Statutory Guidelines [Appendix A(4) IRC 468B] regarding special rules for designated settlement funds.

Virginia Special Rules for Designated Settlement Funds IRS Code 468B

Description

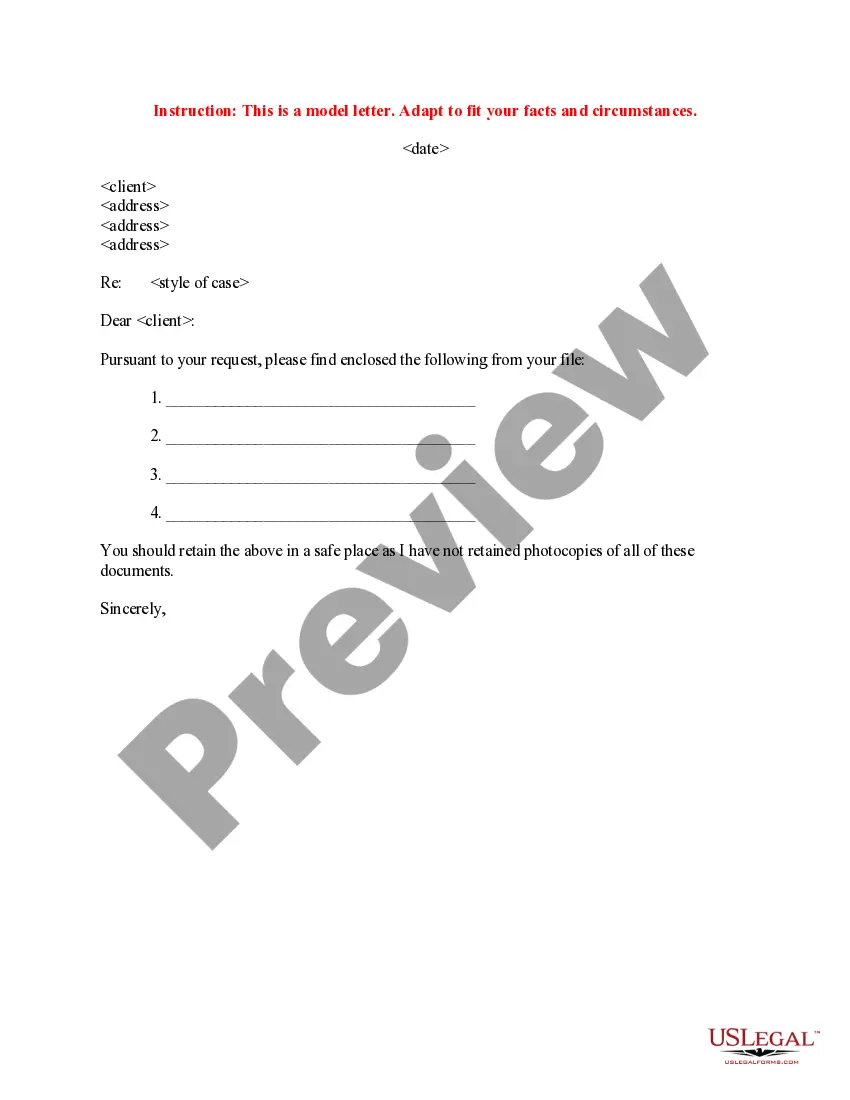

How to fill out Special Rules For Designated Settlement Funds IRS Code 468B?

US Legal Forms - among the largest libraries of lawful kinds in the USA - provides a variety of lawful file templates you are able to down load or print out. Making use of the web site, you can find thousands of kinds for company and specific purposes, sorted by groups, claims, or search phrases.You can get the latest variations of kinds such as the Virginia Special Rules for Designated Settlement Funds IRS Code 468B within minutes.

If you already possess a membership, log in and down load Virginia Special Rules for Designated Settlement Funds IRS Code 468B from the US Legal Forms collection. The Download key can look on every kind you look at. You gain access to all previously delivered electronically kinds in the My Forms tab of your respective profile.

In order to use US Legal Forms the first time, listed here are easy recommendations to help you started out:

- Be sure you have picked out the right kind for your personal town/area. Click on the Review key to examine the form`s articles. See the kind outline to actually have selected the correct kind.

- In the event the kind doesn`t suit your demands, utilize the Look for discipline at the top of the display to obtain the one which does.

- When you are satisfied with the shape, confirm your option by simply clicking the Purchase now key. Then, pick the costs plan you like and provide your references to register on an profile.

- Procedure the transaction. Utilize your credit card or PayPal profile to complete the transaction.

- Pick the format and down load the shape on the system.

- Make changes. Complete, edit and print out and signal the delivered electronically Virginia Special Rules for Designated Settlement Funds IRS Code 468B.

Each template you included in your account does not have an expiry particular date and is also your own property permanently. So, if you wish to down load or print out one more version, just visit the My Forms area and then click about the kind you require.

Gain access to the Virginia Special Rules for Designated Settlement Funds IRS Code 468B with US Legal Forms, one of the most comprehensive collection of lawful file templates. Use thousands of professional and condition-particular templates that fulfill your company or specific needs and demands.

Form popularity

FAQ

A QSF is assigned its own Employer Identification Number from the IRS. A QSF is taxed on its modified gross income[v] (which does not include the initial deposit of money), at a maximum rate of 35%.

Internal Revenue Code (IRC) § 468B provides for the taxation of designated settlement funds and directs the Department of the Treasury to prescribe regulations providing for the taxation of an escrow account, settlement fund, or similar fund, whether as a grantor trust or otherwise.

A QSF is taxed on its ?modified gross income.? The term modified gross income is generally comprised of the investment income generated by a QSF. Moreover, settlement payment amounts transferred to a QSF to resolve or satisfy a liability for which a QSF is established are excluded from a QSF's gross income.

The good news is that, in most cases, personal injury settlements are not taxable in California. However, it's still important to understand the state's rules and regulations, so you can make informed decisions and avoid any unexpected tax liabilities.

The benefits of a QSF for an attorney include: More time to plan for contingency fees using attorney fee deferral. Affording clients extra time to implement settlement planning strategies and comply with government benefits income thresholds.

If you receive a settlement in California that is considered taxable income, you will need to report it on your tax return. You will typically receive a Form 1099-MISC, which reports the amount of taxable income you received during the year.

See § 1.263(a)-5(b)(1). Generally, amounts paid in settlement of lawsuits are currently deductible if the acts which gave rise to the litigation were performed in the ordinary conduct of the taxpayer's business.

How do law firms establish qualified settlement funds? Be established pursuant to a court order and is subject to continuing jurisdiction of the court (26 CFR § 1.468B(c)). Resolve one or more contested claims arising out of a tort, breach of contract, or violation of law. A trust under applicable state law.