Statutory Guidelines [Appendix A(6) Revenue Procedure 93-34] regarding rules under which a designated settlement fund described in section 468B(d)(2) of the Internal Revenue Code or a qualified settlement fund described in section 1.468B-1 of the Income Tax Regulations will be considered "a party to the suit or agreement" for purposes of section 130.

Virginia Revenue Procedure 93-34

Description

How to fill out Revenue Procedure 93-34?

It is possible to devote hours on the web trying to find the legitimate document template that meets the federal and state demands you will need. US Legal Forms supplies a large number of legitimate forms that are evaluated by specialists. It is simple to acquire or produce the Virginia Revenue Procedure 93-34 from my assistance.

If you already have a US Legal Forms account, you can log in and click on the Download button. After that, you can complete, change, produce, or indicator the Virginia Revenue Procedure 93-34. Each and every legitimate document template you purchase is your own permanently. To have one more copy for any obtained form, go to the My Forms tab and click on the corresponding button.

If you use the US Legal Forms site the first time, keep to the straightforward directions below:

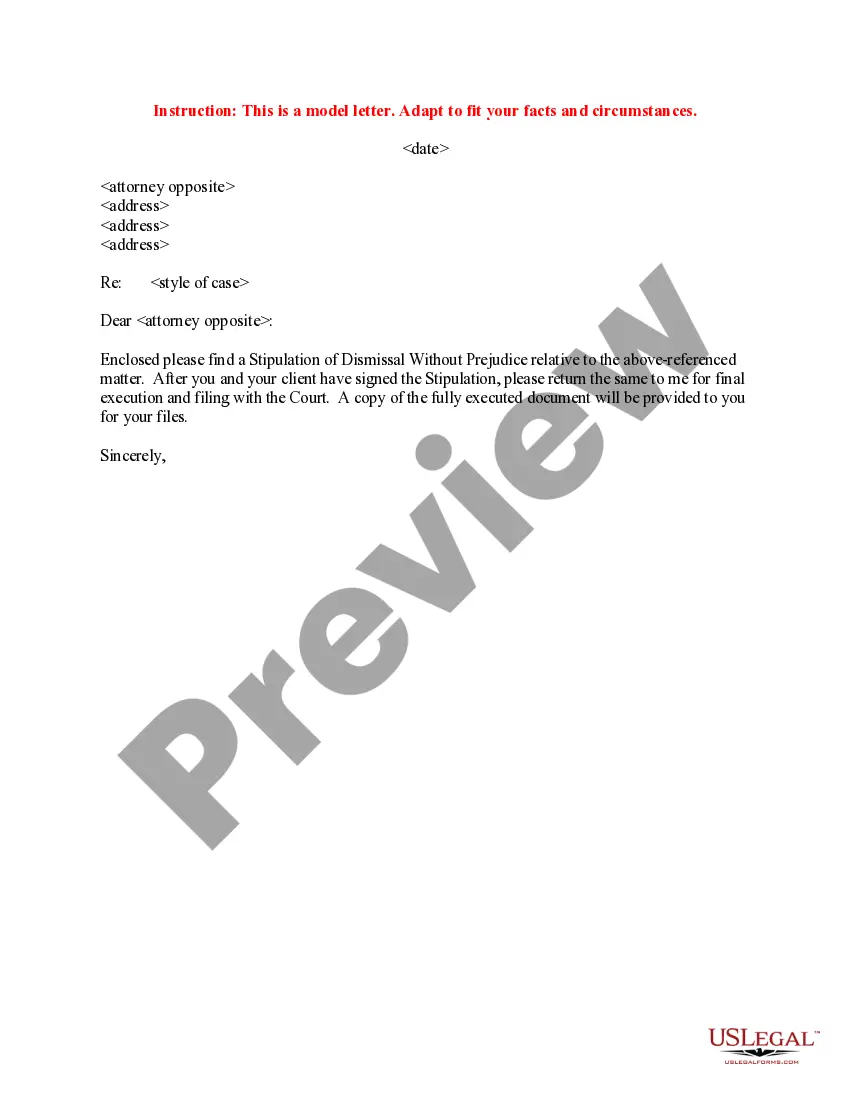

- Initial, ensure that you have selected the right document template for that state/town of your liking. Browse the form explanation to ensure you have picked out the correct form. If readily available, utilize the Review button to look with the document template as well.

- If you would like discover one more version of your form, utilize the Look for area to get the template that meets your requirements and demands.

- Upon having identified the template you need, click Purchase now to move forward.

- Find the rates program you need, type your accreditations, and register for an account on US Legal Forms.

- Comprehensive the financial transaction. You can use your Visa or Mastercard or PayPal account to purchase the legitimate form.

- Find the file format of your document and acquire it for your gadget.

- Make adjustments for your document if necessary. It is possible to complete, change and indicator and produce Virginia Revenue Procedure 93-34.

Download and produce a large number of document themes making use of the US Legal Forms site, that provides the greatest collection of legitimate forms. Use skilled and state-certain themes to tackle your company or individual requirements.