Virginia Annuity as Consideration for Transfer of Securities

Description

How to fill out Annuity As Consideration For Transfer Of Securities?

If you need to fill out, download, or print sanctioned document templates, utilize US Legal Forms, the most extensive collection of legal forms, available on the web.

Take advantage of the site's user-friendly and straightforward search feature to obtain the documents you require.

Numerous templates for corporate and personal use are categorized by groups and states, or by keywords and phrases.

Step 3. If you are not satisfied with the form, use the Search section at the top of the screen to find alternative versions of the legal form template.

Step 4. Once you have located the form you need, click the Acquire now button. Choose the payment plan you prefer and enter your details to register for an account.

- Utilize US Legal Forms to access the Virginia Annuity as Consideration for Transfer of Securities with just a few clicks.

- If you are currently a US Legal Forms subscriber, Log In to your account and click the Acquire button to obtain the Virginia Annuity as Consideration for Transfer of Securities.

- You can also find forms you previously obtained in the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the steps below.

- Step 1. Make sure you have chosen the form for the correct area/region.

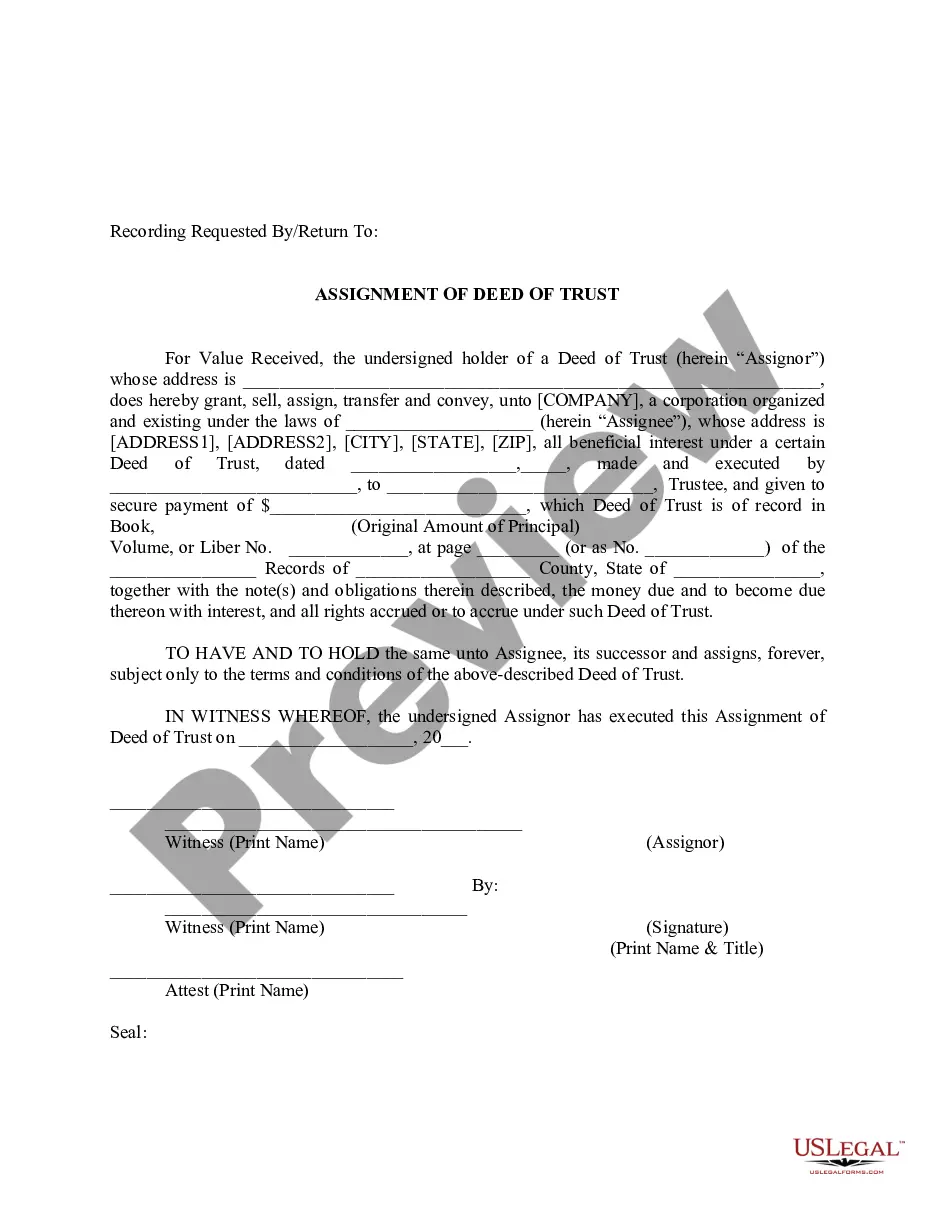

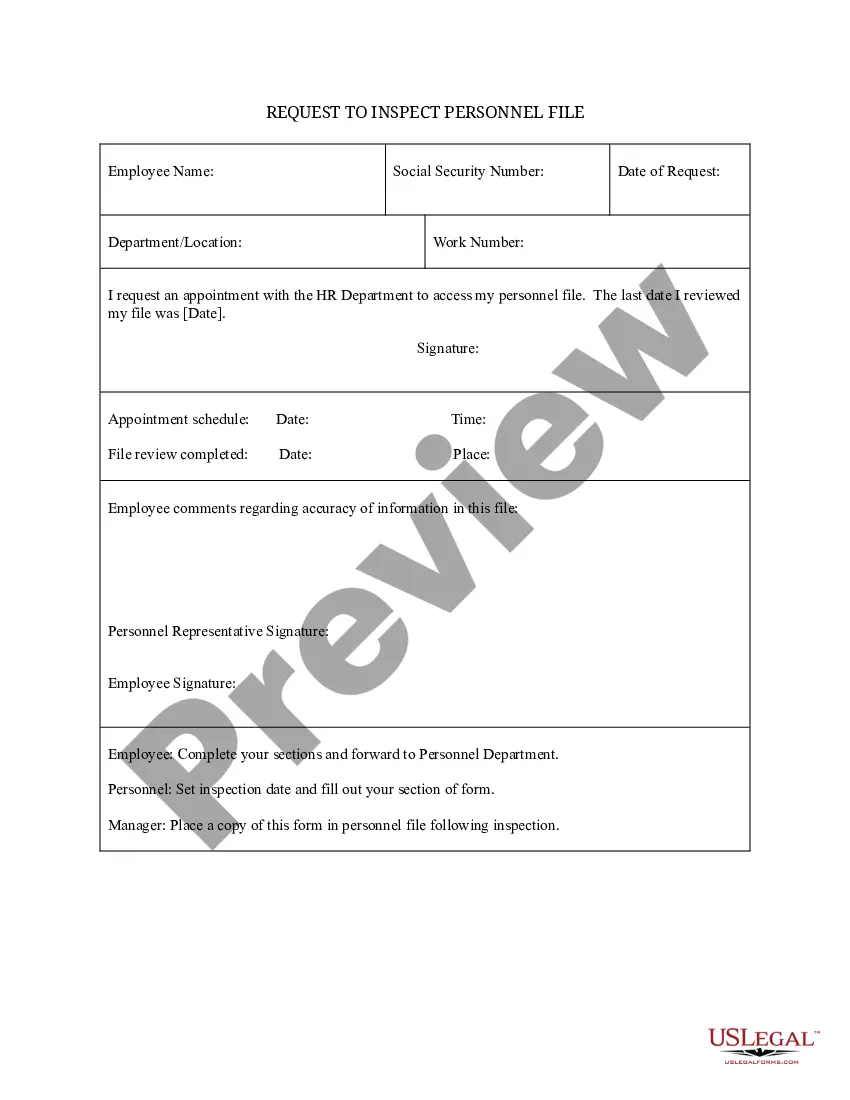

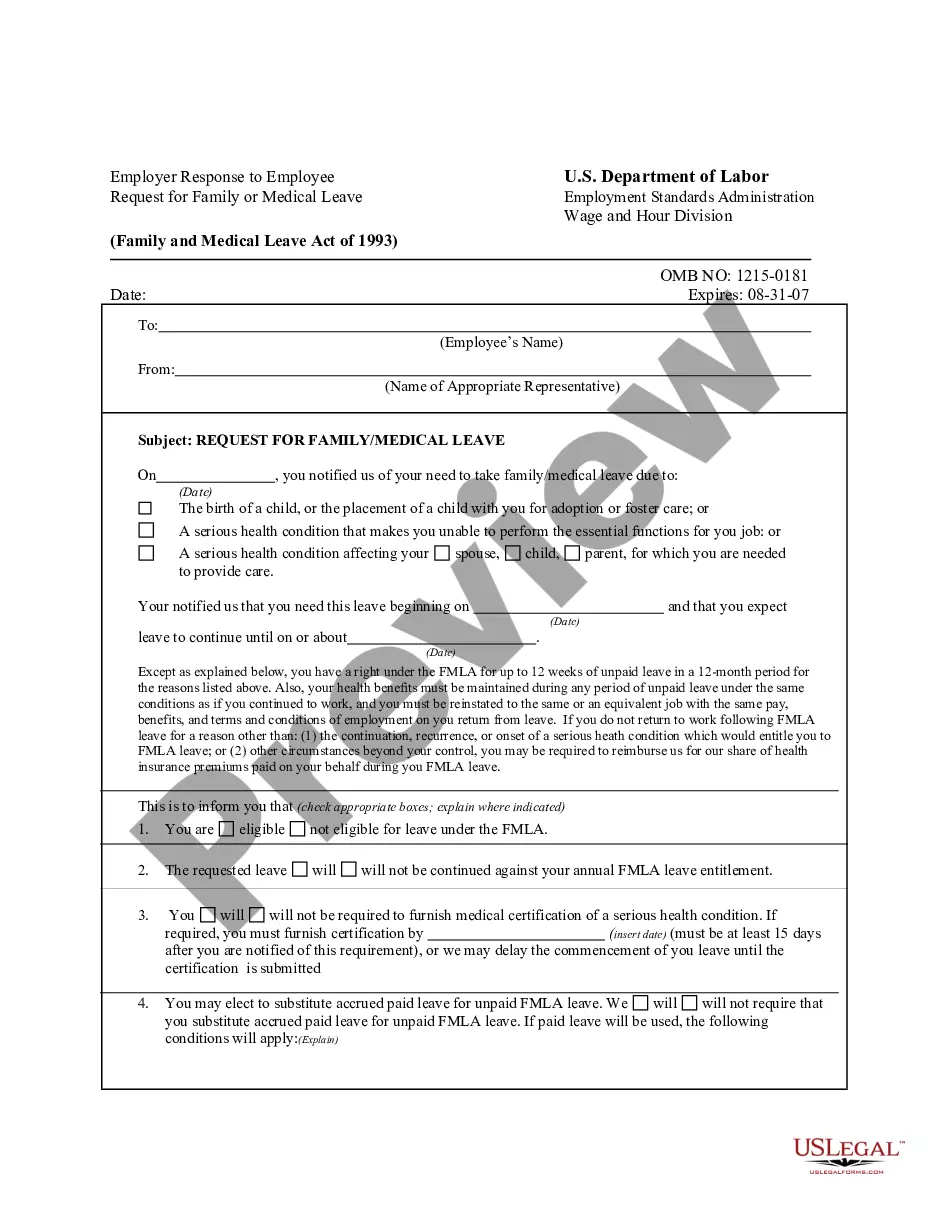

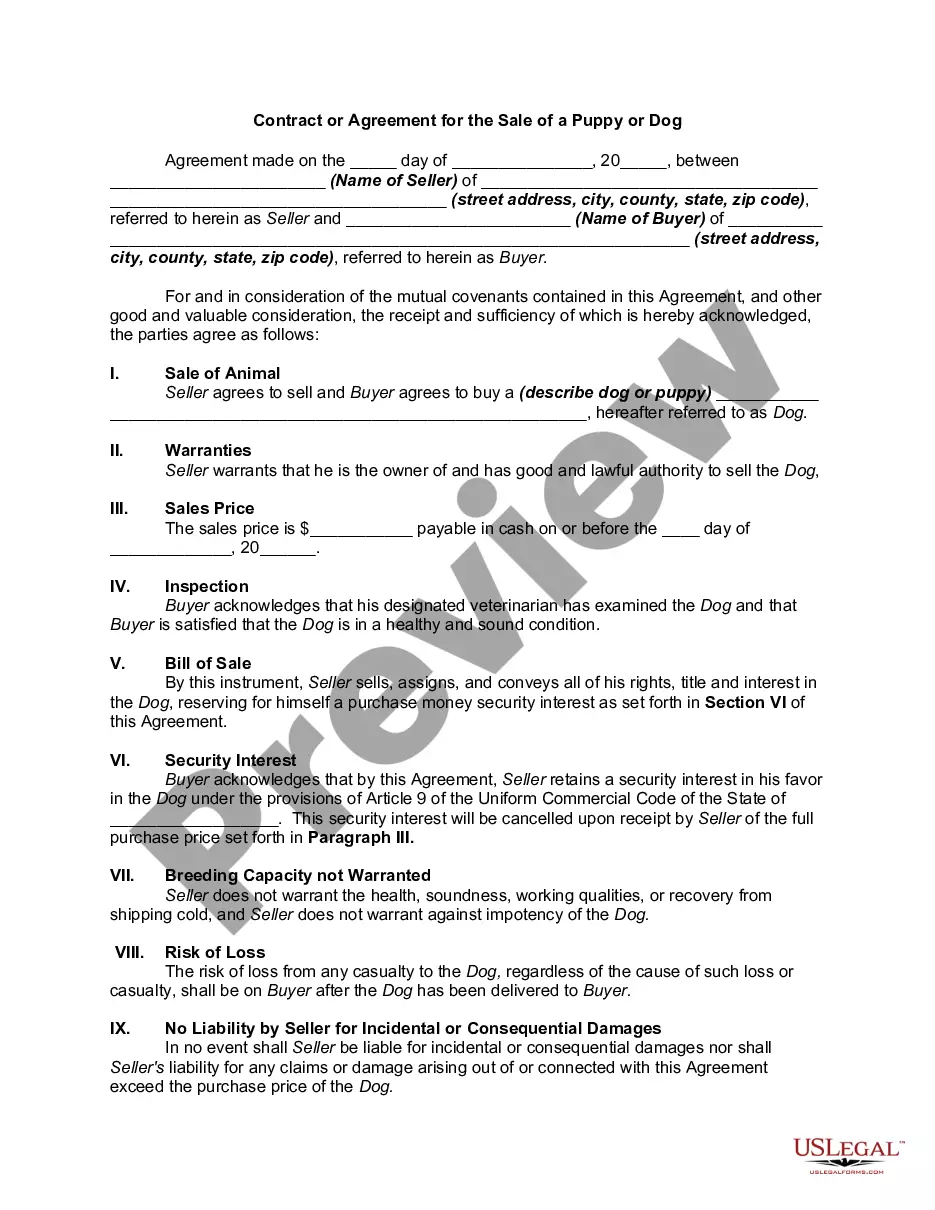

- Step 2. Use the Review option to examine the form's content. Remember to read the details.

Form popularity

FAQ

Annuities outside of an IRA structure can be transferred as a nontaxable event by using the IRS approved 1035 transfer rule. Annuities within an IRA can transfer directly to another IRA with an annuity carrier, and not create any tax consequences as well.

Yes, you can roll over or exchange a fixed annuity for a new annuity. Check to make sure that surrender charges don't apply, however. Typically, a minimum deposit of at least $5,000 will be required.

Variable annuities and their underlying fund investments are sold by prospectus only. The prospectuses contain the investment objectives, risks, fees, charges, expenses and other information regarding the contract and underlying funds, which should be considered carefully before investing.

A "1035 exchange" refers to the U.S. tax code permitting the transfer of value from one life insurance or annuity contract to another. As long as the new product meets IRS guidelines and is relatively similar to the existing one, you are free to move your money from one product to the next.

The new rule permits variable annuity and variable life insurance contracts to use a summary prospectus to provide disclosures to investors. A summary prospectus is a concise, reader-friendly summary of key facts about the contract.

It is a non-taxable event. Even though any money coming out of an IRA will be taxed as ordinary income levels, transferring an annuity from one IRA to another will NOT trigger any taxes at all.

Variable annuities are securities registered with the Securities and Exchange Commission (SEC), and sales of variable insurance products are regulated by the SEC and FINRA.

If you want to sell variable annuities or mutual funds, you will need a Series 6 and 63. If you simply want to offer fixed annuities and life insurance products for guaranteed income or asset protection needs, you will only need a life insurance license in the states you intend to do business.

A 1035 transfer is a tax-free transfer from one insurance company annuity to another. You don't pay taxes or penalties if you transfer the funds this way.

If you own an annuity inside of a Traditional IRA, the transfer is from one retirement account IRA to another retirement account IRA. It is a non-taxable event.