Virginia Senior Executive Management Incentive Plan with attachments for The Geon Co.

Description

How to fill out Senior Executive Management Incentive Plan With Attachments For The Geon Co.?

It is possible to invest time on the web attempting to find the legal file template that suits the federal and state requirements you need. US Legal Forms gives a large number of legal forms that are reviewed by professionals. It is possible to obtain or produce the Virginia Senior Executive Management Incentive Plan with attachments for The Geon Co. from my services.

If you currently have a US Legal Forms accounts, you can log in and click the Download key. After that, you can complete, edit, produce, or indication the Virginia Senior Executive Management Incentive Plan with attachments for The Geon Co.. Each legal file template you get is your own property eternally. To obtain yet another copy for any obtained type, check out the My Forms tab and click the corresponding key.

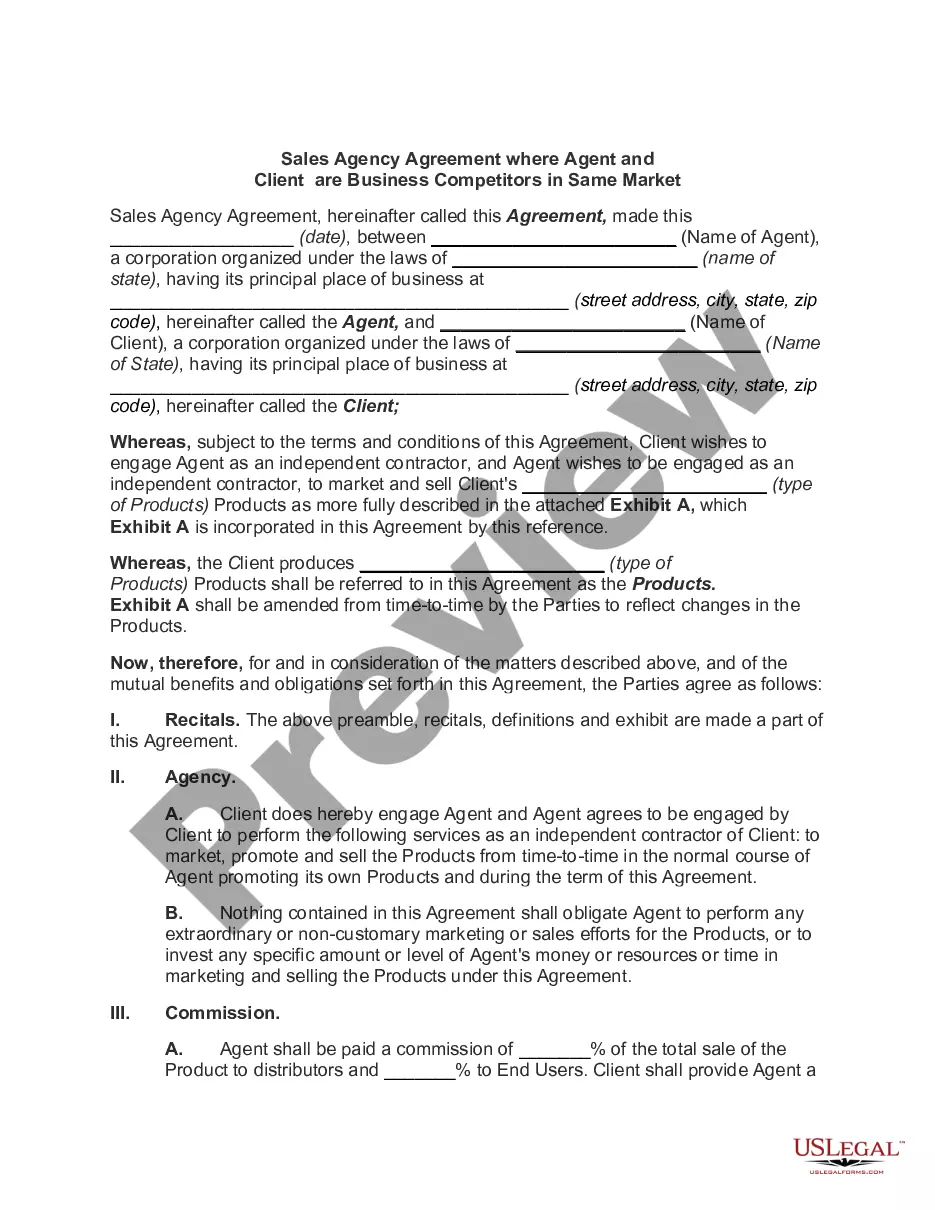

If you are using the US Legal Forms internet site for the first time, keep to the straightforward guidelines beneath:

- First, be sure that you have selected the best file template for your county/city of your choosing. Browse the type outline to ensure you have chosen the appropriate type. If accessible, make use of the Preview key to look with the file template as well.

- If you wish to discover yet another variation of the type, make use of the Look for industry to discover the template that meets your requirements and requirements.

- When you have located the template you need, click Purchase now to carry on.

- Pick the rates plan you need, enter your references, and sign up for an account on US Legal Forms.

- Total the financial transaction. You can use your bank card or PayPal accounts to fund the legal type.

- Pick the structure of the file and obtain it for your device.

- Make alterations for your file if necessary. It is possible to complete, edit and indication and produce Virginia Senior Executive Management Incentive Plan with attachments for The Geon Co..

Download and produce a large number of file templates utilizing the US Legal Forms Internet site, which provides the most important collection of legal forms. Use specialist and state-specific templates to deal with your organization or individual requirements.

Form popularity

FAQ

Incentive compensation is simply additional money, or rewards of value (i.e. stock), paid to employees based on their performance, and on top of their base salary. The performance measures companies use to structure these comp plans can vary widely.

Executive bonus plans are often popular with top-level employees, but they also provide benefits to your company. In some cases, they can be a more tax-efficient way to reward top talent. They give employees additional compensation with a lower current cost to the employer than some other types of benefits. What Is an Executive Bonus Plan and Does Your Company Need One? lgresources.com ? blog ? what-is-executive-bonus... lgresources.com ? blog ? what-is-executive-bonus...

An Executive Bonus Plan, also referred to as Section 162 Plan, is a non-qualified plan used by employers to provide special compensation to key executives. The employers' contribution to an executive bonus plan is considered salary to the executive and is therefore subject to taxation.

Incentive compensation is simply additional money, or rewards of value (i.e. stock), paid to employees based on their performance, and on top of their base salary. The performance measures companies use to structure these comp plans can vary widely. What's Incentive Compensation Management? - Performio performio.co ? insight ? incentive-compensa... performio.co ? insight ? incentive-compensa...