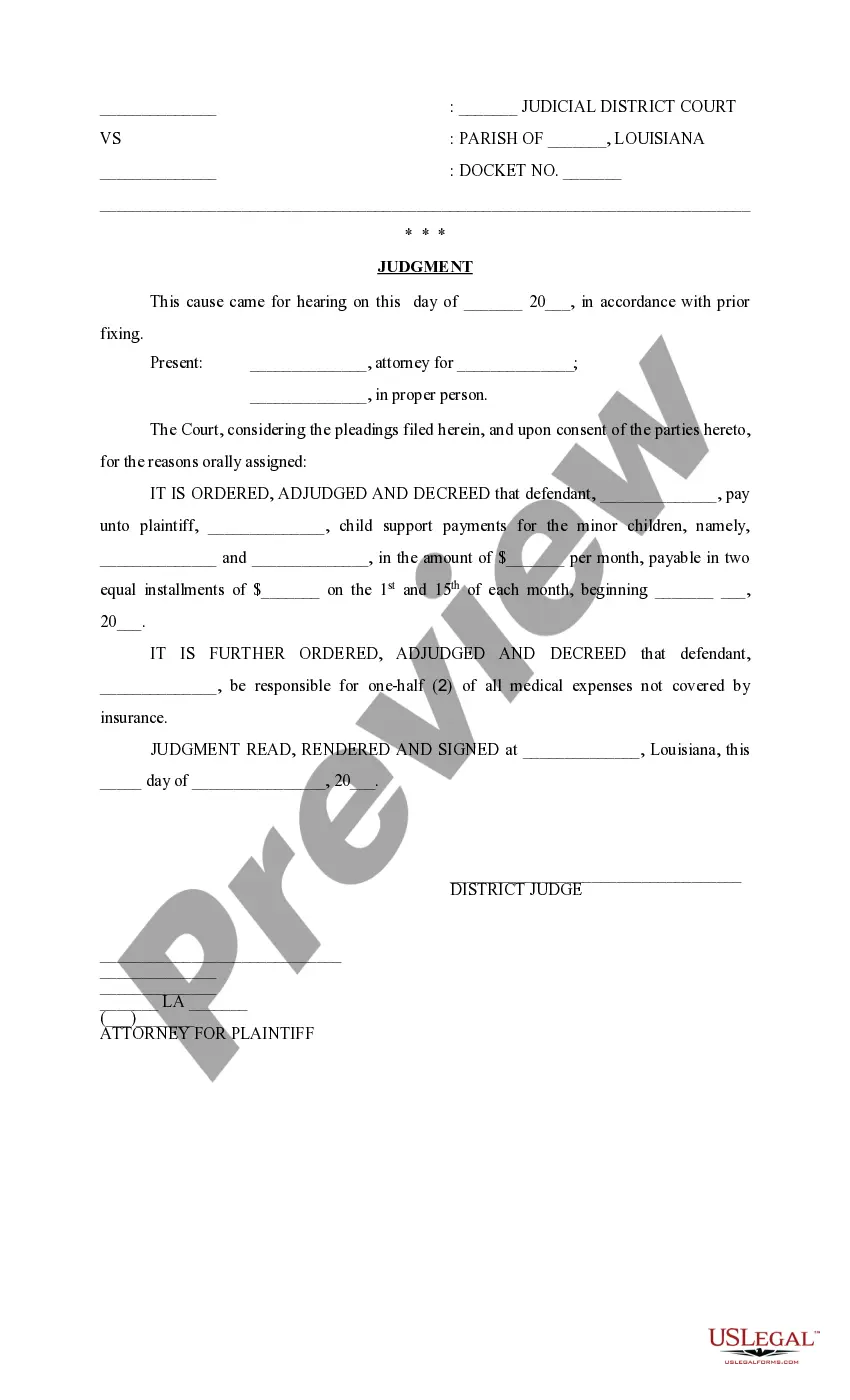

Are you currently in a scenario where you need to have documents for various organizational or specific objectives nearly every day at work? There are numerous legal document templates accessible online, but finding reliable ones can be challenging. US Legal Forms provides a vast array of form templates, including the Virginia Employer Training Memo - Payroll Deductions, which can be tailored to meet federal and state regulations.

If you are already familiar with the US Legal Forms website and possess an account, simply Log In. After that, you'll be able to download the Virginia Employer Training Memo - Payroll Deductions form.

If you do not have an account and are interested in using US Legal Forms, please follow these steps.

You can find all the document templates you have purchased in the My documents section. You can obtain an additional copy of the Virginia Employer Training Memo - Payroll Deductions whenever needed. Click on the desired form to download or print the document template.

Utilize US Legal Forms, the most extensive collection of legal forms, to save time and avoid errors. This service provides professionally crafted legal document templates that can be utilized for a variety of purposes. Create an account on US Legal Forms and start making your life easier.

- Obtain the form you need and ensure it is intended for your specific city/county.

- Use the Preview feature to review the form.

- Examine the overview to confirm that you have selected the correct form.

- If the form does not meet your requirements, utilize the Search field to locate the form that fits your needs.

- When you find the appropriate form, click Acquire now.

- Choose the pricing plan you prefer, provide the required information to create your account, and pay for the order using your PayPal or credit card.

- Select a convenient file format and download your copy.

Form popularity

FAQ

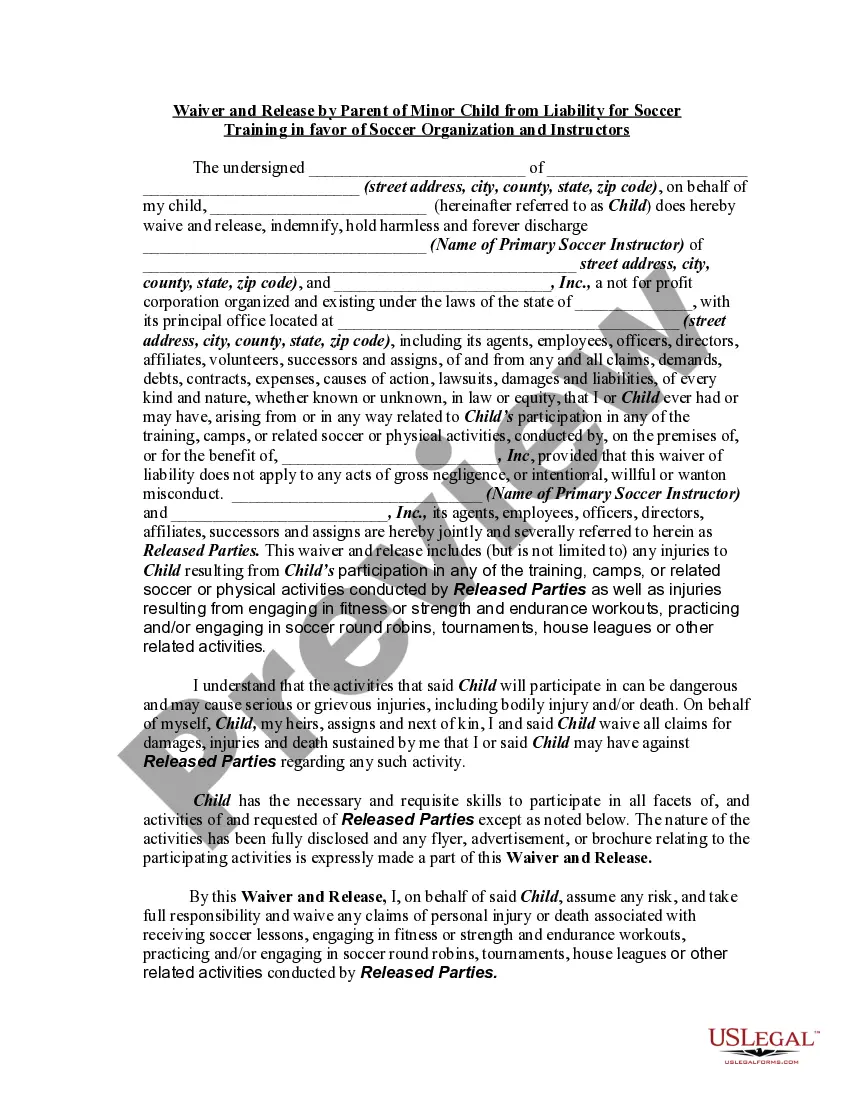

Filling out the Virginia tax form VA 4 requires you to input your personal information, decide how many allowances to claim, and indicate your filing status. Carefully read the instructions provided on the form to avoid any errors. If you need more support, the Virginia Employer Training Memo - Payroll Deductions can help clarify any uncertainties you might have about the form.

To maximize your refund when filling out your W4, consider claiming fewer allowances, such as 0, to increase your tax withholding throughout the year. Additionally, ensure your income sources and deductions are accurately reported, as miscalculations can affect your final return. The Virginia Employer Training Memo - Payroll Deductions is an excellent resource to help you navigate this process and achieve that financial goal.

For the tax year, the standard deduction for Virginia residents is typically based on your filing status. It's essential to check the current year's figures, as they can change. The Virginia Employer Training Memo - Payroll Deductions will provide the most recent information on your state's standard deduction, ensuring you have accurate data for your taxes.

To fill out the Virginia Form VA 4, you need to provide your personal information, including your name, address, and Social Security number. Next, indicate your anticipated filing status and the number of allowances you wish to claim. Make sure to double-check your entries before submitting, as mistakes can affect your payroll deductions. The Virginia Employer Training Memo - Payroll Deductions can guide you through this process.

Eligible educators in Virginia can deduct specific unreimbursed expenses related to their profession. This includes costs for classroom supplies and materials, which can significantly impact your overall tax assessment. For detailed information on these deductions, the Virginia Employer Training Memo - Payroll Deductions offers valuable insights and support to maximize your benefits.

You should file Virginia form 770 with the Virginia Department of Taxation. This form can be submitted electronically or through standard mail, depending on your preference. Be sure to review the instructions provided in the Virginia Employer Training Memo - Payroll Deductions for any specific requirements, as this will help streamline your filing process.

Filling out the VA4 form requires careful attention to detail. Begin by entering your personal information, including your name and Social Security number. Next, provide your withholding allowances as instructed. For thorough guidance, refer to the Virginia Employer Training Memo - Payroll Deductions, which outlines the process clearly and can help ensure accurate submission.

When new employees begin work in Virginia, they typically complete several essential forms. The Virginia Employer Training Memo - Payroll Deductions outlines the specific forms required, which include the W-4 for federal tax withholding and the VA-4 for state tax withholding. Additionally, employees may need to fill out documents regarding benefits and direct deposit. Understanding these forms can streamline the onboarding process and ensure compliance with state regulations.

A 30% withholding tax typically applies to certain payments made to foreign entities or individuals. This tax aims to ensure that the appropriate amount is collected for income generated within the United States. For employers managing payroll deductions, understanding the application of this tax is crucial. Referencing the Virginia Employer Training Memo - Payroll Deductions can clarify how this tax impacts your payroll processes.

In Virginia, employers must consider several payroll taxes while managing employee payroll. These include state income tax, which varies based on income bracket, and unemployment taxes. Additionally, employers should note the federal payroll taxes that apply, such as Social Security and Medicare. For comprehensive guidance, the Virginia Employer Training Memo - Payroll Deductions can provide resources and insights to ensure compliance.