Virginia Revenue Sharing Agreement to Income from the Licensing and Custom Modification of the Software

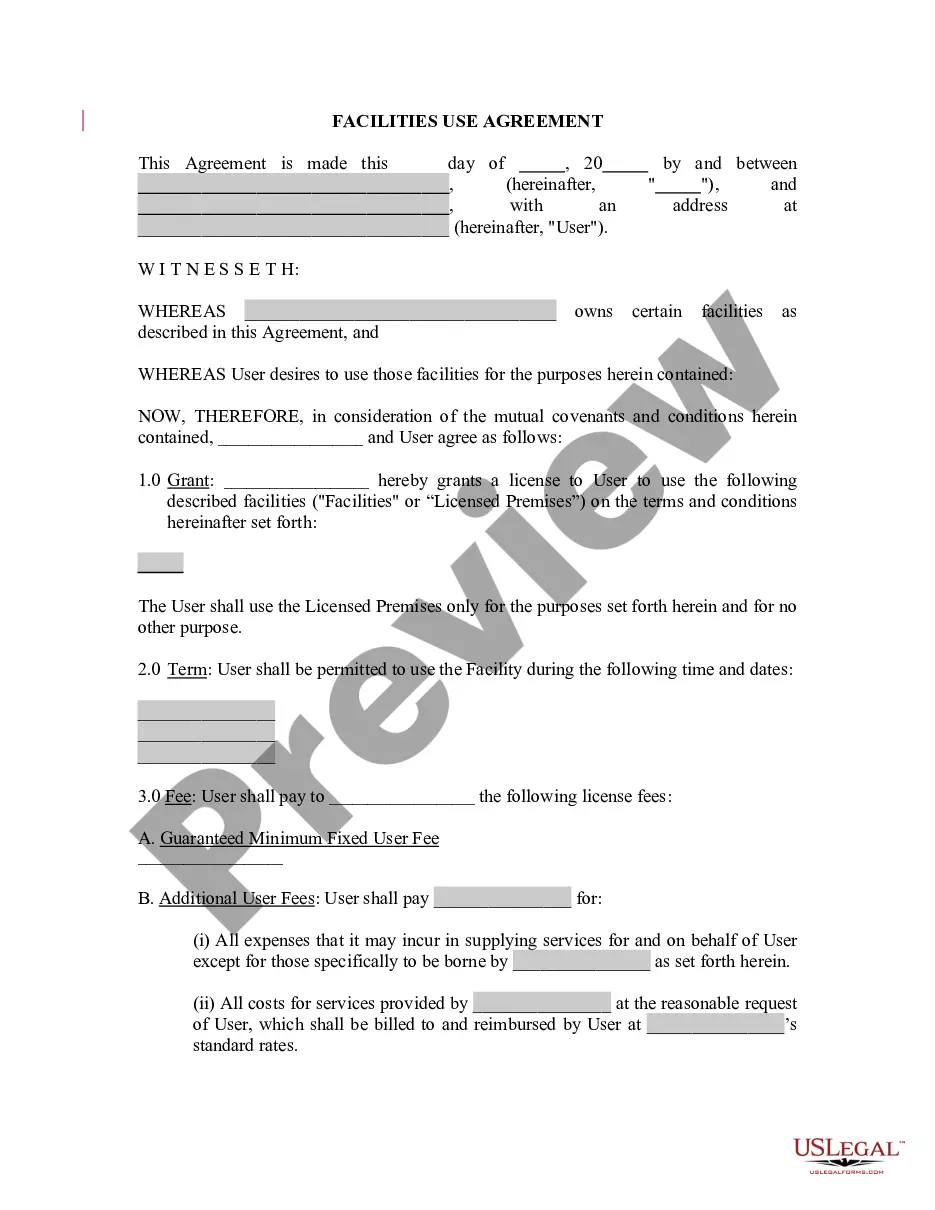

Description

How to fill out Revenue Sharing Agreement To Income From The Licensing And Custom Modification Of The Software?

Are you in a position where you require documents for business or personal purposes almost every day.

There are numerous legal document templates accessible online, but finding reliable ones can be challenging.

US Legal Forms offers a wide array of form templates, such as the Virginia Revenue Sharing Agreement pertaining to Income from the Licensing and Custom Modification of Software, which can be tailored to satisfy federal and state regulations.

When you locate the correct form, click Buy now.

Choose the pricing plan you prefer, fill in the necessary details to set up your account, and pay for your order using PayPal or credit card. Select a convenient document format and download your copy. Access all the document templates you have purchased in the My documents menu. You can obtain another copy of the Virginia Revenue Sharing Agreement regarding Income from the Licensing and Custom Modification of Software whenever needed; just select the appropriate form to download or print the document template. Use US Legal Forms, one of the most comprehensive collections of legal forms, to save time and prevent errors. The service provides professionally crafted legal document templates that can be utilized for various purposes. Create an account on US Legal Forms and start making your life easier.

- If you are already acquainted with the US Legal Forms website and possess an account, simply Log In.

- After that, you can save the Virginia Revenue Sharing Agreement regarding Income from the Licensing and Custom Modification of Software template.

- If you do not have an account and wish to start using US Legal Forms, follow these instructions.

- Find the form you need and ensure it is for the correct city/region.

- Utilize the Review button to examine the form.

- Read the description to ensure you have selected the appropriate form.

- If the form is not what you are looking for, use the Research field to find the form that meets your requirements.

Form popularity

FAQ

The Virginia Department of Revenue has maintained a long-standing policy, which is referenced in Virginia Public Document Ruling No. 05-44 , that sales of software delivered electronically do not constitute the sale of tangible personal property and are not subject to sales tax.

Go to Nonprofit Online, or complete Form NP-1 and submit it to Virginia Tax, Nonprofit Exemption Unit, P. O. Box 27125, Richmond, Virginia 23261-7125. For detailed information on exemption requirements, go to Retail Sales and Use Tax Exemptions for Nonprofit Organizations.

In the state of Virginia, any canned software which has been modified to any degree at all is not considered to be exempt custom software. Sales of digital products are exempt from the sales tax in Virginia.

Based on the definition of custom program provided in Va. Code § 58.1-602, the fact that the Taxpayer modifies a program to fit a Client's needs does not render the program a custom program, and the program remains a taxable prewritten program.

Luckily, California - the US's biggest state for digital goods - has defined digital goods, software, and SaaS as exempt from sales tax.

The Taxpayer is correct that the sale of software delivered electronically to customers does not constitute the sale of tangible personal property and is generally not subject to Virginia sales and use taxation.

In Virginia, certain items may be exempt from the sales tax to all consumers, not just tax-exempt purchasers. Several exceptions to the state sales tax are certain types of protective clothing, certain assistive medical devices, any learning institute's textbooks, and any software and data center equipment.

Go to Nonprofit Online, or complete Form NP-1 and submit it to Virginia Tax, Nonprofit Exemption Unit, P. O. Box 27125, Richmond, Virginia 23261-7125. For detailed information on exemption requirements, go to Retail Sales and Use Tax Exemptions for Nonprofit Organizations.

Ideally, all software purchases should be taxable to final users and exempt for business users. Instead, states tax some kinds of software and exempt others, based on whether it is customized or off-the-shelf and whether it is on CD or downloaded, all silly distinctions for tax purposes.

Typically, though, you can be exempt from withholding tax only if two things are true:You got a refund of all your federal income tax withheld last year because you had no tax liability.You expect the same thing to happen this year.