Virginia Leased Personal Property Workform

Description

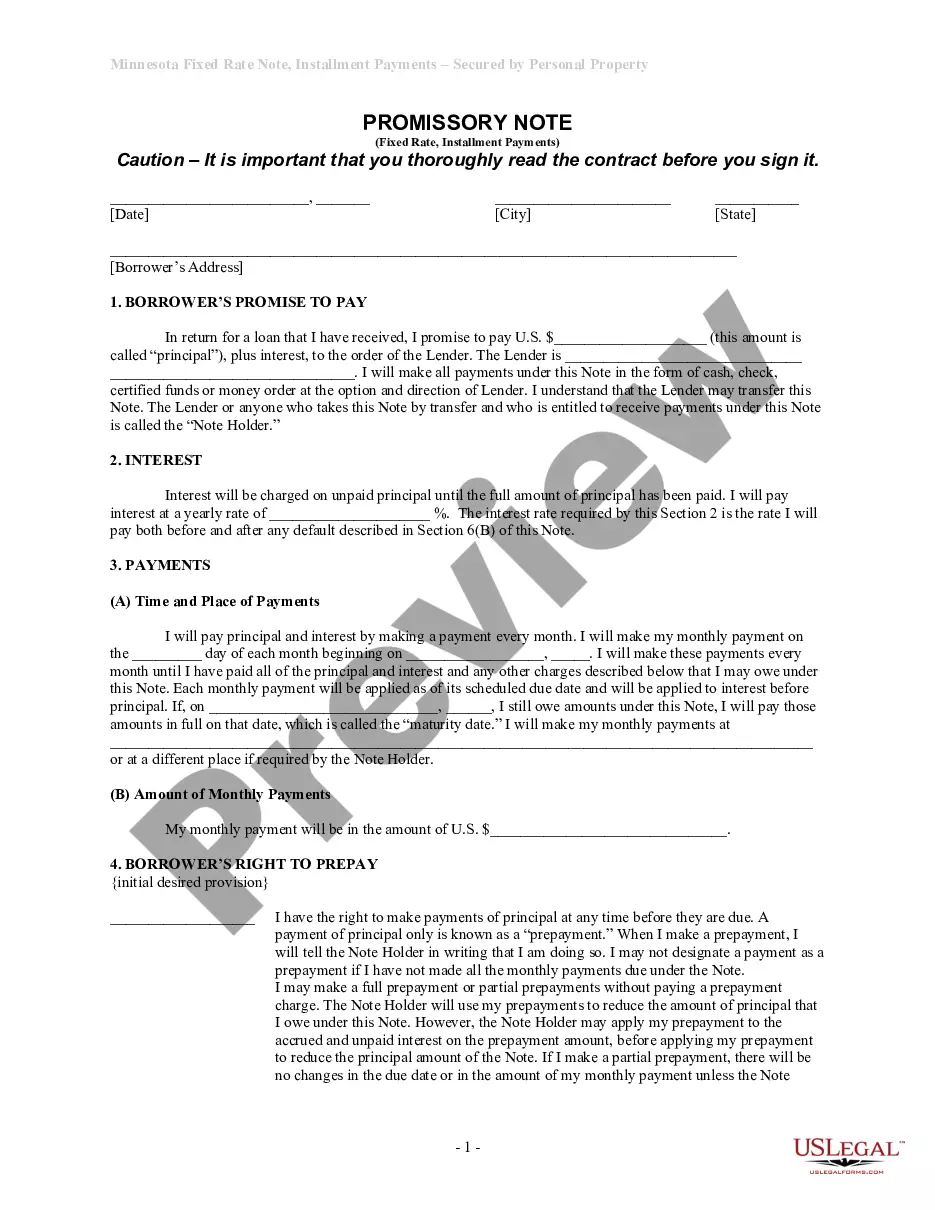

How to fill out Leased Personal Property Workform?

If you wish to gather, obtain, or print authentic document templates, utilize US Legal Forms, the largest collection of legal forms available online.

Take advantage of the website's user-friendly and convenient search feature to find the documents you require.

A selection of templates for business and personal purposes are organized by categories, states, or keywords.

Step 4. Once you have found the form you want, click on the Purchase now button. Select the payment plan you prefer and provide your details to register for an account.

Step 5. Complete the purchase. You can use your credit card or PayPal account to finalize the transaction.

- Utilize US Legal Forms to obtain the Virginia Leased Personal Property Workform in just a few clicks.

- If you are already a US Legal Forms user, sign in to your account and click on the Download button to acquire the Virginia Leased Personal Property Workform.

- You can also find forms you have previously saved in the My documents section of your account.

- If this is your first time using US Legal Forms, follow these steps.

- Step 1. Ensure you have selected the form for the correct state/region.

- Step 2. Use the View option to review the content of the form. Don’t forget to read the description.

- Step 3. If you are not satisfied with the form, use the Search field at the top of the screen to find other versions of the legal form template.

Form popularity

FAQ

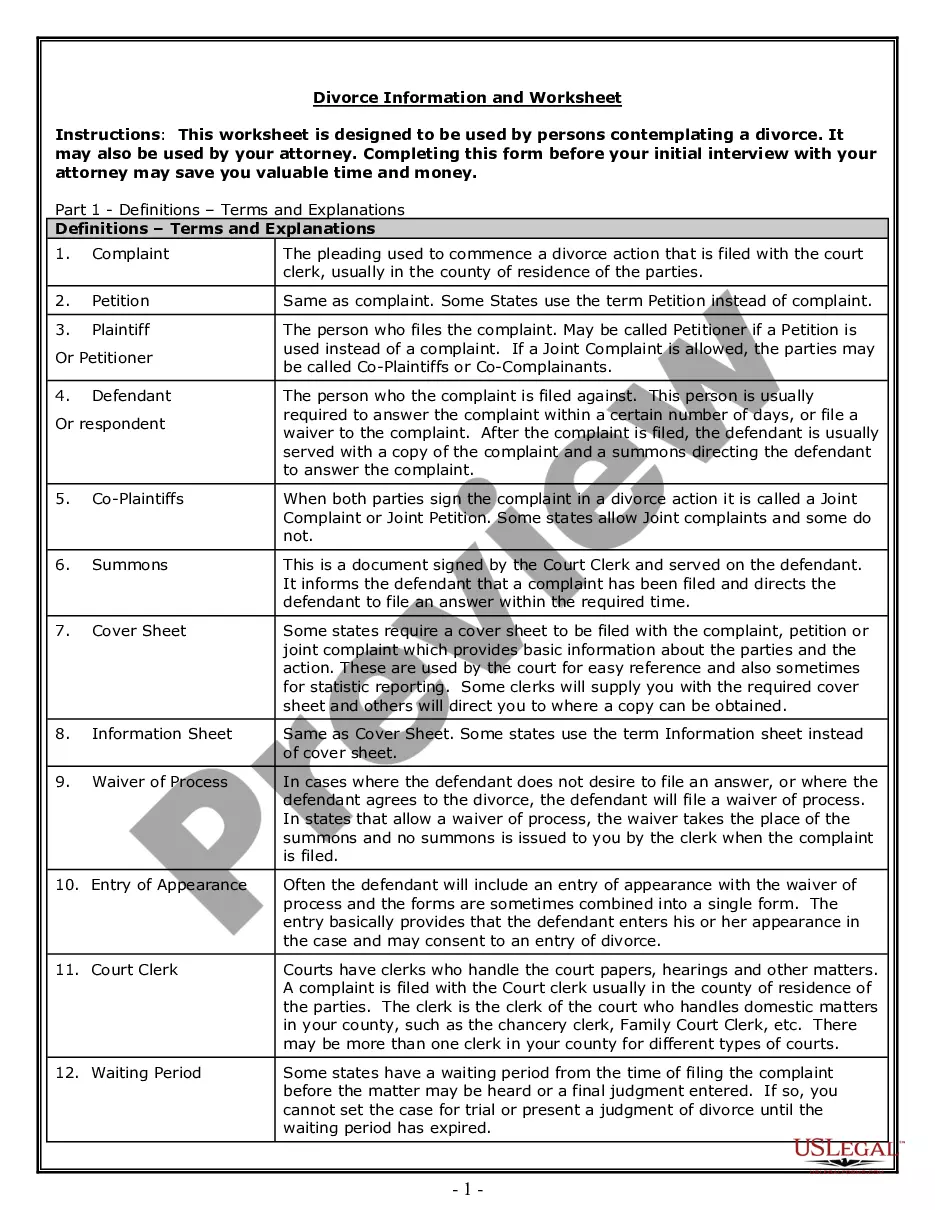

In Virginia, personal property taxes apply to various personal assets, including vehicles and leased property. Tax rates can vary by locality, so it's essential to check with your local government. If you're managing leased personal property, you may need to file a Virginia Leased Personal Property Workform to report the property and calculate your taxes correctly. Utilizing the US Legal Forms platform can simplify this process, providing you with the necessary forms and guidelines to ensure compliance.

To qualify for a personal property tax deduction, the items must generally be considered personal property under state law. Typical examples include vehicles, boats, and leased equipment. Utilizing the Virginia Leased Personal Property Workform streamlines the process of identifying and documenting eligible items for deductions. This clarity can lead to substantial savings, allowing taxpayers to optimize their financial reporting.

The general rule for tangible personal property is that it includes items that can be physically touched or moved. This concept is crucial when dealing with taxes and property forms. With the Virginia Leased Personal Property Workform, individuals can ensure proper reporting and compliance for their leased items, helping them avoid penalties. Understanding this rule helps taxpayers understand their responsibilities regarding property taxes.

You can pick up Virginia state tax forms at various locations, including county or city tax offices, libraries, and some community centers. These locations typically have a stock of common state tax forms readily available for taxpayers. To streamline your tax filing process, especially for leased personal property, consider using the Virginia Leased Personal Property Workform for guided assistance.

Paper tax forms can be found at local government offices, libraries, or post offices throughout Virginia. Additionally, forms are available for download on the Virginia Department of Taxation’s website, ensuring you have the necessary materials for filing. If you are dealing with leased personal property, the Virginia Leased Personal Property Workform provides clear instructions to assist you.

Virginia offers personal property tax relief mainly to residents who own vehicles or certain types of personal property. Generally, this includes those who meet specific income criteria and other qualifications set by local governments. Understanding the eligibility requirements is essential to maximize potential relief. The Virginia Leased Personal Property Workform can help you navigate through these requirements.

You can obtain Virginia form 760 from the Virginia Department of Taxation's official website or at any local tax office. These forms are usually available online for easy access and can be printed directly. If you are filing for leased personal property, the Virginia Leased Personal Property Workform can also be beneficial as it guides you through the necessary process.

The VA 760 adj form is an adjustment form used to amend Virginia state income tax returns. Taxpayers utilize this form to report changes in income that may affect their tax liability. It can also be important for individuals who have leased personal property and need to adjust their tax filings. By using the Virginia Leased Personal Property Workform, you can ensure your forms are accurate and complete.

In Virginia, seniors aged 65 or older may qualify for property tax exemption or relief programs. These programs can provide significant financial assistance, easing the burden of property taxes. Eligibility often depends on income and resources, so it is advisable to check local regulations. For detailed guidance, you might find the Virginia Leased Personal Property Workform useful.

The 706 tax form is used to report estate taxes for a deceased person's estate. It helps calculate the amount of federal estate tax due, which may be necessary if the estate exceeds a certain value. Understanding estate taxes is crucial, as they can affect the distribution of personal property, including leased property. For further information, consider using resources available on the Virginia Leased Personal Property Workform.