Virginia Release of All Auto Accident Claims

Description

How to fill out Release Of All Auto Accident Claims?

US Legal Forms - one of several largest libraries of authorized varieties in the USA - delivers an array of authorized document layouts you are able to download or produce. Utilizing the web site, you can find thousands of varieties for business and individual purposes, categorized by categories, claims, or keywords and phrases.You will discover the newest models of varieties such as the Virginia Release of All Auto Accident Claims in seconds.

If you already have a monthly subscription, log in and download Virginia Release of All Auto Accident Claims through the US Legal Forms catalogue. The Down load key will show up on every single form you see. You have access to all earlier downloaded varieties within the My Forms tab of your bank account.

In order to use US Legal Forms initially, listed here are basic directions to obtain started off:

- Make sure you have selected the proper form for the town/area. Select the Preview key to analyze the form`s content. Browse the form description to actually have chosen the proper form.

- When the form doesn`t suit your needs, make use of the Search discipline on top of the monitor to find the the one that does.

- When you are pleased with the form, affirm your choice by clicking the Purchase now key. Then, opt for the costs plan you prefer and give your credentials to register to have an bank account.

- Process the financial transaction. Make use of bank card or PayPal bank account to perform the financial transaction.

- Find the structure and download the form on your own gadget.

- Make adjustments. Fill up, revise and produce and indication the downloaded Virginia Release of All Auto Accident Claims.

Every format you included with your account does not have an expiration date and is also your own for a long time. So, in order to download or produce one more version, just check out the My Forms area and click on about the form you will need.

Get access to the Virginia Release of All Auto Accident Claims with US Legal Forms, probably the most considerable catalogue of authorized document layouts. Use thousands of specialist and condition-certain layouts that satisfy your company or individual needs and needs.

Form popularity

FAQ

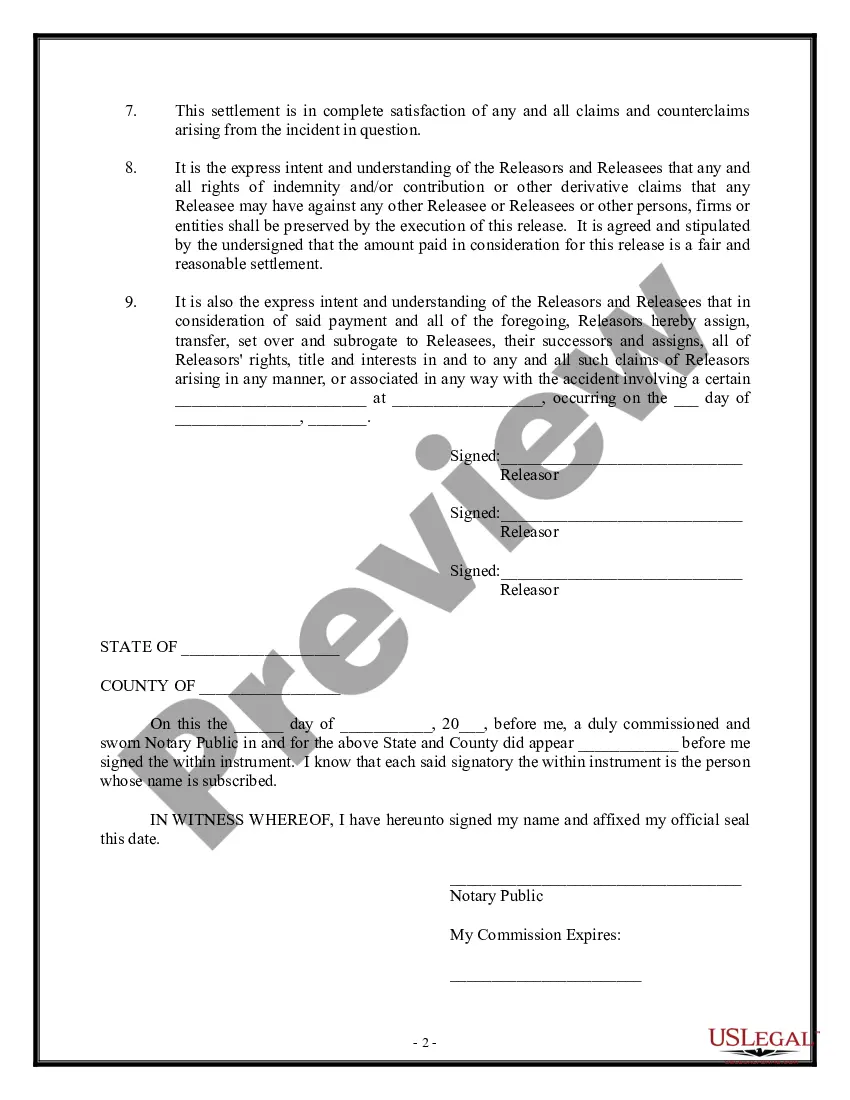

A settlement agreement is a legally-binding document both parties sign, agreeing to end the dispute and dismiss their claims. It's also customary to sign a release in a settlement agreement.

According to the Bureau of Insurance of the state of Virginia, insurance companies have 45 days to investigate a car crash claim and come up with a resolution. In special cases, they may prolong this period, but must keep the claimant informed and present reasonable explanations for this delay.

Under current Virginia law, liability policy limits can only be revealed to a plaintiff's attorney within limited circumstances, unless a lawsuit is filed.

United States: Virginia Supreme Court Affirms Bar To Third-Party Direct Action Against Insurer Absent Judgment. by George B. Hall, Jr.

The release of claims is an agreement between an employer and a worker whose employment has been terminated. Employees typically sign the document in return for a severance package. The release is meant to limit potential litigation for reasons such as discrimination.

A release of all claims form releases the responsible party (the other driver who was at fault and their insurance company) from any liability and obligation to pay you for the damages associated with the accident. Insurance companies usually ask you to sign the release form before making any payments.

When a case is settled, the document that brings the case to a close is sometimes referred to as a "full and final release". These words mean that there is no going back.

A release of all claims form is exactly what it sounds like: it is a document that absolves the parties of any liability for an accident. Once this form is signed, it is no longer possible for an injured accident victim to pursue a personal injury claim against the at-fault driver.

Yes. C.R.S. § 10-3-1117(2). Effective January 1, 2020, insurers writing commercial or personal auto policies must disclose insurance policies to their insureds and reveal the liability policy limits to third-party claimants.

Also known as a general release or release. A written contract in which one or more parties agree to give up legal causes of action against the other party in exchange for adequate consideration (that is, something of value to which the party releasing the legal claims is not already entitled).