Virginia Third Party Financing Agreement Workform

Description

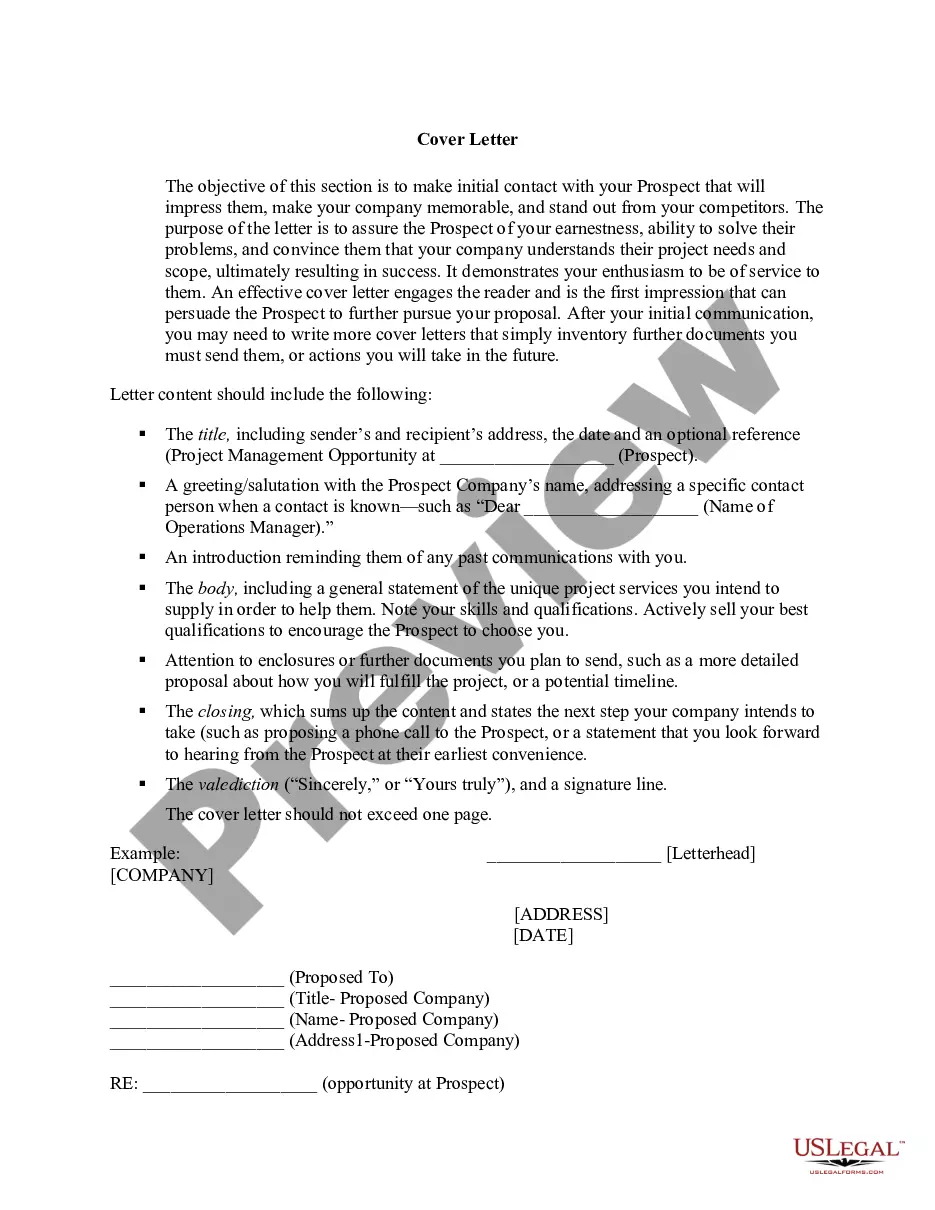

How to fill out Third Party Financing Agreement Workform?

US Legal Forms - one of the largest collections of legal documents in the USA - offers a vast array of legal document templates that you can download or produce.

By utilizing the site, you can discover thousands of forms for business and personal needs, organized by categories, states, or keywords.

You can find the most recent versions of forms like the Virginia Third Party Financing Agreement Workform within minutes.

If the form does not suit your needs, use the Search box at the top of the screen to find one that does.

If you are satisfied with the form, confirm your choice by clicking the Get now button. Then, select the pricing plan you wish and provide your credentials to register for an account.

- If you have an existing monthly subscription, Log In to download the Virginia Third Party Financing Agreement Workform from the US Legal Forms library.

- The Download button will appear on every form you view.

- You can access all previously downloaded forms in the My documents section of your account.

- To utilize US Legal Forms for the first time, here are simple steps to get you started.

- Ensure you have selected the correct form for your city/region.

- Click the Preview button to examine the form's content.

Form popularity

FAQ

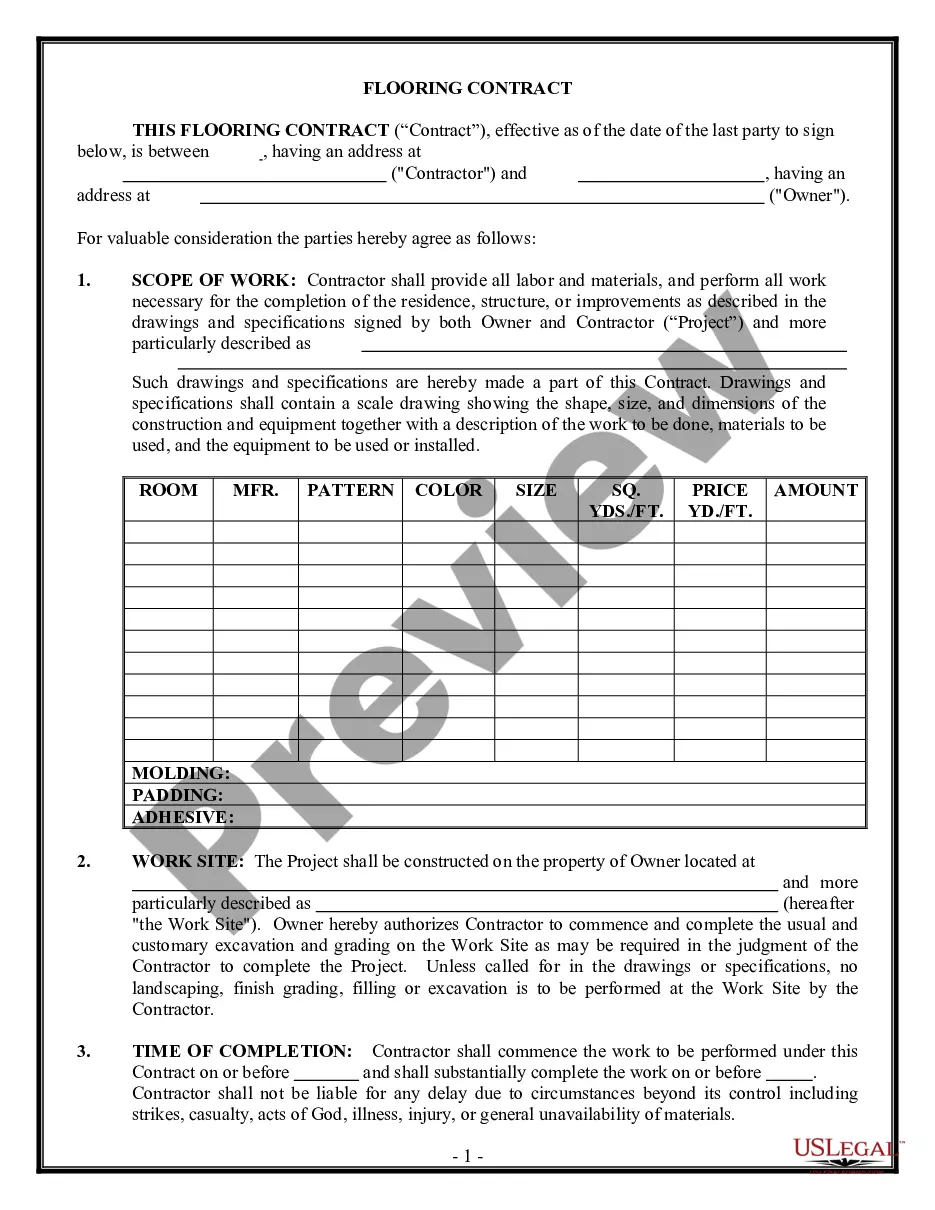

A seller financing addendum outlines the terms under which the seller of a property agrees to loan money to the buyer in order to purchase their property.

A real estate addendum modifies an original lease or purchase agreement. Items in the addendum could reflect a change in the agreed-upon price, what is included in the transfer of property, what improvements must be made before the home is paid for, or any other agreed-upon requests or responsibilities.

N. a person who is not a party to a contract or a transaction, but has an involvement (such as a buyer from one of the parties, was present when the agreement was signed, or made an offer that was rejected).

The Third Party Financing Addendum is designed to limit the maximum amount of interest and loan fees that a buyer would be obligated to pay as part of his loan contingency.

When you waive your financing contingency, you're forfeiting your deposit to the Seller if your lender backs out. In other words, you're walking a tight rope without a net.

The SBA defines the Third-Party Loan as a loan from a commercial or private lender, investor, or Federal (non-SBA), State, or local government source that is part of the project financing. So while it's rare, the Third-Party Loan could be from an individual or government source.

What is Third-Party Financing (TPF)? The Third-Party Financing refers solely to debt financing. The project financing comes from a third party, usually a financial institution or other investor, or the ESCO, which is not the user or customer.

What happens if buyer's credit is not approved under the TREC Third Party Financing Addendum for Credit Approval, and the buyer gives timely notice to the seller? The answer is the contract will terminate and the buyer will get the earnest money.