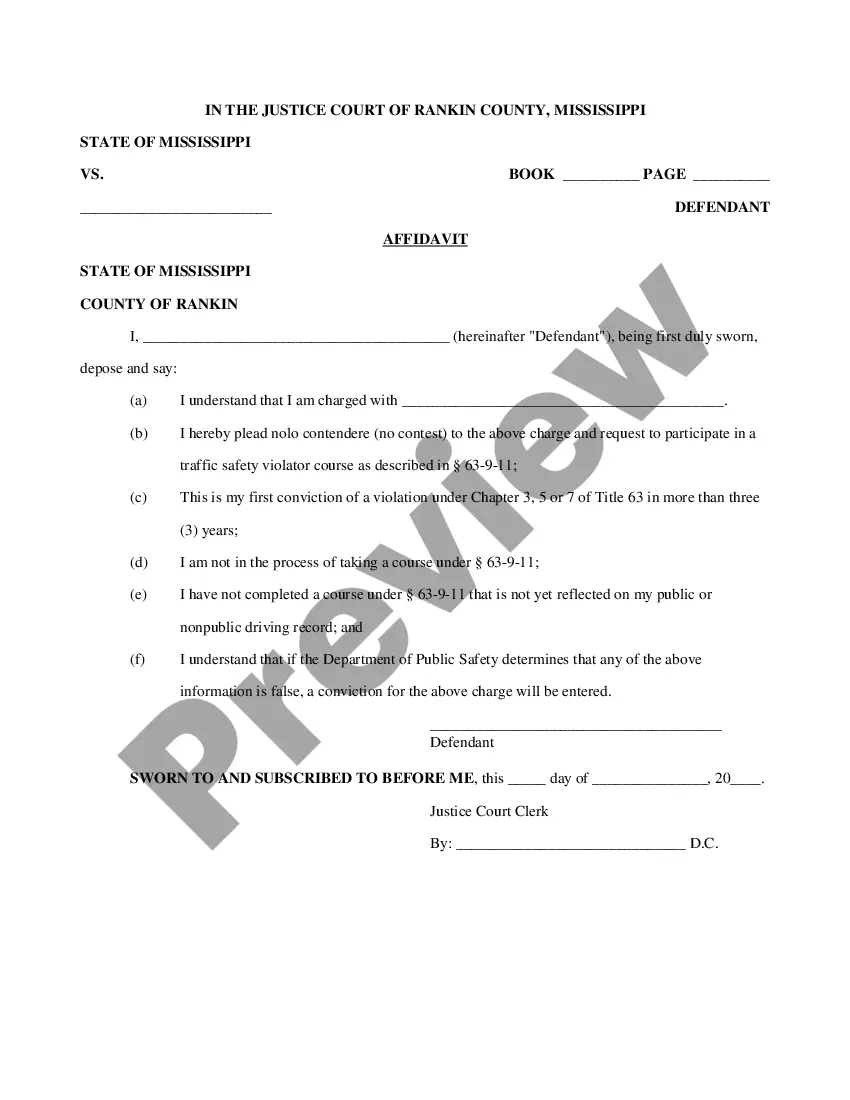

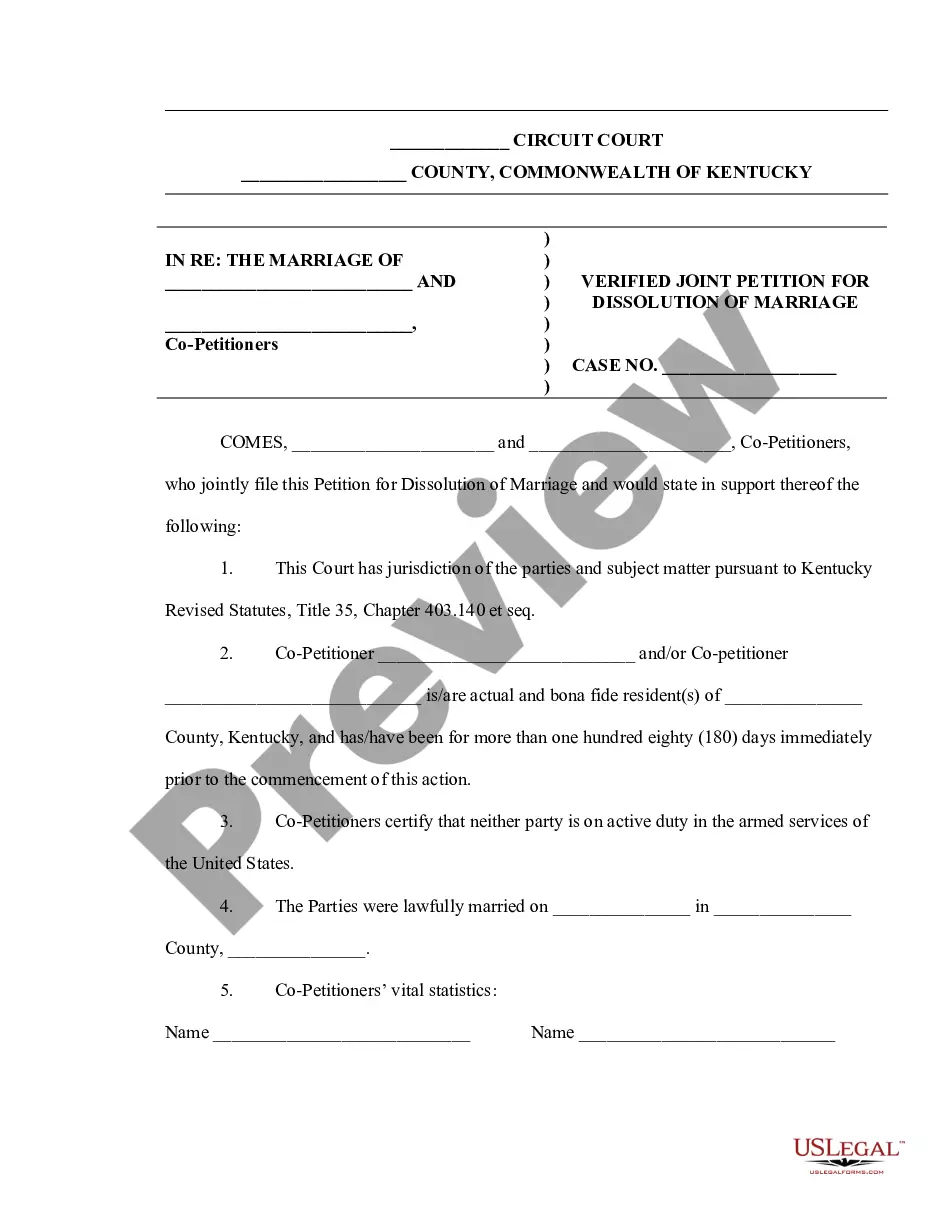

Virginia Order Confirming Chapter 12 Plan - B 230A

Description

How to fill out Order Confirming Chapter 12 Plan - B 230A?

Finding the right legal record template could be a battle. Of course, there are tons of templates accessible on the Internet, but how would you discover the legal type you need? Use the US Legal Forms web site. The service provides 1000s of templates, including the Virginia Order Confirming Chapter 12 Plan - B 230A, that can be used for enterprise and personal requirements. All of the forms are examined by experts and fulfill state and federal requirements.

In case you are currently signed up, log in for your bank account and click the Download button to find the Virginia Order Confirming Chapter 12 Plan - B 230A. Make use of bank account to search throughout the legal forms you have ordered previously. Check out the My Forms tab of your respective bank account and have one more copy from the record you need.

In case you are a fresh customer of US Legal Forms, here are easy guidelines that you can stick to:

- First, make sure you have selected the correct type for your personal metropolis/county. You may examine the shape utilizing the Preview button and read the shape description to ensure it will be the right one for you.

- In case the type is not going to fulfill your preferences, utilize the Seach industry to discover the right type.

- When you are positive that the shape is acceptable, go through the Acquire now button to find the type.

- Opt for the prices prepare you would like and type in the needed information. Create your bank account and pay for your order using your PayPal bank account or bank card.

- Pick the file structure and obtain the legal record template for your system.

- Full, revise and produce and signal the acquired Virginia Order Confirming Chapter 12 Plan - B 230A.

US Legal Forms may be the most significant library of legal forms where you can discover various record templates. Use the company to obtain professionally-made paperwork that stick to status requirements.

Form popularity

FAQ

Chapter 7 is a ?liquidation? bankruptcy that doesn't require a repayment plan but does require you to sell some assets to pay creditors. Chapter 11 is a ?reorganization? bankruptcy for businesses that allows them to maintain day-to-day operations while creating a plan to repay creditors.

The biggest difference between Chapter 7 and Chapter 13 is that Chapter 7 focuses on discharging (getting rid of) unsecured debt such as credit cards, personal loans and medical bills while Chapter 13 allows you to catch up on secured debts like your home or your car while also discharging unsecured debt.

Chapter 12 is designed for "family farmers" or "family fishermen" with "regular annual income." It enables financially distressed family farmers and fishermen to propose and carry out a plan to repay all or part of their debts.

Modification after confirmation. The court and the trustee will ask you to explain why you need to change your plan payments and provide proof of your changed circumstances (such as a job loss or a reduction in income). If satisfied, the court will order a new plan payment for the duration of your case.

The main difference between Chapter 11 and Chapter 13 is that a Chapter 13 bankruptcy requires that the debtor pay his or her debts within five years.

Chapter 7 bankruptcy works well for low-income debtors with little or no assets or those who can protect all household belongings. If you don't have any assets to sell, creditors receive nothing.

This chapter of the Bankruptcy Code generally provides for reorganization, usually involving a corporation or partnership. A chapter 11 debtor usually proposes a plan of reorganization to keep its business alive and pay creditors over time. People in business or individuals can also seek relief in chapter 11.

"Cram down" simply means the process by which the bankruptcy court can, as part of the confirmation of a Chapter 12 Bankruptcy Plan, force treatment upon an objecting creditor, provided the Plan otherwise meets all of the other confirmation criteria under Section 1225 of the Bankruptcy Code.