Virginia Assignment of Profits of Business

Description

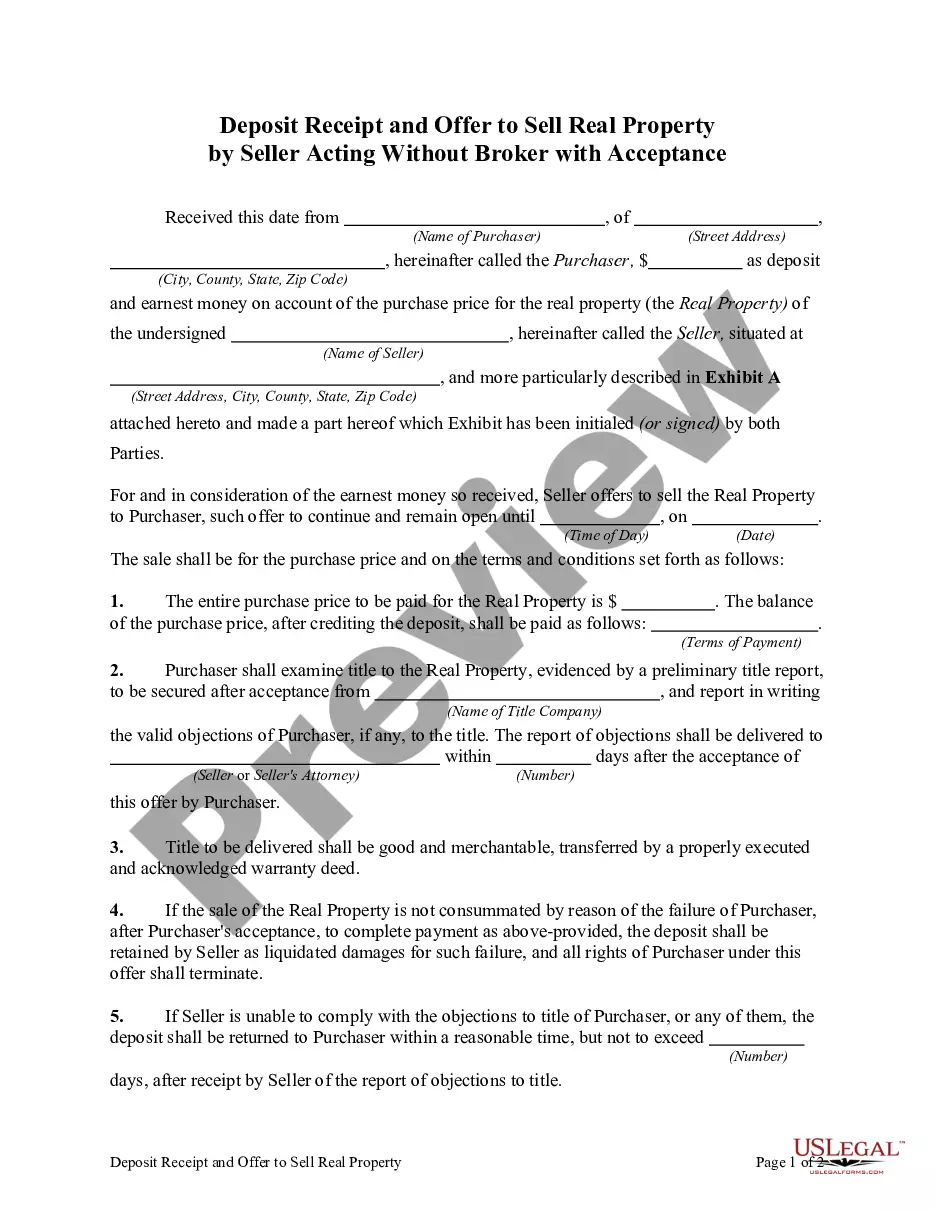

How to fill out Assignment Of Profits Of Business?

You can spend numerous hours online trying to locate the legal document template that meets the state and federal criteria you require.

US Legal Forms provides a vast array of legal forms that are examined by experts.

You can download or print the Virginia Assignment of Profits of Business from this service.

If available, use the Preview button to check the document template as well. To acquire another version of the form, utilize the Search field to find the template that suits your needs and requirements.

- If you already possess a US Legal Forms account, you can sign in and click the Download button.

- Then, you can complete, modify, print, or endorse the Virginia Assignment of Profits of Business.

- Every legal document template you acquire is yours indefinitely.

- To obtain another copy of a purchased form, navigate to the My documents section and click the respective button.

- If you are using the US Legal Forms website for the first time, follow the simple instructions provided below.

- First, ensure you have chosen the correct document template for the location/city of your choice.

- Review the form details to confirm you have selected the appropriate form.

Form popularity

FAQ

To determine if you are subject to Virginia withholding, evaluate your income sources and the law’s guidelines. Factors such as employment status and residency can affect your liability. Resources provided by US Legal Forms can guide you through understanding withholding related to the Virginia Assignment of Profits of Business.

BenefitsOwners in an LLC aren't personally liable for business debts and business lawsuits.LLCs have fewer compliance requirements than corporations.LLC earnings aren't subject to double taxation in the way that C-corporation earnings are.LLCs can choose whether to be taxed as a pass-through entity or corporation.More items...

Tax benefits LLCs aren't recognized by the IRS for tax purposes. Single member LLCs are referred to as disregarded entities. LLCs will be taxed the same as a sole proprietorship, a partnership, or a corporation. You, the single owner, decides how you want to be taxed, and that gives you a lot of flexibility.

P.O. Box 2475, Richmond, VA 23218-2475.

The Virginia General Assembly recently enacted legislation allowing qualifying pass-through entities to be taxed at the entity level on their income, rather than requiring the PTE's owners to be taxed on such income.

In California, S Corporations are taxed at a rate of 1.5% tax of net income earned, whereas LLC's are taxed based on gross receipts pursuant to the above scale.

An LLC is typically treated as a pass-through entity for federal income tax purposes. This means that the LLC itself doesn't pay taxes on business income. The members of the LLC pay taxes on their share of the LLC's profits. State or local governments might levy additional LLC taxes.

Owning a small business does not exempt you from personal income taxes. Whether you pay yourself a salary or draw profits from the company, the money you receive is taxable income.

The corporation must file a corporate tax return, IRS Form 1120, and pay taxes at a corporate income tax rate on any profits. If a corporation will owe taxes, it must estimate the amount of tax due for the year and make quarterly payments to the IRS by the 15th day of the 4th, 6th, 9th, and 12th months of the tax year.

Department of TaxationPhone(804) 367-8031.Mailing Address P.O. Box 1115. Richmond, VA 23218.