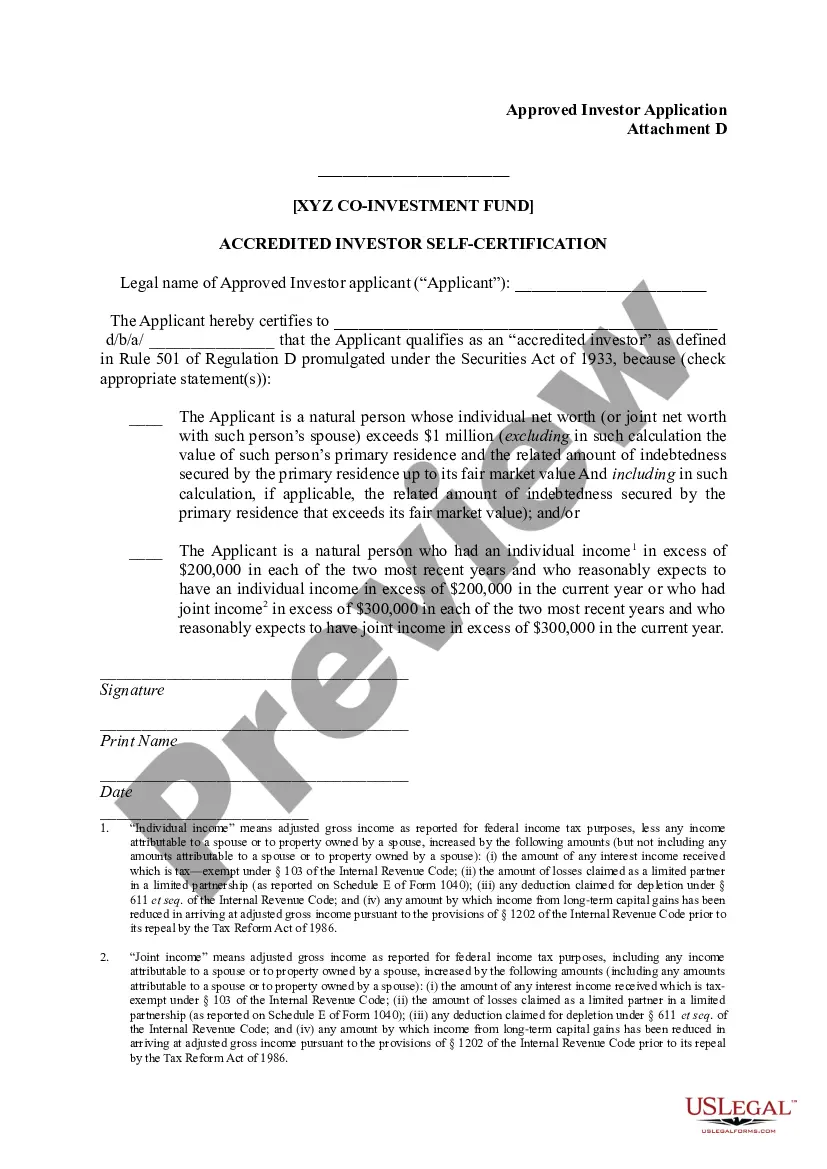

Virginia Accredited Investor Self-Certification Attachment D

Description

To become an accredited investor the (SEC) requires certain wealth, income or knowledge requirements. The investor must fall into one of three categories. Firms selling unregistered securities must put investors through their own screening process to determine if investors can be considered an accredited investor.

The Verifying Individual or Entity should take reasonable steps to verify and determined that an Investor is an "accredited investor" as such term is defined in Rule 501 of the Securities Act, and hereby provides written confirmation. This letter serves to help the Entity determine status.

How to fill out Accredited Investor Self-Certification Attachment D?

If you want to full, down load, or print out lawful document layouts, use US Legal Forms, the largest collection of lawful types, that can be found on-line. Utilize the site`s easy and practical research to find the papers you will need. Different layouts for organization and person reasons are categorized by types and states, or keywords. Use US Legal Forms to find the Virginia Accredited Investor Self-Certification Attachment D in just a handful of clicks.

In case you are presently a US Legal Forms buyer, log in in your account and click on the Down load button to obtain the Virginia Accredited Investor Self-Certification Attachment D. Also you can entry types you formerly acquired in the My Forms tab of your own account.

If you use US Legal Forms initially, follow the instructions beneath:

- Step 1. Be sure you have selected the form for the right metropolis/country.

- Step 2. Make use of the Review solution to look over the form`s content. Don`t forget about to read the explanation.

- Step 3. In case you are unsatisfied with all the type, use the Search industry on top of the display to get other variations of your lawful type design.

- Step 4. After you have found the form you will need, go through the Get now button. Pick the prices strategy you like and add your accreditations to register for an account.

- Step 5. Method the deal. You should use your charge card or PayPal account to accomplish the deal.

- Step 6. Find the file format of your lawful type and down load it on the product.

- Step 7. Complete, change and print out or signal the Virginia Accredited Investor Self-Certification Attachment D.

Each lawful document design you acquire is yours permanently. You possess acces to every type you acquired inside your acccount. Go through the My Forms portion and pick a type to print out or down load again.

Contend and down load, and print out the Virginia Accredited Investor Self-Certification Attachment D with US Legal Forms. There are millions of professional and express-specific types you can utilize for your organization or person requires.

Form popularity

FAQ

In the U.S., the term accredited investor is used by the Securities and Exchange Commission (SEC) under Regulation D to refer to investors who are financially sophisticated and have a reduced need for the protection provided by regulatory disclosure filings.

Regulation D lets companies doing specific types of private placements raise capital without needing to register the securities with the SEC. SEC Reg D should not be confused with Federal Reserve Board Regulation D, which limits withdrawals from savings accounts.

Individuals who want to become accredited investors must fall into one of three categories: have a net worth exceeding $1 million on your own or with a spouse or its equivalent; have earned an income surpassing $200,000 ($300,000 if combined with a spouse or its equivalent) during the last two years and prove an ...

A Regulation D offering, often referred to as a Reg D offering, is a type of securities offering in the United States that allows companies to raise capital by selling equity or debt securities to accredited investors without having to register the offering with the Securities and Exchange Commission (SEC).

Regulation D is a series of rules that govern commonly used regulatory exemptions that companies can use to sell securities. Regulation D requires that companies file a notice of their offering with the SEC using Form D.

If you are accredited based on income, you will need to provide documentation in the form of tax returns, W-2s, or other official documents that show you meet the required income threshold for the prior two years.

Regulation D imposes reserve requirements on certain deposits and other liabilities of depository institutions2 solely for the purpose of implementing monetary policy. It specifies how depository insti- tutions must classify different types of deposit accounts for reserve requirements purposes.

Regulation S is a registration exemption for offers and sales of securities that occur outside the United States. Regulation S allows businesses to raise funds from international investors. Unlike Regulation D, Regulation S only applies to offshore offerings and is aimed at international investors.