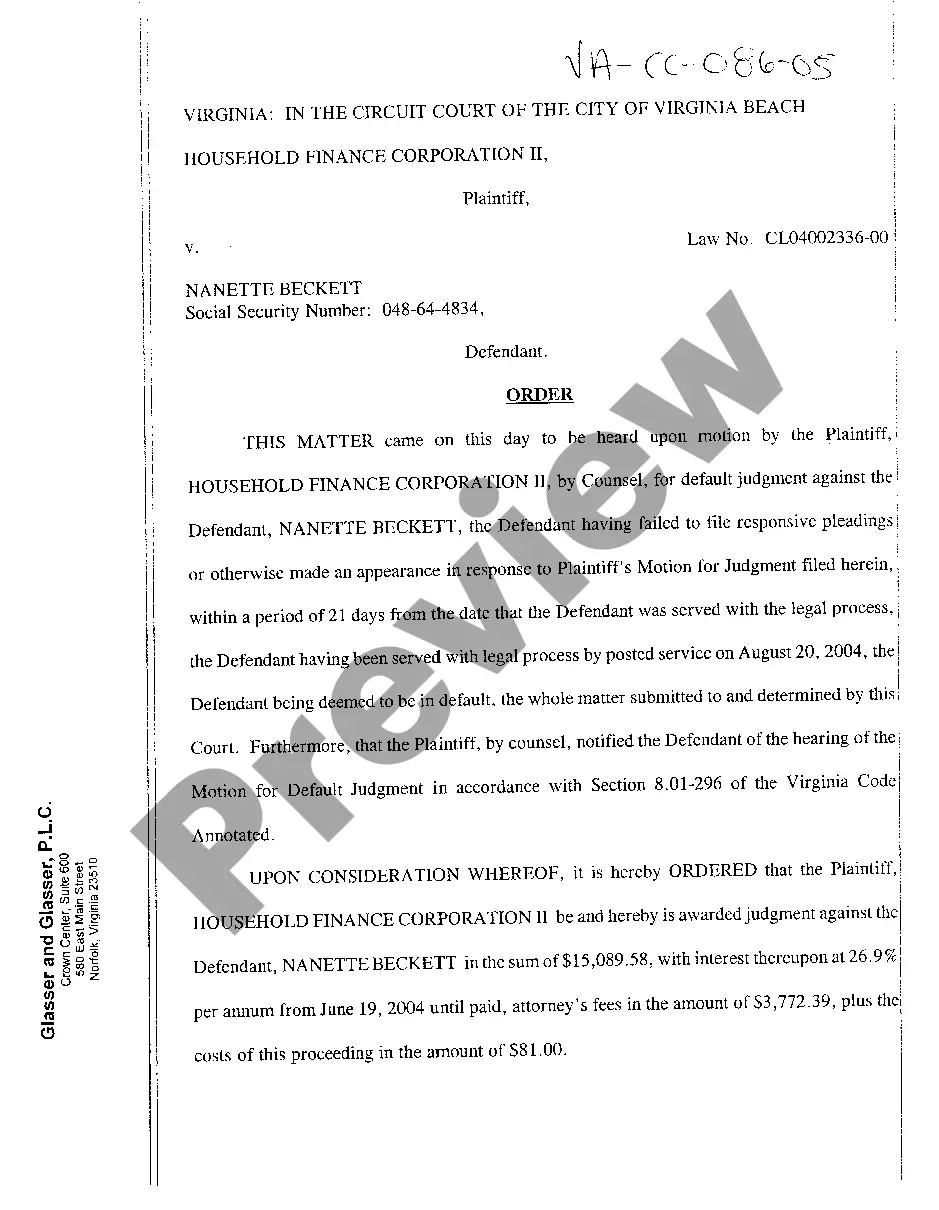

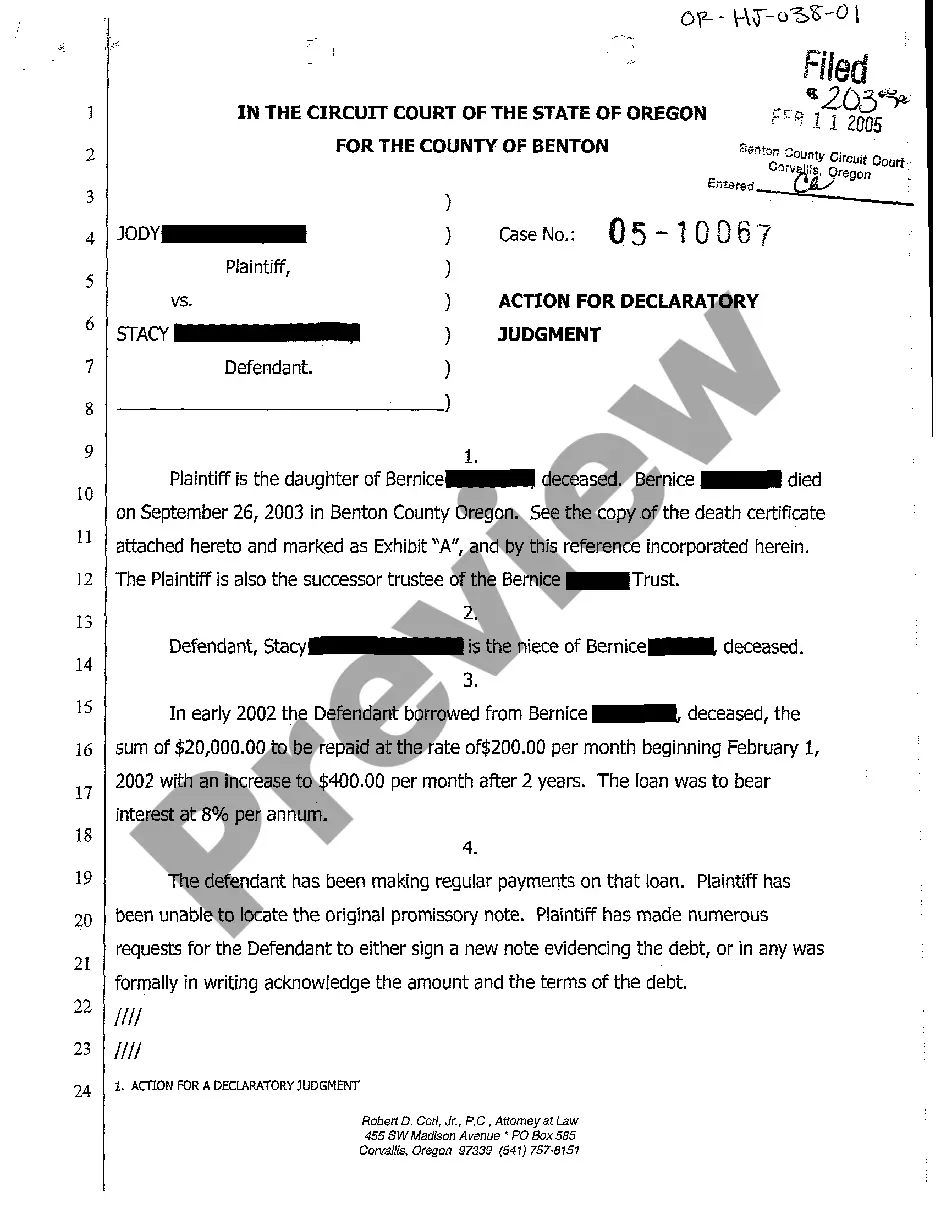

Virginia Guaranty without Pledged Collateral

Description

How to fill out Guaranty Without Pledged Collateral?

You can spend time online searching for the legal document template that meets the federal and state requirements you need.

US Legal Forms offers thousands of legal forms that have been reviewed by professionals.

You can download or print the Virginia Guaranty without Pledged Collateral from my service.

If available, use the Preview button to look through the document template as well.

- If you possess a US Legal Forms account, you can Log In and then click the Download button.

- Afterward, you can complete, modify, print, or sign the Virginia Guaranty without Pledged Collateral.

- Each legal document template you purchase is yours forever.

- To obtain another copy of a purchased form, visit the My documents tab and click the corresponding button.

- If you are using the US Legal Forms site for the first time, follow the simple instructions below.

- First, ensure that you have selected the correct document template for the region/area of your choice.

- Review the form description to confirm you have selected the correct form.

Form popularity

FAQ

These contracts can be either verbal or written agreements and can take place between the two original parties or can involve one of the original parties and a third party. Usually, a collateral contract will be entered at the same time as the original contract.

How To Create a Collateral Contract YourselfNames, contact information, and addresses of all parties.Terms and conditions of the collateral contract.Indication of a promissory note.Duties and responsibilities assigned to each party.The effective date of the agreement.More items...

What should be in a personal loan contract?Names and addresses of the lender and the borrower.Information about the loan cosigner, if applicable.Amount borrowed.Date the loan was provided.Expected repayment date.Interest rate, if applicable.Annual percentage rate (APR), if applicable.More items...?

Understanding Financial Guarantees Guarantees may take on the form of a security deposit. Common in the banking and lending industries, this is a form of collateral provided by the debtor that can be liquidated if the debtor defaults.

Collateral is when an asset is pledged to secure repayment. The five main types of collateral are consumer goods, equipment, farm products, inventory, and property on paper. All can be used as collateral when applying for loans, provided there is a recognizable value associated with the item.

Examples of collateral documents are a security agreement, guarantee and collateral agreement, pledge agreement, deposit account control agreement, securities account control agreement, mortgage, and UCC-1s.

For example, if X agrees to buy goods from Y that will, accordingly, be manufactured by Z, and does so on the strength of Z's assurance as to the high quality of the goods, X and Z may be held to have made a collateral contract consisting of Z's promise of quality given in consideration of X's promise to enter into the

Written or oral agreement associated as a second, or side contract made between the original parties, or between a third party and an original party. This typically occurs before or at the same time of the first or main contract is made. This collateral contract is independent and separate from the primary contract.

Collateral Guarantee means the irrevocable and unconditional limited liability guarantee of the Collateral Owner given or, as the case may be, to be in favour of the Bank, as security of part of the Outstanding Indebtedness and any and all other obligations of the Borrowers hereunder up to the Guaranteed Amount , in

Types of CollateralReal estate.Cash secured loan.Inventory financing.Invoice collateral.Blanket liens.