Virginia Sample Common Shares Purchase Agreement between Visible Genetics, Inc. and Investors

Description

How to fill out Sample Common Shares Purchase Agreement Between Visible Genetics, Inc. And Investors?

Choosing the best legal file template might be a have difficulties. Obviously, there are a lot of themes accessible on the Internet, but how do you discover the legal kind you will need? Utilize the US Legal Forms site. The service provides a large number of themes, like the Virginia Sample Common Shares Purchase Agreement between Visible Genetics, Inc. and Investors, that you can use for company and private requirements. All the forms are checked by experts and fulfill federal and state specifications.

If you are presently registered, log in to the profile and then click the Obtain switch to obtain the Virginia Sample Common Shares Purchase Agreement between Visible Genetics, Inc. and Investors. Make use of your profile to check throughout the legal forms you may have purchased formerly. Proceed to the My Forms tab of your own profile and obtain one more backup of the file you will need.

If you are a new end user of US Legal Forms, listed here are basic instructions that you can follow:

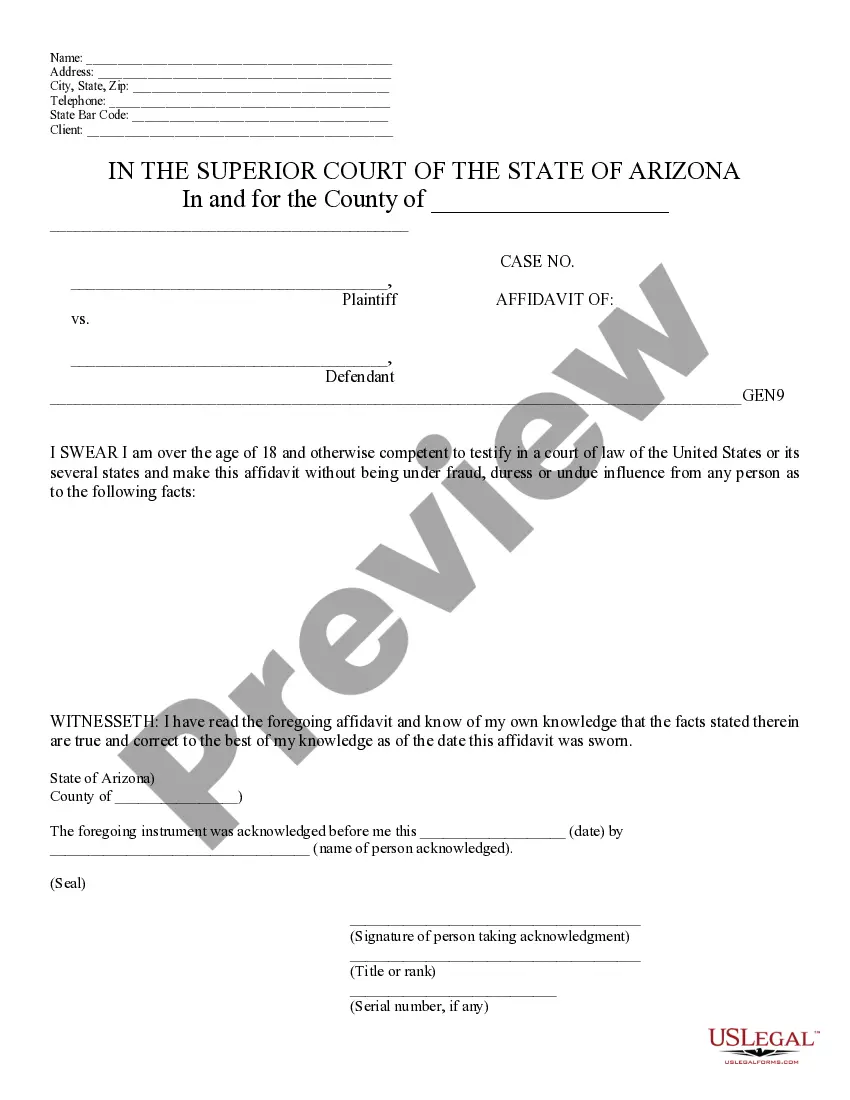

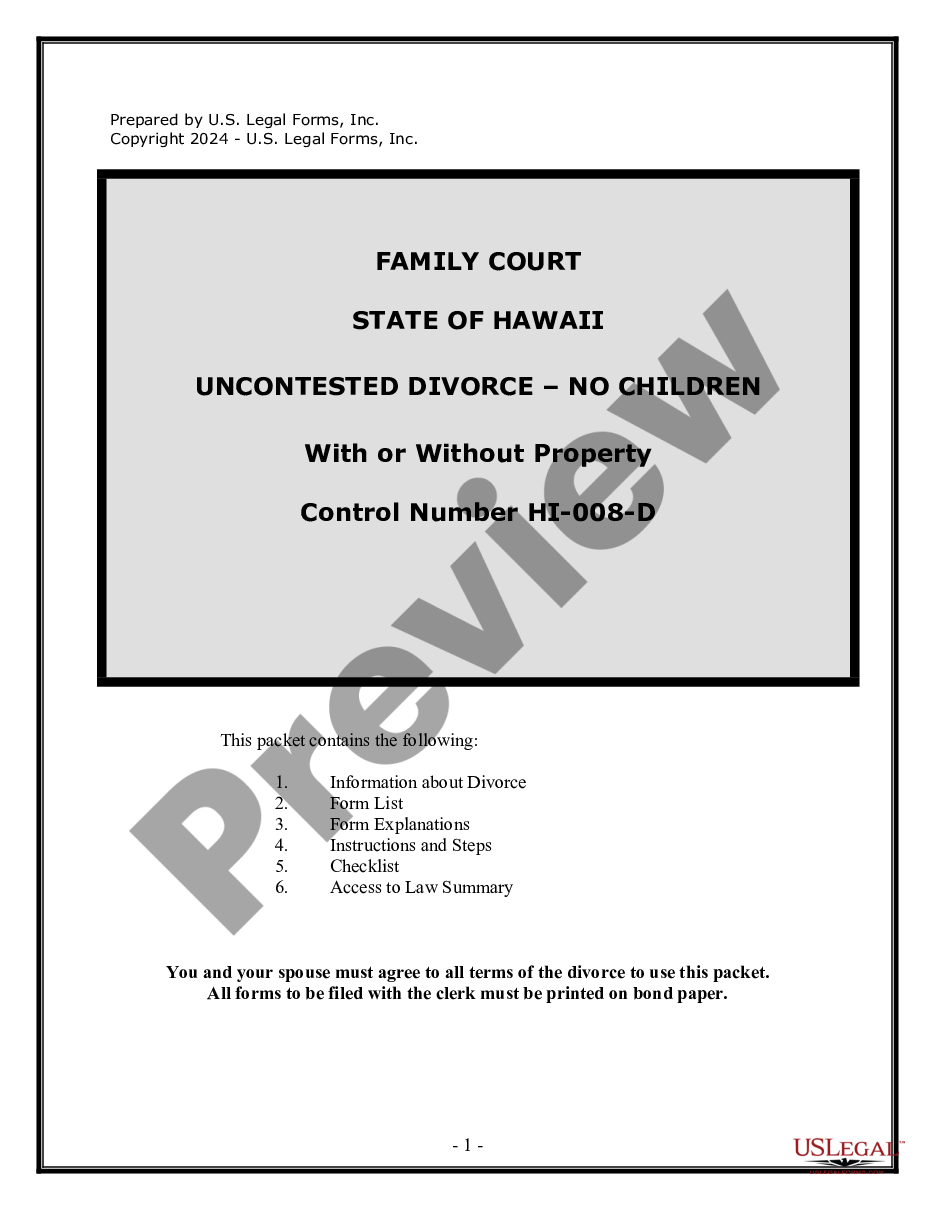

- Initial, be sure you have selected the correct kind for your area/region. You are able to look over the form while using Review switch and look at the form outline to ensure this is the best for you.

- When the kind is not going to fulfill your needs, utilize the Seach field to discover the appropriate kind.

- Once you are sure that the form is proper, select the Acquire now switch to obtain the kind.

- Choose the costs prepare you need and enter the required details. Make your profile and pay for the transaction utilizing your PayPal profile or bank card.

- Choose the submit formatting and acquire the legal file template to the gadget.

- Total, edit and print and sign the obtained Virginia Sample Common Shares Purchase Agreement between Visible Genetics, Inc. and Investors.

US Legal Forms will be the largest catalogue of legal forms in which you can discover different file themes. Utilize the service to acquire appropriately-created paperwork that follow state specifications.

Form popularity

FAQ

This means that the Seller is entitled to the cash on the balance sheet on the closing date of the transaction, and that the Seller is responsible for debts owed by the company (defined as Indebtedness).

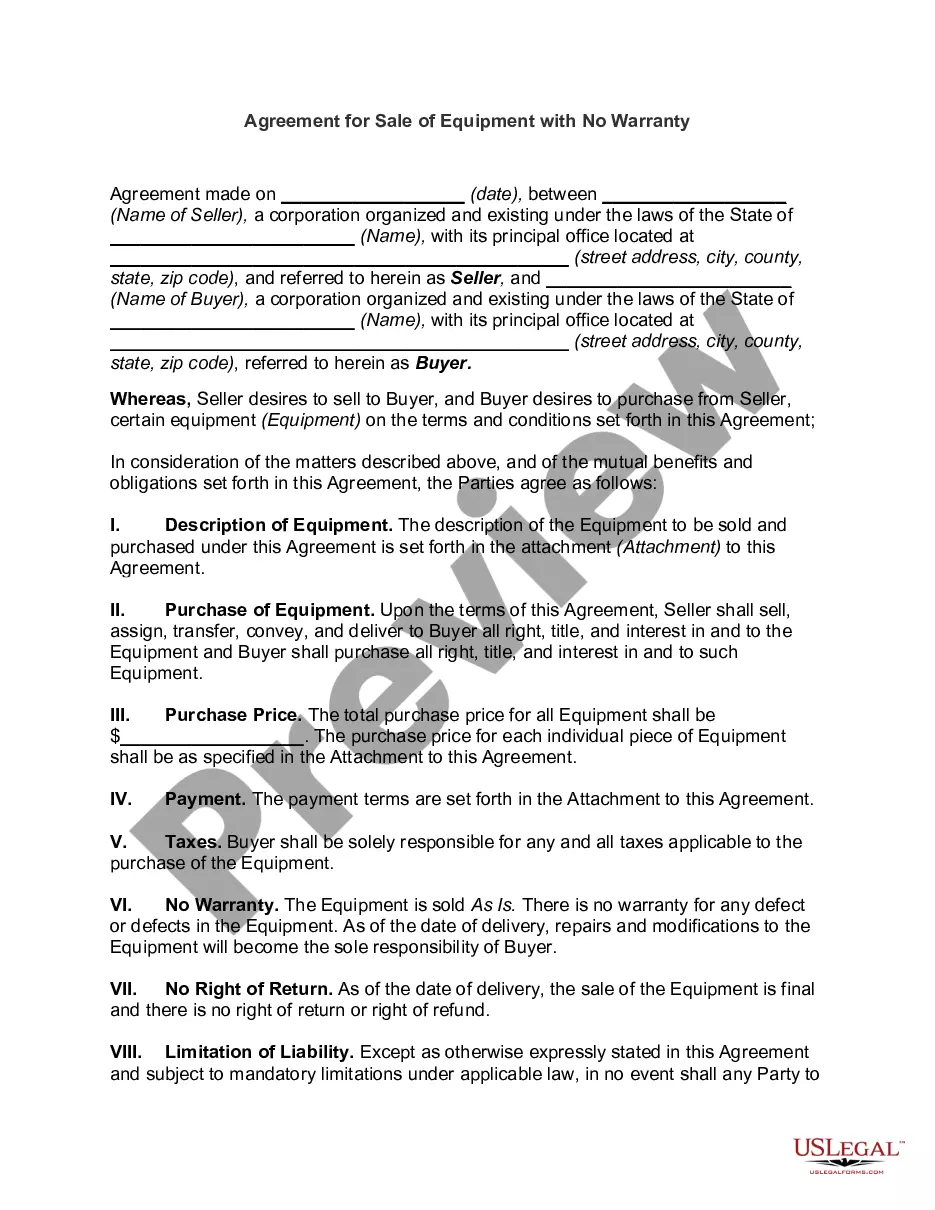

A SPA should specify the sale price for the shares, specify the currency and timescale for the sale, and list any other conditions like staged payments. Usually, payment is made in cash, although sometimes the buyer may offer the seller some of its shares, or issue loan notes to the seller.

How to draft a purchase agreement Name and contact information for buyer and seller. The address of the property being sold. The price to be paid for the property. The date of transfer. Disclosures. Contingencies. Signatures.

A share purchase agreement is a legal contract between two parties: a seller and a buyer. They may be referred to as the vendor and purchaser in the contract. The contract is proof that the sale and the terms of it were mutually agreed upon.

A SPA should specify the sale price for the shares, specify the currency and timescale for the sale, and list any other conditions like staged payments. Usually, payment is made in cash, although sometimes the buyer may offer the seller some of its shares, or issue loan notes to the seller.

The Shareholder's Agreement is generally used to resolve disputes between the corporation and the Shareholder. The Share Purchase Agreement, on the other hand, is a document that justifies the exchange of shares held by the Buyer and Seller.

A Share Purchase Agreement generally includes information about: The person selling the shares. The person buying the shares. The number of shares being sold and their value. The company the shares are being transferred from. The number of shares being sold and their value.

A stock purchase agreement typically includes the following information: Your business name. The name and mailing address of the entity buying shares in your company's stocks. The par value (essentially the sale price) of the stocks being sold. The number of stocks the buyer is purchasing.